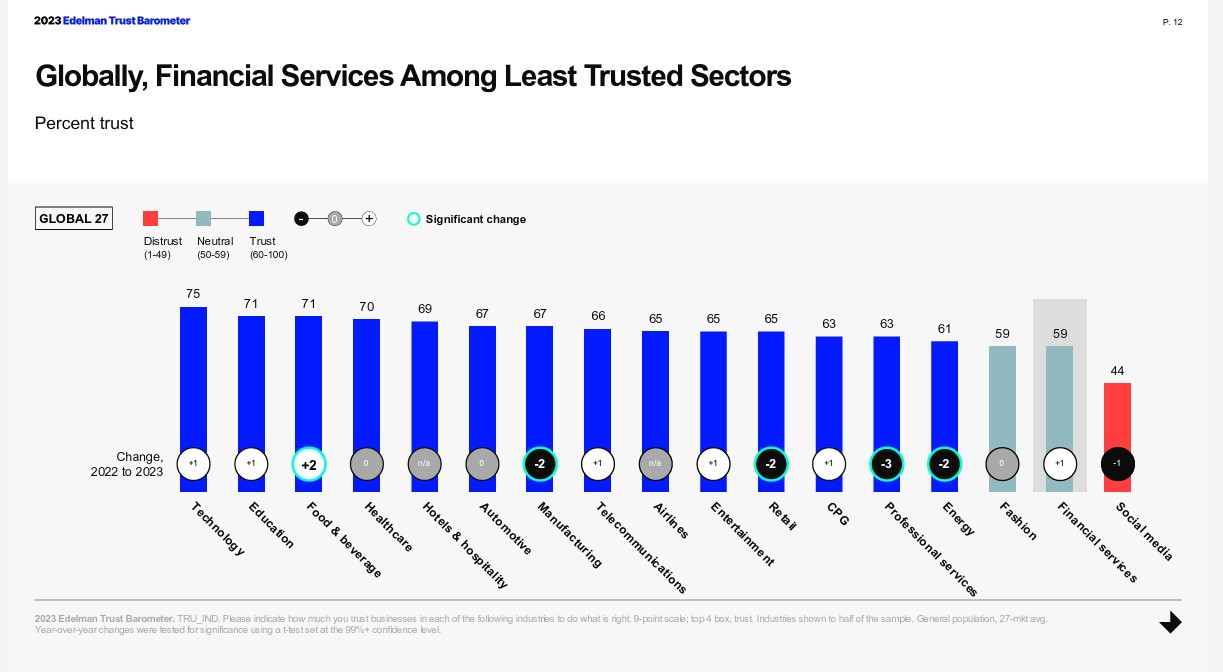

Trust in banks is at an all-time low. A 2023 Edelman Trust Barometer report revealed that only 48% of consumers trust financial services institutions, with younger generations particularly skeptical of traditional banking systems. Additionally, a Deloitte study found that 61% of banking customers consider switching financial providers due to concerns over transparency and hidden fees. With economic uncertainty, digital fraud, and customer dissatisfaction on the rise, banks must adopt smarter, more customer-centric marketing strategies to rebuild trust and retain clients.

Marketing for banks isn’t just about promoting financial products, it’s about demonstrating reliability, improving customer experience, and utilising innovative platforms to engage audiences. This article explores the most effective marketing strategies for banks today, showcasing successful campaigns from traditional banks like Barclays to digital banks like Monzo and more.

Key Marketing Strategies for Banks

The Deloitte Study mentioned above goes on to identify six imperatives for building a successful digital bank. It highlights two marketing points of focus: customer strategy & segmentation, and brand, experience & proposition.

Customer Segmentation and Personalisation

Segmentation isn’t just about demographics or geography, it extends to values like empathy, inclusion, and ESG commitments. Customers align with brands that demonstrate a deep understanding of their community’s needs. Digital disruptors are winning customer loyalty and expanding their market share by delivering human-centered experiences.

Branded Experience

Branding need to be baked into the product and personalisation will be the driver for differentiation. Understanding the value of branding and customer segmentation is not always easy for the C-Suite who are focused on measurable results. As this article discusses, dark social, non-attributable marketing activity, can account for almost 60% of traffic. The takeaway is that an integrated, omnichannel approach is necessary in this digital landscape. Let’s look at which banks and neobanks are effectively using different marketing strategies.

Talk to our team about marketing for your bank.

Social Media & Influencer Marketing

Monzo’s Community-Driven Social Media Success

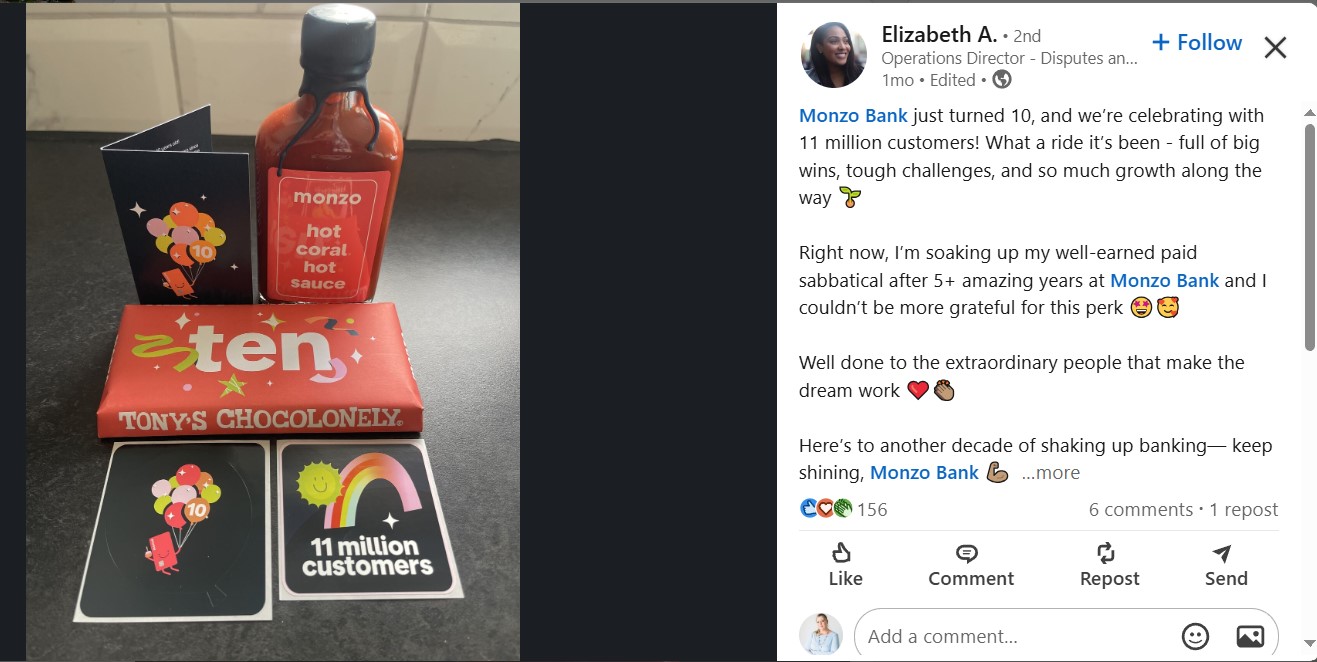

Monzo, a UK-based neobank, are nailing social media and building a community-driven brand. Instead of traditional advertising, Monzo focused on organic engagement by encouraging user-generated content. Their social media presence thrives on Twitter and Instagram, where they directly interact with customers, turning feedback into actionable changes.

Monzo recently turned 10, and celebrated 11 million customers with a tasty Hot Coral collab. Those following Monzo will remember their popular #HotCoral cards campaign.

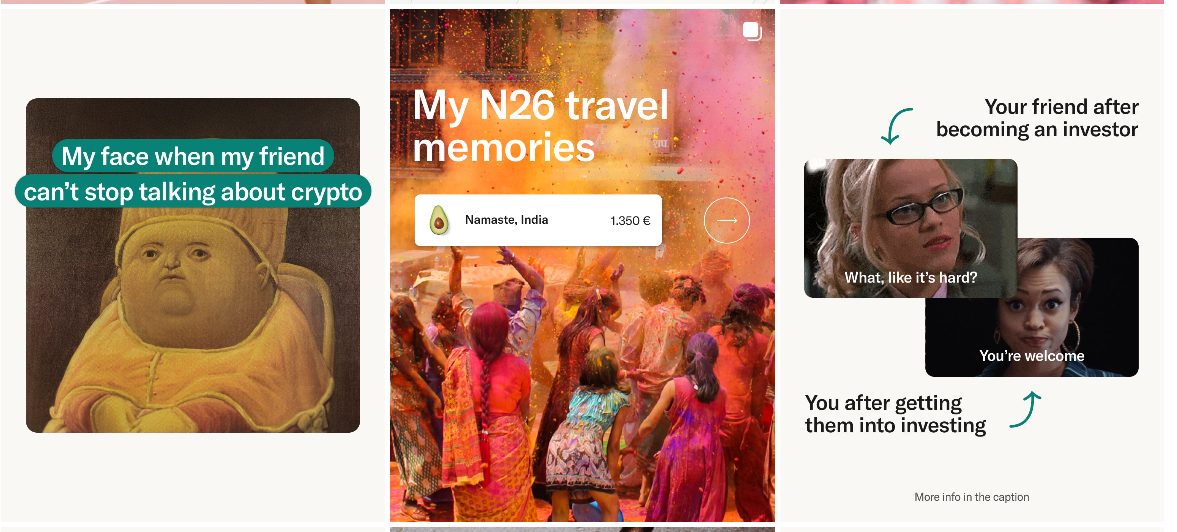

N26’s Instagram-First Approach

N26, a Germany-based neobank, has adopted a visually appealing Instagram-first marketing strategy. The bank regularly posts high-quality lifestyle content that resonates with younger audiences, reinforcing its image as a sleek, modern financial platform. They also collaborate with travel influencers to position themselves as the go-to bank for seamless international transactions. Here’s a peek at how fun their channel is looking like right now:

TikTok Marketing & Viral Campaigns

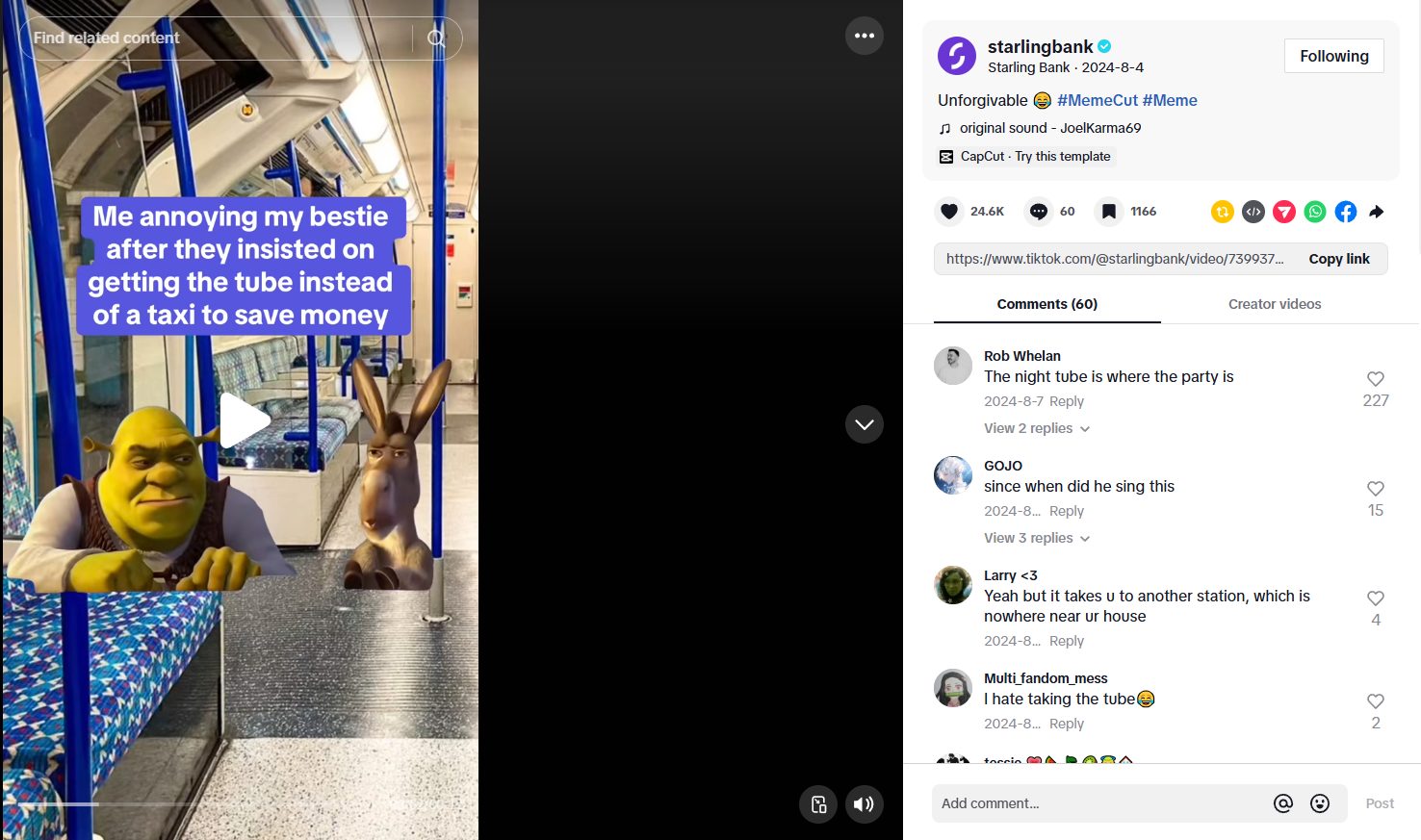

Starling Bank’s TikTok Financial Literacy Campaign

Starling Bank, a UK-based digital-only bank, recognised the potential of TikTok to educate and entertain younger demographics. Their #MoneyMadeSimple campaign featured engaging short videos explaining budgeting, savings, and financial habits in an easy-to-digest format. The campaign gained traction by using humour, real-life scenarios, and collaborations with finance influencers, making banking accessible and fun. They also share relatable and trending TikToks like this one!

Barclays’ Digital Safety Awareness on TikTok

Barclays successfully leveraged TikTok to address an important issue – digital fraud. Their campaign, #ScamAware, educated users on how to spot financial scams, using engaging, short videos that simulated real-life scam attempts. This strategy not only positioned Barclays as a customer-centric brand but also strengthened trust among its audience. Barclays also places its experts centre stage to share expertise on critical topics like mortgages, debt and loans.

Charitable & CSR Campaigns

Barclays’ £100M COVID-19 Relief Fund

During the pandemic, Barclays launched its £100M Community Aid Package, providing essential financial support to charities and vulnerable groups. This initiative received widespread media coverage and enhanced Barclays’ reputation as a socially responsible bank. Customers appreciate banks that go beyond profit-making, and campaigns like this create lasting goodwill.

Monzo’s Gambling Block Feature

Monzo took an innovative approach to responsible banking by introducing a Gambling Block feature, allowing users to self-exclude from gambling transactions. This initiative was widely covered in the media and positioned Monzo as an ethical and customer-focused financial institution.

Personalisation & AI-Driven Marketing

N26’s Data-Driven Personalisation

N26 has integrated AI-driven recommendations into its app, providing personalised spending insights and saving suggestions based on user behaviour. They also use targeted push notifications to offer real-time financial advice, making banking a more tailored experience. N26 has been using AI to offset a number of challenges including the scaling of customer support. Over 20% of customer service requests are now handled by their AI assistant.

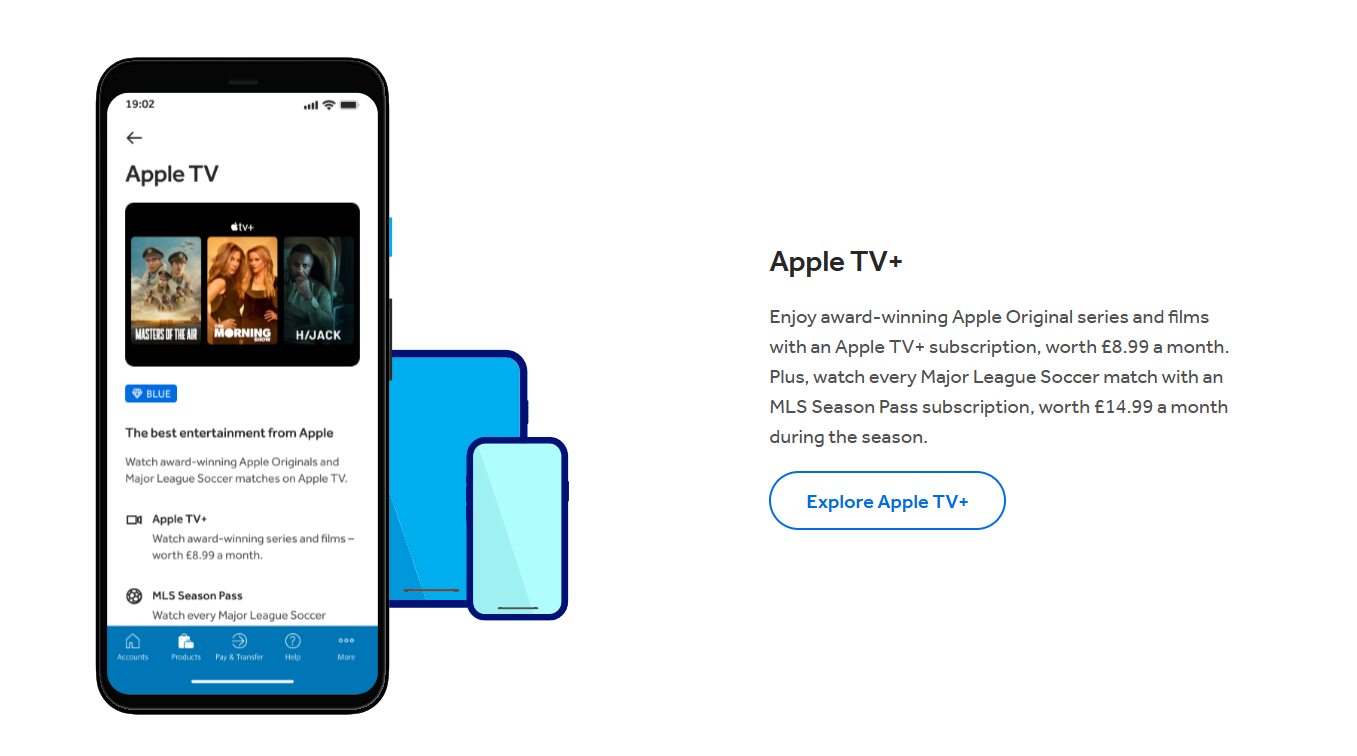

Barclays’ Personalised Rewards Program

Barclays employs AI-driven marketing to offer personalised banking experiences. Their Barclays Blue Rewards programme gives customers cash-back based on their spending habits, fostering loyalty and encouraging more transactions.

Gamification & Referral Programmes

Using game mechanics to engage users is not new, but few are nailing it. Here are some of the more typical examples of gamification:

- Rewards: Discounts, early access, exclusive give-aways, merchandise and cashback are ways users are encouraged to engage with fintechs on a more consistent basis.

- Challenges: Time- or goal-based tasks can keep users motivated, e.g. hitting savings targets.

- Visual progress tracking: Spending or savings milestones, and progress bars, gives users a sense of accomplishment. They reinforce positive financial habits and create feel-good experiences.

- Leader boards: Fostering friendly competition with leader boards can encourage user engagement. It can be for savings, transaction volumes, referrals and more.

- Badges: These can be used for completing certain tasks like reaching savings goals or setting up direct debits, or completing an educational course. Badges can also be redeemed for rewards – or the badge itself is its own reward.

Revolut’s Crypto Cashback Incentive

Revolut, another digital banking giant, introduced a gamified referral program where users earn cashback in cryptocurrency for referring friends. This strategy appealed to tech-savvy users and contributed to Revolut’s rapid growth. Centred around its RevPoints system, Revolut uses a leader board to display clients’ points and encourage competition amongst clients. Points are gained via making transactions, referrals and challenges and can be redeemed for rewards.

Gamification features Revolut leans into:

- Progress bar: Right from installing the app, you are given 7 progress bars that look somewhat like Instagram, which you swipe through to sign up and login. Tap, tap, tap…

- University challenge: Promoting to universities is not a new thing for banks, but creating competition amongst European universities with a leader board was inspired.

Digital Content & Financial Education

Starling Bank’s Blog & Podcast Series

Starling Bank has established itself as an authority on personal finance through its well-curated blog and podcast series. By providing valuable content on savings, investing, and entrepreneurship, Starling builds trust and positions itself as more than just a bank—it’s a financial guide.

Chime’s Millennial-Friendly Financial Guides

Chime, a U.S.-based neobank, uses content marketing to attract and educate millennials and Gen Z. Their guides on avoiding overdraft fees and saving smartly resonate with young professionals looking for financial independence.

Snappi Bank Building Trust

Recently launched, Greek neobank, Snappi are big on financial literacy. Drawing on a climate of distrust of banks amongst locals, the bank took a head-on approach in transparency and literacy. Contentworks Agency is working with Snappi to align its content marketing to the bank’s core values of trust, financial literacy and community.

DBS Bank’s AI-Powered Customer Engagement

Singapore’s DBS Bank has been a pioneer in AI-powered customer service. Their digital assistant, “Digibot,” helps customers with banking queries via WhatsApp, WeChat, and SMS, providing real-time support. This initiative has boosted customer satisfaction and engagement, setting an example for global banks looking to integrate AI into their marketing strategies.

Conclusion

Marketing strategies for banks have evolved significantly, with digital innovation at the forefront. Neobanks like Monzo, Starling, and N26 excel in community-driven marketing and social media engagement, while traditional banks like Barclays leverage large-scale CSR initiatives and AI-driven personalisation. The key to success in banking marketing lies in blending technology, social impact, and customer-centric strategies to create meaningful connections with users.

For effective marketing strategies for your bank, contact the expert team at Contentworks.