Let’s face it, there’s been no time for cocktails and hammocks this summer with covid-19 sending markets into a spin. There’s been volatility not seen in years, brokers adjusting to work from home environments and regulators struggling to keep up. It’s been a strange year to-date but as the holidays end, our focus is back on acquisition. Let’s look at what’s been happening with our September 2020 Forex Broker Roundup.

Lockdown FX trading surge

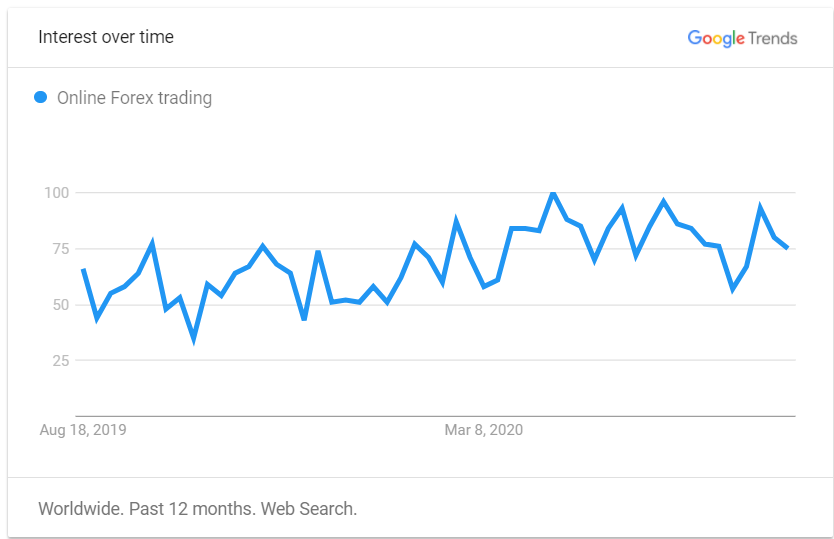

While some people indulged in Netflix and biscuit binges, others sought mental stimulation and a new way to make an income. This led to a significant spike in searches for the term ‘online forex trading.’

This up-tick in retail trader numbers also led to greater volatility and more trading opportunities to take advantage of. Forex unexpectedly woke up from a slump. After all, more volatility means more trading volume.

Did you notice trends and maximise the trader upsurge?

If yes – great! As a broker, it’s really important to follow trends and to seek opportunities to attract new audiences. A quick and easy tip is to follow relevant Twitter accounts such as @OilandEnergy, @Nasdaq for quick stats and shareable news. If no – it’s not too late. Here are 6 things you can do throughout September and beyond to keep potential traders interested – especially as lockdown situations continue across the world and the fear of a ‘second wave’ persists.

- Stay active on social media. Your social accounts should be a go-to for up-to-date information. So, fill your feed with graphs, charts, market updates, weekly outlooks, currency pair fluctuations, breaking news and more.

Create or update your education centres. You want people to trade with you right? So, why would you force them to leave your platform and go elsewhere for the information they need? Keep old, new and potential clients engaged by providing a dedicated education centre, broken down into different sections which cater to specific demands and audience types – from newbies to experts. For example, make it easy to find your trading guides and e-books with digital organisation, just like Blackwell Global.

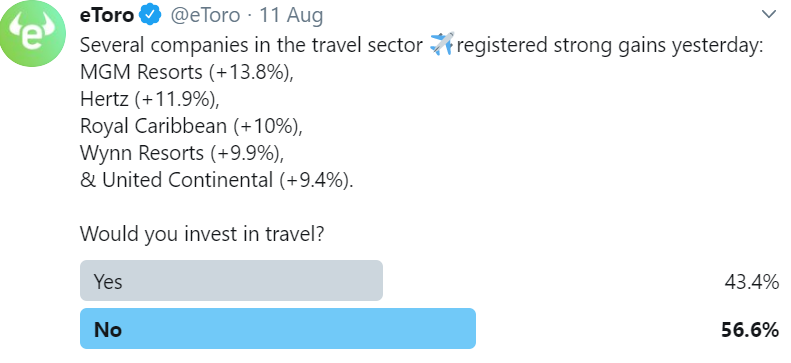

Encourage engagement. Posting polls or questions to your social accounts prompts people to act. So, try weaving a few interactive posts into your social media strategy and track how well they perform. Don’t forget to reply to responses and to post poll results for followers to see.

Improve your social response times. People are on edge at the moment and are looking for reassurance. That’s why maintaining an active presence online and improving your response times will help create a deeper connection with clients. Moreover, the FX world is incredibly fast-moving due to the pandemic. Things are changing rapidly, so you need to update posts or answer questions.

Maintain high trade by maximising upcoming events like the US election. Make sure you’re fully up to date with what’s going on and how the election campaigns are influencing the USD and other currencies. Share news with followers on platforms like Twitter as this can be updated quickly should something change.

Link to relevant landing pages. More people have been trading during the pandemic. We know that. But are you making the most of this by directing them to relevant landing pages? Choose instruments that are on trend like Bitcoin, Gold and Stocks in Disney and Netflix to be relatable. Also, make sure your sign-up pages are intuitive, short and straight forward to reduce bounce rates.

Currency and commodity shocks

The crisis shocked the economy and the FX markets. At the start of the pandemic currencies such as the JYP, USD and CHF were top gainers. Meanwhile commodity currencies fell, particularly the oil-sensitive NOK and CAD as oil prices collapsed. More recently global stocks, cryptocurrencies and metals rallied while the US dollar tumbled.

The USD has had its fair share of volatility to put it lightly. At the start of the pandemic, an unemployment surge pushed people towards ‘safe haven’ currencies such as the US dollar. By the end of July, however, the USD had crashed by nearly 9% since March. This has been attributed to geopolitical tensions as well as the Trump administration’s handling of the pandemic which some believe could downgrade the greenback’s status as the world’s reserve currency.

Top tip going into September: Keep your clients aware of weak and strong currencies and commodities by providing timely social updates and facts.

Latest Regulations

So we’ve caught up on what’s been going on and how you can streamline your strategy going forward. Part of that strategy must also be staying on top of the regulations. It’s tedious, we know. But compliance is everything in the finance realm.

Here’s a rundown of the most essential updates of late:

FCA Launches More Tools to Protect Customers

In a statement, the Financial Conduct Authority (FCA) said that it had launched an updated financial service register to provide more services to customers. The register, which had 7 million unique users in 2019, helps customers to verify people and companies in a bid to protect them from fraud. The key enhancements in the new register include simpler language, clearer navigation and design, and mobile optimisation.

FCA Warns Against Inappropriate Use of Title Transfer Collateral Arrangements

The UK FCA wrote an open letter warning of inappropriate use of title transfer collateral arrangements (TTCAs) and regulatory permissions for financing transactions. They stated: “We are sending this letter to you and other FCA-authorised firms acting as brokers in wholesale financial markets, who currently, or may in the future offer services (including clearing broker and prime broker services) that involve holding clients’ cash or securities as collateral.” You can read the full letter here.

ESMA Published MIFID/MIFIR Annual Review Report

ESMA has published the MIFID/MIFIR annual review report. In the report, the regulator suggested that the European Commission should move to the next stage for the trade percentiles that determine pre-trade sizes specific to financial instruments for bonds. Also, it suggested an addition criterion for the average daily number of trades used for the quarterly liquidity assessment of bonds.

As a leading content marketing agency for the finance sector, we’re always following the latest regulations, so be sure to follow our monthly Regulations Roundup for more.

With regards to regulations, remember to also:

- Include trading warnings – even on social media

- Don’t hide warnings. They must be clearly displayed and in the same-size font

- Provide a balanced trading opinion without bias.

- Don’t make false claims or promises

- Only link to or retweet from reputable and accurate sites

- Avoid misleading images- especially on Instagram

September/October Events Calendar 2020

September is usually an action-packed month. As traders return from holidays there’s usually a surge which brokers prepare for. In other years, there has always been a line-up of events to look forward to. But, due to covid-19, things are slightly different. Here’s what you need to know about the events calendar.

IFX Expo International

The eagerly anticipated iFXExpo International held in Limassol, Cyprus, was moved to September 2020 from earlier in the year. However, a new date of May 21, 2021 has now been set. Fingers crossed it can go ahead as it’s one of the industry’s most exciting networking events.

IFX Expo Asia

IFX Expo Asia, which was also due to take place in September 2020, has been moved to 2021. Be sure to keep an eye on updates for both EXPOs and book your tickets as soon as the events are confirmed.

FinTech World Forum 2020 Online

Fintech is becoming increasingly important within the FX trading world. So, to stay ahead of the game, you may be interested in attending the virtual FinTech World Forum 2020, which will take place online from the 24-25 September 2020. With an impressive line-up of high-profile speakers from top fintech companies such as IBM, Revolut, Citi Bank, Monzo, Starling Bank, Tandem, Western Union, Barclays Ventures, TSB and many more, this is sure to be a gripping and eye-opening event. As the FinTech World Forum 2020 will be conducted online, it’s a safe activity for your company to participate in.

FX Markets Asia – Physical Conference

FX Markets Asia’s physical conference will take place on October 6, 2020 in Singapore and will follow all necessary health and safety measures. Seminars will include topics such as:

- The 20-20 vision of the Covid impact on FX volatility: Is it a revival or downturn?

FX Markets Asia Virtual

This will take place from 13-14 October 2020 and provide access to a selection of topics and sessions from the in-person seminar in a virtual setting.

The Big Forex Breakfast Part 2

Following the success of our first Big Forex Breakfast webinar, we’re back for a second bite. This time, we’re catching up with forex experts to assess the Q4 landscape. After the pandemic induced volatility of Q1 and Q2 and the summer lull of Q3, it’s time for some fresh insights. In this essential webinar, you will hear from key sales, marketing and technology leaders at top international brokers. How are they taking their bite of the trading market and what can you learn?

Did you enjoy our forex broker roundup? If you did then go ahead and hit share. Contact Contentworks today for help with your content marketing in September and beyond. As a leading content marketing agency for the finance sector, we provide articles, PR, web content, education centres, analysis and social media management.