In the hunt for new clients, brokers can overlook the value of their existing client base. Recent statistics tell us that the probability of selling to an existing customer is 60-70%, while the probability for potential leads is 5-20%. That retention is easier and more cost-effective is not a new insight. But as a forex content marketing agency, one of the mistakes we see, is brokers not utilising their existing traders. Once a broker signs up with a signal provider, or posts daily market analysis, they feel their job of supporting their traders is done. But is your forex analysis actionable?

Before we dive into whether your analysis is helping your traders trade more, let’s look at the balance between acquisition and retention.

Retention vs Acquisition

In reality, your brokerage needs both. Yet the approach to each audience is different. Here’s a quick look at how they vary.

Your Objective

Acquisition – To get attention (average CPC for finance is $3.44), excite target audience about your offering (difficult in a saturated market), and inform them of who you are and create trust.

Retention – To build a long-term relationship, encourage more trading, introduce new assets and products. With a churn rate of 40% after their first month, keeping day traders does present its challenges.

Key Metrics

Acquisition – Cost of acquisition (CPA), conversion rates, return on investment (ROI)

Retention – Client retention rate (CRR), churn rate (CR), lifetime value (LTV)

Main Challenges

Acquisition – High cost, you need to identify your audience, find the best channels to target them, spend resources on testing different approaches, keep optimising every detail of your marketing campaign.

Retention – Low cost, utilise personal data to send tailored messages, send timely promotions based on their activity. Main challenges include being relevant, always offering something new, ensuring the quality of the signals and analysis you send, and differentiating from competitors. With only 13% of day traders being consistently successful over 6 months, keeping their spirits up is a challenge.

Do Trader Care About Forex Analysis?

The short answer is yes. Informed, educated traders are more likely to trade with confidence and more frequently. By offering tradeable analysis, you not only encourage clients to trade more but also build their trust in you. If your traders are ignoring your analysis, you need to take a closer look at what you are sending them. Not all traders are the same so you need to tailor your analysis to fit your segmented audience. Retail traders will need different support than professional, or high-frequency traders.

Analysis That Drives Trading

Trading action is the name of the game in this article. Opening emails is great. Engaging with social media posts is also excellent. But are they opening your trading platform, depositing funds and trading? Let’s take a look at the different types of forex analysis you can offer to different types of traders to motivate them to trade.

Fundamental Analysis

New traders understand the concept of fundamental, or market, analysis better. It’s easier to observe how geo-political events like hurricane’s or supply chain disruptions can move the markets. Economic indicators and the degree that they can impact the markets are simpler to explain.

What this trader needs:

- Continual education on how macroeconomic factors impact asset prices.

- An economic calendar to keep up with regular indicator releases.

- A corporate calendar for company earnings announcements.

- Daily market news and geopolitical announcements.

- Check out a sample of our market minute videos.

Technical Analysis

More experienced traders turn to technical analysis and will often ignore fundamentals. To them, it’s all about charts and historical price action.

What this trader needs:

- Tailored education on how to analyse trends, assess trend quality, understand different timeframes, timing of entries and exits, money management and psychology of trading.

- Customised tools for their charts for e.g. Fibonacci retracements, RSI, MACD etc.

- Trading ideas through daily technical analysis on assets they are trading – be that currencies, commodities, indices or stocks.

- For high-frequency traders, speed of platform execution and receiving timely information are paramount.

What Even is Sentiment Analysis?

No, this is not it. This is melodrama.

Sentiment analysis aims to understand the mood of the markets and gives traders a unique perspective into how prices can shift.

These traders need:

- Education on understanding how alternative data can fit into their trading strategies.

- Sentiment analysis charting software.

- Daily emails and alerts on shifting sentiment.

Broker Challenges with Analysis

Delivering timely, actionable analysis can be a real challenge for brokers. There are a multitude of one size fits all analysis offerings from third-party suppliers that have become standard. But as we said at the start, you can’t just plug in your analysis offering and sit back. You need to be more strategic about how, when and to whom you offer it.

Here are some of the more common challenges your traders will face with analysis.

Challenge #1: Infobesity, or information overload of data and market news can paralyse traders. In short it can actually stop them from trading.

Solution: Segment your traders and tailor what they receive. Deliver easy to understand insights on the channels they prefer. Do they want to read it all in an email, or just get the headlines and click through to longer analysis on your website? Do they just want platform alerts, or SMS? Be consistent so they know when to look for it.

Challenge #2: Lack of integration. By not integrating analysis with your platform your traders might put it aside but get too caught up in their busy day and forget it.

Solution: Data and analysis that can be integrated into your trading platform means your traders can instantly trade the ideas or signals. Or it can be as simple as providing a convenient click, either on your forex analysis article or email, that takes them to their logged in platform.

Challenge #3: Analysis bias. Traders often have preconceived ideas of what’s happening in the market and have a hard time seeing the reality leading them to make bad decisions.

Solution: Ensure the analysis you send is unbiased, is crafted by an expert analyst and is consistently correct. This should help them overcome emotional or biased decision making.

Support Your Traders with Better Analysis

So you’ve lined up your expert analyst, or analysts. You’ve verified the sources of your information and you’ve ticked off your compliance obligations. Now, how can you better support your traders with the analysis they receive from you?

Education

Regular articles educating your traders on the different types of analysis is not only great for your long-tail keyword SEO strategy. It will also help your traders make better use of the analysis you send them and the tools you offer on your forex trading platform. Be sure to mix up the education you send them, not everyone learns in the same way. Blogs, video tutorials and live webinars can help traders learn how to interpret the data you send them. We helped IC Markets do this with a series of videos, from ‘how to set up your platform’ to ‘how to trade with indicators’.

Personalisation

A top trend for 2025, tailoring your analysis based on your traders experience level, trading styles, volume and level of activity is a must. A simple trend indicator might be more useful for a beginner, while advanced traders will look for strategies that help them combine multiple indicators, or back-testing tools.

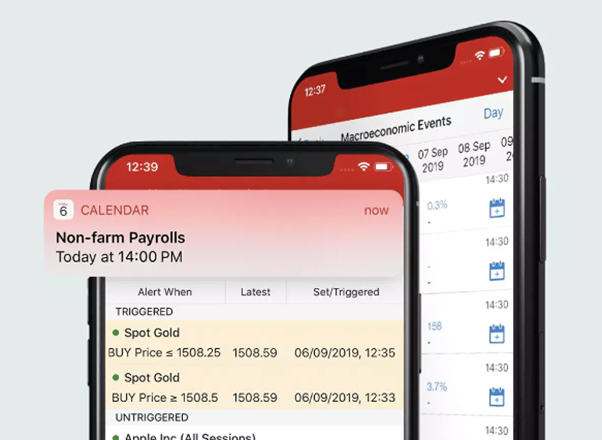

Alerts in real-time

Make sure your trades don’t miss a beat with timely market updates. But don’t overload them with information they are not interested in receiving.

Actionable content

Theoretically, all content should be actionable. That is its purpose, to drive your potential lead or existing trader to the next action you want them to take. When providing fundamental or technical analysis, timing is paramount and so is content that simply and succinctly offers ideas to traders. Different types of alerts can encourage both increased trading and help your traders make better decisions:

- Pricing alerts: notify traders on the direction their chosen assets are moving based on predetermined percentages. When certain resistance /support levels or breakouts are hit.

- Economic event alerts: send out alerts on major macroeconomic events like central bank reports. You can send these ahead of the events and after data releases allowing your traders to take advantage of price volatility.

- Technical indicator alerts: allow your traders to customise their own alerts using popular indicators like RSI, MACD, Bollinger Bands etc.

Engaging content

People have a hard time reading long text and they need to have the entertainment centres of their brains activated. That can be a real challenge when delivering analysis, but not impossible! You need to strike the right balance between quality, relevant analysis that is trustworthy, but also relatable. Examples might be a light hearted video, image or email subject.

Source: Speed Bump by Dave Coverly

Content That Drives Results

Providing actionable analysis, across various time zones, and hitting different market openings in a multitude of languages is a major challenge for brokers. At Contentworks we’ve developed a number of integrated solutions so you can deliver timely, accessible analysis to increase trading activity. From daily outlooks, weekly forecasts and detailed monthly and quarterly reviews, we’ve got you covered. Our team offers ready-to-send html emails in multiple languages that can be delivered quickly and efficiently by your team. Our expert analysts are in key locations to better serve our global client-base.

Could the analysis you’re offering your clients drive more trading activity? Speak to our team about forex analysis.