Have you ever seen colleagues discussing tips to trade the bond market? Perhaps no. Tracking the bond market could be as exciting as watching paint dry, whereas the stock market seems to be on fire. But don’t let news headlines mislead you. Bonds have an important place in portfolio diversification. When held to maturity, they can provide consistent and stable returns. So today, our team is answering the question: Are bonds the latest broker trend?

Global Bond Issuance Reaches Record Highs

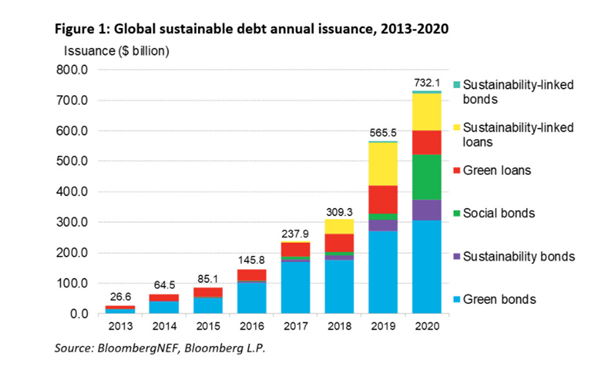

Practically every government in the world has been borrowing money from the public to fund recovery packages and get their economies out of the pandemic-induced doldrums. The global debt market hit record levels, increasing 31% YoY to reach $10.2 trillion in 2020. Additionally, green bonds issuance reached new highs, and is set to register stronger growth in 2021. Over $732.1 billion worth of bonds and loan varieties in the sustainable debt sector were issued in 2020, the highest yearly volume issuance.

Image Source: Bloomberg

Yields Reach Record Highs

Just a year ago, covid fears had driven US Treasury and other yields to ultra-low levels. At the same time, near-zero level interest rates left few alternatives for investors to find better returns.

Interest rates are still at record lows, yet yields are rising. Against a backdrop of a recovering US economy, the US-10 year treasury yields surpassed the 1.75% level in a matter of just 75 days in mid-March 2021. However, the US Fed showed no inclination to raise rates anytime soon, citing unemployment as a bigger concern.

Why Brokers Should Consider Bonds

Demand for bonds has been resilient despite higher supply and higher yields. For instance, sustainable debt sales are surging to record highs in Latin America. Investors in the region have raised about $8.7 billion in bonds related to environmental, social and governance projects.

With rising yields, equities suffer, making the bond market more appealing for the yield-seeking investor.

So, is it time brokers considered offering bonds as a way for their clients to diversify their portfolios? With a $100 trillion global marketplace, bonds offer investors multiple investment options.

But before tackling the complexities of this diverse market, you need to understand the basics. So, let’s look at these fixed income instruments, sometimes also called “the smarter asset class.”

Fun Fact: The first-ever sovereign bond was issued by the newly formed Bank of England in 1693 to fund its ongoing war with France.

Image Source: Intriguing History

What Are Bonds?

A bond is a fixed income instrument, issued against a loan given by an investor to a borrower. These borrowers can be governments, municipalities and corporations that need capital. So, if a government issues a bond and an investor buys it, it means the investor is lending money to the government.

Why Are Bonds So Popular?

Bonds can play so many roles in your portfolio, starting with diversification:

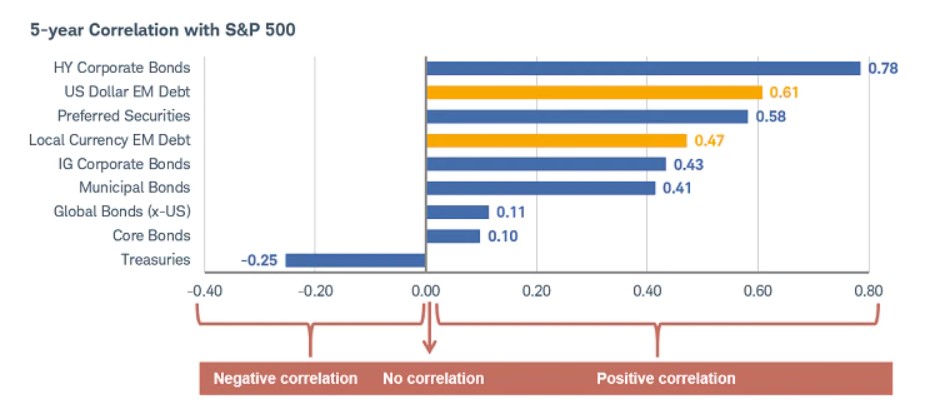

Diversification

Bonds tend to see lower volatility than the stock market. And when held to maturity, they can offer stable and consistent returns. They also tend to perform well when stocks are falling.

Potential Hedge Against Economic Decline or Deflation

A popular consensus among investors, especially in the US, is the fear of rising inflation. Economic growth tends to lead to inflationary pressures, which can make the fixed income offered by bonds unappealing. Economists argue that current monetary policy trends worldwide indicate a rise in deflation, rather than inflation.

As US Fed Chairman Jerome Powell said in a press conference on January 27, 2021;

“It helps to look back at the inflation dynamics that the United States has had now for some decades and notice that there has been significant disinflationary pressure for some time, for a couple of decades. Inflation has averaged less than 2% for a quarter of a century.”

In such conditions, bond income becomes more attractive. That’s because with this income, bondholders can buy more goods and services at lower prices.

Capital Appreciation

If investors sell bonds before maturity, when there is a rise in bond price, they can attain capital appreciation. This increases their total return.

Capital Preservation

Conservative investors and those who must meet a particular liability at a specific time in the future can rely on bonds. Unlike stocks, bonds must repay the principal amount on a specific maturity date. Interest rates on bonds also tend to be higher than savings bank account rates.

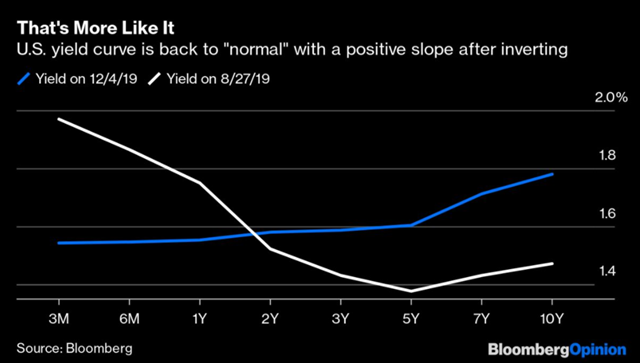

Fun Fact: Nothing fuels recession talk more than an inverted yield curve. When short-term treasury notes pay a higher interest rate than long-term notes, know that there’s trouble ahead.

Image Source: Bloomberg Quint

What Are The Different Types of Bonds?

Broadly speaking, government and corporate bonds are the largest sectors. But, thanks to the advent of financial technologies, bond math became easier. Finance professionals have created innovative instruments, such as agency bonds, mortgage-backed securities, asset-backed securities and emerging market bonds.

Fun Fact: Emerging market bonds have grown from $885 billion in 2008 to $2.7 trillion in 2020. The level of volatility in EM bonds is not for the faint-hearted.

Image Source: Charles Schwab

How to Trade Bonds?

There are broadly two major approaches to bond trading: passive and active.

#1 Passive approach: This is the “buy-and-hold” strategy. You buy a bond and hold it till maturity to gain capital preservation, income and diversification.

#2 Active approach: This includes using market knowledge to find discounted bonds that are likely to increase in value in the future, before maturity. Traders trade bonds based on future interest rate expectations. If the central bank increases interest rates, yields rise, and prices decline. This requires advanced skills and active monitoring.

Ready to add bonds to your brokerage? Or perhaps you added them already but trading volumes are low. If you want to educate your traders about the bond market, contact Contentworks today. We provide articles, PR, education centres, eBooks and videos to explain complex financial subjects in a fun way.

Enjoyed reading Are bonds the latest broker trend? go ahead and hit share.