The prop trading industry has exploded. With more traders seeking professionally funded accounts, new proprietary trading firms have launched at a startling speed. Search interest for “funded trader program” has more than doubled since 2021. Market research also suggests the proprietary trading market will grow at around 6.5% CAGR through 2030.

But with growth comes competition. The firms thriving in 2026 won’t just have attractive payouts, they will invest in brand trust, educational value and compliant marketing that builds real longevity. As a leading prop firm marketing agency, we understand the pressures. Many firms launch as startups with tight budgets. They must build credibility extremely fast, comply with evolving regulations, and prove that trader success isn’t just a marketing gimmick. So what does effective prop firm marketing really look like in 2026? And how do you roll it out in phases that match your budget and growth stage? Let’s walk through the journey.

What’s Changing for Prop Firms in 2026?

While retail traders remain eager to “go pro”, their expectations have become significantly more sophisticated. For many, a prop firm must act more like a career accelerator or a sustainable side-hustle, rather than a quick cash grab.

Traders want to see:

- Transparency in rules, payouts and pass rates

- Professional onboarding and website experience

- Community belonging often via Discord, Social networks

- Educational value that builds their skills

- Legitimate authority markers like media coverage or executive credentials

Meanwhile, regulators are continuing to discuss funded trading structures. Messaging that veers too close to “fast money” now puts brands and licence opportunities, at risk.

How Should Prop Firm Marketing Be Rolled Out?

Marketing cannot be a last-minute scramble after launch. It must be designed in phases, building credibility, proving product quality, and scaling customer acquisition in manageable steps. Here’s how that roadmap can look from startup to sustainable profitability.

Phase 1: Build Credibility and the Brand Foundation

In the early months, every euro is scrutinised. Your goal isn’t to be everywhere, it’s to appear trustworthy everywhere you show up.

We usually start with:

- Brand positioning that states clearly why you exist, whom you serve and how you differ

- Conversion-ready website explaining challenges, user journeys, payouts and rules with clarity

- Compliance-checked messaging framework so every future campaign is safe

- Content strategy designed around real trader questions that increases your online discoverability.

- Smart paid testing: start small and measure success to understand which traders convert best.

Top Tip: One high-impact early step is publishing payout proof and the stories behind them. Even anonymised examples make a big difference. We also recommend launching educational content immediately, especially trading psychology, risk management and market insights.

This foundational phase typically requires modest but meaningful investment. Many firms launch here with €6k–€20k per month depending on localisation, integrations and region priorities.

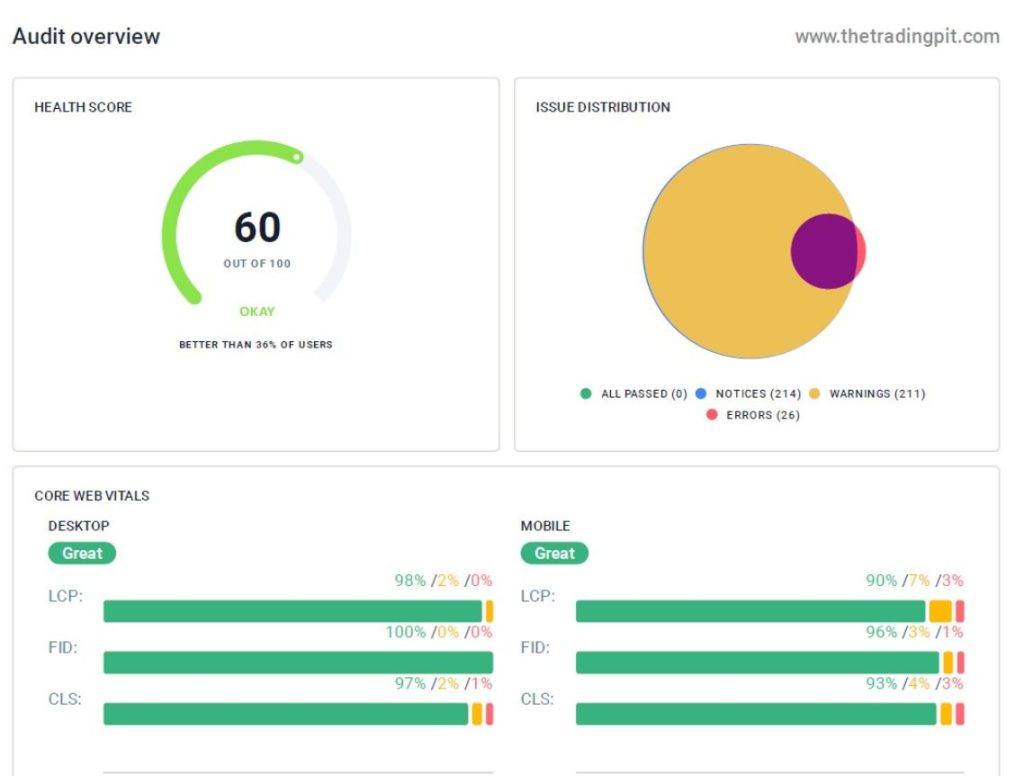

When The Trading Pit needed a website health check, they came to Contentworks. Check out the case study here.

Phase 2: Growth, Community & Acquisition

Once the brand is trusted and messaging is validated, investment shifts into growth. In this stage, community drives conversion.

Many successful prop firms scale through:

- Social Media communities run by pros or internal traders

- Influencer collaborations with credible educators and streamers

- Targeted Meta, Google and YouTube ads focused on funded account funnel metrics

- Automated trader journeys reminding users of their goals and progress

- PR amplification such as expert commentary in trading media and podcast interviews

At this point, geographic expansion becomes critical. Regions like LATAM, MENA and Southeast Asia show high engagement with trading education, so localised campaigns with regional influencers often outperform broader English-only targeting. Marketing budgets also scale here, often €20k–€80k per month, but CAC (customer acquisition cost) becomes increasingly predictable.

Phase 3: Leadership & Trader Retention

Too many firms push 95% of their resources into acquisition and almost nothing into keeping traders engaged after they purchase a challenge. This is where market leaders separate from short-term players.

Phase 3 includes:

- Gamified trader journeys – badges, milestones, perks for consistency

- Elite coaching programmes to turn talent into serious profit

- Regional ambassadors who travel to events and host workshops

- Trading competitions with ranking boards and livestream commentary

- Dedicated content academies including video learning paths and psychology coaching

This phase is typically €80k–€250k+ monthly, but by now, LTV outpaces CAC. The brand graduates from challenge seller to professional trader development institution.

Dos, Don’ts & Insider Tips for Prop Firm Marketers

The large spike in prop firm startups brings with it some advantages. Namely, the ability to learn from their successes and mistakes. Contentworks has partnered with many forex and trader funded firms over the years and is sharing some of these insights below.

Do:

- Anchor every claim in verified data, especially payouts

- Maintain compliance-safe language always

- Invest in SEO and educational content, not just ads

- Show your founders’ credibility upfront

- Have a marketing strategy in place

Don’t:

- Promise unrealistic income or glamorise risky behaviour

- Over-depend on one traffic source like YouTube influencer reviews

- Launch globally without local regulatory checks

- Ignore retention, your biggest cost leak is traders who quit mid-evaluation

- Sound like every other firm offering 90% profit splits

Top tip: The strongest prop brands in 2026 will be those that help traders become calmer, smarter and healthier. This is done through education, delivering market analysis and support.

Contentworks delivers daily market analysis that breaks down complex market information into actionable trading ideas, all while remaining compliant.

Standing Out When Everyone Sounds the Same

With the rapid uptake in the use of AI, it’s inevitable that brands using ChatGPT for their content will sound the same. So the first step here is to employ human writers and editors to differentiate your brand and prop offering. Prop firms must communicate unique value beyond challenges and payouts.

Some emerging differentiators include:

- Skill-based evaluation instead of speed-based stress

- Programs designed for institutional career progression

- Mental health support for full-time traders

- Platforms that focus on iteration and improvement, not instant elimination

Let’s build your strategic positioning and messaging.

What Budget Should A Prop Firm Assign to Marketing?

It’s time to be realistic. The old saying goes “if you pay peanuts, you get monkeys”. There are some activities that you can skimp on, and some that you really need quality for, and it depends on which phase you’re in.

Here’s what you can expect to spend of marketing your prop firm:

- Launch phase: low-to-mid five figures monthly

- Scale phase: strong five figures to low six figures monthly

- Global leadership: seven figures annually and up

What matters more than the number is the ratio, profitable firms carefully track cost-to-revenue and set KPIs around:

- Cost per challenge acquisition

- Percentage of traders who buy again

- Time to next monetisation event

- Community participation rates

With the right planning, marketing becomes an investment with predictable returns, not a spending gamble.

Prop Firm Marketing FAQs

How do you market a prop trading firm?

You market a prop firm by building credibility first (brand + payout proof), then driving targeted acquisition via community, educational content, influencer partnerships and automation. Compliance must lead the messaging.

How much should a prop firm spend on marketing?

Most firms scale successfully when they allocate 20–35% of revenue to marketing efforts during growth periods.

What differentiates a strong prop firm brand?

Clear transparency on performance, coaching-based value, responsible trader narratives and real community engagement create strong differentiation.

Why is educational content important in prop trading marketing?

Traders want to improve long-term performance. Educational hubs build trust, increase retention and support responsible trading outcomes.

The Prop Firms That Will Win in 2026

The prop industry will continue expanding but we will also see many firms drop away To survive the next wave of competition, prop firms must treat traders as long-term partners.

- Invest in brand credibility early

- Scale intelligently with analytics and automated lifecycle journeys

- Prioritise retention, not just acquisition

- Build a community and educational ecosystem that supports trader wellbeing

At Contentworks Agency, we’ve worked with leading prop trading firms to strengthen their positioning, craft data-driven marketing, and maintain full compliance along the way. Get a free consultation and let’s scale your prop firm in 2026.