Marketing for the payments sector is huge. But so is the payments sector, with the global pandemic pushing more and more businesses online than ever before. Accenture forecasts nearly 420 billion transactions worth US $7 trillion are expected to shift from cash, to cards and digital payments by 2023. The amount spent digitally is also predicted to increase to US $48 trillion by 2030. So, if you’re in the digital payments space, things aren’t about to settle down. In fact, they’re likely to speed up. Join us as we update you on the latest digital payment sector marketing trends and provide top tips you won’t want to miss.

Digital Payments – It’s Going Crazy Out There

Click. Pay. Click . Pay. Click Pay. It’s not a strange concept anymore. In fact, half of UK consumers have not used cash since lockdown. The rapid move to digital payments has put additional pressure on the banks, with 75% of surveyed bank executives saying that the pandemic has increased their urgency to modernise payment systems.

And it’s not just banks that are feeling the need for a digital payments revamp. Social platforms have also noticed the trend and are acting accordingly. Look around. Instagram has recently rolled out a new Instagram Checkout service allowing consumer to buy directly from the platform without being directed elsewhere. This has the capacity to potentially generate $10 billion in venue by 2021. That’s huge!

Facebook Shops has also popped up in light of the pandemic allowing consumers to browse, save products and pay (if the business has enabled checkout in the US). The point? To stop people taking their digital payment love elsewhere and fully committing to a platform. It’s like a social media valentines affair with affordable cards to match. Check out Ink Meets Paper, a small e-commerce business using Facebook Shops.

With nearly 11 million British shoppers predicted to have splashed the cash after first seeing a product on social media, adding a digital payment element is the way to go.

Marketing for the Digital Payments Sector – What Works?

Dismissing the digital payments idea would be like saying no to a Friday night takeaway – shocking to say the least. But, if you’re going down this route, what kind of digital payments marketing should you be embracing? Let’s find out.

Make Your Campaigns Relevant

Relevant marketing that’s in-touch with your target audience is more important than ever. We’re all going through pretty hard times due to COVID-19, so it’s essential to connect with your consumers by offering content they can relate to.

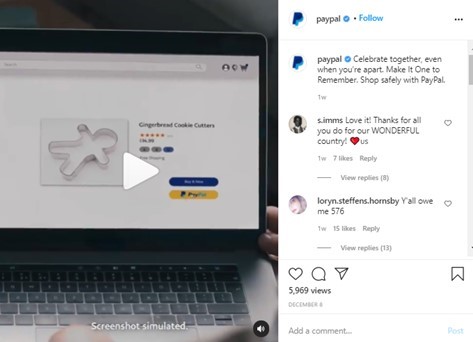

PayPal, for instance, has embraced holiday marketing that’s sensitive and aligned with what people are going through. While they want consumers to use their services, they’ve not bypassed the pandemic and are instead showing how people can ‘celebrate together’ even when apart. This is communicated through clever storytelling that involves a little girl calling her grandma and then making a gingerbread house having bought cookie cutters digitally.

Storytelling is important in a largely virtual world as it helps form a connection between brand and customer.

“The concept of brand intimacy is important for marketers because emotion has been proven to drive purchase decisions, and also long-term customer bonds.”

Says Mario Natarelli, managing partner of MBLM. In fact, top intimate brands in the US have continued to significantly outperform the top brands in the Fortune 500 and S&P indices in both revenue and profit over the past 10 years.

Top tip for marketers: Video is one of the best ways to boost social engagement on Instagram, so try to include this kind of content in your feed. Keep the message short and end with a strong call to action as this will guide people down your sales funnel.

Use Social Proof and FOMO

Social proof is the concept that people will follow the actions of the masses. While FOMO taps into people’s innate desire to not miss out on anything good. Both can therefore be used to create marketing campaigns that trigger emotions. But it doesn’t need to be glaringly obvious that you’re trying to stir people into action and drive them towards your digital payment brand. Simply stating a fact using carefully collected data could be enough for people to click on that all-important buy button. Including language such as ‘top ten’ or ‘most sold’ is a great way to pique the interest of consumers.

Amazon does this exceptionally well by creating content based around what other people have bought from their platform and providing links to the relevant products on their site. They’re essentially pointing out what’s popular and telling people to get in on the action.

Another way to create FOMO and get more people making digital payments is to put a timeline on any offers or product deals. This encourages people to act as they know your offer won’t last forever. You could even show how many people have bought a product before you to tap into the social proof part of marketing psychology.

Top tip for marketers: Stay ahead of the game. If you know other digital payment brands will be offering discounts at certain times of the year such as Black Friday, get in early. Amazon launched their Black Friday week ahead of time. This was a clever move considering many people were still in lockdown and had time on their hands to buy.

Work with Influencers

It’s been a mixed bag for influencers during 2020. While travel influencers were grounded and forced to scramble for interesting content; fashion and retail influencers took the opportunity to work with relevant brands. And rightly so. According to reports, Instagram was the UK’s most popular social media platform during lockdown with the most popular forms of social media content being influencer content (46%) and shopping content (39%). This explains why top digital payment brands like Amazon embraced the influencer lifestyle, regularly featuring well-matched individuals in their Instagram Stories line-up.

Top tip for marketers: Think carefully about your influencer marketing strategy. It’s important to team up with people who are relevant to your business and the product you’re promoting. This is particularly important if you’re a small business with a very specific niche. Read more about influencer marketing.

Highlight Your USPs

You want to stand out from the crowd, right? So why are you hiding your best bits? Models wouldn’t turn heads on the catwalk if they didn’t flaunt their goodies. And the same applies to the digital payments sector. Competition is fierce, so don’t be afraid to promote your USPs across social media. It’s not about being boastful. It’s about tastefully laying out what you can offer.

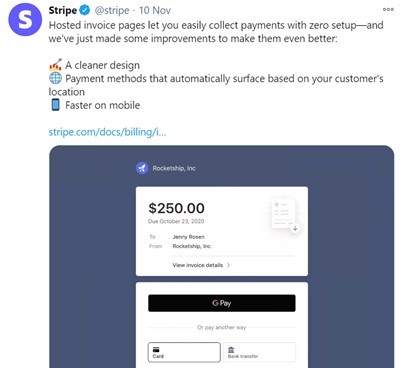

Let’s take a closer look at payment provider Stripe. This brand regularly takes to Twitter to showcase improvements to their services in a clear and concise way. Featuring a branded GIF of how services work also helps to bring products to life and communicates to consumers just how easy it is to get the job done digitally.

Similarly, if you’re offering new products or services, it’s important to create an eye-catching marketing campaign. Revolut, for instance, used the Pinned Tweet feature to maximise the visibility of their limited edition flag card. Again, this is supported by rich media video content which helps to increase the appeal of the post and boost engagement.

Top tip for marketers: Make the most of specific platform features. While Pinned Tweets are ideal for keeping eyes on a product launch, Instagram LIVE is ideal for creating excitement around influencer interviews or releasing new products. Stories on platforms like Facebook can also help take consumers on a journey, while Instagram Reels provides an opportunity to create fun, easy-to-share video content.

Another tip is to brand your content wherever possible, particularly if you want to monitor conversations easily or make your content simple to engage with. Note how Revolut has opted for the short but effective hashtag #RevFlagCards.

Marketing for the payments sector is more important than ever as people head online to make payments, transfer money and shop, shop, shop! Get it right and you could enjoy big gains in 2021. Speak to the Contentworks crew today to get fintech marketing for your brand.

Enjoyed reading Marketing for the Payments Sector? Hit that share.