The fintech landscape is growing at a phenomenal rate. From one-click checkout experiences to social media commerce, fintech has revolutionised the way we do business. Lockdowns also emphasised the need for hassle-free technology including mobile banking, online shopping, up-to-speed trading platforms and more, with all eyes now on a so-called Fintech 2.0 evolution. But what does this mean exactly and what fintech trends should we be watching this year?

The Fintech Landscape – A Quick-Fire Overview

Fintech 2.0 is all about increased integration into our everyday lives and finding more ways it can serve the economy. In fact, so many of us are used to fintech services that we unintentionally demand more from brands on a day-to-day basis. Whether that’s being able to buy products via Instagram or pay for designer products in a bizarre Metaverse environment using cryptocurrencies.

Here’s a quick-fire overview of the fintech landscape.

- The fintech market is expected to grow at a compound annual growth rate (CAGR) of 23.58% from 2021 to 2025 and the global financial services market as a whole is projected to hit $26.5 trillion by 2022. This shows how the industry is very much in acceleration mode with no sign of slowing down.

- By the year 2022, mobile transactions are projected to grow by 121%. This will eventually comprise 88% of all banking transactions.

- The use of cash at all point of sales has dropped by 42% since 2019 and is projected to be the least-used payment method within four years.

- By 2024, blockchain tech is set to hit US$20 billion.

Fintech 2.0 Explained

As with all innovation, fintech started from the ground up and has continued to get better and better. Fintech 1.0 companies varied in size and approach. But what they had in common was offering targeted solutions to specific pain points like savings, micro-investing, stock trading, peer-to-peer payments, small-dollar cash advances and mobile banking. The problem with Fintech 1.0 is that it often resulted in a fragmented consumer experience with too many apps specialising in a single area, all competing for attention.

Fintech 2.0 aims to solve this with a ‘re-bundling’ approach that integrates multiple services and apps into a single place to help save time, stress and money. For this to be a success, companies undoubtedly need customer-centric thinking that targets not just individual pain points but the complete financial needs of an end-user. Cutting-edge technology will also be required. This will analyse real-time date and make it easier to adapt to changing needs.

Many Fintech 2.0 dreams rely on exceptional planning, branding and a thorough knowledge of the growing market. So in 2022, can we expect to see many companies raising their fintech game in a bid to get noticed? The best will also showcase their readiness for the next big step and even start making those Fintech 2.0 boss moves.

So all things considered, here are some top fintech trends to watch this year.

#1 Brand Building Will Intensify

Brands will be looking to enter a whole new fintech era with strength, determination and confidence. This means brand building will intensify. To be seen as thought-leaders and front-runners, companies need to build a distinctive set of assets that they can use to their advantage. From logos and colours to videos and influencer marketing, there’s no time to be wishy-washy. Instead, there must be a focus on how to become instantly recognisable.

Brands doing this well include Klarna. Here’s why:

- They have a strong slogan. Their ‘buy now and pay later’ slogan is everywhere from their Twitter bio to their website. It’s catchy, concise and sums up the essence of their business model. Being clear about what you can offer consumers is of paramount importance when owning your space in a crowded market.

- They have an eye-catching logo and fresh colour scheme. Pink and black stand out amid financial brands that have often turned to blue to represent trust and green to represent money. This colour scheme is also consistently used across platforms including Instagram Stories and their YouTube channel.

- This helps to assert brand dominance and instant recognition. Even Snoop Dogg wore pink knuckle duster rings in his influencer collaboration with the brand.

- Speaking of collaborations, Klarna love to collaborate with celebrities, especially rappers, in a bid to appeal to their younger, more tech savvy audience. They recently teamed up with rapper and producer A$AP Rocky, which resulted in their YouTube video alone racking up 4.8+ million hits. Again, it’s all about brand building and creating a specific reputation with a particular demographic. This requires extensive research into who you’re actually targeting.

Top tip for brands looking to improve their identity

Be sure to fully understand your USPs. What do you do that other companies don’t and how can consumers benefit? Make sure you address consumer pain points based on research. Fee free mobile banking service Chime actually have a ‘Benefits’ drop down on their homepage which leads through to a detailed summary as to why people chose choose them. Include app visuals, statistics and important figures to help bring your content to life.

#2 All-In-One Place Vibes Will Surface

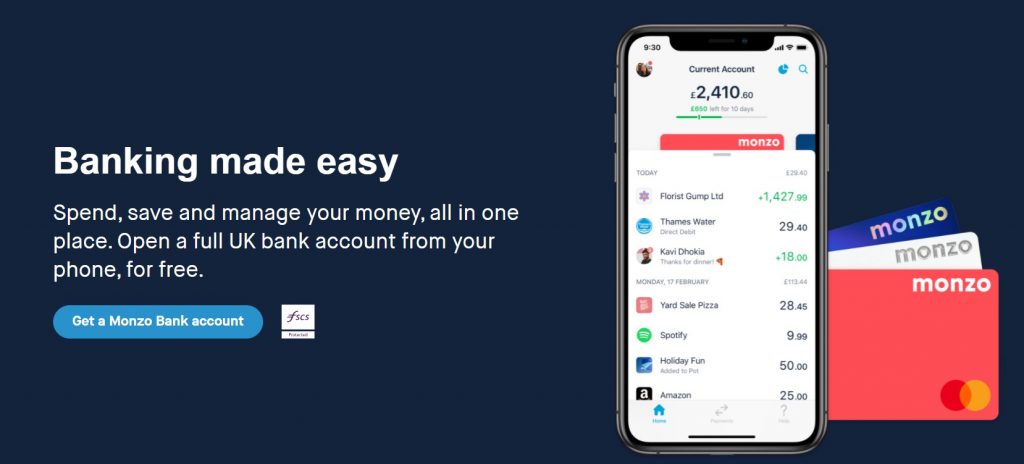

Remember, Fintech 2.0 is all about improving the user-experience and integrating numerous services into one life-changing package. It won’t be smooth sailing, but many fintech brands are already trying to showcase their diverse offerings. This includes online bank Monzo who’ve embraced the ‘all in one place’ motto from their homepage.

They’ve also pushed their mobile banking flexibility which is clever considering that their target market is Millennials. This becomes even more relevant when you take into account that the growth in the use of mobile banking apps is led by the under 35s, with 85% of 18-24s and 79% of 25 to 34 years olds using mobile banking apps more often. Use of mobile banking apps within the 55+ age group has also seen a 52% increase.

Monzo has also been pushing brand collaborations with Strava and IFTTT to show how they can seamlessly integrate with other companies in order to deliver the ultimate user experience. This enforces the ‘all in one place’ vibe that respects the goals of the Fintech 2.0 movement. Collaborations like this are also ideal for brand awareness, especially when promoted on social media with the help of tags, hashtags, shoutouts, news stories and video.

Top tip for brands looking to create a seamless environment

Show how you’re trying to improve the consumer experience. This is not about you using fancy words and showing off your technical capabilities, not directly anyway. This is about putting the customer first and understanding their pain points. Also, if you’re collaborating with other service providers, make this known as this could swing whether someone chooses you – or a competitor.

#3 Providing Thought-Leading Content Will Become a Must

It’s been a slog, but brands in all sectors are now starting to fully appreciate the value of carefully crafted, perfectly tailored and thought-leading content. If you can explain complex topics and set your brand apart as a go-to source of information, you’ll build consumer trust and improve retention and conversions increase too. Why? Because people like to be informed. And they like authentic brands that are passionate about what they do and want to share it with the world.

Conveniently, Google also cares about content that enhances the user-experience and therefore loves long-form blogs that are on trend and keep the user on-site for longer. Thought-leading content also provides keyword opportunities. And you can take snippets from your research to share across social media as seen below. It’s a win-win.

Many fintechs are already exploring the creative content space including investment fintech Acorn. A whole section of their website is dedicated to education with a focus on five specific areas – Saving, Investing, Earning, Spending, Borrowing. Educational portals like this make it easy to:

- Assert your authority and establish industry credibility

- Confirm trust with your customer

- Target specific keywords by creating a content tree of topics. Start with a core idea and expand outwards so that you can incorporate long-tail keywords ideas as well as short-tail ones.

- Include features from prominent members of staff to improve trust

- Include influencer features.

Tips and Best Practices for Fintech Brands in 2022

We’ve looked at where the industry is heading. We’ve analysed several trends for the year ahead. So what should you be doing to keep up with the pace? As a leading content marketing agency for the finance and fintech space, we’re sharing our top tips and best practices for fintech brands in 2022.

Embrace Strategy

Your very first step should be strategy. And strategy is something we help brands with on a daily basis. From the very beginning you should think about budget, target audience, region, competitors and technology. How much do you have for content, design, technology and resources? How can you make your money work harder? What are your competitors doing? Are there things you want to copy, or do you have ideas that you think will work better? Is this backed by analytics and research? Do you know your audience? And have you got your keyword list narrowed down?

A good strategy starts with doing your homework. You must know who you’re targeting and why. What do they want from you? What are their pain points and how will you go about addressing them? From there, you can start to scope out your web design and content requirements. You can find out exactly what goes into a content marketing strategy here.

Craft Content Thoughtfully

We know how important it is to think carefully about what type of content you want to create. You should never copy and paste content from another site. Google hates it and you’ll look lazy and lacking in originality. Content is not something that should be rushed. It’s a craft that needs to be strategised properly and this is something we can help you with. We specialise in:

- Blogs and articles – all the fintech cool kids have a blog these days. The more you know your demographic, the more you can cater your content to their needs. If you’ve noticed an increased number of searches for improving credit scores in relation to your services, for instance, blogging about this could get you even more hits.

- Video with a well-written script – we’re a massive fan of video here at Contentworks Agency. It’s a great way to explain difficult topics like blockchain and crypto in a fun, unique and engaging way. In fact, HubSpot reports that the majority of people (94%) report watching explainer videos to learn more about a product, with 85% being swayed to make a purchase. Check out this account set-up video by Robinhood as a great example of easily sharable content.

- e-Books – take things a step further with an e-book. This is your chance to showcase your industry knowledge and explain in more detail what you offer. It’s also the perfect acquisition and database building technique as you can collect consumer details in return for an e-book download. For more technical fintech offerings, you can contact us about creating a winning whitepaper.

- Social Media Competitions – being active on social media is a must for fintechs, after all, their consumers are tech-savvy and likely to have more than one social account. Running a social media competition around a specific goal that’s likely to relate to your audience is a good idea. This is exactly what Monzo did with their #MonzoTopUpMyPot savings initiative. This was also launched in January, a time when many people will have made resolutions to save their hard earned cash.

Remember, content isn’t just about the written word. It’s about creating videos, gifs, memes, infographics, games and podcasts that’ll grab the attention of your audience.

- Don’t Forget About Compliance

Compliance is huge in the finance sector, so it’s important to obey the rules or risk a significant financial penalty. You might be a cool fintech but if you’re dealing with access to client bank accounts, lending, trading, investing or anything else you will need to follow regulations. For example, you can’t be unfair, misleading or give an unbalanced view of products and services. Regulations governing the fintech sector including crypto rules have always been a bit blurrier, with each country making their own decisions. Keeping up with the ever-changing rules around this is a chore, but it must be done. And you can find all you need to know via our Regulations Roundup section which is released monthly. To be sure your content is safe to publish, always:

- Pass it through your compliance team

- Have a two-person sign off process

- Get your content created by professionals like Contentworks

Here at Contentworks, we work with fintech and finance brands from startups through to mid to large enterprises. Contact us today for professional content marketing services to elevate your brand. Enjoyed reading Fintech Trends to Watch this Year? Go ahead and hit share.