With thanks to FX News Group for publishing our article.

None of us like a failed marketing campaign. But the truth is, not all marketing campaigns succeed, and many of them fizzle out or fail altogether. So, let’s talk about it. The best way to improve your success rate is to learn from failed marketing campaigns. As a leading financial services marketing agency, we’ve compiled the top 7 reasons your marketing campaign failed. Plus, how you can improve your success rates for future campaigns.

But First, Define Failure

Some marketing campaigns are epic failures that turned brands into a laughing stock. One infamous example was Pepsi’s 2017 “Live for Now” campaign, featuring Kendall Jenner. The cringe was real. But in most cases, failure is more subtle. So much so that many brands in the finance space brush it off and learn nothing from it.

Here are some of the smaller campaign failures you might have overlooked:

- Backfired due to using inappropriate or controversial content, resulting in brand damage

- Made a significant financial loss based on spend and returns.

- Fell short of targets due to unrealistic expectations.

- Failed to resonate with your target audience due to poor targeting.

- Struggled to gain traction due to being launched at the wrong time.

So, what are the most common reasons behind these failures, and how can you avoid them? Let’s dig in.

#1 Targeting The Wrong Audience

Failing to understand and target the correct audience demographic can lead to disappointing results in marketing. Before starting a marketing campaign, know who your audience is, what their interests and habits are, and where they spend their time online. Here are some questions you should be asking before spending your budget:

- Who is my ideal customer?

- What are their demographics (age, gender, income, education level)?

- How do they usually research and make purchase decisions?

- Where does my audience spend time online?

- Are they more likely to respond to emails, ads, or organic search results?

- What are their pain points or motivations?

- What stage of the buyer’s journey are they in?

- Who are my direct competitors targeting, and how can I differentiate my targeting strategy?

- What type of messaging will resonate with this audience?

- Are there cultural references or language that will connect with / or alienate them?

- Should I exclude certain demographics, locations, or behaviours that are irrelevant to my campaign?

- What KPIs does the brand need to achieve?

Asking these questions will help you refine your target audience, ensuring that your marketing campaign reaches the right people.

#2 Weak Content And Creatives

As a financial content marketing agency, we’re big on brilliant content. And that’s because it matters to gain trust, build brand awareness, garner community and obtain cold hard ROI. Low-quality visuals, poor copywriting and uninspiring calls to action (CTA) will fail to capture audience attention. This is especially true in 2024 where users are bombarded with content. Here are some mistakes you might be making with your content and creatives:

- Unclear or Confusing Messaging. It might be clear to you, but is it clear to your audience? Asking too many questions or using complex jargon can lead to low engagement.

- Low-Quality Visuals or Design. Using pixelated images, poorly designed graphics, or off-brand videos can make you look spammy or cheap. Would you click on an ad like that? We wouldn’t.

- Overly Salesy Content. We see this all the time. Forex companies repeating the CTA DEPOSIT NOW! in their content. This can be perceived as overly aggressive.

In each of these cases, weak content undermines the effectiveness of a campaign by confusing, alienating, or irritating the target audience, leading to a drop in engagement, conversions, and brand trust.

#3 Poor Timing or Market Conditions

Launching a campaign during an off-season, during major negative events, or in an over-saturated market can lead to poor performance. That’s why it’s important to pay attention to trends, key dates, holidays and other factors that can impact a campaign. Here are some dates you should avoid:

- During a natural disaster, pandemic, or political crisis means you look tone deaf and may even attract negative publicity for your campaign.

- Right before a holiday or festive season is a bad time because your target audience are busy doing other (maybe more fun?) things! Either chime in with a festive contest or giveaway or stay quiet!

- Launching a campaign immediately after a major competitor means your campaign could be overshadowed by the media attention and consumer excitement for the competitor’s product, making it harder to capture attention.

- Launching a luxury product campaign when there’s widespread economic uncertainty, high inflation, or during a stock market crash is a bad move. It may be harder to convert leads into paying customers during this time.

- Launching a campaign when your company is facing legal issues, a major PR crisis, or public backlash won’t end well. Focus on correcting negative PR instead.

#4 Inadequate Budget Allocation

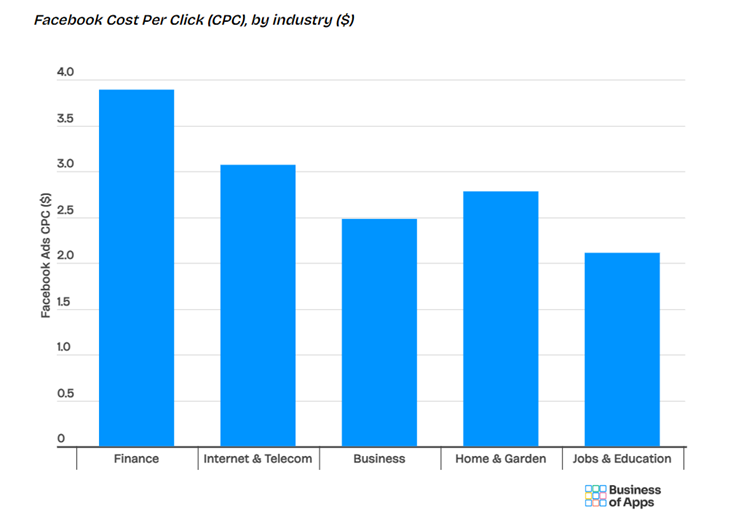

Sometimes what you think is a good budget for a marketing campaign, just isn’t. Insufficient budget can limit reach, quality, or frequency of messaging. The average CPC (cost per click) for Financial Services Products is $3.44 for Google. And on Facebook it’s $4.57 which is double compared to other categories like Home Improvements. It’s a fiercely competitive space with big players pouring millions into advertising.

Here are some workarounds if your budget is lower:

- Target a different angle to your competitors that will make you stand out. For example, offering a free forex course instead of asking traders to deposit funds. This is a longer route to ROI but it can be more cost effective.

- Work with a keyword expert to include more niche keywords to attract your traders and investors.

- Ensure that your budget is realistic for your goals. Allocate enough for not only content creation but also promotion and testing throughout the campaign.

#5 Failure to Track and Adjust

If you’re not tracking the performance of your campaign in real-time, you’re missing valuable opportunities to adjust your course. Failing to adapt to underperforming elements, like messaging, creative, or targeting, leads to wasted resources. Here are some of the elements you can adjust if you’re accurately tracking your campaigns:

Target Audience

- Reassess demographic and psychographic details (age, gender, interests, income).

- Narrow or broaden targeting based on campaign data.

- Use retargeting to reach people who’ve interacted with your brand before.

Ad Creative

- Refresh your ad visuals (images, videos) to capture more attention.

- Test new headlines for stronger messaging.

- Use different ad formats (carousel ads, video ads, animated GIFs).

Call to Action

- Test different CTAs on your ads to improve their CTR (Click Through Rate).

- Make CTAs clearer.

- Place CTAs in more prominent locations within the ad.

Budget Allocation

- Increase the budget for top-performing ads and reduce or remove for non-starters.

- Optimise your daily/total campaign budget for better ROI. (you might want to pause or increase budget on weekends)

Bidding Strategy

- Adjust your bid type (CPC, CPM, CPA).

- Increase or lower your bid amounts depending on competition and ad performance.

- Experiment with automatic vs. manual bidding.

Ad Copy

- Personalise the copy to speak directly to different audience segments.

- Shorten or lengthen ad copy depending on performance data.

- Incorporate social proof (reviews, testimonials) to build more trust.

Geotargeting

- Refine geographic targeting to focus on areas where conversion rates are higher.

- Test regional vs. national/international targeting to find the sweet spot.

Ad Compliance

- Ensure ads comply with platform policies to avoid underperformance.

- Avoid misleading claims or non-compliant images or content.

#6 Ineffective Landing Pages

Two out of three marketers report that their average landing page conversion rate is less than 10% (HubSpot State of Marketing Report, 2023). And that’s considered ok. So if your conversions are considerably lower, you might want to look at your landing page performance. A strong ad or social media post will get clicks, but if your landing page fails to convert, the campaign will struggle. Common reasons include slow loading speeds, poor design, unclear messaging, or confusing CTAs on landing pages lead to high bounce rates.

- Test your landing pages and optimise for speed, usability, and clarity.

- The page should match the ad’s message and provide a clear, simple path to conversion.

- Your landing page images and design should be clear and non spammy. We’ve seen landing pages with pop ups, links to other sites and even flashing banners. None of these will inspire trust.

#7 Not Using the Right Channels

If you’re running ads on platforms your target audience doesn’t frequent or creating content that doesn’t suit the channel, your campaign may fail. For example, very long and serious forex trading educational videos on TikTok are a surefire fail.

Here are some of the channels we find effective for financial services marketing.

- PPC (Pay-Per-Click) is highly effective for financial services. 63% of financial services brands are increasing their Google Ads budget, generating $3 in revenue for every $1 spent on average.

- LinkedIn is considered the most effective social media channel for financial services. It is used by 80% of financial marketers due to its ability to target professionals and decision-makers. LinkedIn advertising is pricier than the others so take your time to work on targeting, content and creatives first.

- 71% of marketers said they spent less budget on Twitter (X) in 2024 and 67% plan to invest in X alternatives.

- YouTube ads can increase brand recall by 80% if your ads are executed correctly.

- 77% of people in the financial services sector turn to blogs, whitepapers, and case studies before making a purchasing decision. This is why whitepapers are a must for startups looking for investment.

- Don’t forget about email marketing as a channel. Email has one of the best ROIs in financial services, with a median ROI of $44 for every $1 spent.

Contentworks Agency is the leading content and communication agency for the financial services sector. We work with our clients to create effective communication policies, corporate messaging, and targeted content and social media marketing strategies. Book a Zoom with our team to get started.