In order to nail financial services marketing, it’s important to understand that many consumers have not achieved financial literacy. Everything from saving to investing can cause a big headache. So, what should you do? We’ve pulled together some insights and marketing tips for helping your clients achieve financial literacy.

Financial Literacy – The Stats You Need to Know

Before we get into the finer marketing details, it’s important to cover the stats.

- U.S adult financial literacy is at 57%. That’s only slightly higher than the financial literacy of Botswana, whose economy is 1,127% smaller.

- 9/10 consumers in the UK feel that they are uneducated in terms of personal finance according to a new survey commissioned by Israel-based Bank Leumi’s challenger brand, Pepper.

- 67% of Brits also don’t feel equipped to make the best financial decisions for themselves with 68% admitting they’re not financially observant.

- 72% from the Pepper survey also said they don’t invest in stocks, shares or investment funds, with nearly one-fifth stating they don’t know how.

- Nearly half of Brits said they think it’s their bank’s job to help them make better financial decisions, despite 24% believing they’ve been misled by a bank’s advice.

How to Improve Financial Literacy

Global stats on financially literacy are concerning. But with a few tweaks in the way you market, you could get consumers onside and improve attraction and retention rates. Here’s our advice.

- Create e-Books

It seems there’s a direct link between education and financial literacy. Indeed, Scandinavian countries such as Denmark, Norway and Sweden rank at the top of the global list for financial education, with 71% of their populations being financially literate. It makes perfect sense if you think about it. The more you’re taught, the more you can grow your financial skill-sets. We love e-books here at Contentworks as they educate and inform without being overly promotional. An e-book has the power to:

- Explain trickier concepts such as blockchain and crypto, in a fun and engaging way

- Allow readers to absorb information in their own time or return to it later

- Provide gated content or tiered learning

Download our Launch Your Blockchain Rocket e-book to see what we can do.

- Offer useful hints and tips about a juicy topic

- Go into industry-specific details, including consumer benefits

- Explain Financial Management Tools

If you’ve an app or product that will help consumers manage their finances efficiently – shout about it. There are many ways to do this. For example:

- Post how-to videos on YouTube

Consumers love video, so hitting up YouTube is a great way to showcase how your app/product works in all its glory. Explainer and how-to videos are great for this channel. Remember to keep your videos short, sweet and to-the-point like those from Revolut.

- Create simple social media updates

When creating social media updates, think about your target audience. Chase tapped into convenience-loving millennial demographic by promoting the Chase Mobile app on Instagram. Not only was the platform relevant to the consumer, but the messaging was short and concise with a strong call to action.

- Use Instagram Stories

Instagram Stories are one of the best ways to showcase and explain a product or service. Simple, a brand promoting online banking with built-in budgeting and saving tools showcased the benefits of mobile banking through a succession of Insta Stories.

Contact Contentworks to get Socially Sorted.

- Delve into the World of Financial Podcasts

Podcasts are hugely popular with 32% Americans tuning into a podcast at least once a month. As podcasts listeners are more likely to be high earners, with 45% having a household income of $75,000 or more, it’s worth delving into the podcast realm.

There are many wonderful podcasts out there, all offering useful advice. These include:

- The Australian Finance Podcast – this has recently focused on making smart money moves during the Covid-19 pandemic.

- Bloomberg Surveillance Podcast – this covers the latest in finance, economics and investment and features leading industry voices

- CNBC Fast Money Podcast – podcasts break through the noise of the day and provide sound knowledge to traders.

Top tip: Become a go-to source of knowledge as this will help with brand recognition and encourage loyalty. The more you can keep people coming back, the more likely they are to remain customers. For instance, if you have an investor platform, it’s a good idea to create an investor-focused podcast covering all major updates.

- Create a Financial Literacy Course

Everyone likes to be top of the class! So, how about creating a financial literacy course for investors, brokers and savers? Essentially, this should cover everything your clients need to know about the financial world and be specifically targeted to their needs.

For example, creating an educational blog series with step by step instructions about trading cryptocurrencies could be a great start. This could begin with a breakdown of popular cryptocurrencies being traded before moving onto trading platforms and techniques. Contact us for help scripting the perfect online course.

- Create a Glossary

Finance, investment and trading terms can be really daunting. And not only for newbies. Terms like “candlestick patterns” “pips” , “Spread” and “Leverage” mean nothing to most people. Similarly banking terms like “Annual Percentage Yield”, “Loan to Value Ratio” and anything to do with Interest Rates can frustrate and intimidate savers. And … newsflash… traders and investors who don’t understand terminology will either make mistakes or refrain from spending. Make it your priority to create a glossary for your finance brand. It can be fun too!

- Make Financial Literacy Fun

Your financial literacy marketing shouldn’t send people running for the hills. If it’s as dull as dishwater, people won’t read it and that won’t be beneficial for your bottom line, especially if you’ve heavily invested in ‘educational’ content. Similarly, overly simplified or insanely complex content won’t cut it either.

One of the best ways to grab attention is to make financial literacy fun. Finance doesn’t have to be boring, so here’s how to add a dash of spice to your campaign.

#1 Use interesting imagery and graphics

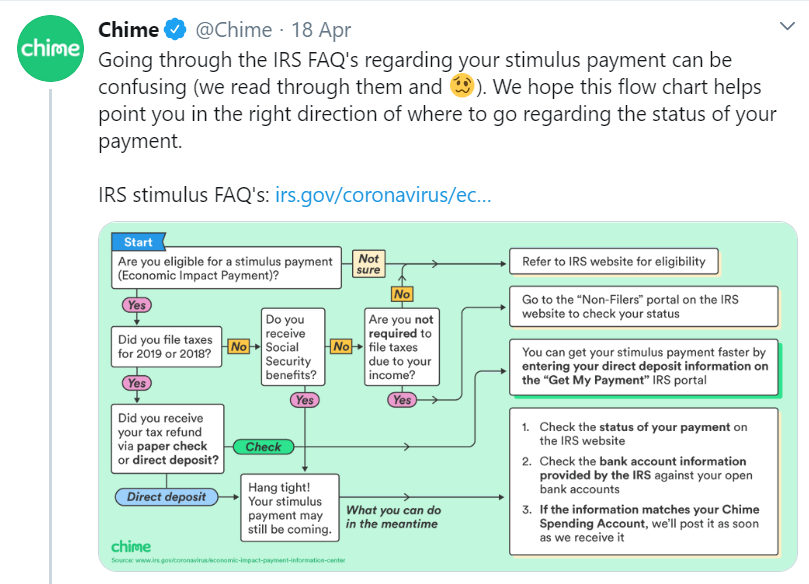

While certain topics aren’t particularly ‘fun’ on paper, you can bring them to life with them help of imagination and some cool imagery. Chime, for instance, addressed the oh-so-exciting issues of stimulus payments by presenting a flow diagram to help consumers. This was ideal for social media and directed consumers to follow-up information.

Revolut also uses GIFs to add excitement to their financial literacy messaging.

#2 Maximise video content

54% of consumers want to see more video content from brands. So, start creating videos about financial literacy and sharing them across your social media. Try to be unique and relevant, keeping up with any updates and cross-checking facts.

Feeling creative? Get your brand on Tiktok and start pumping out some 60 second finance vids. But be warned… this is no place for boring content!

#3 Encourage Engagement

Liven up your educational content by encouraging engagement. Betterment hosted a live Q&A session based on consumer questions – an ideal way to boost engagement and increase return visitors. Polls, questionnaires and quizzes are effective too.

- Update on Regulations

An effective way to help your clients achieve financial literacy is to keep them updated on financial regulations. The industry is heavily governed and therefore it’s important to provide the latest news. Don’t also forget to state how the updates might impact your clients.

Here at Contentworks, we provide monthly Regulation Roundups and can produce similar content for your brand. Get in touch today.

Speak to our expert content marketing crew today for blogs, articles, video scripts, podcasts, whitepapers, e-books and more that will take your brand to new heights and improve client literacy. Enjoyed reading Helping Your Clients Achieve Financial Literacy? Go ahead and hit share.