The rise of fintech has not only disrupted banking operations but has also rewritten the rules of banking marketing. These agile startups are winning customers with sleek interfaces, lightning-fast onboarding, and bold, transparent branding. The message is clear: adapt now, or risk irrelevance. Let’s look at what legacy banks can learn from fintech’s marketing playbook and how they can evolve to stay competitive.

Want to talk marketing for your bank or fintech? Book a free Zoom with our team.

Fintechs V Legacy Banks – Fun Facts

- Digital banks consistently outperform traditional banks in customer satisfaction surveys. In the UK, Chase UK topped the latest Ipsos survey commissioned by the Competition and Markets Authority, with 81% of customers willing to recommend it. Monzo followed closely, while traditional banks like HSBC and Royal Bank of Scotland lagged with 57% and 46% respectively. Nationwide was the highest-ranked traditional provider at 69%.

- Fintech revenues are projected to grow almost three times faster than those of traditional banks between 2024 and 2028, according to McKinsey. This growth is driven by the adoption of technologies such as AI-native banking, biometric authentication, and embedded finance.

- Despite offering competitive rates, fintechs like Revolut have yet to significantly disrupt traditional banks in certain markets. In Ireland, Revolut attracted €500 million in deposits within six months of launching its savings product. However, traditional banks like AIB and Bank of Ireland continued to see substantial deposit inflows, attributed to customer trust and the appeal of physical branches.

#1 Customer Centricity Over Corporate Formality

Fintechs understand that people no longer want stiff, complicated interactions with their banks. They want simplicity, speed, and empathy. Fintechs market themselves as enablers of everyday life, not just as institutions that hold your money.

What Banks Can Learn

- Shift the tone of your banking marketing from formal to friendly.

- Speak in plain language. Ditch jargon in favour of clear, helpful messaging.

- Highlight how your services fit into real-life goals like saving for a trip, recovering from debt or building wealth.

Example: Chime and Monzo thrive because they talk to users as peers, not clients. Fintechs do however face challenges in gaining trust for handling large financial decisions. Many consumers still prefer traditional banks for services like mortgages and large savings, valuing the ability to interact with bank staff in person. This preference is particularly strong among older demographics.

#2 Leverage the Power of Digital Storytelling

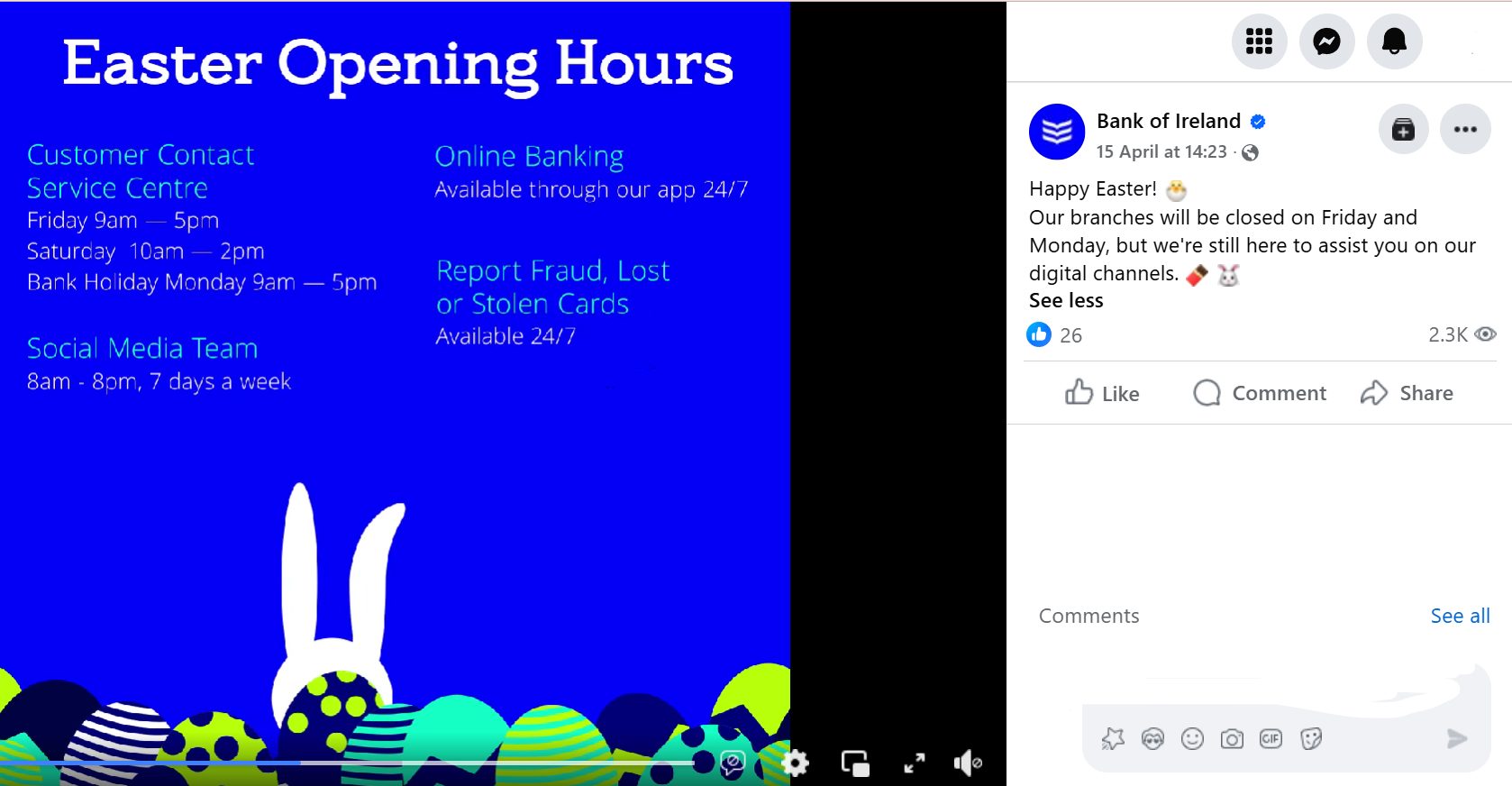

Fintechs have mastered the art of brand storytelling through modern digital platforms. Whether it’s through engaging TikToks, interactive IG explainers, or relatable Facebook content, they bring financial concepts to life in ways that feel accessible.

What Banks Can Learn

- Invest in content marketing. Talk to us about blogs, videos, social media and educational tools that solve customer problems.

- Use customer stories and case studies to build an emotional connection.

- Run targeted campaigns on platforms like Instagram, YouTube, and TikTok to reach younger demographics.

Pro Tip: A well-executed digital campaign needs a solid strategy behind it. Understand your regions, demographic, customer wants and audience alignment with your products before you start.

#3 Make UX and CX Part of Your Marketing Strategy

One of fintech’s biggest advantages is customer experience (CX). From a seamless app interface to intuitive account setup, the user journey is often the product itself, and it’s something they actively market.

What Banks Can Learn

- Invest in a customer centric app with well placed content that improves the user experience. Minimise touchpoints and the need to contact you for help.

- Use social proof like customer reviews, app ratings, or “X number of happy users” in campaigns.

- Offer instant, responsive customer support, automated where it makes sense, but human when it matters.

Remember: New generations like Gen Z do not hold the same loyalty to financial institutions as older generations. If your app is glitchy, your service slow and your features lacking, they won’t hesitate to swap to another provider.

#4 Be Transparent, Even Bold

Fintechs are bold. They talk openly about hidden fees, slow processes, and outdated systems, positioning themselves as the modern alternative. This honesty has become a powerful branding tool but it’s something traditional banks often struggle with.

What Banks Can Learn

- Acknowledge past limitations but highlight how you’re evolving and the changes you’re making.

- Be transparent about fees, timelines, and terms. Avoid the old-style urge to hide them on pages your customers don’t see.

- Share team news, events and progressions with your banking audience. This demonstrates transparency and creates a bond with your audience.

Banking marketing doesn’t have to be conservative, and your audience largely doesn’t expect it to be. If you have a more conservative customer segment, consider launching a new portal, account, card or feature. This will appeal to a more fun-loving audience without alienating the conservatives.

#5 Use Banking Marketing Data to Personalise Everything

Fintechs thrive on data. Whether it’s AI-powered insights, behavioural analytics, or personalised product recommendations, they make users feel like the experience was built just for them.

What Banks Can Learn

- Use customer data (ethically) to tailor marketing messages, product offers, and content.

- Segment campaigns based on life stage, financial goals, or user behaviour.

- Embrace automation for timely and relevant touchpoints like reminders, financial tips, or exclusive offers.

Did You Know: Personalisation in banking marketing increases conversion rates, retention, and customer satisfaction.

#6 Act Fast, Iterate Faster

Fintechs are nimble. They test, learn, and adapt quickly, whether it’s an A/B test on ad copy or revamping an onboarding flow based on user feedback.

What Banks Can Learn

- Launch MVP (minimum viable product) campaigns, then optimise in real-time.

- Track everything and use data to make smart, quick marketing decisions.

- Build agile marketing teams that can pivot when needed. If something didn’t work, own it, understand it and build on it moving forward.

The bottom line? Speed is a competitive edge in modern banking marketing.

#7 Create Communities, Not Just Customers

Fintechs know that building a user base isn’t enough. They create communities where users feel empowered, informed, and heard.

What Banks Can Learn

- Build digital communities around financial education, saving challenges, or investment journeys.

- Engage on social media with polls, Q&As, and real-time feedback loops. Reply to customer complaints and questions on threads and never block genuine complaints.

- Reward loyalty with referral programs, early access to features, or special perks.

#8 Appeal to Values, Not Just Value

Many fintechs market around purpose: democratising finance, closing the wealth gap, or making banking fairer. They understand that today’s customers care not just about what you do, but why you do it. That said, democratising, disrupting and other buzzwords have been overused in the fintech space. If you’re going to disrupt or democratise you need to be clear and focused about how you will do it and why you’re different.

What Banks Can Learn

- Align your marketing activities with ESG (environmental, social, governance) values that are close to your heart or mission statement. For example, working alongside a homeless charity to align with banking the unbanked.

- Support and spotlight initiatives that promote financial inclusion in your smaller and wider communities.

- Be authentic and don’t greenwash or overpromise. Show measurable impact or state how you are aiming to do so.

Purpose-driven marketing in finance isn’t fluff, it’s a key differentiator in the modern marketplace.

Fintechs may have disrupted the financial industry, but that doesn’t mean traditional banks can’t catch up, or even lead. By embracing transparency, agility, personalisation, and human-first messaging, banks can refresh their banking marketing strategies and build deeper, more resilient connections with their customers. The lesson is simple: evolve like a fintech but leverage the trust, knowledge and resources of a legacy institution.

Ready to improve the marketing for your bank? Book a free call with our team and let’s talk about it.