As a fintech marketing agency we stay updated on a diverse and fast-moving space. One of the best ways we do that is attending events like Money 2020 in Amsterdam, Finance Magnates Summit in London and the Cyprus Fintech Summit. At the 2025 Cyprus Fintech summit we caught up with a lot of innovators in the space and one of the more compelling keynote addresses was by Panagiotis Kriaris, a leading voice in fintech. We are at a pivotal transition from digital banking to ‘invisible finance’. Kriaris highlighted a central theme that is redefining the sector: finance is no longer a destination; it is an integrated, invisible part of the customer journey. As finance becomes more embedded, the need for clear, authoritative communication has never been higher. At Contentworks, we believe that behind every fintech and payments product, the narrative is the brand’s most vital asset.

We think you’ll love our article Write Like A Fintech Not A 90’s Bank”

The Great Decoupling: From Products to Experiences

A core insight from Kriaris is the concept of “The Great Decoupling.” Traditional banks are being unbundled, moving away from being monolithic entities, where consumers go just for banking. Today, we don’t go to a bank for a loan; we access credit at the point of sale. We don’t visit a branch to move money; we do it through a messaging app.

This shift represents the rise of Embedded Finance, where the frontend (the customer interface) is separating from the backend (the license and infrastructure). As Alex Rohloff, Head of Commercial for Klarna UK, noted during the summit discussions, the focus is shifting toward “how the user feels at the point of interaction, rather than the complexity of the rails underneath.”

The Marketing Opportunity

When the bank brand disappears into the background of a retail app or a SaaS platform, how do you stay top-of-mind? This is the paradox of invisible finance. The strategy must be two-pronged:

- For Backend Providers (B2B): Marketing must build brands that partners (merchants and platforms) can trust implicitly, turning “rails” into “reliability” through thought leadership.

- For Frontend Providers (B2C): Content can play a central role in creating an emotional resonance that survives the “invisibility” of the transaction.

A great example is our work with Snappi, where we crafted the neobank’s website content that simplified complex digital banking into a seamless, user-centric experience.

The 6 Layers of Competition

To survive in this new landscape, Kriaris outlined a framework of six layers where fintechs must compete. Here is how content marketing serves as the backbone for each.

Layer 1: Trust (Digital Identity, AI, & Security)

Kriaris emphasised that in a world dominated by AI agents and deepfakes, trust is the highest hurdle. If a user doesn’t trust the security of an “invisible” transaction, the entire system fails. As Klarna’s Rohloff suggested, “Trust is the currency of the future.”

Trust isn’t built with a security badge or industry award; it’s built through consistent, high-value education. This is where “Proof-of-Expertise” content, such as deep-dive security blogs and whitepapers, are used to turn sceptical users into loyal advocates. By explaining how encryption works or why biometric data is safe, we bridge the fear gap created by new technology.

Layer 2: Data (Access, Quality, & Portability)

Kriaris noted that “Data is the fuel,” but the advent of Open Finance means data must be portable. The challenge for fintechs is convincing users to share that data.

The Strategy: Use content to explain the “Value Exchange.” Infographics and clear UX writing, help users understand that by sharing data, they receive hyper-personalised financial advice or lower interest rates.

Layer 3: Orchestration (The “Air Traffic Control” of Finance)

Competition is now about who can orchestrate different payment rails, cards, A2A, crypto, BNPL and more, into a single, seamless experience.

The Marketing Tie-in: Content marketing helps Payment Service Providers (PSPs) explain their orchestration capabilities to merchants. Merchants don’t want a lecture on API architecture; they want to know how you’ll reduce cart abandonment. Use content to translate the technical into the tactical. For instance, for specialised payment solutions provider, PayRetailers, we created a series of deeply researched, regionally focused eBooks to showcase their expertise in each of their target countries.

Layer 4: Ownership of the Customer Relationship

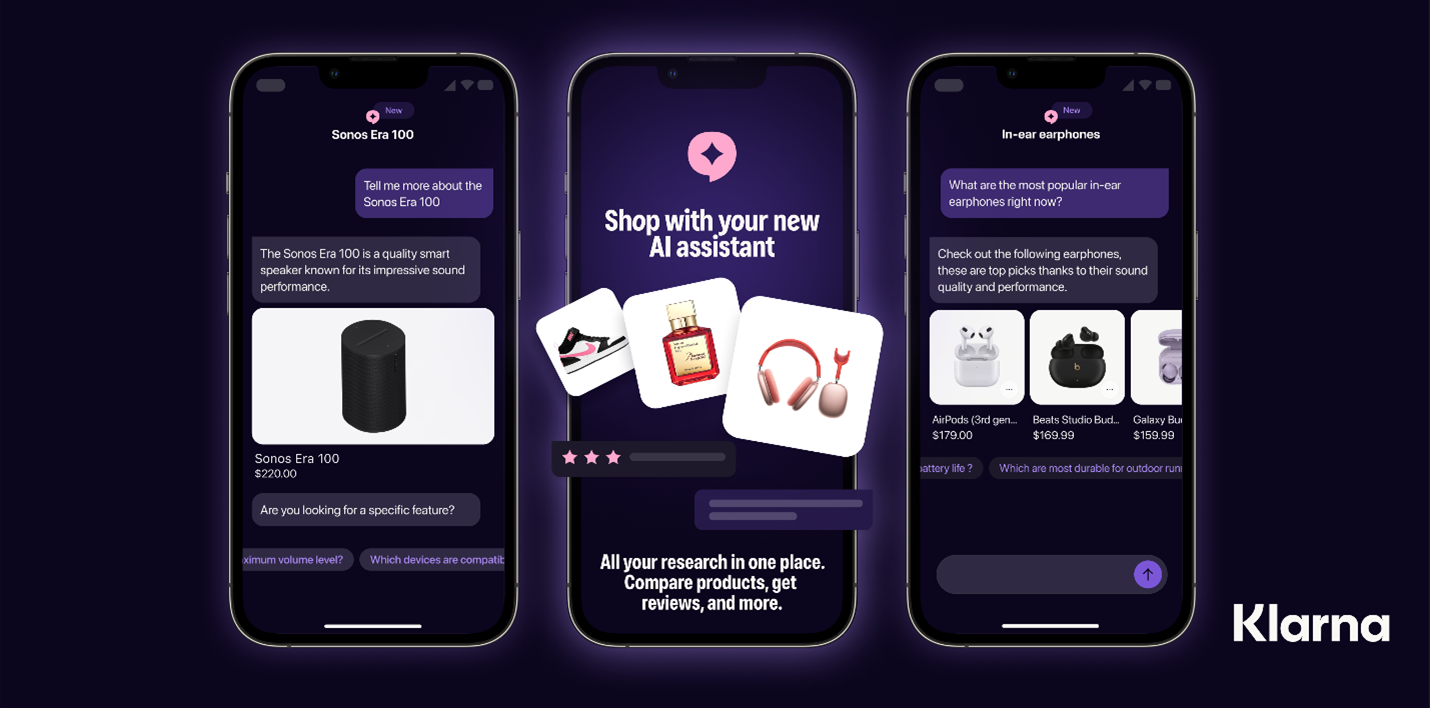

The industry is moving from generic services to hyper-personalisation. Klarna is a prime example of this. They don’t just provide a payment method; they own the shopping journey through personalised deals and a sleek interface.

The Content Angle: Content is the personalisation. AI can be used to deliver the message at the right moment for the user, but it’s the human content and connection that turns a transaction into a relationship.

Layer 5: Distribution (Ecosystems & Platforms)

Finance is moving to where the people are, whether it is social media, SaaS platforms, or retail apps.

The Strategy: Your marketing needs to be as embedded as your payments. Multi-channel content distribution ensures that whether a user is on LinkedIn or a retail app, your brand’s voice is consistent and present. To meet clients on their preferred platforms, we not only create thought leadership articles for multi-asset liquidity provider, X Open Hub, but we also ensure well-researched, relevant social media posts on Facebook and LinkedIn on a regular basis.

Layer 6: Regulation and Governance

With PSD3 and MiCA on the horizon, Kriaris pointed out that compliance is a moving target. We can see this in the rapid changing regulatory environment for cryptocurrencies. Although MiCA has been in full force since December 30, 2024, the national transitional periods for Crypto-Asset Service Providers (CASPs) ends on July 1, 2026. CASPs must obtain authorisation before this date, with ESMA focused on enforcing compliance and overseeing the newly licensed, authorised and compliant entities.

The Strategy: Position compliance as a “feature.” Use content strategically to turn dry regulatory updates into “Consumer Safeguard” stories. For instance, Revolut explains how being licensed in the UK means consumers are protected by FSCS.

The Future: Agentic Commerce and AI

One of the most provocative insights from the Cyprus Fintech Summit was the rise of Agentic Commerce. Panagiotis Kriaris discussed a future where AI Agents, rather than humans, might make purchasing decisions. If your fridge orders milk or your AI assistant chooses the best insurance policy, the traditional marketing funnel breaks.

The Content Paradox: If an AI is the “buyer,” how do you market to it?

The answer is shifting the focus to SEO and Semantic Authority by ensuring your fintech is the most cited and “most authoritative” source across the web. When an AI agent scans the landscape for the “most secure cross-border payment provider,” the goal should be to ensure your platform is the undisputed gold standard it recognises.

How Contentworks Positions Fintechs and PSPs in an Evolving Landscape

The Cyprus Fintech Summit emphasised that the technical side of finance is largely solved. The human side, trust and relationship, is the new battlefield. As Kriaris and Alex Rohloff both hinted, the winners will be those who can articulate their value in an increasingly crowded and invisible market.

At Contentworks Agency, we specialise in updating fintech content for increased AI visibility, greater trust and authority, enhanced discoverability across platforms, relevance for the latest industry and content marketing trends, and, of course, outranking competitors.

We have a proven track record with PSPs and fintechs across the world. We translate high-level insights into everyday marketing success, ensuring that while your finance might be invisible, your brand remains unforgettable.

The “rebundling” of finance is happening now. As the industry moves from products to invisible experiences, the voice of your brand is the only thing the customer can hold onto. Contact Contentworks Agency to build your authority and win across the layers of competition today.

Thank you Panagioitis Kriaris for sharing your insights. Catch his full talk here: Keynote Presentation – The Changing Fintech and Payments Landscape: Trends, Challenges & Opportunities.