Elon Musk’s vision for X, the platform formerly known as Twitter, is evolving. Musk’s vision encompasses social media networking, media consumption and financial services. A significant stride in this direction is the recent partnership between X and Visa to introduce a real-time payment system, marking progress toward creating an everything app. As financial marketers, we’ve been closely following activities over at X headquarters. Here’s what we know about X Money so far.

The Genesis of X Money

In late 2024, X CEO Linda Yaccarino announced plans for a payment system called X Money, set to launch in 2025. This initiative aims to integrate financial transactions directly into the platform, allowing users to send and receive money seamlessly. Yaccarino emphasised that X Money is part of a broader strategy to connect users in unprecedented ways, alongside other features like X TV and the Grok AI chatbot.

The Visa Partnership

The collaboration with Visa is what really caught our attention. Visa is a pivotal component of X Money’s development. By leveraging Visa’s extensive payment infrastructure, X plans to facilitate peer-to-peer transactions, enabling users to transfer funds from Visa debit cards or bank accounts to their X Money accounts. This integration is expected to provide a seamless and efficient payment experience within the platform.

Musk’s Payment Roots

Musk’s involvement in X Money reflects his early career in fintech. He moved to California in 1995 to attend Stanford University, and with his brother Kimbal co-founded the software company Zip2, that was later acquired by Compaq in 1999. That same year, Musk co-founded X.com, a direct bank, that later formed PayPal. In 2002, Musk acquired U.S. citizenship, and eBay acquired PayPal. This makes his new venture with X Money feel like a full-circle move.

Musk’s vision for X extends beyond payments. He envisions transforming the platform into a “super app” akin to China’s WeChat, which combines messaging, social media, and financial services in a single application. This ambitious plan aims to create a one-stop digital ecosystem where users can interact, consume content, and manage financial transactions seamlessly.

Challenges Ahead

Despite the promising partnership with Visa, X Money faces significant challenges. One of the primary hurdles is user adoption. Many consumers are already accustomed to existing payment platforms for both consumer-to-business and peer-to-peer transactions. Convincing users to transition to a new system will require demonstrating clear advantages over established services. Users might also question Musk’s reliability following a series of erratic and spontaneous decisions on X since his takeover.

Additionally, regulatory compliance poses a substantial obstacle. As of early 2025, X has secured money transmitter licenses in 38 U.S. states, but obtaining approval in key markets like New York remains a challenge. Navigating the complex landscape of financial regulations will be crucial for the nationwide rollout of X Money.

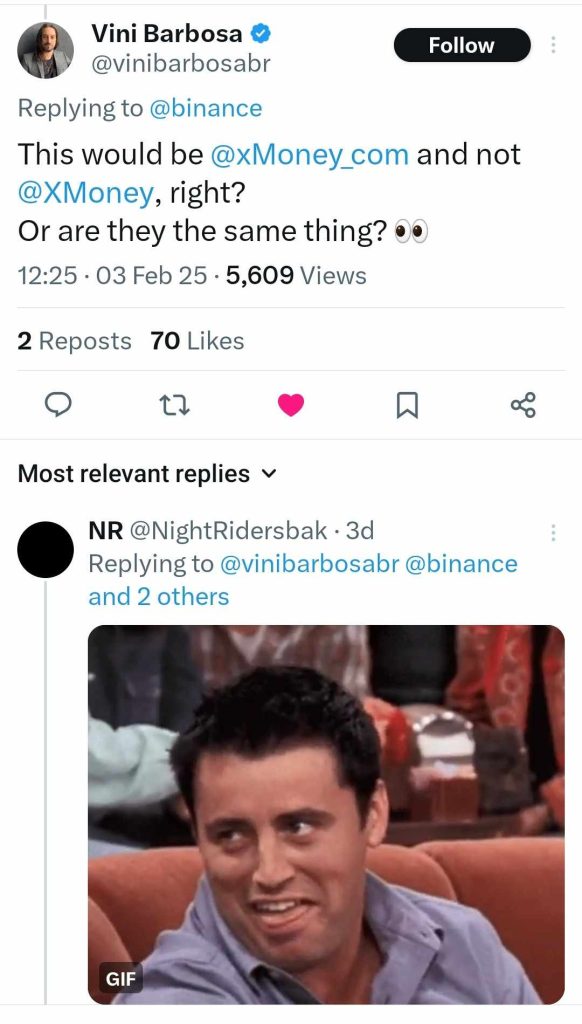

Our team also noticed that XMoney.Com already exists and is not affiliated with Musk’s XMoney. Other X users noticed too! Will Musk aim to quash that company? Or will he (or they) find SEO to be a challenge?

Fun Prediction: We anticipate that Musk will quash his competitors XMoney.Com account on X. Musk has form when it comes to seizing back handles. The @x handle was originally owned by photographer Gene X Hwang, who registered it in 2007. Hwang had expressed willingness to sell the handle, but received an email stating that the company was taking it, and he was not offered financial benefits.

Market Reception and Future Prospects

The announcement of X Money has garnered significant attention in both the tech and financial sectors. Analysts are closely monitoring how this development will impact the competitive landscape of digital payments. The partnership with Visa lends credibility to X Money, but its success will ultimately depend on user adoption and the platform’s ability to differentiate itself from established players like Venmo and PayPal.

Musk’s deepening ties with corporate America and the current U.S. administration could influence the trajectory of X Money. Major companies are increasingly aligning with Musk’s ventures, potentially providing strategic advantages as X navigates the complexities of launching a new financial service. As X Money prepares for its anticipated launch later this year, the tech and financial industries will be watching closely to see if Musk’s latest venture can redefine the landscape of digital payments.

Contentworks Agency works closely with fintechs and payment providers to deliver strategic marketing. Speak to our team about marketing your finance brand.