Contentworks Agency is a leading forex marketing agency working with top brokers around the world. Working closely with forex brokers, we understand the trends, regulatory pressures and best marketing practices to win and retain traders. In this article we’re looking at social media for forex brokers in 2025. Here’s the latest forex marketing stats, top forex social media platforms and the do’s and don’ts of social media for forex.

Stats About Forex Trading In 2025

Before we get into social media for forex brokers, let’s look at the forex market in 2025.

- In 2025, the global foreign exchange market is worth $2.73 quadrillion, making it the largest financial market globally.

- There are approximately 10 million forex traders in the world. This figure encompasses a diverse range of participants, from beginners to seasoned institutional investors.

- Men make up 89% of all forex traders worldwide, while only 11% of traders are women. However, a study by Warwick Business School found that women outperform men by 1.8%, due to a preference for long-term strategies over short-term risk.

- 27% of forex traders fall into the 18-34 age group. The 35-44 age group represents 28% of traders, while the 45-54 age group accounts for 21% of traders. Only 24% of traders are older than 55, and only 9% are older than 65.

- How many forex traders lose? Actually forex trading has the highest loss rates, with up to 90% of traders losing money. 72% of forex traders had no experience trading any other markets before trading forex.

- 6% of traders frequently use leverage, and 40% use it occasionally, indicating a high prevalence of leverage in trading strategies.

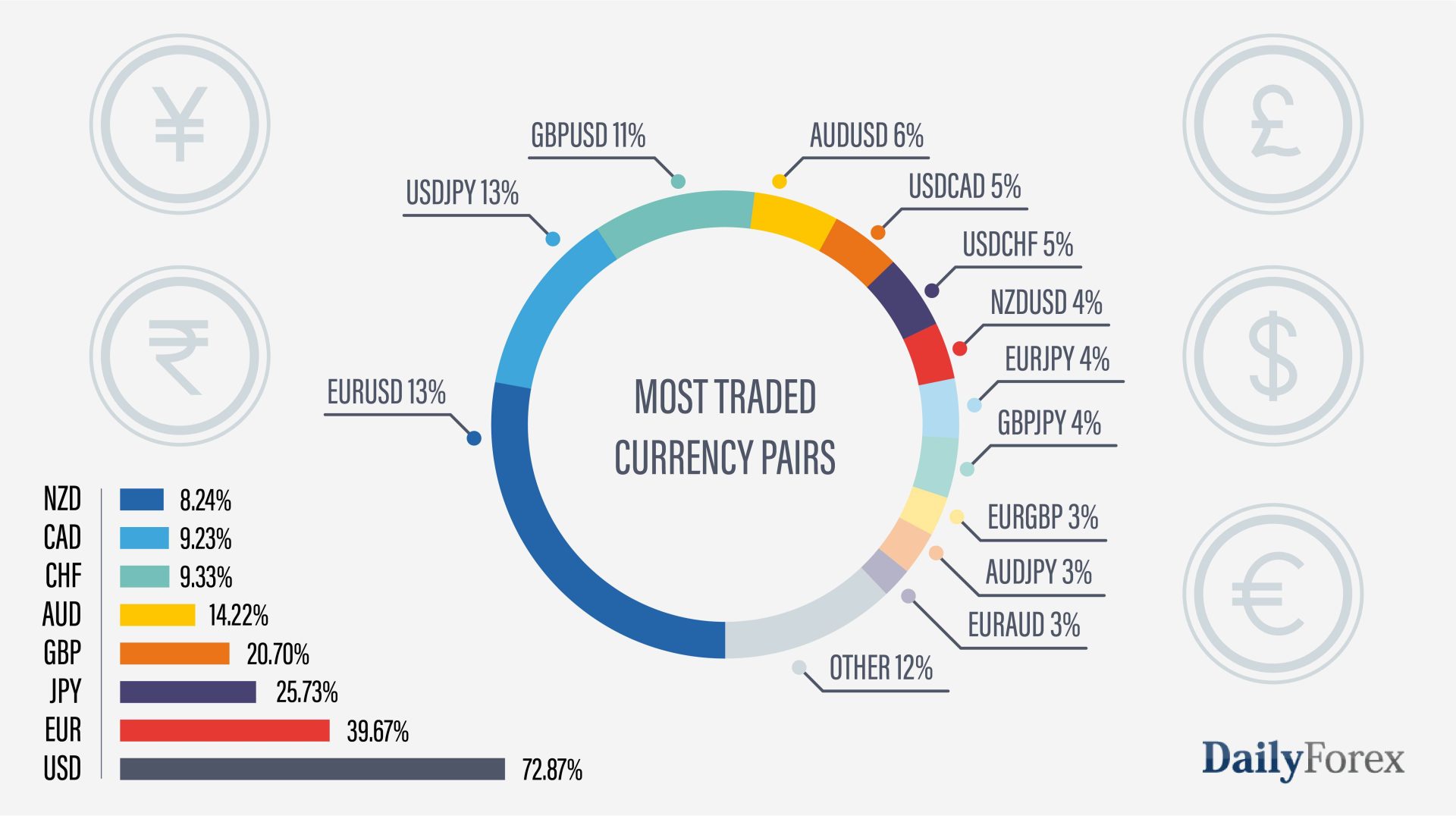

- Crypto and futures are tied as the top asset classes for trading opportunities. Forex is least popular. This gives a distinct advantage to brokers who carry a range of tradable assets. Stocks are the preferred asset class for 47.6% of traders, with futures coming in second at 38.1%. Check out this handy chart for the top traded currency pairs too.

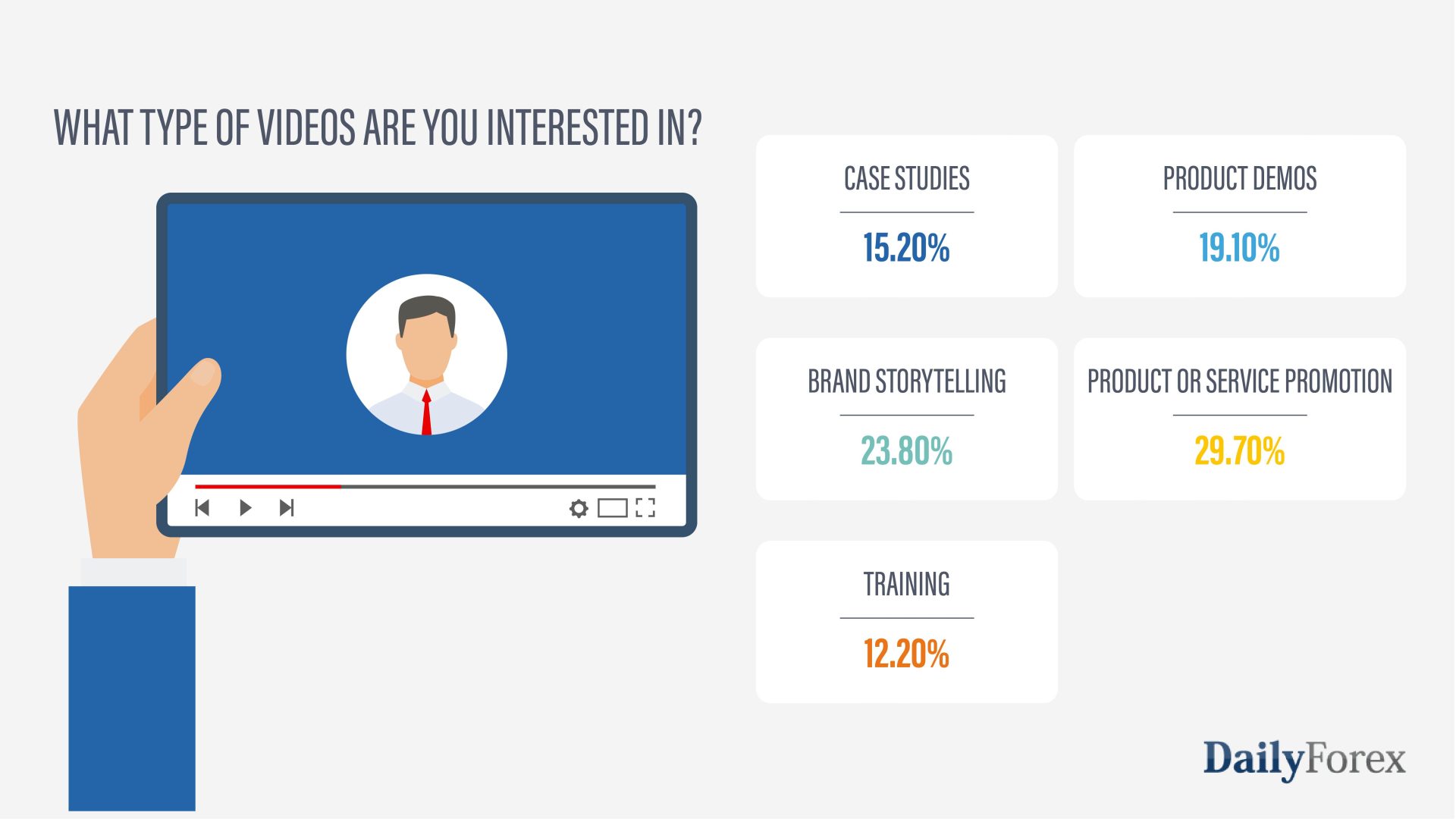

- Most traders rely on financial websites to learn and update about the forex market. 13.7% of the traders are taking an active part in social media communities such as Facebook, LinkedIn and Telegram. Additionally, traders are watching videos (case studies, training, demos etc) to improve their knowledge.

- The number of traders who rely on mainstream social media channels for the latest market news is increasing. Traders want to stay abreast of the latest updates that might affect their preferred asset classes.

Forex Social Media Platforms

Aside from the mainstream social media networks (Facebook, X, LinkedIn, TikTok and Instagram) there are also forex specific social media networks. These forex social media platforms share trading results, analyse trading systems and offer social elements and copy trading facilities. They often provide contests and are a popular place for brokers to advertise. Here’s a quick look at the popular ones:

- TradingView offers traders an opportunity to share their ideas in the form of complex charts with a range of graphical tools and also with a text description. The site has news, education, downloads, forums and active competitions.

- Forex Factory has just under a million members and is one of the biggest and oldest forex social media platforms. With forums, trading news, education, broker comparisons and trade explorers, this platform has many gated members only

- MyFXBook was launched in 2009 and features detailed performance analysis, backtests, chart sharing, autotrading, calendar, calculators, reviews, forums, pattern analysis, volatility meter, currency heatmaps, correlation filters, CoT charts and forex sentiment.

- com/r/Forex is not owned by a brand or broker and is a subreddit which is public and has 431k members. Whilst it’s mostly newbies on the forex subreddit, this space shouldn’t be discounted for forex brokers to watch. Reddit saw a significant surge in visibility due to its structured, user-driven discussions. Features like “Discussions and Forums” in SERPs expanded, creating competition for traditional informational sites. Reddit now appears as a top-ranking domain.

- BabyPips is popular with new traders. It also has forums for traders to discuss their trades, ask questions, interact with one another, and talk about brokers and crypto exchanges. The site has quizzes, contests, learning resources, news and much more. For brokers there are paid marketing options on this site, and we have seen good traction there in the past.

Social Media For Forex Traders – Dos and Don’ts

Forex trading is one of the most competitive and yet most regulated industries. Effective marketing is crucial to stand out, attract traders, and build trust. However, navigating the complex landscape of forex marketing requires adherence to strict compliance standards to ensure legal and ethical operations. Here’s our checklist on the dos and don’ts of social media for forex.

Forex Marketing – Dos

- Understand Regulatory Requirements. Do familiarise yourself with the laws and regulations in every jurisdiction where you operate or advertise. For example, markets like the U.S., EU, and Australia have strict compliance standards enforced by agencies like the CFTC, FCA, and ASIC. Ensure all advertising materials meet these requirements and avoid misleading claims. You should also choose a compliance aware marketing agency that understands the rules.

- Be Relatable. At Contentworks Agency we often see brokers posting chart after chart after chart on their Facebook page. A deeper dive often reveals that these charts are posted to all their channels. Charts have their place in forex analysis, but they aren’t relatable for many traders. If your traders fall in the beginner to intermediate category, consider posting memes, education and problem solving posts.

- Focus on Education. Do provide educational content that adds value to your audience. Tutorials, webinars, market analysis, and eBooks help build trust and position your brand as an authority in the forex space. Educate traders about risks alongside potential rewards to maintain transparency and trust. We provide unique forex content for your glossary, knowledge base, blog and whitepapers and eBooks. All this can be shared to your social media channels.

- Adopt Multi-Channel Strategies. Do employ a diversified marketing approach using social media, email campaigns, search engine optimisation (SEO), and paid advertising to reach different segments of your target audience. Ensure consistency in branding and tone of voice across all platforms by following a workable strategy.

- Think About Your Funnel. Your trader funnel needs to be filled with on-brand touchpoints. For example: A potential trader clicks on your Facebook ad, he goes to a landing page and watches a video, he downloads an eBook and gets an email welcoming him to your community. All these touchpoints should be branded, aligned and cohesive.

- Partner with Influencers and Affiliates Wisely. Do vet influencers and affiliates thoroughly to ensure they align with your brand values and comply with regulations. Monitor their promotional efforts to prevent any non-compliant or deceptive practices. Remember that brokers are liable for fines if their official influencers step out of line with the regulators.

- Share Events. LinkedIn is a great place to share your event photos and updates. Whether you’re hosting, exhibiting or just attending a forex event, this is the place to talk about it. Be sure to include details like your booth number, speaker slots and photos of the team members attending. Securing meetings in advance can avoid missed opportunities.

- Use The Right Hashtags. Remember to use the right hashtags, whether they’re branded or relevant to the finance industry as a whole. Popular hashtags include #bitcoin #cryptocurrencies #daytrading #forex #forextrading . You can also hashtag currency pairs such as #USDCHF or #EURJPY. Using the right hashtags allows people to easily find your content. Branded hashtags will also get people talking about your company, boosting brand awareness in turn. Check out our top finance hashtags for 2025.

Forex Marketing Don’ts

- Don’t Neglect Risk Warnings. Failing to prominently display risk disclaimers can lead to legal penalties and damage your brand’s credibility. Also, don’t hide critical information in small print or obscure locations. This in itself can land you in trouble with regulators.

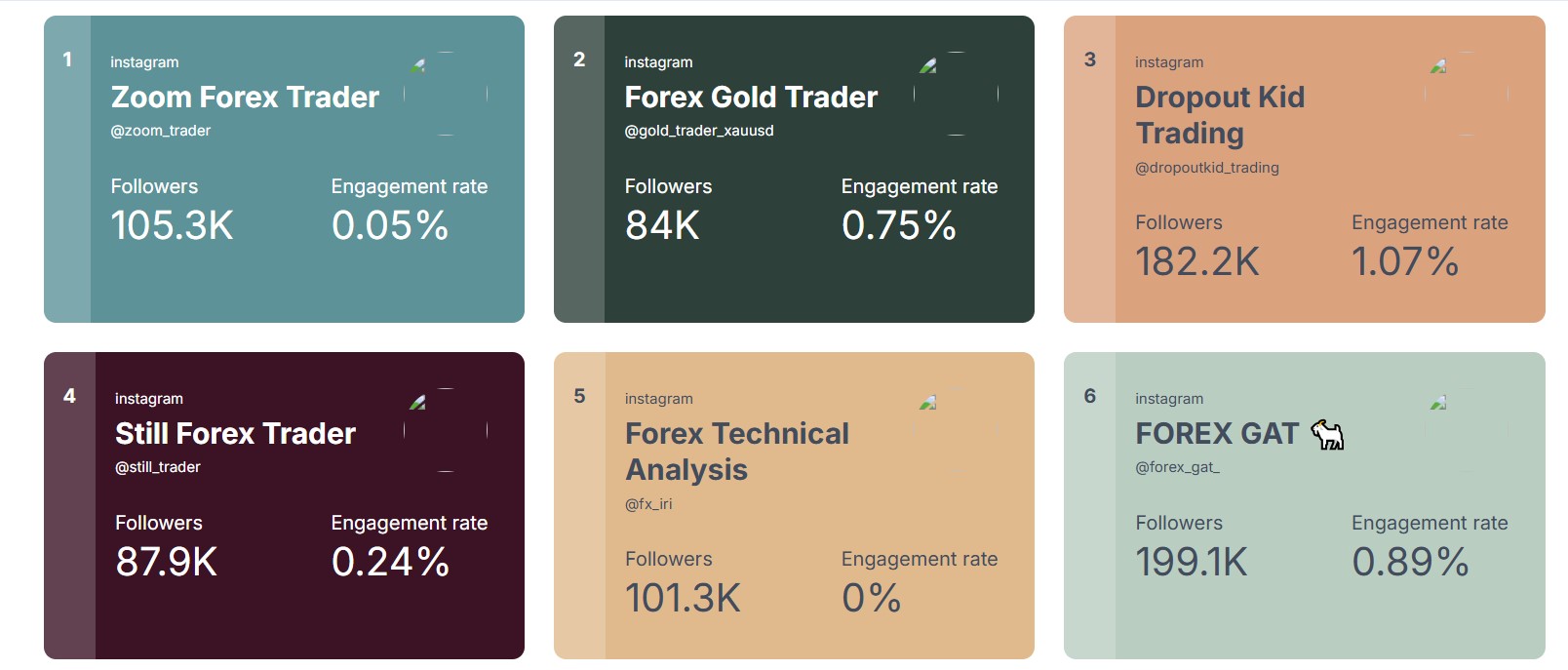

- Don’t Forget Influencer Due Diligence. Forex influencers have a presence on platforms like TikTok and Twitter (X). But remember that follower counts don’t always equal genuine engagement. Whilst it can be challenging to obtain authentic organic engagement, you can see from the example below that 101k follower accounts can have 0% engagement. Always do your due diligence before choosing to partner with an influencer.

As a reminder, these are the average engagement rates for the social media platforms in 2025:

- TikTok average engagement = 6.92%

- Instagram = 0.96%

- Facebook = 0.38%

- Twitter = 0.08%

- Don’t Forget Compliance Regulations. Whatever social media channels you’re on, it’s essential to comply with the various rules and regulations. The financial sector is heavily governed, and regulators can and do check social media for violations with fines are frequently dished out. All content should be fair, clear and not misleading. All posts also need to include the relevant warnings for your region and images shouldn’t imply unrealistic earnings or excessive wealth. Compliance for social media is a huge topic and one we’re hot on. Check out our monthly regulations roundups to stay in the loop.

- Don’t Be Too Aggressive. Avoid pressuring potential clients into opening accounts or depositing funds. This approach often backfires and can lead to regulatory scrutiny. Similarly, don’t resort to spammy emails or cold calls that could alienate your audience and put you at risk of a GDPR violation.

- Don’t Ignore Cultural Sensitivities. Avoid one-size-fits-all campaigns that might unintentionally offend or alienate audiences in specific regions. Don’t neglect the importance of localisation in language, visuals, and messaging.

- Don’t Mismanage Affiliate Relationships. Allowing forex affiliates to engage in unauthorised or misleading marketing practices can damage your reputation and result in penalties. By providing your affiliates with a frequently updated resources library, you can avoid this. The library can include logos in all sizes, social media headers, videos, eBooks, articles and promotional content.

Forex marketing is a balancing act between creativity and compliance. By adhering to the dos and avoiding the don’ts, you can create campaigns that attract traders, build trust, and meet regulatory standards. Remember, success in forex marketing isn’t just about acquiring traders, It’s about fostering long-term relationships through ethical and compliant practices. Book a free Zoom call with our team to improve your forex marketing this year.