We’re wrapping up another eventful year in the financial markets. 2022 started off well with the Dow Jones and S&P 500 closing the first trading day of the year at record highs. The S&P 500 rose 0.6%, the Dow was up 0.7% and the Nasdaq soared 1.2%. But this was only a flash in the pan. The S&P 500 started its descent fairly quickly in January 2022, with other indices following suit worldwide. Although most indices had lost over 20% at some point through the year, a few were able to partly recoup the losses.

December started with:

- The S&P 500 down almost 15% YTD

- The Nasdaq having lost 25.57% YTD

- The German DAX dipping 8.66% YTD

- The EuroStoxx 50 fell 7.84% YTD

The surprise has come from the UK’s FTSE 100, which started December up 1% YTD. But that isn’t the only surprise the financial markets have seen this year.

At Contentworks Agency, we closely follow the financial markets and we’ve been on the edge of our seats this year. Here’s our roundup of the top 10 market shockers.

Don’t want to read it all? Watch the video instead:

#1 The Russia / Ukraine Conflict

The second month of the year saw the beginning of prolonged conflicts between Russia and Ukraine. What might have been expected to have lasted a few weeks at the most has continued through the entire year. The invasion has had significant economic and humanitarian impacts. The news sent the markets tumbling, with the European stock market being the worst performer.

A large part of this decline was driven by the heavy reliance of the EU on Russian imports, especially oil and gas. Even among the European equities, the financial and consumer discretionary sectors performed the worst. The markets expected pressure on economic activities and consumer spending due to the Russian invasion-led rise in energy prices.

US stocks also declined in February as the markets attempted to process the potential impacts of the invasion.

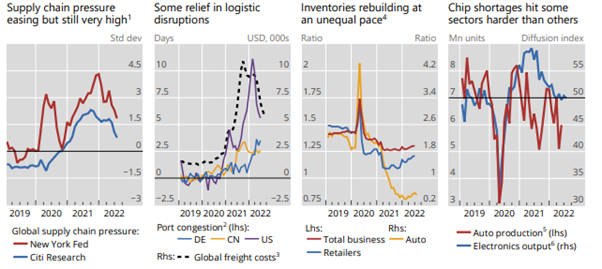

#2 Supply Chain Disruptions

Supply chain disruptions fuelled by covid-19 lockdowns worsened following the Russia-Ukraine war. The year began with optimism regarding demand, which would, in turn, drive economic growth worldwide. That soon changed with the US and other Western nations imposing sanctions on Russia. Transactions with Russia’s central bank were banned, while restrictions were placed on the nation’s largest financial institutions, such as VTB and Sberbank, and its wealthiest citizens. With trade routes and ports being closed, food, energy and raw material supplies were hit. Worst affected by the sanctions were the EU member nations. As a result, inflation rose.

Image Source: Bank of International Settlements

Although the supply chain bottlenecks have been easing in the second half of the year, it has been an uneven recovery across regions and sectors. One of the worst affected stocks due to supply chain issues is Apple. The shares are down almost 19% YTD. It all started with the company predicting an up to $8 billion hit due to the supply chain constraints as part of its Q1 earnings call in April. The stock declined over 4% following this announcement.

Apple has spent a large part of the year making changes to its supply chain. Since October 2022, it has been trying to move “some AirPods and Beats headphone manufacturing to India for the first time,” but that isn’t likely to happen anytime soon. In the meantime, its manufacturing facilities in China continue to impose lockdowns, sparking public unrest. This has led some analysts to cut their estimates for the December quarter.

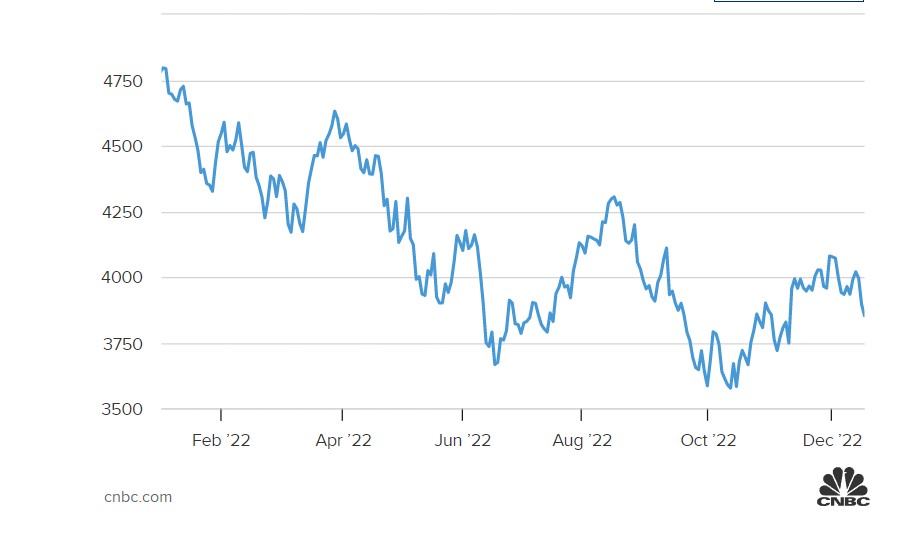

#3 The Worst First Half in 50 Years for the Equity Markets

Apple isn’t the only stock to have suffered this year. The global stock markets have been on a bear run for a large part of 2022. In fact, the first half of the year was the worst since 1970, majorly driven by uncontrolled inflation. Through the first half of the year, the US Federal Reserve kept insisting that inflation was “transitory.” It finally woke up in June, but the damage to the markets was already done by then.

The S&P 500 had declined almost 20% while the DJIA was down more than 14%, reflecting a pessimistic market sentiment and declining risk appetites.

Image Source: CNBC

Even the tech-focused Nasdaq has lost close to 30%. But the impact of such market sentiment wasn’t limited to the equity markets though. The price of Bitcoin had dropped 60% from January 1 to June 30, while copper, which is often seen as an economic bellwether, was down over 15%.

#4 The UK Prime Minister(s)

Amid much political drama, Boris Johnson resigned as the UK’s Prime Minister on July 7. His successor, Liz Truss, lasted in office for a record 45 days. The problem was her campaign promise to bring in tax cuts, which were unfunded and would lead to huge government borrowing and a tax windfall for exempted energy companies. The mini-budget, presented by the newly appointed Finance Minister, Kwasi Kwarteng, sent the pound sterling tumbling to its lowest against the US dollar in decades. Gilt prices also collapsed.

This brings us to the third Prime Minister in as many months for the UK, Rishi Sunak. The announcement of Rishi Sunak as the next Prime Minister, on October 24, was received very positively by the markets. There was optimism that the new PM would bring in some much-needed stability. As a result, the GBP rallied to $1.13, while the FTSE 100 started the trading session up 5%.

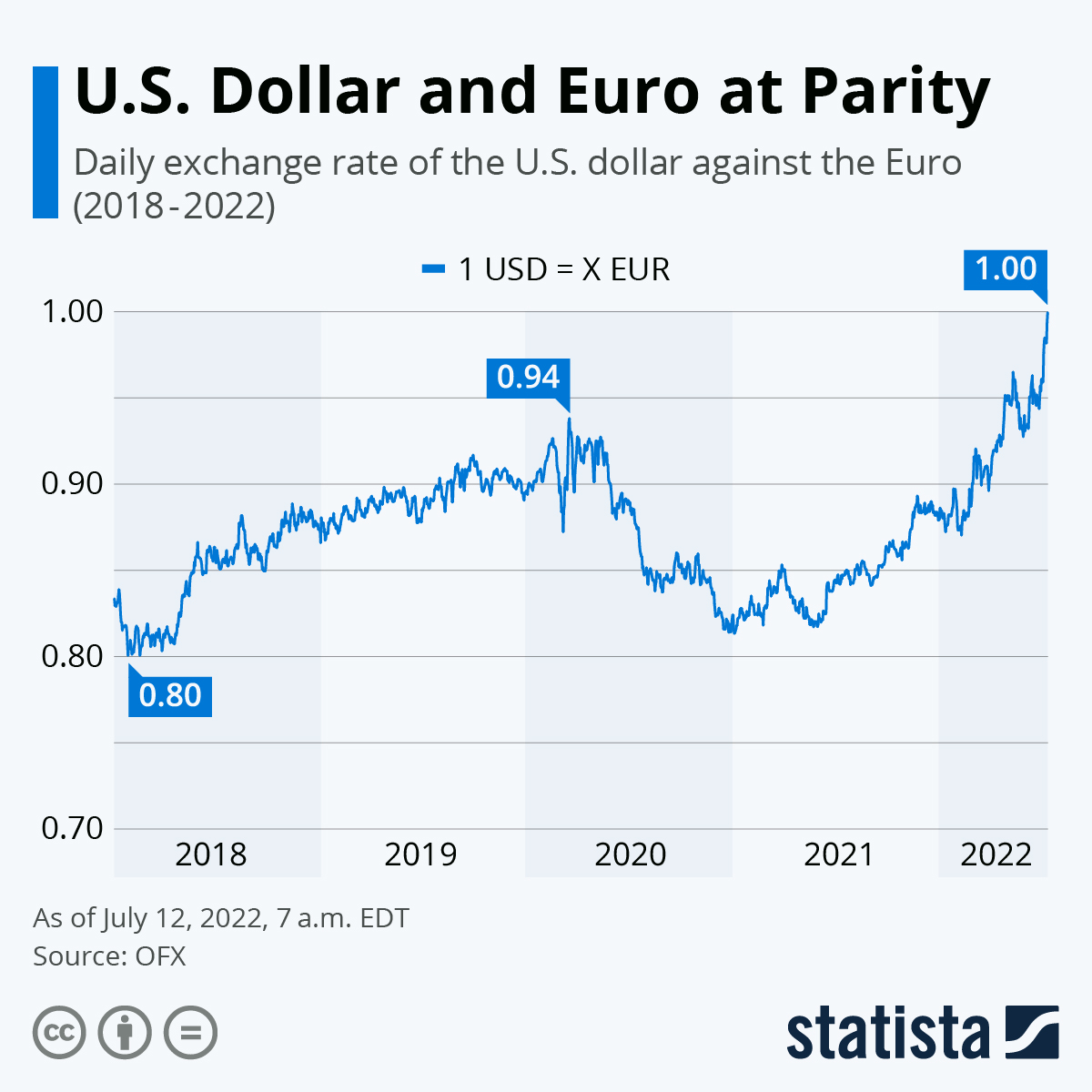

#5 The Euro Reaches Parity with the US Dollar

For the first time in two decades, the euro reached parity with the US dollar in July, indicating market concerns regarding a deep and prolonged recession in the EU. The Russia-Ukraine war played a key role in fuelling these fears, leading to food and energy shortages and rising prices.

It put the ECB in a difficult balancing act between rising inflation and a slowing economy. On the other hand, the Fed had already taken a hawkish stance, which bolstered the USD and US Treasury bonds. This drove investors towards the greenback and away from the EUR. As a result, the euro started December with a decline of almost 8% YTD against the dollar, trading at $1.0503 on December 1, 2022.

#6 The Crypto Winter

It’s been a tough year for cryptocurrencies. Not only have crypto prices gone through the floor, but some crypto-related firms also are in deep financial trouble. The total crypto market cap, which stood at $2.7 trillion on November 7, 2021, had fallen to $1 trillion by July 24, 2022. All digital currencies in the list of top 100 cryptos had lost a large chunk of their value within those 9 months.

But this year’s crypto winter has been different from the one we saw in 2018. At that time, BTC had dropped over 50% from its all-time high amid a bull run in the traditional markets. This time around, we are seeing the crypto market trading much lower than the ongoing bear run in traditional financial instruments. The overall market sentiment, which has led to a global sell-off in most asset classes, is making it difficult for cryptos to gain ground.

Bitcoin was down 63.28% YTD, starting December at $17,008. But the biggest shocker was the collapse of the stablecoin, TerraUSD and (UST) its sister coin, Terra (LUNA), which led to $40 billion in investor losses and a domino effect across the crypto market.

#7 Hawkish Central Banks

It all started with the US Fed raising its federal funds rate by 25 basis points to the range of 0.25%-0.50% in March 2022. The American central bank has raised rates 5 more times since then. Following the 0.75 percentage point to 3.75%-4% in November, US equity indices plunged, since it marked the sixth straight rate hike. The Nasdaq was down 3% by the end of the trading day. But Fed Chair Jerome Powell confirmed at the end of November that smaller rate hikes would start from December 2022 due to a cooling inflation outlook.

The ECB was next, raising interest rates by 50 bps for the first time in 11 years in July. The European central bank has raised rates thrice since then, with the latest being on November 3, when it cut subsidies and raised its deposit rate by another 75 bps to 1.5%, the highest since 2009.

The EuroStoxx 600 has declined 17% in 2022, while the ICE BoFAML MOVE index, which tracks the volatility of treasury bonds, reached its highest since March 2020.

The Bank of England was slow to get started with rate hikes, raising interest rates for the first time in September by 0.5 percentage points. The most recent increase has been a 75 bps hike in the BoE’s benchmark rate, the largest increase in 33 years. This was contrary to expectations, given that economists had expected the central bank to take a less hawkish stance after the appointment of Rishi Sunak as the Prime Minister.

#8 Energy Crisis

The supply and demand imbalance in oil was expected to grow to 2% in 2022, with demand recovering post-pandemic. Little did the world know the historic supply shortfall it would face following the Russia-Ukraine war and ensuing sanctions. Russia is the world’s third-largest producer of oil and the second-largest producer of natural gas. It is also among the largest exporters of these energy commodities, accounting for almost a sixth of the global supply.

The impact of Russian sanctions was the worst for Europe, where some countries, including Hungary, Poland, Slovakia, Austria and Finland, depend on Russia for anywhere between 50% and 100% of their oil and gas needs. The supply shortage tool oil prices past the $130 per barrel mark in March, with natural gas also hitting record highs.

With energy still in short supply and the winter months setting in, demand is expected to rise even further. The OPEC has raised its global oil demand forecast for 2023 higher by 1.4 million barrels per day in October 2022. This is supported by news that China, the largest crude importer in the world, potentially relaxing its COVID-19 restrictions in the near future. Rising demand from China would significantly tighten supply and drive oil prices up.

#9 China’s Zero Covid Policy

Unfortunately, China’s housing market crisis and zero-Covid policy led to the nation’s economic growth lagging the Asia-Pacific region for the first time in over 30 years. The World Bank has pointed out that China’s seemingly unattainable zero-Covid policy has disrupted both domestic sales and exports. As a result, the growth forecast for 2023 has been cut to 4.5%.

Steady growth of the Chinese economy boosts global supply chain and industrial stability, while opening up opportunities for trade and investment. But the extreme restrictions led to the total closure of some of the most important cities, such as Shanghai, which together account for 40% of the nation’s GDP. The prolonged disruption to Chinese manufacturing has been a significant shock to the global economy.

#10 The Twitter Complaint Hotline Operator

Who other than Twitter to best narrate the drama that has played out through most of the year? So, here’s a look at Elon Musk’s Twitter acquisition straight from the horse’s (or should we say bird’s) mouth.

Image Source: Twitter

Twitter is now delisted, and its top leadership (actually ,most people) have been fired. The entire process, from bid to backing out to lawsuit and then retracting to complete the bid, has kept the stock markets on tenterhooks. Those who accurately predicted the end could have made a killing before the stock stopped trading. Will Musk use his newfound position to manipulate the markets? Check out our article over on Medium.

That’s a Wrap

Who could have predicted that this year would be full of such momentous events? At Contentworks Agency we follow the markets daily, delivering market analysis, PR, blogs and social media updates for our clients. Contact our team to discuss the content marketing needs of your broker, fintech or bank.