Let’s be honest here, forex marketing isn’t for the faint of heart. Between ever-changing regulations, over-enthusiastic affiliates, and market changes, standing out can be tough. But here’s the thing: some strategies work consistently well in this industry. While others just drain your budget and credibility. Whether you’re launching a new brokerage or trying to revive an old one, knowing the best and worst forex marketing strategies can save you time, money, and compliance headaches. Let’s dig in.

The Best Forex Marketing Strategies

#1 Actually Have a Strategy

I know, it may sound like an obvious thing to say but it’s amazing how many forex brokers don’t have a sound strategy. As our Contentworks Director, Niki was quoted as saying in this article “Creating a marketing strategy is crucial to ensuring everyone is on the same page”.

What a strategy includes:

- Mission and value proposition (brand)

- Market research and competitive analysis

- Target market STP (segmentation, targeting and positioning)

- Your unique selling proposition (USPs)

- Setting KPIs and performance measurement

- Marketing budget

- Marketing mix – product, price, promotion, place and people,

- Marketing tactics and goals – which channels, activities will you focus on

Pro tip: When developing the strategy, engage with core stakeholders but keep the number of voices to a minimum.

#2 Educational Content That Builds Trust

According to HubSpot, 70% of consumers prefer getting to know companies through content rather than ads. In forex, where scams are common, content builds authority. Forex traders are information-hungry. The more you feed them with valuable insights, the more likely they are to trust your brand—and eventually sign up.

What works:

- Weekly market analysis videos or newsletters

- Beginner-to-pro eBooks and trading guides

- Live webinars with analysts or influencers

- Educational YouTube shorts or TikToks (yes, even short-form works!)

Pro tip: Don’t hide all your content behind lead forms. Give away high-quality material upfront to warm your audience.

Need help to strategise and build your education centre? Check out some of the work from the Contentworks team and tell us about your needs.

#3 Build a Community

An active community increases engagement and loyalty. Traders who feel connected to a brand and to like-minded peers are more likely to stay active and trade consistently. They can also grow to be excellent brand advocates AKA affiliates!

Why it works:

- Great for peer-to-peer learning and sharing strategies

- Supports your support team

- Creates connection and increases engagement, loyalty and retention

- Generates user-driven content (UGC)

- Increases traffic and SEO juice to your site

- Garner market feedback

- Differentiates your brand and adds unique emotional value

Pro tip: Launch your community with a strong moderator team, regular educational content, and exclusive perks. Encourage early members to become ambassadors, they’ll shape the culture and attract others naturally.

#4 Affiliate and IB Networks (Done Right)

Affiliates and introducing brokers (IBs) are lifeblood for many brokers. The trick is managing them properly. Top-performing affiliates generate 3–5x better ROI than in-house ads. But without controls, they can become a compliance nightmare.

What works:

- Vetting your partners carefully

- Offering tiered commissions based on quality, not just volume

- Providing marketing assets, data insights, and ongoing training

- Paying them properly and on time

- Rewarding top affiliates with events, prizes and incentives

Pro tip: Use a dedicated affiliate CRM to track lead quality and prevent brand abuse.

#5 Multi-Channel Retargeting

The average forex trader takes 5-10 touchpoints before converting. Smart retargeting bridges the gap. Getting a demo signup is only the first step. Turning them into funded traders? That’s where retargeting shines.

What works:

- Email drip campaigns with trade tips and platform tutorials

- WhatsApp follow-ups with live chat support

- Retargeting ads on Facebook, YouTube, and Google Display Network

- Maintaining consistent organic social media posting across all channels

Read how Acuity Trading use Contentworks to deliver daily tradable news to their clients with this case study.

Pro tip: Personalise messaging based on behaviour. For example, if someone downloaded a crypto CFD trading guide, show them crypto-related campaigns.

#6 Localisation and Native Language Support

Forex is global, but traders want to feel like you’re speaking directly to them. A CSA Research study found 76% of online consumers prefer buying from sites in their own language. In forex, that’s even more important for trust and support.

What works:

- Translating your website, emails, and platforms accurately

- Hiring native-speaking support agents

- Tailoring promotions and campaigns to local holidays or trends

Pro tip: Go beyond translation, localise your brand tone, imagery, and payment options too.

The Worst Forex Marketing Strategies

#1 “Spray and Pray” Paid Ads

“Spray and Pray” in paid ads refers to a strategy where advertisers broadly target a wide audience with little precision, hoping that some of the ads will randomly reach the right people and convert. Spending big on Google or Facebook ads without a proper funnel is like throwing money into a black hole.

Why it fails:

- Cost-per-lead is notoriously high in forex ($100+ in some markets)

- Conversion rates are poor without retargeting or content

- Compliance blocks are common on major ad platforms

Better alternative: Use paid ads in conjunction with retargeting and content offers, not as a standalone tactic.

#2 Fake Reviews and Social Proof

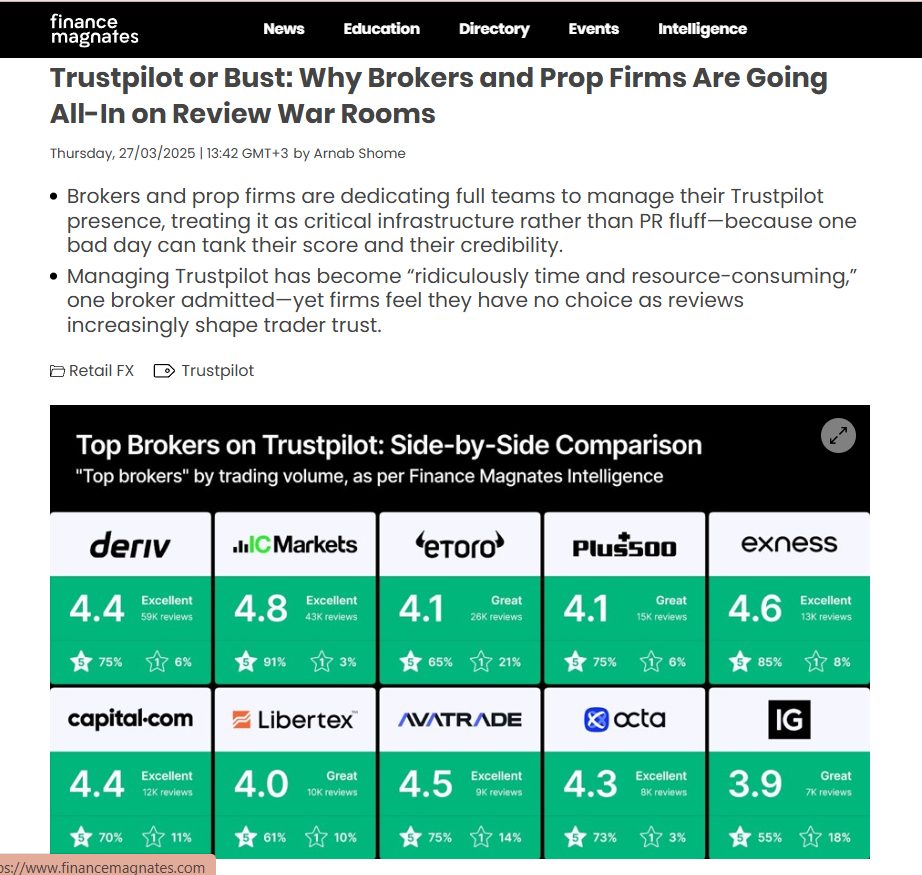

Fake Trustpilot reviews are currently flooding the forex sector, making it harder for traders to distinguish between genuine brokers and deceptive operations.. But we can spot them and so can savvy traders.

Why it fails:

- Damages long-term trust in your brand

- Violates many platforms’ T&Cs

- Traders will compare reviews across sites and catch inconsistencies

Better alternative: Encourage real feedback and display third-party verified ratings (e.g., Forex Peace Army, Trustpilot, or G2 if you’re a tech company).

#3 Cold Email and LinkedIn Spam

Cold email and LinkedIn spam have become rampant in the forex sector, with countless brokers and marketers bombarding traders and businesses with unsolicited messages. These outreach attempts are often poorly targeted, offering questionable services, fake signals, or dubious investment opportunities. As competition intensifies, some players resort to mass messaging tactics that erode trust and damage the industry’s reputation. Traders and companies alike are increasingly wary, making it more important than ever to approach networking and marketing with authenticity and respect. Sending mass emails or DMs like “Hey, wanna make money trading forex?” isn’t just annoying, it’s ineffective and extremely non compliant.

Why it fails:

- Gets flagged as spam meaning it’s harder to reach your audience in future

- Damages your sender reputation and may leave you blacklisted

- Creates a negative brand impression which will be hard to shake later

- Can land you in hot water with regulators who carefully watch broker communications

Better alternative: Build lead lists through gated content or partnerships, and nurture leads with helpful, relevant emails.

Need effective whitepapers for lead generation? The experts at Contentworks research, write and design robust and engaging whitepapers.

#4 Over-Promising, Under-Delivering

In the forex industry, many brokers fall into the trap of over-promising and under-delivering. They can often be found advertising unrealistic returns, VIP services, or unbeatable trading conditions that rarely match the reality. This not only damages their credibility but also fuels scepticism across the entire sector, making it harder for legitimate brokers to build trust with traders. Claiming “95% winning signals” or “instant profit” isn’t just shady, it’s illegal in many jurisdictions and can mean hefty fines from regulators.

Why it fails:

- Leads to high churn and complaints lodged with regulators

- Attracts low-quality traders who won’t place large deposits or stay with you for long

- Invites regulator scrutiny (especially in the UK, EU, and Australia)

Better alternative: Be transparent. Promote your strengths and your USPs!

#5 Ignoring Post-Conversion Engagement

Getting the signup is just the start. But many brokers ghost their users after registration. Ignoring forex traders after they sign up or deposit is a costly mistake, because without consistent support, engagement, and value, they can easily lose confidence and take their business to a competitor. In such a highly competitive market, traders have endless options just a click away. The moment they feel neglected or undervalued, they’re likely to move to a broker who gives them the attention and service they expect. Retaining a client is far cheaper and more valuable than constantly chasing new ones, making post-signup care just as critical as the initial acquisition.

Why it fails:

- New traders feel lost and drop off to seek out competitors

- No nurturing to deposit or trade means inactive traders

- High customer acquisition costs are wasted

Better alternative: Build a strong onboarding customer journey. Provide tutorials, offer market updates, and send timely nudges to help users get the most out of your platform.

Let’s Work On Your Forex Marketing Strategy

At Contentworks, we understand the unique challenges of the forex industry and what it takes to stand out. We work closely with you to craft a winning forex marketing strategy that builds trust, drives engagement, and fuels long-term growth. From content creation and PR to social media and campaign management, we’re here to help you connect with traders, outshine competitors, and achieve real, measurable results.

Need help building a smarter forex marketing strategy? Let’s talk. Our team specialises in content-led funnels, and compliance-safe content creation.