In many financial services firms, content marketing is seen as a brand-driven function rather than a driver of measurable business outcomes. But content marketing done right, can map directly to your KPIs. Let’s look at how finance focused CMOs can align content marketing with boardroom goals through metrics, governance, storytelling, and structure.

#1 What Does The Board Care About?

At Contentworks one of the challenges we see when setting content marketing KPIs is that the board hasn’t been consulted. Before we can set content KPIs, we need to know your business KPIs. Before setting any content plan, reverse engineer from the metrics your board or finance leaders care most about. In financial services, these typically include:

- Net revenue growth

- Deposits from FX traders/ customers

- Profitability / contribution margin

- Customer acquisition cost (CAC) and unit economics

- Customer retention and lifetime value (LTV)

- Risk, compliance, brand integrity, reputation

Page views, social shares and engagement rates do matter, but they need to be aligned with leads, pipelines, revenues and brand awareness.

#2 Choose Content KPIs That Ladder Up To Business Metrics

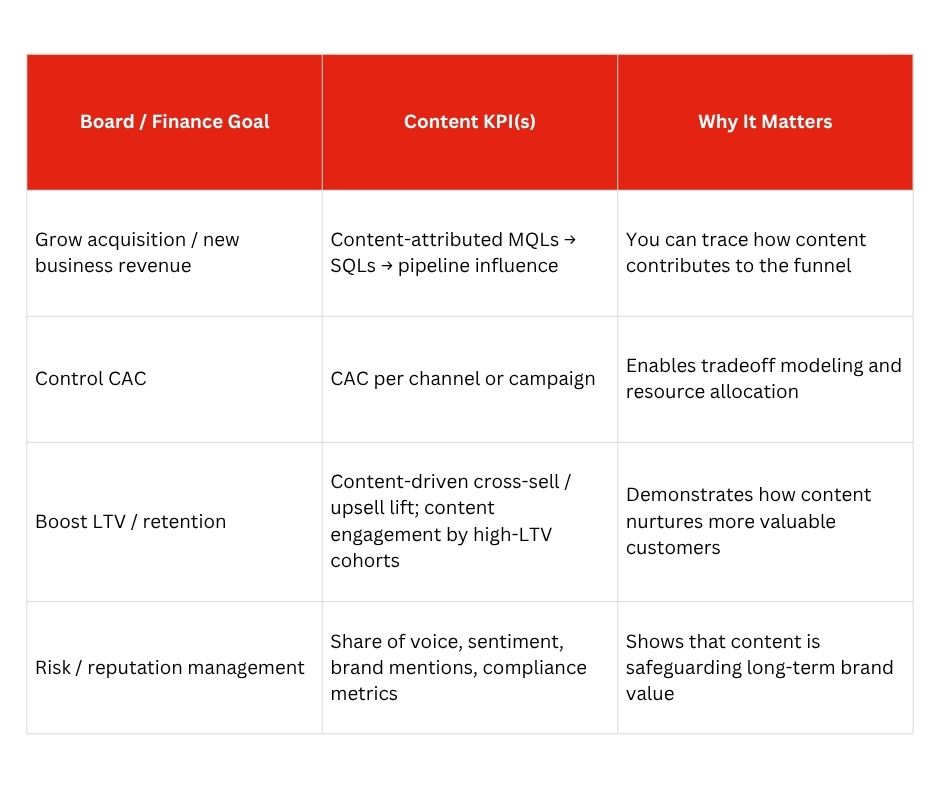

Once you know which financial and operational levers matter most, define content KPIs that tie directly into them. Here are a few examples of content marketing KPIs that align with boardroom priorities:

It’s often helpful to structure your metrics in tiers (leading / mid / lagging) so that short-term execution signals feed into longer-term value.

Another smart move is to translate content performance into “return on objectives” (ROO), not just ROI. That means demonstrating how your content meets predefined objectives (thought leadership, retention) while also mapping to financial outcomes.

#3 Build Attribution And Bridging Models

One of the biggest barriers to boardroom credibility is the “black box” problem. How do you prove that content caused revenue? In financial marketing, the acquisition cycle can be long and multi-touch. But there are proven approaches:

- Multi-touch attribution and weighted models

Distribute credit across content touchpoints rather than full credit to the last click. Use attribution models that reflect how your content influences awareness, education, and decision. - Media mix modelling / MMM

Use econometric modelling to estimate how shifts in content investment (versus other levers) impact revenue or margin. This approach is more acceptable to finance functions. - Control experiments / pilots

Run a campaign with a control group vs. treatment group; measure incremental lift attributable to content investment and extrapolate to full scale. Use that to build your business case. - Cohort-based progression tracking

Tag cohorts of users exposed to content and track their conversion or LTV over time vs. unexposed cohorts.

These approaches allow you to move beyond claims to defensible, data-backed narratives.

#4 Storytelling, From Narrative To Numbers

When you present to the board or finance committee, your narrative must combine vision, metrics, and causality. Here’s a structure your executive presentation might follow:

- Context: Remind stakeholders of the corporate objectives

- Hypothesis & plan: “We believe investing in a thought leadership engine will accelerate lead quality in high-potential sectors.”

- Pilot outcomes: Present results from controlled experiments or past content themes.

- Attribution bridge: Show how content touches flow through funnels to pipeline to revenue.

- Next steps & investment ask: Propose forward content investments with their projected returns.

Try to frame stories in financial terms. Instead of saying, “this content generated 5000 views,” say: “This campaign produced 30 qualified leads, resulting in 15 new clients.”

#5 Use Benchmarking, Peer Comparisons, And Macro Statistics

To strengthen your boardroom case, bring in external benchmarks and industry data:

- According to the Content Marketing Institute, only 29% of marketers with a documented content strategy say it’s “very or extremely effective,” while 42% cite weak or unclear goals as the cause of underperformance.

- Among B2B firms, while 89% use content marketing, only 43% actively measure ROI.

- Companies with strong marketing-sales alignment generate 208% more revenue from marketing campaigns.

Using these kinds of statistics helps underscore that what you are proposing is not speculative, it is in line with what top performers are doing.

Content As Capital, Not Cost

When content marketing is genuinely aligned with boardroom goals, it ceases to be a discretionary expense and becomes a valuable growth engine. For finance CMOs, the path to alignment lies in:

- Starting from the board’s financial view and priorities

- Selecting content KPIs that ladder into business metrics

- Delivering narrative and data in boardroom formats

- Benchmarking your approach

Ready to start aligning your content marketing with your business goals? Book a Zoom call with our team.