Content marketing for millennials is tough. Mainly because this is the age bracket that knows all your market tricks. But, fintech companies have an advantage because the innovative and inspired products offered by fintech brands are a perfect match for a generation that’s grown up with tech. So, how can you rock fintech marketing for millennials? Here are some tips from the millennial marketers on our team.

Fintech and Millennials Just Makes Sense

So-called digital natives born roughly between 1980 and 2000 have never been exposed to a world without computers. They approach new technologies without fear. And have learnt not only to feel comfortable within a fully-connected environment but have come to expect connectivity in most areas of their life! Online brands and digital concepts are therefore a playground for millennials looking for the very best of what fintech can offer.

What are the Challenges?

That said. Just because you’re a fintech company does not mean millennials will naturally buy into your idea. There are some significant marketing challenges for those targeting an inpatient and technology-savvy audience? Let’s delve deeper.

#1 Millennials don’t like to be tied down

This category of consumers like to have access to products and services as and when they need them. That’s why mobile banking is so popular with 47% of millennials using their gadgets to check out their banking activity.

Takeaway: Be useful. Give your audience a reason to come back for more!

#2 Millennials are impatient

And rightly so! With so much competition in the fintech world, millennials don’t have to sit around waiting for services to improve. Indeed, 40% of American millennials have switched banks due to poor service. 77% would also switch banks for a better service.

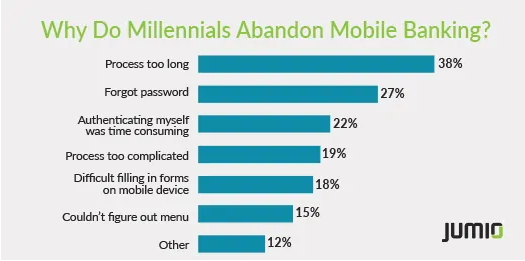

Below are just some of the reasons this age group abandon mobile banking.

Takeaway: Don’t overcomplicate. As Al Pascual, SVP, Research Director and Head of Fraud & Security at Javelin Research said: “To capitalise on the growing demand for mobile banking as millennials grow in spending power, financial institutions must simplify user experience and address ongoing concerns around security and fraud.”

#3 Millennials are wicked smart about manipulation

Millennials have been around long enough to see marketing techniques develop. They deeply distrust banner ads with storytelling and immersive experience likely to work far better than in-your face sales messages.

Takeaway: Don’t underestimate the power of millennials. They can smell a sales message a mile off. So, if you’re going to market a product, you’ve got to get smart!

Effective Fintech Marketing for Millennials

The challenges are very real for fintech marketing teams. But there are ways to get millennials on-side. Here are some effective marketing ideas:

Embrace Chatbots

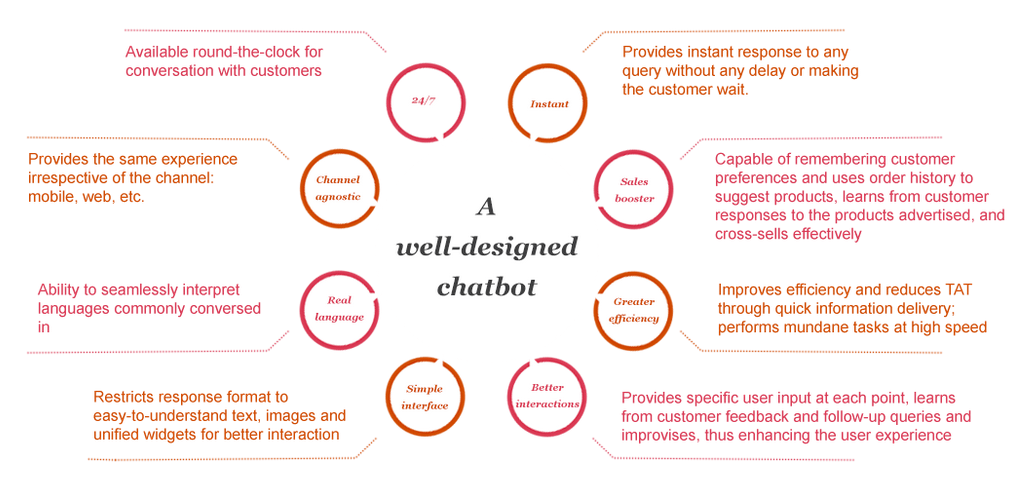

Millennials are five-time less likely to visit their bank in person than older generations. So, how can you tap into a market that relies heavily on digital? Embrace chatbots! Gartner predicts that chatbots will power 85% of all customer service interactions by the year 2020. It also predicts that the average person will have more conversations with chatbots than with their spouse by the same year.

The shift to digital communication services over call centre and face-to-face interaction is extremely relevant to those targeting millennials.

Chatbots are quickly becoming the preferred digital interface to react with brands. They can be great for business helping to rapidly curtail response times. Indeed, research by Harvard Business found that organisations are too slow to follow up on sales leads. 24% of companies take longer than 24-hours to respond whereas a staggering 23% of companies do not respond at all. The reality is, you have a very small window to successfully convert a lead. So, it’s essential to be on the ball with rapid chatbot responses.

Top financial institutions such as Bank of America and NatWest effectively use chatbot initiatives across their social media in a bid to instantly answer customer queries. As you can see, replies are virtually instantaneous and therefore appeal to the millennial mindset.

Interestingly, baby boomers are 12% more likely than millennials to expect a 24-hour service and 20% more likely to expect an instant response. While millennials expect prompt communication, they’re more interested in receiving a high-quality customer experience with 45% of millennials expecting “good customer service” from chatbots, compared to only 38% of baby boomers.

Takeaway: If you venture down the chatbot route, make sure your AI technology is responsive and intelligent enough to deliver appropriate and relevant replies. Chatbots will need to become increasingly human-like to meet the demands of younger generations. If your chatbot doesn’t deliver, there’s a high chance your millennials audience will go elsewhere. So, pay attention to advanced technology initiatives that reflect your brand.

Have a Social Media Strategy

If you’re a fintech brand without a social media strategy, it’s time for a serious marketing overhaul. Indeed, 94% of millennials follow brands through social media, so it’s important to work on your omni-channel online presence.

Contact the Contentworks team to get Socially Sorted.

Knowing what does and doesn’t work is key. As a fintech company you should avoid pushy, in-your-face marketing, fake testimonials and reviews and anything that’s completely insincere, disingenuous or non-personal. So, what should you do across your social media platforms? And what are some 2019 content marketing trends for the fintech sector?

Video Content

80% of the world’s internet content will be in video form by 2020! That’s huge amounts of watchable content. So offer millennials video content. Not sold on the idea? Then check out these useful facts that will help shape your marketing strategy.

- 60% of millennials prefer to watch a company video than read a newsletter

- 80% of millennials find video useful during initial purchase research

- 76% of millennials report following brands on YouTube

- Nearly half of millennials only watch videos on their mobile device

- Millennials are 3x more likely than baby boomers to watch a video on their mobile

Video content is hugely popular. It can sit nicely on your website or be shared easily across social sites.

Top Tip: Be informative, engaging and innovative rather than promotional. Over two thirds of millennials will lose interest in your video if it’s too salesy.

NEC’s video about their blockchain initiatives (created by Contentworks) is a great example of educational online content. You can watch the whole video here.

Provide Snackable Content

Millennials don’t hang around if they’re unhappy or bored. We’ve established that. One of the best ways to pique their interest and to improve loyalty and retention is to offer snackable content that they can dip in and out of! This could be in the form of:

- Video teasers of around 10 seconds

- Infographics

- Graphs/charts

Takeaway: Make the most of visually gripping material. Enticing content leading through to a more extensive blog/article is ideal or you might want to think of coming up with a question/poll that will help people to engage with your brand.

Competitions and giveaways

Millennials are extremely loyal if they have reason to be. They need to feel appreciated and respected as consumers which is why competitions and giveaways are ideal. Not only do you get to build your fan base and improve brand awareness, but your consumers will get something in return. Below is an example from payment processor Skrill.

Takeaway: Give a precise call to action!

Think Corporate Responsibility

The millennial consumer is a driving force for corporate responsibility and sustainability. Having grown up in a progressive world of globalisation and economic disruption, millennials often need a reason to make a purchase. They look for brands that think carefully about their impact on the world rather than those too inwardly focussed.

Millennials are subjected to a content overload on a daily basis including scams and fake news. They are therefore naturally suspicious as a result. So, if you can come up with a strategy that ties your company mission in with a larger goal, this will help to gain their respect. Here’s an example from online banking fintech provider Simple.

Contact Contentworks today for help with your fintech marketing strategy.