The finance sector is all about reputation. Traders and investors aren’t going to part with their money unless they can be sure it’s safe. When it comes to forex, negative reviews and threads result in lost business. And having no reputation at all can be just as bad. Positioning your forex broker as trusted takes time and effort, as well as a clear strategy, so here’s how you can build and keep a good reputation.

Watch our #AskCW video below and remember to unmute sound!

#1 Find yourself on review sites

Up to 93% of consumers look for online reviews before they buy. That’s why it’s critical your brand regularly monitors popular forex review sites such as Forex Peace Army. Traders that feel wronged by a forex broker will often leave scathing reviews and if you want to maintain your reputation, it’s your job to respond to them (or avoid their existence full stop). But more than this, monitoring review sites gives you an idea of how your brand is being portrayed and perceived and what you can do to either change this or (if the reviews are good) what you should do to keep your good reputation.

In order for your broker to be seen as a genuine company, authenticity is key. How can you convey this to your audience? It goes without saying that you should encourage your traders to place real reviews and testimonials rather than writing them yourself. Lots of review sites actually monitor IP addresses. So if they see that all your gleaming reviews have come from the same source, you’ll be called out or even blocked. And that’s your reputation in the toilet.

Most consumers today are fairly savvy. If they notice that every review is five stars they’ll likely doubt your credibility. You won’t find many established businesses without a poor review or two. Encourage real and honest trader reviews and embrace constructive criticism.

How should I respond to reviews?

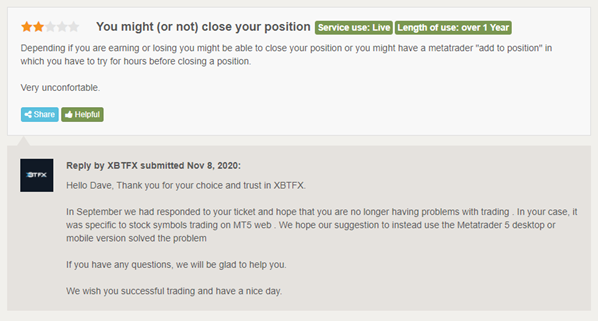

Responding to online reviews requires tact, politeness and a good awareness of compliance. Any reply should be considered, professional, compliant and adherent to GDPR. Never reveal client details, accounts or even profits publically. Instead, acknowledge the complaint and suggest a private chat, email or telephone to resolve. When leaving a response to a poor review, take great care to address every issue mentioned and detail how you are going to remedy them. Take XBTFX’s reply to an unhappy trader below as an example.

The response is polite but straight to the point. They mention how they have already responded to the trader’s help ticket where they shared advice on how to avoid such an issue from occurring again. Any potential client reading this response is likely to perceive XBTFX as a professional broker that values customer satisfaction.

#2 Good Content Buries Bad Content

The truth is, good content buries bad content. That means that well ranked, SEO friendly articles, social media, videos and PR will move above poor reviews and threads. So the first pages of Google will be favourable to your company with snippets, links and positive PR. 90% of all companies and organisations use content in their marketing plans with 70% reporting that their content marketing efforts were more effective in 2020 than the previous year. Despite the clear advantages of incorporating content into marketing strategies, there are plenty of brokers that don’t use content at all. These brokers typically have no online reputation to speak of and that is just as bad. There simply isn’t enough information out there for clients to ascertain if they want to trade with them or not.

A sound content strategy can turn this around. Clients look at things like reputation, credibility, relevance, and if your broker’s personality and product offering matches theirs. So, how can your broker leverage great content to win conversions?

- Get your site to the top of search results by using both short and long-tail keywords

- Push out high-quality fresh content on your blog. This will help your SEO ranking as well as let potential clients get to know your brand and its credibility

- Take a multi-channel approach by posting PR content to other channels. This could be via guest blogging or your own social media; create a buzz and increase brand awareness

- Take part in discussions on social media, reply to forum threads, work with micro influencers and retweet other higher ranking accounts. All these actions will see your own content channels elevated.

Be prepared to pay for good PR

There are times when paying for PR will get a better ROI. Free or cheap PR often means you’re appearing on low traffic sites. Not a waste of time but not necessarily helpful in burying bad content. Allocate a decent budget towards FX sites where you can publish PR content.

Top Tips: Find the keywords with the biggest potential to drive traffic. Google refreshes rankings frequently and if your brand is always producing fresh, engaging content with popular keywords and phrases, your broker should fare well.

Ensure all content on other sites contains company backlinks and that it’s high quality and relevant i.e. something that people from the sector will actually want to read . Content that reads like a sales brochure or offers nothing of interest will likely go unread or even be rejected from credible sites. Contentworks Agency is well-versed in creating winning content for brokers. Utilising Contentwork’s expert writing team means you don’t need to allocate your broker’s valuable time and effort to creating content.

#3 Be active on social media

In 2020, there were close to four billion people using social media. This figure has continued to grow year on year. In addition, 90% of those aged 18-29 are on social media with 90% using Instagram and following a business page. 73% of marketers think social media marketing is very effective for their business. Being active on social media is a must for improving and maintaining your forex reputation.

What does being active on social media mean?

It doesn’t only mean posting and tweeting now and again. If you want to do social media well, you also need to be engaging with your target audience, chatting with influencers, and replying to your audience’s comments, replies, and DMs. And you need to do it fast too. 40% of consumers expect brands to respond within just one hour on social media, while 79% expect a response within 24 hours?

Deleting comments is a bad idea and ultimately looks like you have something to hide. This is especially true for complaints. Complainants often screenshot their comments and can shame you for deleting it later on. Adding credibility on social media can be done by:

- Answering promptly and politely on all channels

- Sharing positive customer reviews, testimonials and feedback

- Going live with question and answer sessions

- Going live with AMAs with your company bosses or key stakeholders

- Share updates on how you improved situations for customers who were unhappy

- Update on new policies for the protection and wellbeing of clients

Top Tips: Avoid a PR disaster on your socials – always make sure the right people are managing your accounts. Never pay for fake followers or likes and comments. It’s so easy to tell which brokers are doing this when almost every comment is something like ‘great pic!’ or ‘amazing trading service!’ And make sure whoever has access to your socials, fully understands all forex compliance rules. Learn more about tackling social media as a financial services brand.

#4 Use tools to monitor your reputation

You can find tools that remove the guesswork when determining your broker’s reputation. Reputation monitoring software can do things like track down reviews of your broker across different review sites and social media, increase search traffic, gain insights into customer feedback trends, notify you of high-impact events and emerging risks, and more.

Here are just a few of our favourite tools out there:

- Agorapulse – With Agorapulse, you can manage all your social media accounts from one hub. You can also use Agorapulse to identify key influencers, ambassadors and receive incredibly helpful reports from across all your socials. Agorapulse supports Facebook, Twitter, Instagram, YouTube, and LinkedIn.

- Meltwater – Around since 2001, Meltwater claims to be the world’s first online media monitoring company. Meltwater scans millions of social media posts, blogs and news sites every. It then notifies you when it finds something that mentions your broker or is something relevant to you or the sector in general.

- Google Alerts – Google Alerts will send you an email when it discovers new results that match the search terms you’ve set. It’s 100% free but doesn’t offer the same capabilities as the paid ones. It also won’t dig into forums or social media for you.

- Marketing 360 – Offers straightforward management, monitoring, and alerts of your business reviews that Marketing 360 has tracked down. Great price.

- Podium – Podium is designed to simplify the process of leaving reviews. Customers can leave you reviews in as few as 30 seconds through SMS. This means you get more and can build your reputation quicker. You can also use Podium to track common sentiments and trends, respond to reviews, and more.

- Birdeye – An all-in-one platform for multi-location businesses. Use Birdeye to find your reviews across the web and get connected with leads and customers via various channels They also offer survey, ticketing and insights tools to get to know customers.

- Twitter Analytics – A free service offered by Twitter. Get relevant tweets delivered to your dashboard including those that mention your brand as well as all the other tools that come with Twitter Analytics.

Need help with your content and social media management? Keen to improve your PR and give your online reputation a much-needed boost? Talk to the Contentworks crew today. As a leading content marketing agency for the finance space we can help you improve or build your online reputation.