Financial literacy is insufficient across the globe. Young people often get very little financial education and enter adulthood with poor knowledge about important topics such as loans, debts, interest rates, savings, investing and trading. There’s also evolving currencies like crypto to factor in. The demand to know more is there, however, with The London Institute of Banking & Finance revealing some interesting stats. According to the Young Persons’ Money Index, 81% of young people feel anxious about money, with 72% wanting more financial education in school. This increased to 85% for those aged 17-18. Contentworks Agency provides education centres for the leading banks and brokers. Today, we’re putting the spotlight on financial education.

Financial Literacy: The Current Climate

- 3.5 billion adults lack an understanding of basic financial concepts – most of them in the developing countries. Financial illiteracy is a problem in developed countries too, however, with more than 65% of Americans showing signs of gaps in financial knowledge according to Walden University.

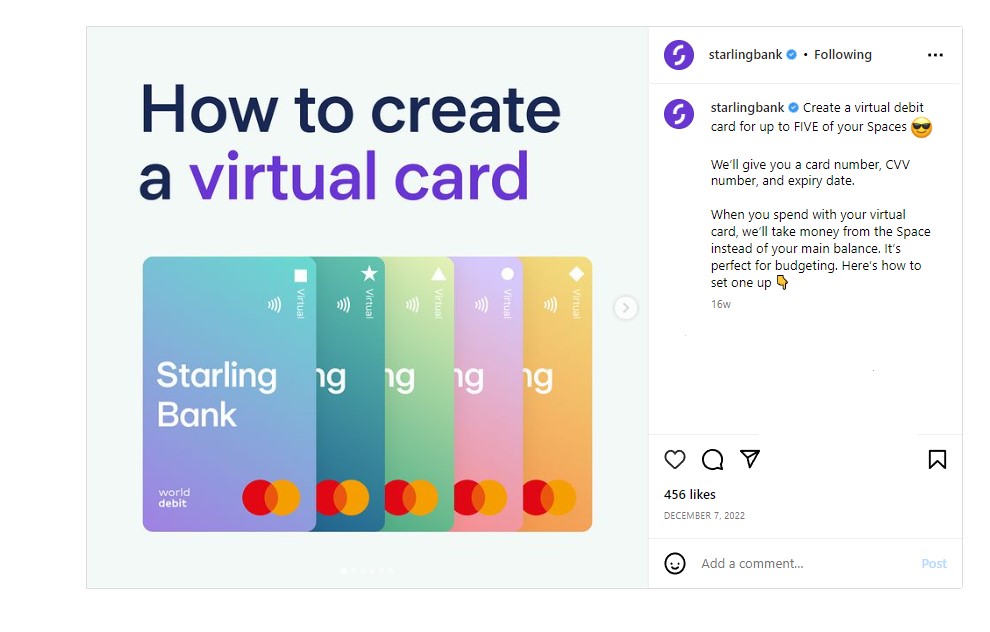

Top consideration for marketers: Evaluate the financial literacy of your demographic and identify gaps in knowledge. It’s also worth analysing your own data to see how well people understand your product offerings and services. If you have a really cool concept that just hasn’t taken off yet, a lack of literacy around more complex financial tools may be the issue. So, don’t be afraid to offer breakdown posts and focus on one area of your business. Check out Starling Bank promoting their virtual cards on Instagram. Offer step-by-step instructions or link through to a full explainer blog/video if needs be.

- More than a quarter of people in the UK (26%) started 2023 in debt. The types of debts covered included informal debts such as borrowing from friends or family as well as credit card spending, overdrafts, loans or buy now pay later (BNPL) spending, according to research from Tesco Bank. One of the main contributors to debt was a lack of control over finances suggesting poor financial literacy.

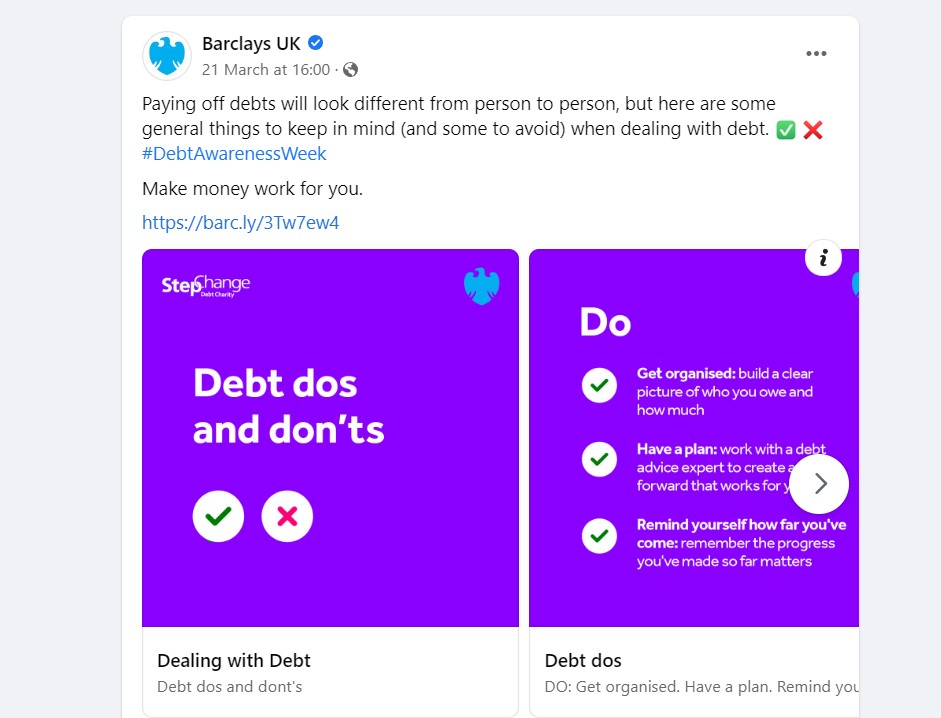

Top consideration for marketers: Create consistent content around debt management. Promote any apps or services that may help with this process and keep a lookout for national days to plan content around. Barclays offered a debt dos and debt don’ts post for #DebtAwarenessWeek in partnership with charity Step Change. Simple bullet points made this content visible, hard to scroll past and easy to absorb.

- A report from the National Financial Educators Council showed that 38% of individuals in a recent survey said their lack of financial literacy cost them at least $500 in 2022, including 14% who said it set them back by $10,000 or more. That’s up from 11% from 2021. People in the UK owed £1,837.4 billion at the end of January 2023. This was up by £70.5 billion from £1,766.9 billion at the end of January 2022, an extra £1,325.92 per UK adult over the year.

Top consideration for marketers: Prioritise transparency. If you’re a BNPL brand, for instance, make interest rates crystal clear to help build trust and knowledge. Klarna has a whole section of their website dedicated to financial explanations. You’ll need to do this anyway for legal reasons, but don’t just bombard people with numbers and percentages. Instead, give them a clear breakdown of potential payback amounts to help your customers feel more in control.

- More than four out of five Gen Zs (85%) say they face a barrier to financial success, reporting the following as a financial burden: High cost of living (59%), not enough income for goals (45%), state of the economy (39%), housing and rent (31%) and not being able to save (21%). Moreover, almost half of the generation (46%) in Bank of America’s survey carries debt.

Top consideration for marketers: Think about addressing audience pain points on the channels they’re most connected with. Research to know where your demographic hangs out online. Hint – 88% of GenZ spend their time on YouTube, so having a strong YouTube presence is a good place to start. The Monzo Insider series on YouTube is a good example of how complicated topics can be broken down in an interesting way. Remember, finance marketing shouldn’t be boring and you can inject a bit of humour into your brand, especially if you’re targeting a younger generation. It’s also a good idea to include a significant team member like your CEO as this will build credibility.

- More than 24.5 million people (46%) in the UK are financially disengaged, according to new research from Legal & General Retail. While 18% blame a busier lifestyle for their poor money handling, almost 17% couldn’t state a reason for why they no longer feel financially focussed.

Top consideration for marketers: Many people zone out because they can’t connect to brands. Using social proof and detailed examples of success can help spark interest. People want to see others like them using products and services successfully. So make sure anyone featured in your marketing material represents your audience. For example, use Millennial influencers when talking to a Millennial customer base.

- While pre-retirees (those aged 55+ who are still in work) are more financially engaged than the rest of the population (62% compared to the UK average of 54%), many are still inactive when it comes to retirement planning suggesting they don’t know where to start. More than a third (34%) do not currently check their workplace pension while 28% do not currently review their personal pension.

Top consideration for marketers: If you target the 55+ aged group, create content around retirement planning. This could be video content, blogs or segmented email sends loaded with easy-to-absorb information. Take a look at this example from Barclays regarding wealth management and planning for retirement.

An Increased Demand for Financial Literacy

There are certainly a lot of challenges when it comes to financial literacy and a lot for marketers to think about. But people want help and are ready to take big steps to improve their financial situation. Here are some of the stats to keep in mind when planning your content marketing strategy and some more handy content ideas from top brands.

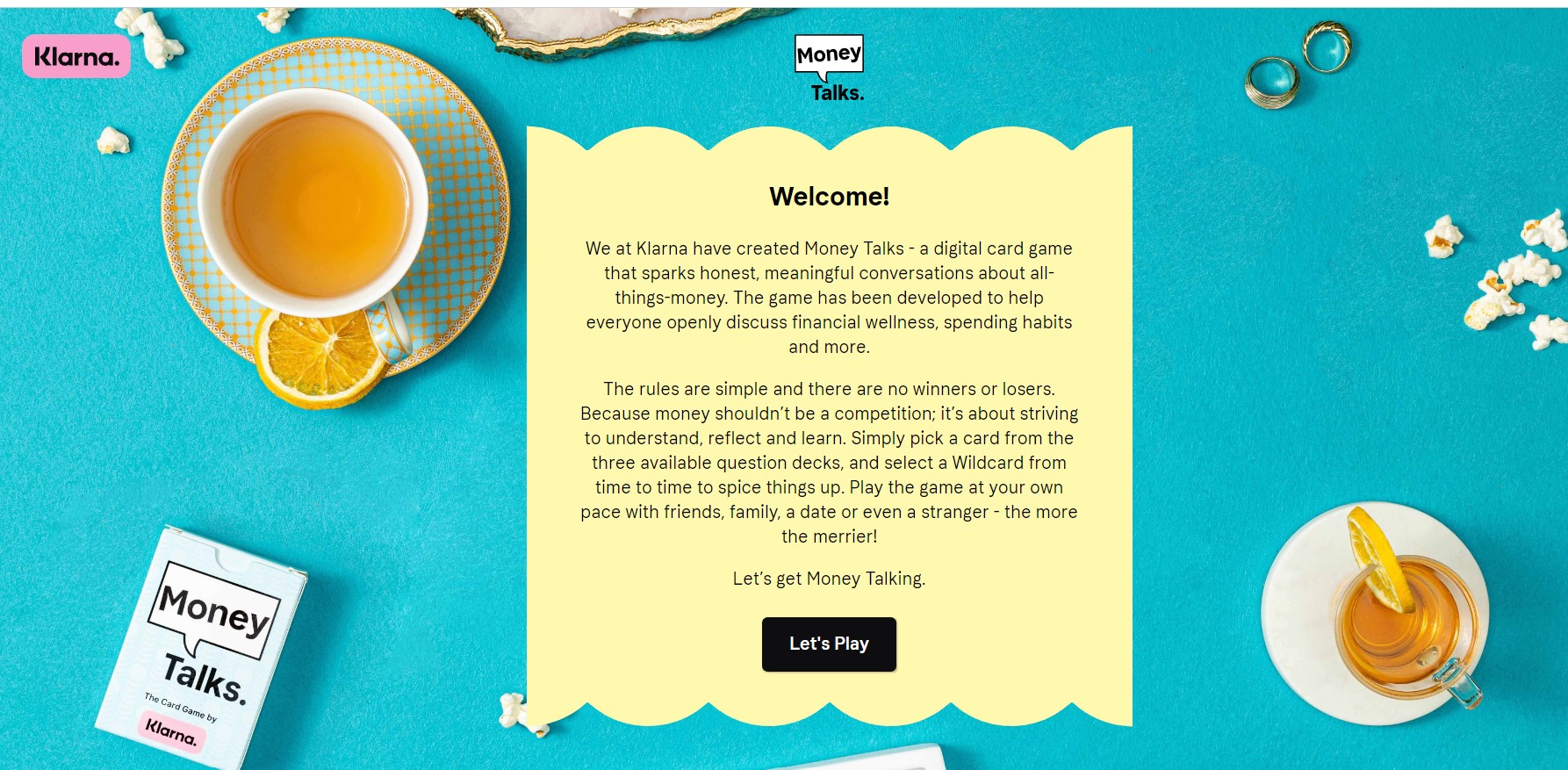

The majority of UK adults now feel comfortable discussing personal finances with friends and family, up by 28% from last year, according to YouGov and Klarna polling. Gen Z is most at ease with the topic, with 67% now feeling comfortable talking about money. This is huge for financial literacy as money issues are no longer a taboo and people are reaching out for information.

Hoping to continue boosting these numbers, Klarna has relaunched its Money Talks digital card game. This has been played more than 40,000 times since its launch two years ago and consists of three levels and a wildcard round, each touching on different themes like relationships, personal habits and financial knowledge to encourage users to have open conversations about money. This is a really innovative approach to financial education and one that shows how learning doesn’t have to be boring. Quizzes, live games, polls and competitions are also great learning tools.

Nearly 80% of Millennials and Gen Z get financial advice from social media on a wide range of topics. Investing in stocks and bonds was the most common choice, with 57% of young adults saying they use social media to learn about this. Personal budgeting (51%), passive income (49%), reducing debt (40%) and building or improving credit (37%) rounded out the top five topics. 78% believe they have more access to financial advice than they would have in the past due to their identity (race, gender or income). And 76% of Millennials and Gen Z believe social media has made it less taboo to talk about money.

Armed with this knowledge, financial companies like Step Bank regularly take to platforms like TikTok to address a wide range of topics including stocks and investment. Their videos are short, to-the-point and make financial concepts easier to understand for a younger, social-savvy audience. One thing to remember is that younger people don’t want to just see numbers and boring facts. They want to relate to topics they understand such as buying a daily Starbucks, so think about this when coming with social content.

Starling also uses financial influencers to explain key budgeting concepts. This boosts brand awareness, makes financial subjects more cool and helps younger audiences to stay switched on. Don’t forget those all-important keywords and hashtags such as #Budgeting and #VirtualCards to make your content searchable. #Budgeting alone has over 3.1 billion views showing just how in demand this content type is.

Other Financial Education Ideas for Brands

As you can see, there are loads of ways to spark interest in your audience and provide them with the education you need. Other ideas include:

Rewards for education

Revolut offers clients a free crypto education in return for free crypto tokens just for taking part. Considering over 60% globally still don’t understand the ins and outs of digital currency, this is a great incentive to learn more. To take the course and earn the cryptocurrency, consumers need to sign up for the app, which in turn boosts app uptake. Genius.

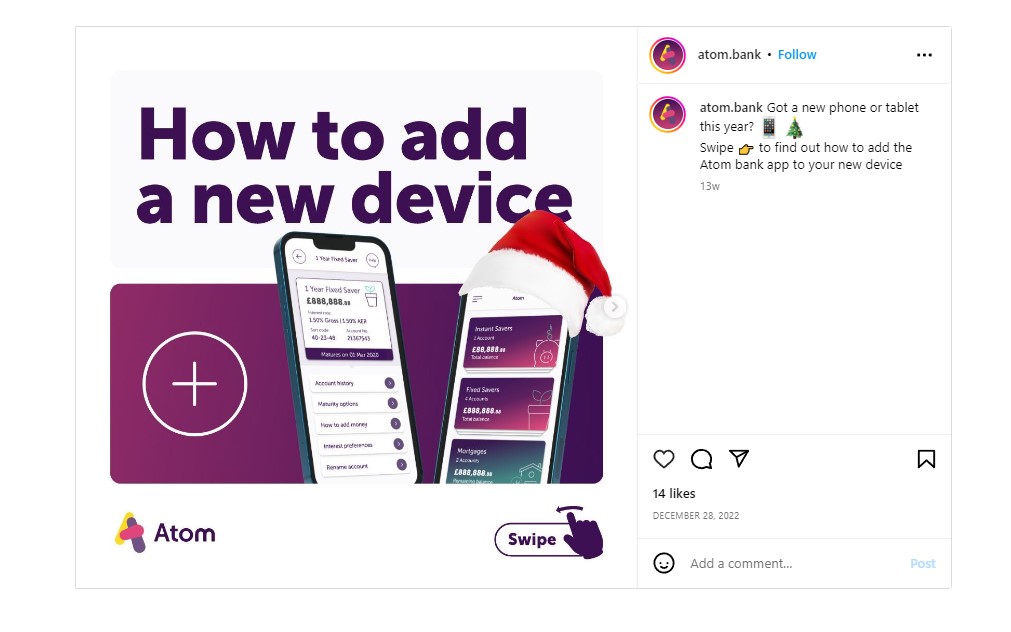

Detailed How-Tos

Don’t assume that people know what to do when it comes to the more technical aspects of finance. Digital banking and using apps for financial purposes is still new to many, so handy explainers and how-to guides posted to social media are ideal. Atom Bank recently posted a step-by-step guide on how to add the Atom Bank app to a new device complete with clear instructions and images. Educational content can really be this simple.

Educational Theme

The financial landscape is heavily saturated with brands trying to outdo one another. So it makes sense to focus on a particular theme that will set you apart. Tandem Bank, for instance, are challengers dedicated to helping consumers reduce their carbon footprint. They help customers save, borrow and spend a little greener and offer savings products, green home improvement loans, EPC discount mortgages and much more. Due to the unique nature of this approach, Tandem offers a wide range of educational content to help customers connect with their brand. The Tandem Bank blog, for example, is loaded with articles about how to make greener choices. They also use social channels such as Instagram to promote eco-friendly gift ideas for important days of the year such as Christmas and Mother’s Day. This hooks people in who are interested in protecting the planet as well as improving their finances.

Tandem uses the term #financialeducation, launching educational workshops across Britain to help people learn. By including hashtags like this in marketing material, you can specifically highlight your aim and show that you care about the future of your clients.

At Contentworks Agency we create content for education centres, social media, Reels, TikToks, videos and blogs. Our team of finance writers can deliver content that’s tuned into your demographic, their level, interests and concerns. Can financial education really be something you enjoy in the evening with a glass of wine? We think so. Book a free 15 minute Zoom call with our team to get started.