The rules of content creation are changing. Brands need to keep up with Google algorithms and consumer demand for high-quality, personalised marketing. Consequently, many brands are turning to AI to tailor and scale their content creation processes. On average, 19% of marketers in Europe, North America, and Asia Pacific are already using AI tools for content creation, but does AI produced finance content cut the mustard – will it ever? Let’s take a look.

The role of AI in content generation: An overview

AI-produced content is becoming increasingly creative. For example, content marketing agency Fractl runs the “This Marketing Blog Does Not Exist” blog, the content of which is generated by an AI model called GROVER. This is a real-life example of how AI can already churn out almost-coherent passages of text about complex topics such as “ROI scales” and “synchronicity”. This is done via AI tools that have learnt how to mimic online text.

GROVER can also mimic the styles of major news outlets such as the Washington Post and the New York Times and rattle out fake news. It can spam us with 900-word articles littered with keywords, all while creating fictional authors for each post with StyleGAN – the AI tool that’s been used to generate less-realistic Pokémon.

Potential concerns

Should we be worried about the power of AI content? Well, with fake news being a big problem in today’s digital world, the lesson is to double and triple check sources. Don’t believe everything you read and when it comes to marketing, always use facts and stats from credible sources. With AI producing keyword rich articles that may be hard to tell apart from human generated articles, the trick is to focus on content quality and readability. In comparison, AI generated content tends only to have surface meaning, with little correspondence to the real world. What’s more, with tools such as the Giant Language Model Test Room (GLTR) currently being developed to detect AI content, it seems there’s a defense already emerging against auto-babble content.

Financial brands and AI content

The AI process that automatically produces content is called natural language generation (NLG). And despite the concerns around AI, NLG is simplifying the way financial brands handle their data. The following are some top ways AI is enhancing the content creation process:

- Quick reports

Reports are important, and in most cases, required by law. However, they tend to be too long and boring for the average non-financial person. Narrative Science’s NLG platform Quill is helping financial brands produce 10-15 page financial reports using text summations. These shorter and more coherent reports are more engaging because many people prefer snappy content.

Associated Press (AP) news agency isn’t a financial brand but it’s using AI to produce earning reports. Financial brands can exploit this capability to improve their own efficiency. AP started using Wordsmith, an NLG platform from Automated Insights, to combat the low output of quarterly earnings reports by its writers.

The network now produces 4,400 reports, 15 x more than before. The reports have retained their original quality and without the explanatory note at the bottom of the report, people would likely never know that they are AI generated.

- Large data handling

NLG can process large amounts of data to produce thousands of narratives in a fraction of the time it would take humans to produce the content. For instance, Quill can generate over 1 million words daily. This is helpful to finance content marketers who constantly have to produce lots of content.

- Cost savings

Following the implementation of MiFID II, firms were forced to cut down their research earnings. Consequently, the research revenue for some firms has fallen by as much as 30% and many of them are under pressure to cut their research costs.

In response to the new regulation, Commerzbank is using AI to create its equity research reports. The bank is looking to cut costs and research time and although the AI system is not yet fully automated, it’s already able to perform 75% of what a human analyst would do.

- Enhanced marketing

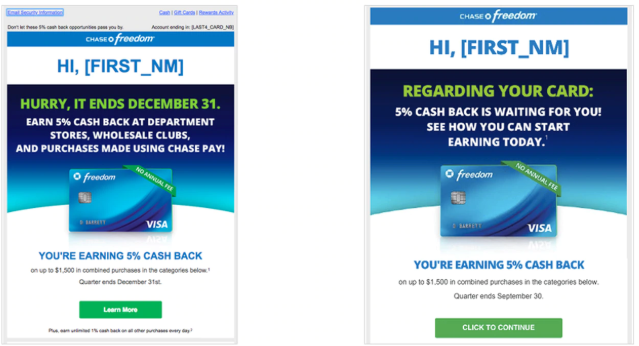

Chase has entered into a five-year partnership with AI platform Persado after Persado’s AI machine-generated ads garnered 2-5 x more engagement compared to the ads created by human copywriters. Here are 3 examples:

- The AI-produced promotion titled “LIMITED TIME OFFER: We’ll reward you with $5 Cash Back when you go paperless” got nearly twice as many unique clicks compared to the original “Go paperless and earn $5 Cash Back” promotion which was crafted by Chase copywriters.

- The “REGARDING YOUR CARD” AI-generated campaign got nearly 5 x more unique clicks compared to the human-created “HURRY, IT ENDS DECEMBER 31” campaign.

- Chase copywriters created the “Access cash from the equity in your home” with a “Take a look button” and Persado generated the “It’s true – You can unlock cash from the equity in your home” with a “Click to apply” button. Persado’s promotion got 47 applications in a week while the copywriters attracted just 25 applications.

Chase has seen an ad click-through rate increase as high as 450% and it will be using Persado to rewrite not only its online ads but its email promotions and possibly its snail mail promotions too.

- Jargon simplification

Natural language processing is making financial data more understandable. For instance, 63% of Americans are financially illiterate and while charts and graphs are visually appealing, most people are unable to extract the message they should get from them. NLG is increasing engagement with financial information by producing key insights and summaries to go with charts and graphs.

- Complex personalisation

77% of consumers want personalised content and NLG is enabling organisations to scale complex personalisation. For example, Morgan Stanley is using the AI to generate customised emails for over 15,000 of its financial advisers to send to clients when the markets become chaotic.

Is the human touch still necessary?

The short answer is yes, absolutely.

AI content is increasing and improving. People don’t have full confidence in the creativity of machines yet but they are starting to wonder if human content creators will be necessary in the future. Nonetheless, the fact is that human ingenuity is powerful, and AI still has a long way to go.

- Consumers want emotion

Consumers engage with brands based on how well they appeal to their unique personalities. AI can churn content that grabs attention but relationships with customers are built on emotions. In fact, marketing campaigns with purely emotional content perform almost twice as well as those with only rational content.

There is an increasing expectation for brands to be ‘more human’ and for this, brands need emotive content. For instance, Amex gets 3.7 million social media engagements annually with its #AmexAmbassador campaign because the campaign taps into the human emotion of desiring good things.

A brand’s ability to form emotional bonds with customers correlates directly with the brand’s customer retention rate. 47% of consumers who feel they have a relationship with a brand trust the brand and stick with it in the long-term.

- Brands are not built on conversions alone

AI can generate content in large quantities, but most of this content is still relatively short. However, brand authority is built on consistent, cohesive, and in-depth content. Human-produced content can contribute to brand identity with humour, opinions, cultural references and style but AI can only create content based on the narratives it’s taught. The ability to empathise with readers and connect with them on a personal level will enable brands to stand out and create loyalty.

- Humans bring more to creativity

Things like imagination and creativity are difficult to automate and this is what sets humans apart from AI. AI can create logical articles but they cannot become part of wider communities outside of the scope of their data.

There’s more to conveying a message and communication than the right words. AI thrives on pattern recognition but brands will thrive more on spontaneous and reasoned human conversations that contribute positively to consumer experience.

- Watch the compliance

Whilst AI can be taught over time, there are still a lot of rules and regulations governing the finance world which are continually changing. Regulatory bodies like CySEC, MiFIDII, ASIC and the FCA regularly issue amendments or rules and an AI writer will not necessarily adapt to this. Financial services companies need to be cautious about producing content that flouts compliance rules as it can land them with a sizable fine.

Is AI content here to dominate?

The best content is emotive and computers are not good at being emotional, at least not yet. AI-generated will likely increase going forward, but it can’t replace the humour, creativity, empathy, and insights provided by human writers. Instead of viewing AI as being on the verge of rendering human writers obsolete, it’s better to consider how it can improve content creation. The synthesis of human and AI capabilities is more probable than total AI domination. AI will likely continue generating content while humans contribute more precision, uniform style and tone with their emotional intelligence. Would we like an AI researcher on our team? Absolutely!

Merging AI and humans in the content creation process

The need for search and conversion optimisation is one of the common reasons why creating content is time-consuming. AI can be trained to factor in the optimisation during content creation to make it more efficient. AI can analyse information, follow news updates, and suggest content that could go viral therefore, brands can use it to determine the best content to cover in future down to the smallest details.

Also, 85% of marketers feel under pressure to produce more campaigns fast because consumers have a growing appetite for immediate content gratification. Using the speed of AI content generation, brands can deliver their campaigns more efficiently.

Before synthesising AI and human content creation

A robust content marketing strategy will not rely wholly on AI but will use it to improve the strategy. Integrating AI into the strategy effectively requires a plan which includes:

- Identifying repetitive manual content marketing tasks. Such tasks are the best starting point for automation. Once these tasks are automated, human content creators can focus on refining the content creation strategy.

- Identifying opportunities for exploiting data with AI. Use AI to get more insights out of your data. This will help you create more customised content that attracts more engagement.

- Testing and improving your AI. Test to see if AI is giving you the required results and best return on investment. In most cases, there’s usually room for more efficiency and quality.

Will AI-generated content ever cut the mustard?

No one can predict the future with 100% certainty but two things are highly likely:

- AI will drive the automation of content marketing and eliminate the human element from menial and research based tasks; but

- This will not eliminate the need for human emotional intelligence in the creation of a robust, compliant content strategy for a long time.

Does AI Content Cut the Mustard – Will It Ever? Tweet us your thoughts @_contentworks . Need content marketing that works hard for your financial brand? Speak to Contentworks Agency today for expert financial content.