Imagine logging into your banking app and seeing a progress bar inch closer to your savings goal. Every time you save, a virtual confetti animation bursts on screen. Your “level” increases, unlocking a new set of challenges and rewards. The experience feels less like balancing a budget and more like completing missions in your favourite video game. That’s gamification in finance and it’s changing how we interact with money.

Did you know: The global gamification market is projected to grow to $30.7 billion in 2025, with a CAGR of 27.4%, and a growth rate of 24.2% from 2020 to 2030.

What Exactly Is Gamification?

At its core, gamification means using the mechanics of games, like points, challenges, leader boards, rewards, and progress indicators, in non-game settings. The goal isn’t to trick people into thinking they’re playing Mario Kart when they’re paying bills. It’s to make everyday tasks more engaging and rewarding.

In the financial world, these mechanics turn otherwise mundane interactions like saving, investing, and budgeting into compelling experiences. Instead of checking your bank balance with dread, you might log in to “collect your daily streak reward” for reviewing your budget. Instead of slogging through an investing tutorial, you could complete interactive “quests” that teach you about asset classes, earning badges along the way.

The magic lies in psychology. Gamification taps into our innate desire for achievement, recognition, and progress. When we see measurable improvement, we’re more motivated to keep going.

Why Finance Needs Gamification

Financial tasks can be dry, complex, and, for many, anxiety-inducing. Neobanks, fintech apps, and trading platforms are in a constant race for customer attention and retention. Gamification has emerged as one of the most effective tools in that race.

A recent report by Miquido found that gamified features can increase engagement by nearly 50% and lead to a 67.9% positive effect on financial behaviours. That’s not just more people logging in; it’s more people saving, investing, and making informed money decisions.

Gamification also breaks down complexity. Think of it like learning chess by playing short, interactive puzzles rather than reading a 4000 page manual. Gamification in finance means turning intimidating concepts into manageable steps. Whether it’s showing you how compound interest works through a simulated savings challenge or visualising debt repayment as a “boss battle” you chip away at over time.

Case Studies: Gamification in Finance

Let’s check out some real-world examples where gamification has transformed user engagement, and in some cases, entire brand identities. There’s some great ideas to steal here, and one to maybe avoid!

Monzo: Challenges That Nudge Behaviour

UK-based neobank Monzo doesn’t just show you your spending breakdown, it gamifies it. Users can set “challenges” such as spending less on takeaways for a month, complete with progress tracking and encouraging notifications. Monzo’s “Coin Jar” feature rounds up transactions and tucks the change into savings. Users often describe the satisfaction of watching the jar fill up as similar to completing a side quest in a game. Remember those piggy bank scenes in Squid Game that got players hooked on continuing? It’s exactly this.

Piggy Bank visuals keep players hooked on the deadly games in the Squid Game series.

Moneybox: Saving Without Thinking About It

Moneybox takes an ultra-low-friction approach. Every time you spend, it rounds up to the nearest pound and saves or invests the difference in a portfolio of your choice. The app turns investing into a passive yet gamified journey, offering milestones, projected future values, and “personal bests” for saving streaks. By lowering the barrier to entry, it draws in first-time investors who might otherwise have been intimidated.

US Bank’s Smartly Savings Programme: The Gentle Onboarding Game

US Bank’s programme welcomes new customers with a series of “missions” to complete: set a savings goal, deposit your first amount, automate a transfer. Each mission comes with visual feedback and tips, rewarding customers with a sense of momentum right from the start. It’s the financial equivalent of a tutorial level in a video game – teaching you the controls before throwing you into the main quest.

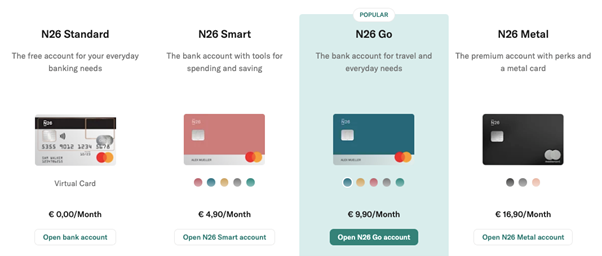

N26: Tiered Membership as a Status Game

German neobank N26 uses gamification subtly through tiered account memberships—Standard, Smart, Go, and Metal. These aren’t just functional upgrades; they’re status signals, much like unlocking higher ranks in a multiplayer game. Customers feel an aspirational pull to “level up,” whether for tangible benefits or the prestige of holding the top-tier card.

Robinhood: The Controversial Side of Gamification

On the trading side, Robinhood has faced scrutiny for using visual cues, like celebratory animations when trades are executed, that critics say could encourage risky behaviour. This highlights an important point: gamification is a powerful tool, but in finance, it must be handled ethically. The same features that make saving fun can make over-trading dangerously addictive. And you know you need to watch your compliance in all marketing elements!

Boss Level Forex Broker Case-Study

eToro’s copy-trading platform lives and breathes gamification by blending it with social media mechanics. Traders can “follow” top investors, see their performance stats in a public profile, and copy their trades automatically. Leader boards highlight the most successful traders, creating a competitive environment where performance becomes a visible score. Badges and performance milestones reward consistent returns or risk management, turning portfolio building into a mix of skill-building and status-chasing.

If you’re a broker that doesn’t have gamification steeped into your DNA like eToro, here’s a standout example comes from Zerone. This broker embraced gamification to transform how users engage with financial tools and learning. Zerone integrates three classic game-inspired mechanics:

- Points: Users earn points by completing actions such as executing a certain number of trades or engaging with the app regularly.

- Badges: These are unlocked milestones tied to performance or participation—like hitting a trade streak or accomplishing specific tasks.

- Leader boards: A competitive element where users can see how they rank against others, inspiring performance improvement.

By turning routine trading behaviours into a progression system, Zerone adds enjoyment and a sense of progression to what might otherwise feel like mundane or stressful tasks. These game mechanics help combat boredom, increase retention, and build a more vibrant, motivated user community.

Why Gamification in Forex Matters

- Boosted Engagement

Gamified elements like points and badges incentivise users to return, explore features, and stay invested longer. - Increased Retention

Having short-term goals (e.g., badges) and a comparative context (e.g., leaderboards) encourages sustained use over time. - Fostering Community & Competition

Leaderboards bring a social energy—traders naturally strive to outperform peers, which drives engagement and behavioral improvement.

How Zerone Balances Benefits and Risks

Zerone’s model is effective but in the high-risk, real-money environment of forex, gamification must be handled carefully:

- Ethical Nudging: Rewarding strategic, well-informed trading behaviors rather than reckless volume chasing.

- Clear Communication: Users must understand what earns points and what the real risks are behind trades.

- Avoiding Addictiveness: Ensure competitive mechanics don’t push users toward unhealthy, impulsive trading just for badges.

How to Implement Gamification in Finance

If you’re a finance brand considering gamification, the first step is deciding what behaviour you want to encourage. Is it saving more? Spending less? Learning about investing? Without a clear goal, gamification is just a gimmick.

The design stage involves selecting the right mechanics for your audience. Progress bars and streaks might work for budgeting apps, while quizzes and badges suit educational platforms. For forex and trading apps, interactive tutorials or practice accounts with virtual currency can provide a safe, gamified introduction before real money is on the line.

Compliance is non-negotiable. In finance, regulations exist to protect consumers from misleading practices and behavioural manipulation. Gamification elements must not obscure risks or encourage harmful behaviour. That means avoiding “dark patterns”, UX tricks that push users into impulsive actions, and ensuring all rewards are tied to genuinely beneficial outcomes.

Lastly, freshness is key. A game with no new challenges soon becomes boring, and the same is true for finance apps. Rotating seasonal challenges, introducing new badge types, or running limited-time savings events can keep the experience dynamic.

Gamification isn’t just about engagement metrics; it’s about long-term trust. A finance brand that uses game mechanics to genuinely help customers build wealth will foster loyalty that no cashback offer can match. Conversely, one that uses them to exploit impulsivity risks reputational and regulatory damage.

Conclusion: Yes, This Article Was Gamified

If you made it this far, you’ve just completed Level 5 of this reading quest. Along the way, you encountered:

- Narrative hooks (opening with a scenario to draw you in)

- Progress milestones (case studies as “missions” you completed)

- Rewards (useful insights you can apply immediately)

- Boss levels (the tricky parts about compliance and forex risks)

- The Final Boss (the ethical considerations section)

Ready for your next quest? Contact the Contentworks team and let’s start strategising.