Whether it’s splitting the bill with a friend, investing in cryptos or paying for Starbucks by tapping your phone. All generations are using fintechs. There’s good reason why the industry is worth over $226 billion with 30,000 fintechs vying in a highly competitive space. In January, HSBC shut down it’s international payments app, and Revolut competitor, Zing. It’s not an easy landscape to stand out in, and innovative industries need fresh content marketing ideas. From Ryan Reynolds fronting payments provider Nuvei, to Wise getting down with rising pop-star KENA, fintechs are finding content marketing strategies to stand out. But, not everyone has the budget to compete with big money players. In this article, we’ll be looking at fintech content marketing strategies that win investment.

What Do Fintechs Want?

Financial technology (fintech) firms come in many shapes and sizes. They can be payment apps, neo banks, wealthtech, regtech, healthtech and anything else you can prefix ‘tech’ to. Some firms like PayPal have been around for decades and new ones seem to be sprouting every day.

Each fintech has specific aims and goals and uses a variety of content marketing strategies to achieve them. Whether they are:

- Launching a new brand

- Expanding to new markets

- Looking for series A, B or C funding round

- Aiming to get the attention of specific investors

- Planning an initial public offering (IPO)

Ultimately they want to build trust and grow brand exposure with their target audience. Whilst heavy investment in fintech PR is one way to do this, there are some other lower cost routes. Here are some fintech content marketing strategies that deliver results.

What Do Fintech Investors Want?

Before diving into the various strategies to target investors, its crucial to understand what investors are looking for. Any serious investor will ask What’s In It For Me (WIFM) and that’s the key question you need to have the answer to. Here are some other points that today’s investors will take into consideration:

- What is the product/service offering, is it realistic, achievable and scalable

- What is the current sector’s landscape and competitors

- What are the competencies of the management team

- Is the roadmap planned out and realistic

- Can the fintech demonstrate growth and when would investors expect to see a return

This is where a well crafted and laid out white paper is crucial. It should strike the right balance of demonstrating market and technical expertise, while speaking simply to the targeted reader. Infographics are a great way to break up the text and can deliver a lot of information at a glance.

Tip: Repurpose elements of your white paper to share on your social media and in your communities.

Influencer Partnerships

With a slew of regulations against influencer marketing, the core word here is ‘partnerships’. Collaborating with influencers that have built credibility on platforms their target users are on, allows finance and tech brands to reach a receptive audience.

Partnerships with influencers can cover more than just one base. Here Crypto.com partnered with Matt Damon to deliver on their environment, social and governance (ESG) objectives.

Tips When Using Fintech Influencers:

- Choose partners that align with your brand values and are followed by your target audience

- Ensure that your influencers understand the compliance required for your finance/fintech brand.

- Build authenticity by forging long-term partnerships

- Ensure expectations are clear and that you have a contract in place

- Consider using micro, as well as macro influencers to balance engagement and reach.

Strategic Sponsorships

Here the fintech firm will be partnering with external brands, sports teams or events to promote their offering. With that comes some fantastic opportunities to leverage exposure but also some risks. Here are some considerations to take into account with sponsorships:

- For every $1 spent on the cost of the sponsorship you should put aside another $1 for promoting the collaboration

- Partnering with one team may turn away fans from a competing team. Sponsoring matches or leagues might be a better approach

- Sponsoring individuals like athletes means you get the benefit of the association but can also be risky if they fall foul of the law.

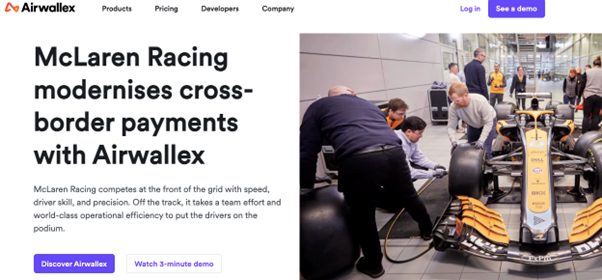

Melbourne-based fintech, Airwallex, sponsors McLaren Formula 1 team and balances global brand exposure with trust. Going beyond logo exposure, Airwallex interviewed McLaren Racing CEO Laura Bowden on the financial challenges of their operations. They were able to assist them with cross-border payments highlighting Airwallex’ USP and solving a real problem McLaren Racing was facing.

Takeaway for targeting investors with the Airwallex example: Show a real use-case for your product along with aligning with a global brand.

Social Media For Fintechs

Fintechs are looking to engage with their audience on platforms like LinkedIn, Twitter (X), Instagram, TikTok and more. When aiming to reach investors, keep in mind that people are on different platforms for different reasons. While at work, the user may check their LinkedIn for industry insights, thought leadership, investment opportunities. On the train home, they may be scrolling through TikTok for entertainment, or watching an educational video on YouTube.

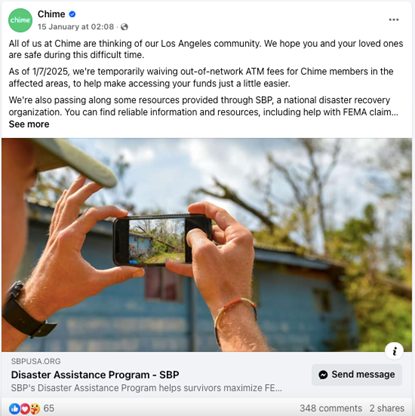

Banking app Chime understands this clearly with their Instagram channel providing relatable and visually appealing posts. Their Facebook focuses on community. And on Twitter they are sending timely updates and news.

- Promote an investor focused whitepaper on your targeted social media

- Join serious investment groups or forums and participate in discussions surrounding your niche with industry peers

- Promote an attend investor shows

- Use social media to establish expertise and authority in your field

- Develop a thought leadership strategy for your brand ambassadors for regular posting

- Check your company pages and ambassador profiles are up to date and on brand

Get more insights by reading our article on what works in social media for banks.

Community Marketing

Digital bank Monzo is the perfect example of building a community around a fintech brand. They have cultivated a strong community by engaging with users on social media and forums and even involve them in product development. The sense of ownership they’ve engendered among users has seen growth in retention and referral marketing.

Here’s how they do it:

- A dedicated community forum

- Adopting a friendly, human, tone of voice

- Turning their card into a fashion accessory

- Rewarding users for word-of-mouth marketing referrals with a free card with £10 on them

- Building a strong organic presence with dominant content marketing

- Compounding their discoverability on search engines by ramping up their blogging from 3 articles per month to 6 per week

- Being transparent when disaster strikes. Read about how they handled the Ticketmaster hack

How to Use a Fintech Community to Gain Investment

- Research and create a dedicated channel for your potential investors. Reddit and WeChat are excellent hubs for investors discussing financial insights and strategies, especially for cryptocurrencies

- Share exclusive content and early bird news

- Induce loyalty through transparency and sharing your roadmap with them

- Use gamified elements to engender excitement as you hit various milestones in product development, investment achieved

- Make sharing easy and offer perks for referrals

- Be strategic, branded and consistent with your messaging and approach

- Actively follow and respond to discussions with followers to build rapport

- Incorporate feedback into your future content strategies and products.

Tips for Growing Loyalty:

- Understand your client’s financial needs and journey to develop meaningful content

- Email marketing is a great way to nurture relationships

- Loyal clients can be rewarded with exclusive content and early access to events or features

The key to targeting investors is to have a deep understanding of who they are, which platforms they are on and what they are looking for. Understanding how your product solves their problems is key to crafting fintech content marketing strategies that win investment. If you need help developing your fintech strategy, fintech content, social media and PR, reach out to our team for a free Zoom call.