Over the past few years, cryptocurrencies and blockchain have been buzzwords worldwide. And although cryptos have enjoyed mainstream adoption over the past couple of years, this has not been the case in the African continent. Historically, the trajectory of any new technology adoption has been from the west to Africa. But this time, cryptos are facing something of a speed bump when it comes to mainstream acceptance and adoption in Africa. As a marketing agency specialising in finance, we are often asked to market crypto products and increasingly so in Africa. But how do you begin building trust in crypto in the African continent?

A Little Bit of Background

In Africa, mobile money rules. Telecommunication companies like Vodacom, MTN, and Airtel are making a killing. Banks have also jumped onto the mobile money train. The primary reason mobile money is winning in the digital age is the same reason why crypto isn’t winning. Admittedly, Africa still has low financial inclusion, and crypto was touted as a bank for the unbanked. So why isn’t crypto solving this?

Why, you ask? Well, for the most part, it has to do with trust!

It is never easy to trust new technology, especially one whose implications are not fully understood and don’t yet have the government’s full backing. Let’s face it, when it comes to money, some are more trusting with the government’s stamp of approval. It serves as an unspoken insurance policy.

But this hasn’t been the case for cryptos. Quite the opposite, actually.

Governments and financial regulators globally have been the most outspoken critics. It’s a tall order to get people to trust cryptocurrencies when the watchdogs paint them as unsafe. It doesn’t matter how many crypto enthusiasts demonstrate all the advantages that come with cryptos and blockchain.

There are over 7000 cryptos in circulation; thousands more crashed and burnt before they could amount to anything – and this happens almost yearly! Compared to market crashes in centralised finance, crypto crashes are more frequent but only localised. But this has not succeeded in being a selling point despite the fact that market crashes in CeFi are always widespread with lasting impact globally.

For this, we can often blame the volatility that’s pervasive in cryptos.

Bitcoin was launched in the aftermath of the 2007 -2008 global financial crisis. Its guiding light was to solve the problems that fiat currencies have on global finance. While this was a noble idea, the volatility inherent in cryptos makes them almost impossible to use as currencies. It makes cryptos the worst means of exchange.

Econ 101 – the value of any means of exchange shouldn’t be more volatile than the value of the goods or service they intend to purchase. Simply put, the value of a currency should remain stable over time. That serves to guarantee that your purchasing power is protected.

In a continent where the poverty rate is 41%, purchasing power is more important than any perceived inflation rate. That’s because, inflation creeps in slowly, giving households the chance to adapt. With crypto volatility, your purchasing power could be wiped out in days.

Cryptos have been touted as insurance against inflation in fiat currencies. However, it can be argued that the trade-off between long term inflation in fiat currencies and the unpredictable volatility pervasive in cryptos is just not worth it. To which you’d ask, what about stablecoins?

Stablecoins are designed to eliminate the volatility inherent in other cryptos. And true, they’ve so far managed to do just that. But the problem arises from the fact that these stablecoins cannot be audited. And if the recent reports are anything to go by, they are not exactly 100% backed by fiat in the ratio of 1:1 as they claim.

The Cajee Brothers

In a world where confirmation bias is in overdrive, headlines of failed crypto projects and the fraud surrounding them are often used to justify why we shouldn’t trust cryptos. Remember, crypto transactions are anonymous, making them ripe for fraudsters. This has unleashed a new breed of masterminds like the Cajee brothers. The two South African brothers, 21-year-old Raees Cajee and 18-year-old Ameer Cajee defrauded investors of about $3.6 billion in BTC!

They operated the Johannesburg-based Africrypt – a cryptocurrency investment platform since 2019. They vanished in May, cutting all communication with investors, after an alleged hack of the company accounts.

This is where it gets interesting. Reportedly, a week before the alleged hack, Africrypt employees lost access to the company’s backend systems. And after the hack, the brothers implored investors not to report the matter to the authorities. The company also did not report it. They were allegedly trying to recover the lost funds (but there’s proof of this).

What’s more disturbing, investigators have since unearthed an elaborate system designed to defraud investors. The brothers transferred funds from the company bank accounts and investors’ crypto wallets to untraceable BTC accounts. And what’s worse, the investors have no recourse. South African financial authorities (and many more across the continent) do not recognise bitcoin and cryptos as investment assets. That means any investment made with cryptos are not regulated. There are no laws regulating cryptocurrencies.

This is probably why the Cajee brothers managed to pool so much money from the public without raising any red flags for running a non-regulated firm. It’s also why they are probably going to get away with it!

The Fix

Most countries have currency crises, and for Africans in the diaspora, remitting money back home is expensive. Countries could harness the power of blockchain to tame the pervasive corruption in public governance. The potential is limitless. But only if trust is built.

Education

As the world pivots into a fully digital economy, it’s largely believed that blockchain will carry us through, making it imperative to build trust. And most crypto and blockchain companies have woken up to this realisation. That trust needs to be earned. That trust comes from more financial education.

Only 16.9% of investors who have bought crypto “fully understand” the value and potential of cryptocurrency, while 33.5% of buyers have either zero knowledge about the space or would call their level of understanding “emerging.” With a Cardify survey revealing that 40% of all crypto purchases come from new investors, creating educational content around cryptocurrencies could help your brand become an attractive option for those looking to boost their portfolio.

Several crypto companies are engaging African communities in CSR projects. They are engaging governments to help unlock the potential of cryptos in the region. In Africa, several companies have started to showcase blockchain services to various African countries. Unlike most other cryptocurrency blockchains, focusing on private sector use in developed regions such as Europe and North America, their approach has been on developing states and their public institutions.

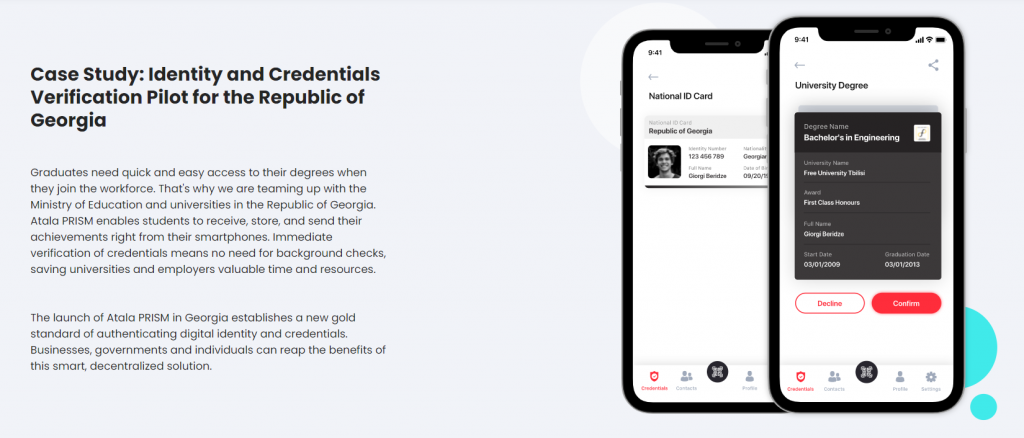

Cardano is leading the pack here. It recently partnered with Ethiopia’s Ministry of Education to create Atala PRISM. It is a blockchain-based digital register for over five million students and teachers, making it the largest blockchain deployment globally. It is designed to curb forgery in the education sector by monitoring school performance and verifying grades while also boosting nationwide education.

The deal is a turning point for the crypto asset industry, blockchain technology and African economies. The most important reason for this is the promise of using blockchain technology in the name of socio-economic change. Digital identity, missing in most African countries, is the first step towards spreading to the real financial base. It is worth noting that this is a very important detail.

Prism displays authentic case studies to build trust in its product. Case studies and testimonials are proven marketing techniques for establishing buy-in and even investment.

Compared to the rest of the world, Africa has low digital connectivity. Cardano founders IOHK has partnered with World Mobile to develop infrastructure to ensure a fully interconnected Africa, even the most remote places. This will be based on Cardano’s blockchain.

World Mobile utilises stunning visuals and actual video footage to explain the challenge and solution. Video is proven to be an engaging technique that helps boost learning and understanding of a product.

The logic behind this is simple yet elegant. Firstly, it doesn’t matter whether you uses cold or online wallets; you would need internet connectivity to transact at the end of the day. Ensuring that even remote places are connected is a step closer to ensuring crypto adoption.

Secondly, education is one of the primary factors that would contribute towards building trust in crypto. For the most part, distrust often comes from fear of the unknown.

What makes these projects promising is that they are the first major blockchain projects focused on serving the African market. They are also compatible with the development agendas set out within the scope of the United Nations Sustainable Development Goals and African Union Agenda 2063 goals.

Regulation

However, there’s still a long way to go to build trust. A sure way would be regulation. As we mentioned earlier, potential investors and traders are looking out for regulations and government approval.

South Africa is among the first nations in the continent to move towards crypto regulation. An Intergovernmental Fintech Working Group set out the trajectory of the cryptocurrency’s future in an article outlining their position on regulation to stop fraudulent crypto activity in South Africa.

This framework provides details on South Africa’s regulatory recommendations for cryptocurrencies is grouped into three categories. The details include implementing AML/CFT draft, monitoring cross-border financial flows, and implementing financial sector laws. It is a joint initiative involving the National Treasury, the Financial Sector Executive Authority, the Central Bank of South Africa, the Financial Intelligence Center and the South African Revenue Service.

Some of the recommendations in the policy document include dealing with cryptocurrency like any other foreign currency.

The Bottom Line

Africa is ripe for crypto. Not just crypto, but everything blockchain. And as we’ve seen here, building trust in crypto in the African continent is contingent on regulation and education. At Contentworks Agency we specialise in creating financial education for our brokers, fintechs, banks and tech providers. Through articles, knowledge centres, videos and whitepapers, we are working to improve financial literacy and crypto product understanding. Talk to our team about marketing your cryptocurrency brand.