Brexit: Like a rollercoaster that won’t end. There continues to be many twists and turns, but what exactly is happening and what can we brace for next? As a content marketing agency for the finance sector, we’ve got our eyes on the ball… even if it is a Brexit yoyo. In fact, we provide forex and crypto analysis, so we really have been glued to the trading charts. Let’s delve deeper into a world of Brexit on the trading charts. * Check back as we update this article*

A Brexit Recap

On June 26, 2016, the United Kingdom went to the ballot to vote on the future of the country’s involvement in the European Union. The result of the closely-watched vote was surprising to most people, including those who voted for the country to exit the European Union. In the aftermath of the vote, sterling dropped by 10% and reached a 31-year low as traders grew considerably concerned about the country’s future. Brexit had begun – but little did anyone know about the saga that would follow.

Before Brexit

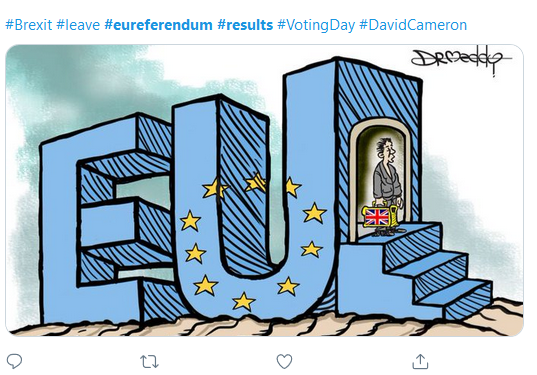

Think carefully and you might just remember a time before Brexit and tweets like this…

Oh, and this… the Referendum really threw a spanner in the works, didn’t it?!

Brexit silence seems like a faint memory, we know! But as hashtags such as #brexitshambles #brexitvote #exitfrombrexit and #brexitmeansbrexit remain prominent online, it’s important not to lose sight of where it all began and why people are so passion about Brexit topics. So, here’s a rundown of the essential background stuff.

- UK Referendum Talk Bubbles

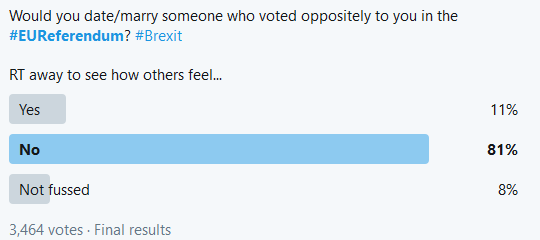

In January 2013, British Prime Minister David Cameron delivered a speech on the future of the United Kingdom in the European Union. The speech was held at Bloomberg’s offices in London during which Cameron expressed his desire for a referendum.

Brexit on The Trading Charts- on this day, the British pound dropped by 8% from 1.6385 to a low of 1.5072. Shortly afterwards, sterling regained momentum and in July 2014, the currency reached a multi-year high of 1.7237 against the US dollar. At the time, polls showed that most people in the United Kingdom favoured staying in Europe. Still, most of them wanted to see changes implemented to improve the relationship.

On April 14, 2015, the pound sterling started moving lower as the Conservative Party released its manifesto for the election. The manifesto called for a real change in the country’s relationship with the European Union. It also reiterated the earlier desire by David Cameron to have a referendum. This referendum would decide on whether the UK would continue being part of the European Union. The losses continued after the May 7 general election.

After winning the election, Cameron started negotiations with the European Union on what needed to be changed. The first European Council meeting happened on the 25 June and another one happened on October 19. In the latter meeting, he delivered a speech on the four things he wanted. These were competitiveness, sovereignty, free movement and social benefits. As these negotiations went on, sterling declined because Cameron could not secure a deal with the EU. The period ran until February 2016, when Cameron announced a referendum date. As a result of the announcement, sterling rose because polls showed that more people favoured remaining in the EU.

Before Article 50

- The Referendum Becomes a Reality

On the 23 June 2016, UK voters went to a referendum on a day that’s been marked in the history books forever. Before this date, polls showed that the remain side would win, albeit with a small margin. Almost all polls showed that more people wanted to remain. The remain campaign was led by David Cameron. It was supported by key international figures like George Soros, Angela Merkel and Barack Obama.

The leave side was led by the likes of Boris Johnson and Nigel Farage. This side argued that the country would do better as a standalone country instead of being in a large bureaucratic organisation headquartered in Brussels. This case was cemented by the increase of foreign migrants, who were supported by the European Union.

- The Leave Campaign Wins

On the June 24, 2016, Brexit on the trading charts saw the sterling drop by 10% and reach a 31-year low against the USD. This was after the total vote count showed that the leave side had trounced its rivals by 3.8%. Those wanting to leave the EU came commanded 51.9% of the vote compared to the remain side, which had 48.1% of the total vote. Cameron announced his resignation shortly afterwards.

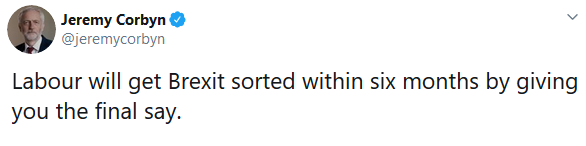

Social media lit up with mixed opinions…

- Theresa May Takes the Stand

On July 13th, 2016, Theresa May became the next Prime Minister. Previously, May had campaigned for the UK to remain in the European Union. In her maiden speech, she reiterated that she would help the UK leave the European Union as mandated by the voters. As this went on, sterling continued declining. Ultimately, it reached the lowest level of 1.1636 on October 3, 2016. This was after May delivered a speech at the Conservative Party conference where she announced the Great Repeal bill. She also confirmed that Article 50 would be triggered in March.

In January 2017, a few things happened. Theresa May gave a speech at Lancaster, where she set out the priorities that the government would use to negotiate with the EU. On January 26, the pound sterling remained unchanged after the government published a notification of the withdrawal bill. Shortly afterwards, in February, the government published the Brexit white paper. This paper outlined the strategy the government would use to leave the EU.

On March 16, the withdrawal agreement received the Royal Assent and sterling remained unchanged. On March 29, sterling rose after the Prime Minister triggered Article 50.

The currency rose because the market was already expecting it. As such, it was not thought to be a big deal.

Past Article 50

Shortly after triggering Article 50, Theresa May called for a general election. Her hope was to use this opportunity to increase her mandate in the UK Parliament. She called for a general election on April 18. The election was held on June 8, 2017. It resulted in a ‘Hung Parliament’, with Conservatives losing votes. This led to a sharp increase of the pound sterling.

Shortly after the election, Theresa May formed her cabinet and negotiations with the EU started. The first round of negotiations happened on June 19. On July 13, the government introduced the Great Repeal bill to Parliament. This happened ahead of the second round of negotiations. It laid down the UK approach on ongoing judicial and administrative proceedings, nuclear materials, and privileges and immunity. The second round of negotiations took place on July 14, 2017. These negotiations continued until June 26, 2018, when the withdrawal agreement received Royal Assent.

Sterling reached its highest level since Brexit in April 2016. This was after the European Union voted to agree on a framework of a future relationship with the UK.

Past Chequers Meeting

It was a warm summer’s day, the UK had run out of BBQs and everyone was heading for the nearest water hole to cool off. Meanwhile… on July 6, 2018, the cabinet met at the Prime Minister’s country house retreat known as Chequers. In this meeting, the cabinet agreed on proceeding with the Brexit negotiations. Three days later, Brexit Secretary, David Davis resigned in protest of May’s deal.

He was replaced by Dominic Raab, who resigned on November 15 and was replaced by Stephen Barclay.

The shape shifting cabinet, of course prompted a host of online humour – it was either laugh, or cry!

On November 14, the EU and the UK reached a deal. On November 25, the European Parliament voted to pass the deal. Between the Chequer’s meeting and November 25, sterling was on a downward trend. It received some short-lived recovery after rumours of a deal.

The ball was in the House of Commons after the EU Parliament voted for the deal. The country was supposed to leave on March 29, 2019. To do this, Theresa May needed votes in the House of Commons. However, her deal faced significant criticism mostly because of the backstop clause. This was a clause which would prevent a hard border between Northern Ireland and the Republic of Ireland. Northern Ireland is part of the UK while the Republic of Ireland was in the European Union. The EU insisted that Northern Ireland or the entire UK would remain in its customs union. They argued that if Northern Ireland was excluded, its tax regime would disadvantage the EU.

On January 15, the government lost Theresa May’s Plan A. She lost because a good number of Conservatives and the influential Democratic Unionist Party (DUP) did not support the agreement. In response to this defeat, the pound sterling dropped slightly. The drop was not very significant because the market had priced-in the situation. Four days later, the Prime Minister survived a vote of no confidence.

On February 14, the House of Commons voted for Theresa May’s Plan B. Again, the government lost the vote by a wider margin. At this time, the clock was ticking. On March 12, the government lost another vote. Two days later, the UK Parliament voted and authorised the government to ask the EU for an extension. This extension was granted to April 12. A failure to clinch the votes would have led to leaving without a deal on May 22. On March 29, the government lost another vote. On May 21st, the government unveiled another plan but did not present it to Parliament. The pound sterling, which was previously consolidating, saw significant declines.

- Boris Johnson Replaces May

On July 29, 2019, Boris Johnson became the new Prime Minister and the pound sterling continued to decline. This is because Johnson had pledged to exit the EU with or without a deal. On September 2, sterling started to rally as negotiations with the EU continued. The supreme court had also ruled that Johnson’s decision to prologue Parliament was unlawful.

The turbulence continues…

On Tuesday October 22, 2019, the UK Parliament voted in support of Boris Johnson deal. This was his first major victory. However, it lasted for just 15-minutes because members rejected his timetable for Brexit. Johnson’s goal was to have everything done so that the country could exit the EU on October 31, 2019.

Boris Johnson also called for an election to be held on December 12. While this was initially rejected by MPs, it later was given the green light.

The Election

On December 12, UK voters went to the ballot. The election’s front-runners Conservative Boris Johnson and Labour’s Jeremy Corbyn came head-to-head. During the campaign, Boris Johnson focused on “getting Brexit done.” He vowed to take the country out of the European Union by Christmas. Jeremy Corbyn, on the other hand pledged to negotiate another Brexit deal with the European Union and then have another referendum.

Before the election date, polls predicted that the Conservatives would have a significant win which led to a sterling rally. This changed slightly before the election, as the YouGov poll said that the win was narrowing.

On December 12, shortly after the election, exit polls showed that the Conservatives would have the biggest victory in more than 30 years. This was confirmed when the official results came in. The Conservative Party won 365 seats in the house of commons while the Labour Party won 203 seats. The Scottish National Party (SNP) won 48 seats while the Liberal Democrats won 11 seats. This was the biggest electoral victory for the Conservative Party since 1987 when Margaret Thatcher was re-elected.

In reaction to Johnson’s win, sterling jumped to a high of 1.3520, which was the highest level since May 2018. The market hopes that with the current majority, Johnson will be in a good position to pass through his Brexit bill in Parliament.

Of course, reaction was mixed on social media.

After Brexit Exiting The EU

After Brexit Exiting The EU

Boris Johnson vowed to get Brexit done. And that’s one job he can now tick off his list (in part anyway). On February 31, 2020, the United Kingdom finally left the EU and reactions were unsurprisingly mixed. After all, it’s important to remember that the UK voted to leave the EU by 52% to 48% meaning almost half of the country did not support this decision. As #BrexitDay trended on Twitter, some people celebrated…

While others commiserated…

And some expressed their sheer concerns over what Brexit really means for the country…

Notably the term #thick trended in response to interviews with leavers celebrating, who were unable to cite a single positive reason for exiting the EU.

Britain’s exit from the EU was marked with the Union Jack being removed from all European Union institutions but what will a life after Brexit actually entail. Well, the reality is, nothing much will change in the near future as the UK will continue to have normal relations with the EU as the two sides negotiate a comprehensive deal.

Still, there will be a lot of uncertainty as the negotiations go on. This uncertainty started just after the December 12 election when Johnson said that the country would not seek an extension if a trade deal is not reached by December 31, 2020. The new Parliament voted for this on December 20.

The challenge is that making a comprehensive trade deal within less than a year is almost impossible. In fact, the new European Commission President, Ursula von der Leyen said that it would be impossible for a deal to happen but the will to move forward and look to a positive future persists.

This confusion has seen the British pound slow the momentum it had after the December 12 election. In 2020, the British pound index has dropped by almost 50 basis points. The pound index is an index that tracks the performance of the pound against other peer currencies. This is partly because the market expects the Bank of England to slash rates later this year as uncertainties over Brexit continue.

Looking ahead, there are several key dates to watch. The first date will be February 25. This is when the European Union will decide on the mandate for negotiations. This will happen as European Union ministers meet in Brussels. The next day to watch will be June 30. This is the deadline the UK has on requesting a Brexit extension. If the country fails to request an extension on this date, the likelihood of having no deal will increase. The next date will be November 25. This is the deadline the EU has, to accept the negotiated trade deal. Finally, December 31 will be the end of the transition. The chart below shows the performance of the GBP/USD in January this year.

Brexit and Coronavirus

We all know what happened. As #lockdown and #stayhome trended, #COVID-19 memes and tweets hit social media:

But back to the markets. Sterling has been on a free fall in the past few months. In March, the currency dropped to the lowest level since May, 1985 as investors worried about the impact of Coronavirus on the UK economy. Another big concern was on Brexit talks and whether they would continue during this period. Most importantly, investors were concerned about whether 10 Downing Street would ask for an extension to the December deadline.

The December deadline was always tight. Before she assumed office, Ursula von der Leyen warned that it would be impossible to reach a concrete deal in less than a year. At the time, she had not anticipated the challenges presented by Coronavirus, which has halted international travel. In addition, she had not anticipated that Michel Barnier, the chief EU negotiator, would be among the prominent people with the disease.

As things stand, it will be impossible to reach a deal because Boris Johnson has been infected with the disease. Meanwhile, his government has said that talks will continue through video link.

This is wishful thinking from the UK side. First, negotiating a deal of this scale cannot work using video link because of how complex these things are. Second, the number of people involved in the negotiations is so big that it would be difficult to come up to an agreement. The talks involve more than 200 officials, who are divided into 11 working groups, meaning that coordination would be tough. Last and most importantly, this will require face-to-face talks between Boris Johnson and his EU counterparts. With Coronavirus spreading, and given that Johnson has been infected, this will not be possible.

Another challenge is how divided the two countries are. The European Union has insisted that the UK must follow its rules and regulations to access its market. The UK, on the other hand, does not want this. Instead, it wants a deal similar to the one the EU has with Canada. With that deal, Canada is responsible for regulations and ensuring that its exports meet standards. The EU has rejected this, arguing that the scale of its business with Canada is relatively small.

There is a positive point in all this. With Boris Johnson and Michel Barnier being sick, and with the disease spreading, there are chances that the UK will seek an extension. This is possibly the reason why sterling has made some gains against the USD.

Moving onto May 2020. In our last update, Boris Johnson and Michel Barnier were both diagnosed with the coronavirus illness and the British pound was gaining.

In the chart below, we have summarised the British pound response to key events after the June 2016 Brexit vote.

As you can see, the GBP/USD pair has struggled for direction since our last report. In the past two months, it has remained between a low of 1.2083 and a high of 1.2645.

A few Brexit-related things have happened since the last update. First, Barnier and Johnson have regained their health and are actively doing their respective duties. Second, the game of chicken between the UK and the European Union has continued. The two sides have held two round of talks and the fourth one is starting today.

Third, the US dollar has generally been weak as most countries start to open their economies. Finally, sentiment on the British pound has continued to weaken. Data from CFTC shows that the net short positions on the currency in the futures market have continued to rise. In the last CoT report, the CTFC showed that the net short positions were more than 22,000. The highest they have been this year.

UK and EU negotiators held the second round of talks between April 20 and 24. They then held the third round in the first week of March and not much progress was made.

After the third round, David Frost the Chief UK negotiator blamed the European Union for trying to bully the UK. He said that the EU was trying to force the UK to remain in the union indirectly. For example, he accused the EU of trying to push its regulations to the UK, through what it termed as “level playing field” rules.

The EU argues that these rules will help protect countries in the region from unfair trading practices in the UK. That is because the UK could implement a lax regulatory framework in a bid to attract companies from the region.

Fisheries are also serious hindrances to a deal because of how important the UK is in the industry. Estimates show that fishermen from the EU catch more than 50% of their fish in UK waters. Therefore, the UK has said that it wants an agreement that will give it freedom to control who fishes in the waters. The EU, especially France, have rejected this saying that any free trade agreement should also include freedom of fishing.

The fourth and final round of talks will begin on Tuesday. A draft timetable of the talks show that the two sides will spend most of the time deliberating on fisheries, trade and energy. Still, because of the fundamental differences, analysts don’t expect any significant progress to be made.

After these talks, Boris Johnson will travel to Brussels to hold high-level negotiations before the summit later this month. It is in this summit that Johnson will say whether he wants an extension. Most analysts don’t expect that Johnson will request an extension.

Still, it is possible that he will use coronavirus as an excuse to request for an extension. Furthermore, all previous extension requests by Theresa May were done in the last minute.

The fifth round of Brexit talks was held in London in July. Like in the other rounds, the focus among the negotiators was on goods and services trade, fisheries, and legal issues. In a statement after the talks, David Frost, the Chief UK negotiator, said that the two sides had failed to reach any meaningful progress on thorny issues. In the statement, he said:

“That is why we continue to look for a deal with, at its core, a free trade agreement similar to the one the EU already has with Canada – that is, an agreement based on existing precedents. We remain unclear why this is so difficult for the EU, but we will continue to negotiate with this in mind.”

As always, Michel Barnier, the chief EU negotiator blamed the UK side of being inflexible. He emphasised that the EU position was broken down to three key parts. First, he insisted on robust guarantees for a level playing field, a long-term solution for European fishermen and women, and an institutional framework on dispute resolutions.

Looking ahead, the next round of Brexit talks will take place in Brussels between August 17 and 21. These will be followed by a meeting of the chief negotiators on August 24 and another meeting on August 31. The next round of comprehensive talks will happen between September 7 to 11th followed by an extraordinary meeting of EU leaders in Germany. The next round will take place between September 28 to October 2 in Brussels followed by an EU leaders meeting in the same venue.

Meanwhile, the British pound has been relatively steady. In July, it gained by more than 5% against the US dollar. The pound index also rose by more than 5%. This could be because investors believe that the two sides will reach a deal eventually. For example, analysts at Danske Bank expect that the two sides will pass a narrow deal in December and continue debating on more complex issues.

Updated November 2020

In our last update, the UK and the European Union were still having significant differences on key issues. Well, nothing much has changed even after a series of talks in London and Brussels.

As we move into the final stretch of talks, the two sides are struggling to find a middle ground on key issues. The first major hurdle is on regulations or the so-called fair playing field regulations. Ideally, the UK wants to set its own regulations, something the EU has rejected. The EU argues that such measures will make it difficult for firms in the EU to compete.

Second, the EU insists that the UK needs to abide by laws about subsidies. As with regulations, the EU wants a commitment that the UK will not provide subsidies to companies, which will also create an unfair relationship. The UK insists that, as an independent country, it has rights to set its own laws.

Finally, on fisheries, the UK has said that it has the right to protect and regulate its fishing waters. The EU – particularly France – has insisted that it wants to have unconditional access to British waters. This is an important aspect because France catches more than 80% of its fish in these waters.

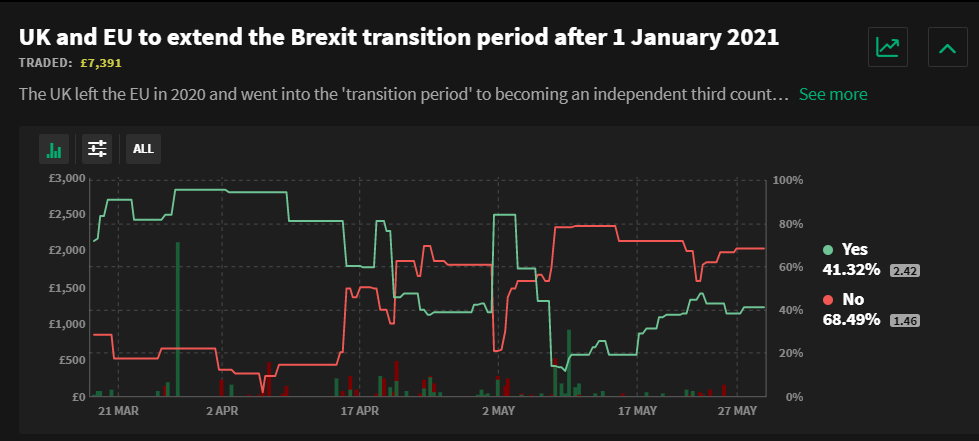

Fortunately, the two sides have already reached agreements on law enforcement. In November and December, we expect that the two sides will continue engaging with each other and possibly reach a deal. Indeed, the odds of a Brexit agreement in betting circles have also risen.

Odds of a Brexit deal

The outcome of the US election will also have an impact on the next phase of negotiations. If Donald Trump and Republicans win in congress, it will provide an incentive to Boris Johnson to continue playing hard ball. On the other hand, a Democratic sweep will make life more difficult for Johnson. That is because the Democrats committed to stand with the EU by ending any negotiations until Johnson withdraws the internal markets bill.

Meanwhile, the performance of the British pound is also sending signals that the market is optimistic about a deal. As shown below, the GBP/USD pair has been in an upward trend since October. This optimism is because of the disruption that a no-deal Brexit would have on the British economy. For one, the country sells more than 45% of all its goods to Europe. As it goes through its worst recession in years, a no-deal Brexit would make things worse.

GBP/USD performance

Brexit deal at last

After months of tense negotiations, the UK and the EU agreed to a post-Brexit deal a day before Christmas. This progress came after the two sides made significant concessions on key issues. On fisheries, the UK will leave the existing Common Fisheries Policy on December 31.

However, the existing rules will remain intact in a 5-1/2 transition period. After this, the two sides will have annual consultations to map the level and conditions for EU’s access to UK waters.

The two sides also left some of the key contentious issues intact, pending further negotiations. For example, on financial services, the two will continue negotiating, with the deadline for a deal being on March 2021. They will also continue deliberations on haulers, tax issues, and dispute resolution.

Still, the deal is a win-win for the two sides. That’s because it means the two sides will keep doing trade with minimal barriers. A no-deal, would have disrupted trade worth more than £665 billion.

The UK, which sells goods worth more than £294 billion, equivalent to more than 45% would have been the most affected. The EU, which also sells goods worth more than £374 billion would also be significantly affected. As such, as shown above, a deal was in line with what most traders and investors were expecting.

So, what next for the GBP/USD pair? The pair reacted mildly when the deal was arrived. While it first rose to 1.3615, it then quickly pared those gains and dropped to 1.3410.

This performance was possibly because of the buying the rumour, selling the news situation.

Still, on the four-hour chart, it remains above the ascending trendline that connects the lowest levels since September. It is also being supported by the 25-day and 50-day exponential moving averages. Therefore, in the near term, the uptrend will possibly continue, with the immediate target being at this year’s double-top at 1.3630.

And breathe. Following Brexit certainly requires patience, energy and a big bucket of popcorn. The good news is, we love a snack and keeping up with all the breaking news, social updates, market movements and more. Contact us today for crypto or finance analysis. We offer everything from daily forecasts and reviews to monthly outlooks as well as day-to-day social updates and financial content marketing that works hard for your brand.