The last few years have been rough. COVID-19 lockdowns wreaked havoc upon virtually every sector of the American economy. This has left many potential US investors wary of entering, or re-entering, financial markets in the wake of unprecedented disruption. Let’s look at some of the challenges and opportunities influencing financial services marketing in the USA.

Whether you’re an FX broker, hedge fund, bank or insurance company, growing your finance business is tough but not impossible. You have many competitors in the financial services sector, and you’re looking to establish a voice for your brand. The right financial services marketing for your US based brand can make you a destination for investors, traders and decision-makers from around the globe.

Growth Sectors of Finance in The USA

Before establishing line-of-sight into the content American investors are looking for, we need to analyse the segments of the financial industry that are making headlines. Fintech is a booming sector, and the cryptocurrency market is generating plenty of buzz. Here’s an example of how to structure a narrative that highlights recent successes in both verticals.

In the wake of global lockdowns, some sectors are showing positive upticks. The influence of rebounding and emerging technologies is shaping the future of financial services marketing in the U.S…here’s how the trendsetters are painting the picture of a brighter tomorrow.

The Fintech Sector

This sector will likely continue its reinvention as a comprehensive alternative solution to traditional financial services.

Positioned as data organisations that also take payments, fintech businesses like PayPal and Venmo bolster their market share by providing differentiated offerings in the eyes of investors and the market. They are aiming for the B2B and B2C markets showcasing an attractive marketing presence on Gen Z popular sites like TikTok:

#1 Designed to provide disruption to the traditional methods of financial service delivery, fintech’s emerging payment processors market is forecasted to gain $22,163.8 million in global annual sales by 2023, according to a report published by The Business Research Company. Contactless cards (does anyone even remember swiping their debit card anymore?) and the emergence of retail-focused fintech companies are catalysts for healthy growth.

#2 The fintech industry is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% by 2023, to an estimated $158,014.3 million. Contrasted against a market value of $111,240.5 million in 2019, it’s clear to see covid19 hasn’t significantly impacted the growth of tech designed to improve and automate the delivery of financial services.

#3 Resilience in the turbulent period resulted from the strength of emerging markets, increased funding and significant investment into fintech startups. Factors as varied as the increasing popularity of digital payments, exponential growth in e-commerce and investments into blockchain technology are sure to continue to drive the market.

Cryptocurrencies in the USA

NextAdvisor touts 2021 as a year of unprecedented success for the global cryptocurrency market, and forecasts 2022 as another breakthrough year. Many Americans still don’t understand the concept of blockchain technology, but that isn’t holding the market back from celebrating a series of wins amongst the onset of increasing regulation. It does however open the door wide for solid cryptocurrency education – Talk to us about that!

#1 October saw the first exchange-traded fund (ETF) related to Bitcoin hit the New York Stock Exchange. The win allows investors to buy in on cryptocurrency like the BITO Bitcoin ETF directly from traditional investment brokerages like Fidelity, a first for a relatively new vertical.

#2 As reported by Bloomberg, BITO debuted as the second-highest traded fund ever, with over 24 million shares trading hands on the first day of eligibility. While crypto remains a speculative and volatile investment, the increasing establishment of industry regulations are providing a sense of security for cautious market participants.

#3 NextAdvisor notes the $1.2 trillion bipartisan infrastructure bill signed by President Biden on November 15 implemented tax reporting measures that affect capital gains or losses on crypto assets. The provisions provide investors line-of-sight into the proper documentation and reporting requirements of cryptocurrency transactions. Such increased regulation will undoubtedly go a long way towards establishing consumer trust in what has been regarded as the ‘Wild West’ of investment opportunities.

By providing carefully researched and accurately-sourced content to your target audience, you’re building brand trust, a key factor in customer loyalty. Download our free eBook that’s focused on building trust through content marketing in the financial services space.

The US Forex Market

The origins of modern Forex trading can be traced back to the gold standard. After WW2, a new system was implemented with the Bretton Woods agreement. The US dollar was pegged to gold, at $35 per ounce. The USD became the world’s reserve and reference currency and other national currencies were fixed to the dollar.

Budget and trade deficits in the US plus dwindling gold reserves, led president Richard Nixon to abandon the Bretton Woods system in the early 70s. By 1973, the modern form of Forex trading was taking shape. For many years after that, forex trading was solely available to large institutions with a huge amount of capital, like governments and banks. And then, hello 1990s, hello internet and hello to the emergence of fore trading for end users.

The advent of retail Forex brokers allowed individual forex traders to invest far smaller sums and today we see over 9.6 million people around the world trading. That’s 1 in every 781 people. The forex market dwarfs the largest stock exchanges in the world. Nasdaq has a daily volume that averages around $200 billion. FX markets reach an incredible $6.6 trillion per day!

A reputable US broker will be registered by the National Futures Association (NFA) and the Commodities Future Trading Commission (CFTC). A broker of repute will typically list their NFA member number in the “About Us” section of their website.

Grabbing Your Piece Of The Forex Trading Pie

Some people would have you believe that the forex market is oversaturated with brokers and all the traders are already “taken”. But this is a high churn industry with new participants entering each day. Here are some stats you need to read:

- 27% of forex traders fall into the 18-34 age group

- 72% of forex traders have no prior experience in trading in other markets

- Only about 15% of forex traders make a profit leaving them constantly searching for education (or another broker)

- 41% of traders average 9 – 20 trades each month

- There are approximately 15.3 million crypto traders in the United States.

- The largest US broker is Forex.com owned by GAIN Capital Holdings inc. It has an average daily trading volume of $15.5 billion

- 31% of traders have been trading for less than a year, and 39% have been trading for 1-3 years.

The lack of knowledge in the finance space, as referenced by the above Pie means great opportunities for brokers.

We have a deep understanding of the forex landscape. Our team of forex content marketers can provide marketing strategy, technical analysis, forex education centres, market moving articles and forex focused social media. We follow FX news and create content that inspires your traders to deposit and enjoy the excitement of the markets.

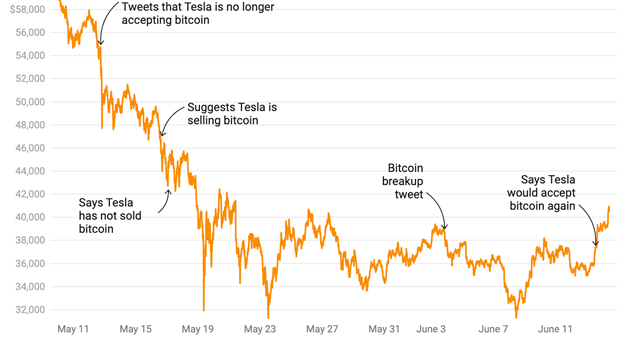

Compliance are not our enemies though, and we watch out for regulatory news and updates from ASIC, CySEC, MFSA, FCA, FSA, FRB, SEC, MiFID II and more. We also follow incredible US finance influencers like Dasha Kennedy, Hayley Sacks AKA Mrs Dow Jones, Nate O’Brien and Spencer Hochhaus. Plus of course, the US based market mover that is Elon Musk.

Contentworks provides expert financial services marketing consulting and content. Our team of experts grew their knowledge in the relative trenches of the forex and financial services sectors.

After years of inundation to the terms and metrics that rule the financial industry, we decided to distil all that hardwired information, statistics and mind-boggling data into a financial services marketing solution that leverages high-level experience with an engaging, fun copywriting style.

The result? Content that resonates with your target audience.

Contentworks Agency provides compliance-friendly content to banks, forex brokers and fintechs looking for an edge in competitive search engine optimization. Our content marketing services include technical analysis, intelligence reports, press releases, whitepapers, video marketing and social media management. Arrange a free consult with our team to discuss marketing for your US financial services brand.