As a marketing agency working predominantly in the finance and fintech spaces, we’re familiar with BNPL. And as fintech embeds itself further into retail, BNPL (buy now, pay later) is likely to become more prevalent. Today, we’re diving into the sometimes murky waters of BNPL, to look at its regulations, trends and frontrunners.

A Brief History of BNPL

BNPL started when Nordstrom began issuing private-labelled “credit” cards in the 1980s and evolved into a $22.86 billion by 2022. The market snowballed during the lockdowns, when uncertainties compelled people to leverage the facility to hold on to their capital for a little longer. The untameable inflation that followed further pushed customers to opt for instalment-based pay later modes for even small ticket purchases. The popularity flourished so much that PayPal reported a 400% rise in y-o-y Black Friday volumes in the BNPL segment in 2021. While the e-commerce boom has significantly changed the way consumers manage their finances, shop, and make payments, fintech has made available a variety of mechanisms for them to accomplish that.

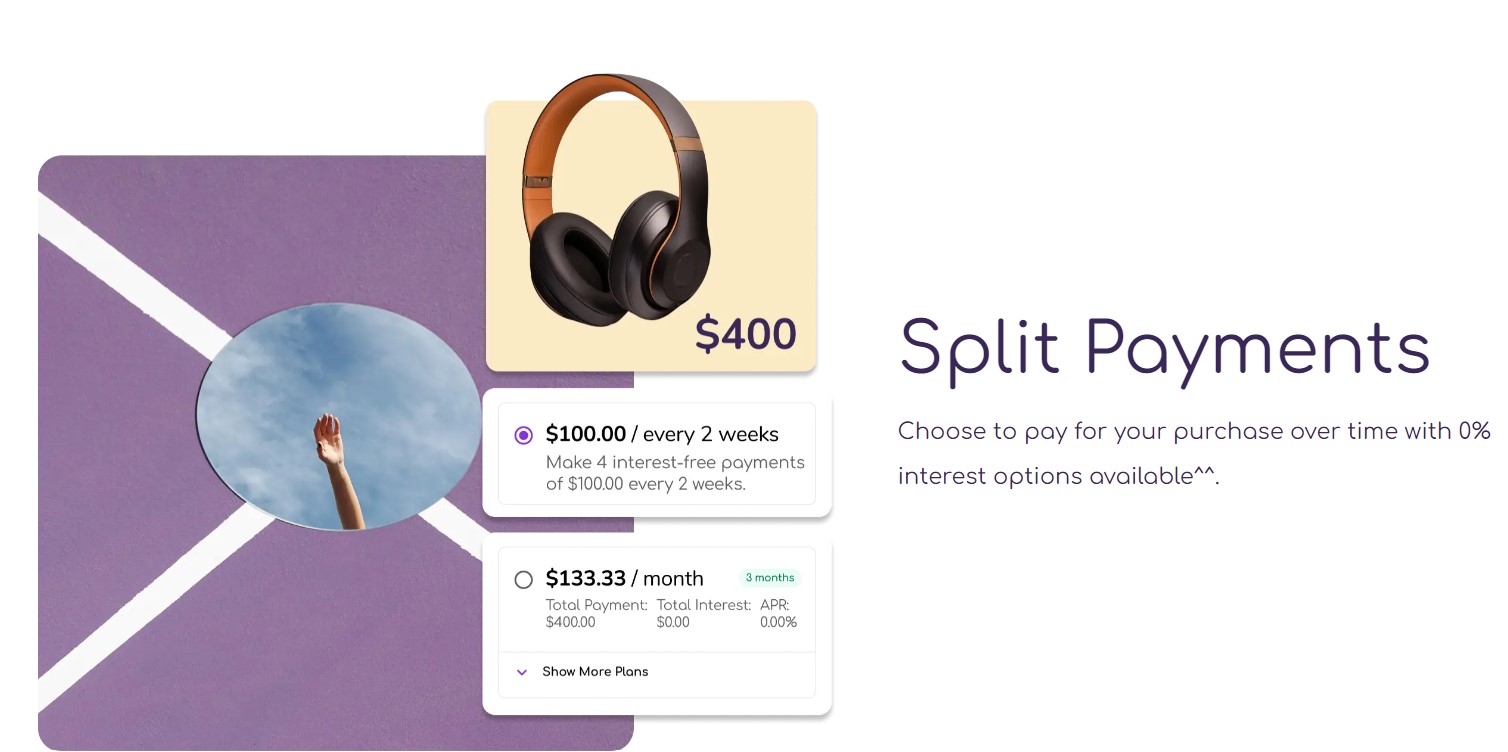

BNPL works at two places – Point of Sales (POS) instalment loans and post-purchase credit card instalments. Both enable a consumer to make large ticket purchases without having to pay the full amount upfront. They are interest-free loans, although credit card-based split-pay models could entail a convenience fee. A major difference between the two modes is that pure-play BNPL providers operate at the edges of the financial ecosystem, since the space is yet to be regulated. BNPL adds a lot of flexibility and stretches the customer’s lifecycle with the merchant. Exclusively created plans instil a sense of being appreciated by and important for the merchant among consumers.

Industries Driving BNPL

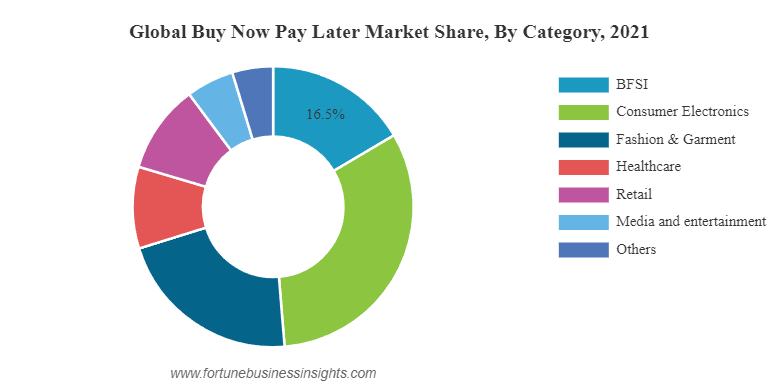

Every consumer-facing industry is embracing the delayed payments model to serve a broader spectrum of clients and drive buying decisions. Remember FOMO? The strong psychological sales and marketing technique is alive and well and feeding the BNPL machine. Consumer electronics, apparel and BFSI are the top three industries offering the facility to gain customer traction.

Image Source: https://www.fortunebusinessinsights.com/buy-now-pay-later-market-106408

North-Western Europe has been the largest market, with Sweden and Germany leading ahead of the USA. Going forward, Asia and Australia are expected to drive the market to its glory.

Growth of BNPL

Buy Now Pay Later models are expected to see a CAGR of over 22% between 2023 and 2028. Major factors driving the growth of the BNPL market are:

- Increasing penetration of online shopping and payments, which is expected to grow by 56% from 2021 to 2026 and surpass $8 trillion, is the biggest market for BNPL vendors to embed their services without denting the customer experience. Deeper smartphone penetration is fuelling it further.

- Millennials and Gen Zs are the most likely BNPL consumers, with 75% talking about numbers. They prefer wealth creation without compromising on their desires or aspirations. They use BNPL as a tool to budget their expenses and get exactly what they want right now.

- Ease of use and embedding lending within the POS is helping BNPL providers offer their services seamlessly across platforms.

Current Climate

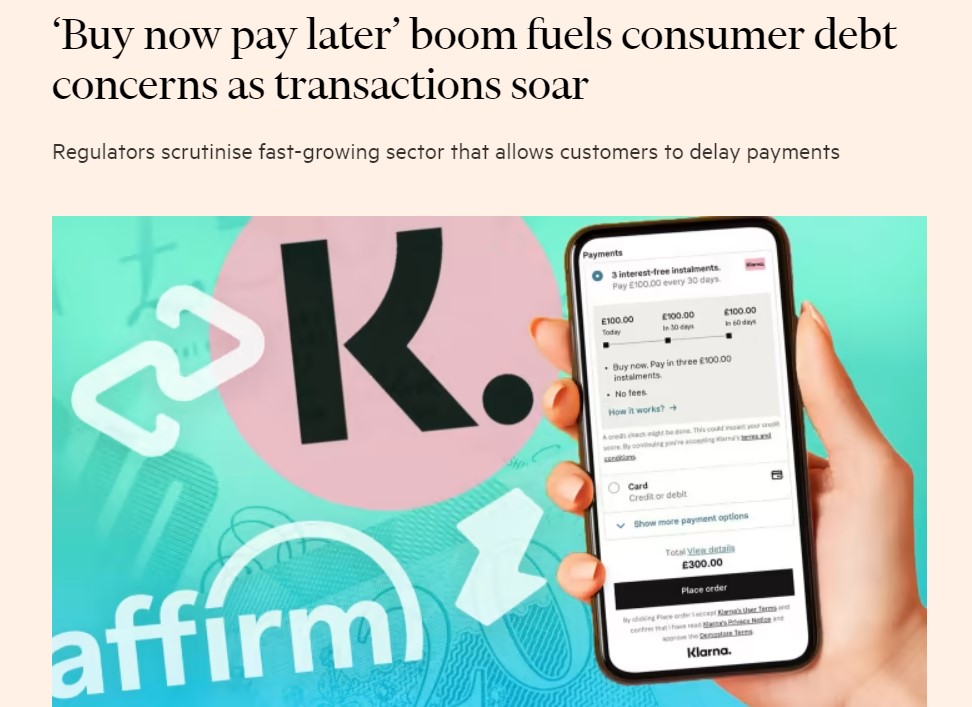

The ubiquitous presence of BNPL providers is almost like the air we breathe. No one sees it, but everyone uses it. It doesn’t interfere with anything you do and still accomplishes the complex task of lending. Providers don’t need to market themselves or even create an infrastructure or digital platform to serve their clients! However, the monitoring bodies do not approve of lending without scrutinising the borrower or their ability to pay the loan back.

Unfortunately, a third of US BNPL users have faulted on a payment. As a result, BNPL is drawing a lot of heat from the financial regulators.

They need to balance the availability of necessary interest-free credit for the short term while preventing merchants and customers from being exposed to risks, such as:

Overextension

The trade-off remains between leveraging innovation for customer experience and preventing its overuse, destroying personal financial health. Multiple small payments every month run a risk of consumers losing sight of how much they are actually spending. 45% of consumers admit to buying beyond their budget, while 59% confess to making an unnecessary purchase. In the long run, it shouldn’t render them unable to fulfil their obligated non-BNPL payments.

Data Harvesting

BNPL lenders and sellers could exploit consumer spending behaviours to run marketing campaigns to improve consumer engagement and loyalty, and maximise revenues. Firstly, it blurs the boundaries of privacy and, secondly, it increases their exposure to the risk of overspending.

Discrete Harm

Most BNPL providers operate at the POS, a point where either the consumer may abandon the cart or buy an item due to the benefits of instant credit that they possibly don’t need. Often, loan terms, dispute settlement conditions, the necessity of auto pay and implications of late payments remain undisclosed. Notably, consumers do not completely know what they are getting into.

Credit Score Damage

BNPL companies require only a soft credit check to assess the creditworthiness of an applicant. However, traditional loan providers tend to conduct a hard pull of customer data before issuing a loan. That is when tiny overdrafts or payday loans may reflect negatively on their credit reports. This is a significant factor that is often ignored by consumers, merchants and regularised creditors, at least for now.

Further, the growing emphasis on open banking and greater financial control supports the BNPL concept, since neither the lender nor the borrower is mandated to undergo any background checks.

The Regulatory Landscape

Globally, governments are tightening their lending policies. In India, for instance, the Reserve Bank of India (RBI) has restricted non-banking institutions from issuing pre-paid or credit-based payment instruments. At the same time, it has brought forth a model to enable the nascent industry to grow sustainably within the nation’s economy. The Australian Treasury released the Options paper – “Regulating Buy Now, Pay Later in Australia,” to invite submissions for regulating the sector. Although the providers don’t need to gain an Australian Credit Licence (ACL), they must follow a responsible regime till the laws are in place.

In Europe, 16 countries have mandated supervisory authorisation for starting any consumer credit business, while 5 others require a special registry. As providers experiment with other models, such as using factoring to finance merchant activities, the industry is looking for new approaches to prevent these limiting factors from affecting its growth.

The UK Financial Conduct Authority (FCA) has issued a warning to firms marketing over social media without clearly enlisting the risks involved in taking on unaffordable debt. The FCA was informed by the financial watchdog about the unethical promotional practices of Klarna and Clearpay. Sheldon Mills, the executive director of consumers and competition at the FCA, said that it is critical to keep customers in vulnerable circumstances informed about the risks in a fair, clear and non-misleading manner.

The Frontrunners

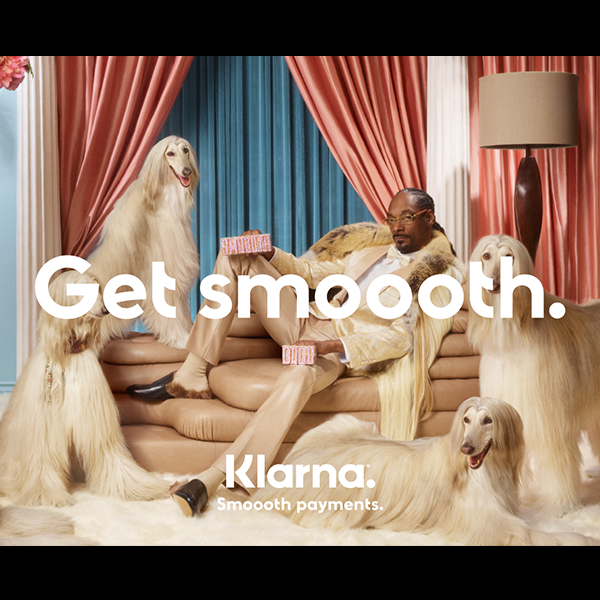

There are four key players in the delayed-payments mode of consumption – BNPL providers, payment enablers, merchants and fintech. The space is dominated by a select few, who have shaped the industry over the last few years with disruptive products and tasteful advertisements.

Klarna is the undisputed leader of flashy Instagram advertisements, with over 150 million active users, and has been a creative disruptor in the marketing of “Smoooth Payments.” The marketing team focuses on becoming a part of the cultural conversation.

Affirm closely follows Klarna, with a unique business model enabling customers to pay via a futuristic commerce platform linked with banking partners. Affirm promotes itself as a merchant marketer. It assists businesses to improve their ROI by solving the affordability and revenue acceleration challenges faced by them. It follows a two-way marketing agenda, where merchants promote Affirm as well. The strong network works well for both parties.

Australia’s AfterPay uses an in-app marketing technique where merchant partners can promote their ongoing deals and pay them per click. The company uses social media platforms like TikTok, to collaborate with merchants from time to time and promote them via influencers. They also introduced a live shopping concept.

Sezzle, known for its flexible payment plans, keeps its marketing focus on the most digitally active generation – Gen Z. It believes in staying on trend and even setting trends with the help of micro-influencers, especially those with a niche audience to help their targeted marketing campaigns.

Want more articles about BNPL marketing? Tweet us @_contentworks

The Outlook for BNPL

The market for BNPL is projected to hit $90.51 billion by 2029, fuelled by the consumer preference for online shopping, integration of AI within B2C business models to accelerate growth, and rising awareness of the split-payments facility. Despite the dominance of banks and credit providers, the BNPL sector is burgeoning as e-commerce penetrates deeper into the lives of consumers. However, regulators across the globe are worried that this might affect consumer buying behaviour adversely and are working towards regulating the sector. They see a Buy Now Pay Later plan as an unintentional loan.

What Experts Say?

The digital lending space has always been infamous for malpractice and consumer rights exploitation. And the staggering pace at which the segment is growing demands legislative intervention. Azad Ali, a financial services regulation practitioner in the UK and EU said,

Automated lending decisions based on open-banking data will need to be closely monitored and validated regularly. We have already seen some examples where banks have failed to publish accurate information.

He added that new rules might come into force only after 2024.

Steve Perring, head of the compliance and risk at Deko, a multi-lender checkout enabler, stated that additional tech support and compliance oversight can become necessary as consumer uptake escalates. He added that:

Loan-affordability assessments may require BNPL providers to associate with licensed bank account partners or get licensed to access the data as open banking takes over.

Utkarsh Sinha, Managing Director at Bexley Advisors:

“Identity theft is an issue as old as credit, and whenever there is a new paradigm for credit, identity thieves find new exploits.”

He also mentioned the risks associated with ghost lenders and incapable borrowers in the absence of financial audits.

User Support

The BNPL sector has gained the unwavering support of a large chunk of consumers. So much so that 57% of consumers believe that it is potent enough to take over credit cards due of its embedded nature and ubiquity. Even banks with a credit-card base are tempted to offer BNPL products since they address the needs of the younger demographics. Visa and Mastercard have partnered with Four and Splitit to take advantage of the extensive customer and merchant relationship opportunities they offer. Digital payments companies such as Paytm and MoneyTap are also enabling BNPL models for daily expenditures, such as groceries, and this is helping the sector strengthen its roots.

Despite their fears about data privacy and increased online financial activity, 84% of customers believe that lending companies and merchants take requisite measures to protect their rights. POS financing players, on the other hand, are working towards refining their techniques and facilitating a scepticism-free ecosystem of credit-based purchases. Regulatory tightening is bound to change how the future of payments shapes up, as the balance between consumer protection and accessibility takes centre stage.

Contentworks Agency understands the financial services and fintech marketing space. Our team of multi asset financial services content marketers can provide technical analysis, financial blogging and finance-focused social media. Compliance are not our enemies and we follow regulatory news and updates from ASIC, CySEC, MFSA, FCA, FSA, FRB, SEC, MiFID II and more.