The Dow Jones, a measure of the general health of the stock markets, fell a jaw-dropping 1000 points in August. Some analysts are talking about a soft-landing for the economy in 2024 while others are predicting a recession in 2025. Regardless of which proves true, companies are tightening belts and keeping a short leash on budgets. Marketers are under ever more pressure to deliver results on spend. In a highly competitive space, financial firms are turning to performance marketing to deliver specific and measurable outcomes. If your goal is to generate leads, acquire new clients, or retain and grow existing clients, then performance marketing gives you a framework to achieve your goals. In this Financial Services Guide to Performance Marketing, you’ll discover the key elements of your strategy, channels to focus on and some key terms to know.

What is Performance Marketing for Finance Firms?

A comprehensive marketing strategy will encompass both brand and performance marketing. While brand marketing is in for the long-haul, performance marketing is orientated towards immediate goals like driving traffic, or acquiring leads. It is measurable and can encompass both digital marketing – which includes native ads, display ads, programmatic advertising, search engines and social media advertising, along with influencer and affiliate marketing.

What sets performance marketing apart from other forms of marketing is that fees are not paid upfront but on successful transactions. So instead of paying for impressions, you pay for user actions. This means your target audience has more relevant experiences with you and helps track ROI effectively. It is a data driven approach, allowing you to target specific audiences, at specific times and devices.

However, costs are increasing so you need to create smart strategies, engaging content and continuously measure results.

Challenges Financial Services Marketers Face in 2024

- Global digital ad spend will continue to increase 8.4% in 2024, reaching over $526 billion

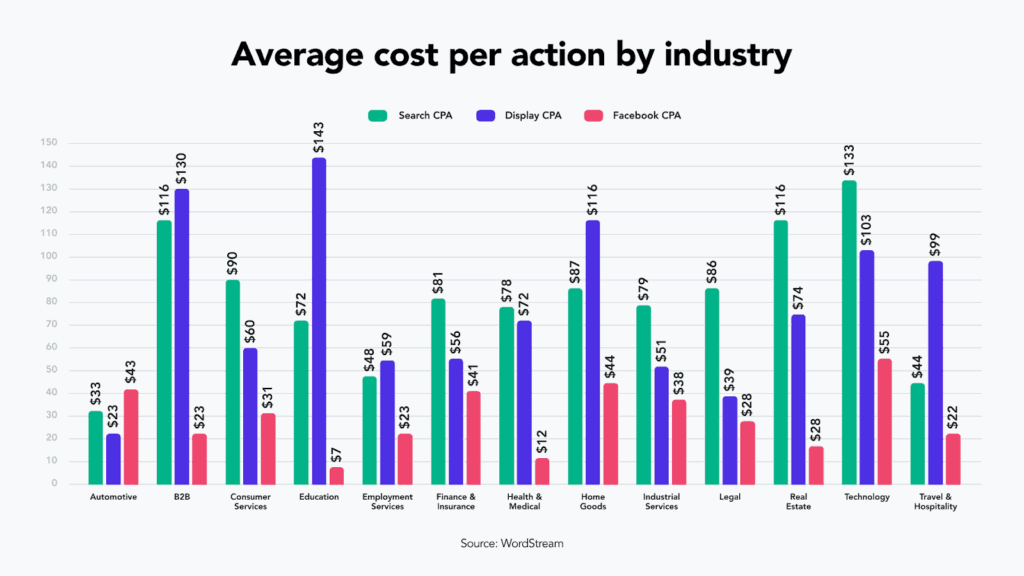

- The average cost per action (CPA) for the finance industry is $81 for paid search and $56 for display ads

- 40% of marketers say proving the ROI of their marketing activities is a top marketing challenge.

- 42% of B2B marketing professionals state that a lack of quality data is their biggest barrier to lead generation.

Basics of Your Performance Marketing Strategy

A combination of paid advertising and brand marketing, performance marketing refers to advertising programs in which affiliates and marketing companies are only paid when a desired action is completed. Actions include a completed lead, sale, booking or download. But what are the basics of your performance marketing strategy?

Set Goals

Ensure you set clear and measurable goals. These might be driving traffic to your site, downloading an eBook, new account openings, increased deposits and more. Understand your Key Performance Indicators (KPI) so you know whether you’ve achieved your goals. Common KPIs are click-through rates (CTR), cost per acquisition (CPA), and return on ad spend (ROAS).

Identify Audience

Finance firms need to segment audience based on certain criteria beyond basic demographics and geographies. You need to look at income level, investment preferences, risk tolerance. The more precise you can be the more effective your performance marketing campaign will be.

Selecting Channels

Once you’ve ascertained the above, you can select which channels and activity to funnel funds into. Common channels include email marketing, display ads, social media ads, search engine marketing. You need to know where your audience is as each channel has it’s pros and cons. We’ll dive deeper into channels later on in this article.

Content Creation

One of the most crucial steps in performance marketing is killer content. Whether that’s a value-added blog post, a stand out display ad, or a persuasive email or video. The message needs to be clear, on brand, and targeted to drive the client to the next action.

Decide on Budget

Each channel will have it’s own budget and expected ROI. If for example search ads are working for you and converting well, then you might allocate more funds to SEM. It can take a while to understand what is working, and conducting A/B testing is a good way to see what’s delivering results.

Data Analytics

This is where performance marketing does really well. Use tools like Google analytics, conversion pixels or your CRM to monitor and report on the success of your campaigns.

Got a great inhouse data team but need help with creating winning content? Speak to the team at Contentworks.

Performance Marketing Channels

If you’re already marketing in the finance space, you need no introduction to these channels. A recent study showed that omnichannel campaigns received an 18.96% engagement rate, while single-channel saw just 5.4% engagement. Here are some tips that we’ve found effective in these channels for forex brokers and fintechs.

Display Ads

Once the king of digital advertising, banner blindness and ad blockers put a dent in the crown of display ads. Display ads work best when they are relevant, interactive and have engaging graphics or videos.

Native Ads

Sponsored content, social media ads and in-feed ads are particularly effective on devices like mobiles as they are typically used for personal activities. The aim is for these ads to give an uninterrupted experience to the user. It’s important to be conscious of what the user is doing and if your content is providing value. E.g. if they are shopping for clothes online, they might not be interested in hearing about a trading platform. But a buy-now-pay-later (BNPL) ad would be well placed here, especially towards the end of the salary month.

Affiliate Marketing

Not new to forex or financial firms, affiliate marketing can deliver great results. As with all channels, the better aligned the affiliate’s sites or channels are, the more your message will resonate with their followers. Speak to us about creating affiliate resources, social media content, education centres and daily analysis.

Sponsored Posts

There are a myriad of finance sites that will publish your content for a fee. Here are some considerations when choosing which to go with:

- Is your audience there? Most publications can provide traffic and demographic data to ensure they are aligned to your target market

- Can you get a do-follow permanent backlink to your site?

- What additional value can the publication add – will they promote it on their social media?

- How will you track results?

Digital Content Marketing

This is a great way to educate your audience and to provide valuable information. This might be marketing news and analytics in the form of a daily email, educational eBooks, or high quality articles on your blog or education centre.

Effective content marketing:

- Is distributed regularly so your audience learns to look for it.

- Is actionable. You want your traders to trade don’t you!

- Uses your brand voice consistently so you stand out in a densely competitive market.

- Is unique. In today’s AI generated content landscape, forex content has grown dull. Unique on-brand content will grab attention.

Paid Search

Search marketing ads will usually be higher than organic listings and if combined with relevant, actionable content, can be very powerful. Ensure your campaigns are optimised for all devices and precisely aimed at your demographic, target keyword sand budget.

Social Media Advertising

A quick tip for financial firms conducting performance marketing campaigns on social media. Each social channel has its own audience on that channel for a specific reason so your content and graphics should be relevant. Nearly 3 out of every 4 users think there are too many ads on social media. The number grows to 78% for adults 35+ years old. 63% of users say they only see a few things advertised, repeatedly. 44% of users find the ads irrelevant to their wants and needs.

Here’s a quick run through of the cost per click (CPC) on the top social media platforms:

- TikTok $1 per click

- Facebook $0.97 per click

- Twitter $0.38 per click

- Instagram $3.56 per click

- LinkedIn $5.26 per click

- YouTube $3.21 per click

- Pinterest $1.50 per click

Keep in mind that some of the pricier CPCs like LinkedIn may produce higher ROI (return on investment). They might also deliver a better LTV (lifetime value) compared to Pinterest. This is certainly true in the finance space.

Key Performance Marketing Terms

These are some of the basic terms you’ll come across when setting your KPIs and measuring the success of your performance marketing campaigns.

- CPA (Cost Per Acquisition): The cost incurred to acquire a customer. For example, if you spend $500 on a campaign that results in 10 new customers, your CPA is $50.

- CPL (Cost Per Lead): Similar to CPA, but it focuses on the cost to acquire a lead rather than a paying customer. This is often used in industries like finance where the sales cycle may be longer.

- CTR (Click-Through Rate): The percentage of people who click on your ad after seeing it. A high CTR indicates that your ad is relevant and engaging to your audience.

- ROAS (Return on Ad Spend): A metric that calculates the revenue generated for every dollar spent on advertising. For example, if you generate $500 in revenue from a $100 ad spend, your ROAS is 5:1.

- Conversion Rate: The percentage of visitors who complete a desired action, such as filling out a form, signing up for a newsletter, or making a deposit. A higher conversion rate often indicates a well-targeted and effective campaign.

- Customer Lifetime Value (CLV): For finance firms, it’s important to consider not just the immediate ROI but the LTV of acquired customers.

Our Tips For Financial Performance Marketing

- Data is your friend: Continuously monitor and adjust your strategy. Conduct A/B testing of various elements of your campaign, e.g. email headlines and send times, landing page formats and content, ad copy – which call to actions (CTAs) are more effective

- Tailor your message: A key advantage of performance marketing is the ability to find your target audience and deliver a personalised message or experience. A young professional is probably more interested in growing their wealth, whereas an older HNWI (High-net-worth individual) is looking to maintain.

- 360 degree marketing: Optimise your marketing efforts with cross-channel integration. Deliver a cohesive message across all your channels for a smooth customer journey.

- Compliance: This is key for any financial services marketer. Ensure your campaigns are compliant to your regional regulators and data privacy laws.

- Care About Content: In this competitive landscape, creative content is needed more than ever. Utilise skilled financial writers to craft your performance marketing copy.

Enjoyed reading our financial services guide to performance marketing? Hit share and send the article to your team. Book a free Zoom to get started with your performance marketing campaigns.