The use of innovative tech across the financial services sector is becoming mainstream as consumers demand efficient, value-added services. Indeed, the emergence and growth of services such as PayTech, WealthTech and RegTech highlights how digitisation is impacting the sector. Fintech innovations are rolling in thick and fast but what can we learn from the marketing techniques used to showcase these developments? Our team has the answers and some 2020 marketing lessons from PayTech, RegTech & WealthTech.

2020 Marketing Lessons From PayTech

PayTech is as it sounds, payment technology. It focuses on using technology to improve and simplify the way transactions are conducted. But, as with most of the fintech business landscape, competition is fierce. Not only do PayTech firms have to compete with each other, but they must keep up with big banks that provide payment solutions. PayTech firm, Pannovate, is showing that putting user experience first makes for a good differentiator in a highly competitive sector.

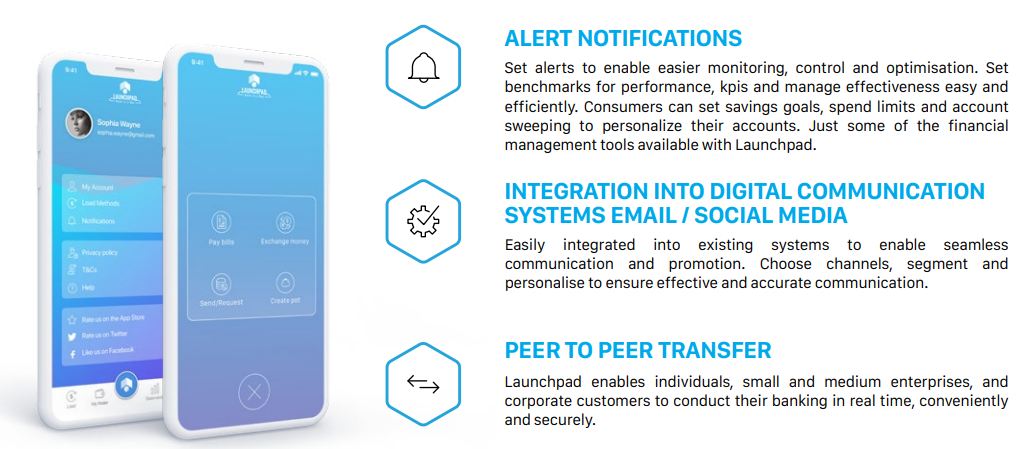

Lesson 1: Omnichannel is the new way to market

Pannovate successfully released its LaunchPad application which was designed to prioritise customer experience. During the marketing process, Pannovate highlighted one of LaunchPad’s key features as the ability to “easily integrate into existing systems to enable seamless communication and promotion.”

This points to a key marketing lesson – today’s customer is omnichannel and omnichannel is the new way to market.

Omnichannel marketing gives customers a completely seamless and integrated experience throughout their purchasing journey. This means that all channels work together to create a unified brand message. This is important because over 70% of consumers will use three channels or more when researching a product.

The result

Adopting an omnichannel approach has made LaunchPad attractive to even the most critical end-users and it’s driving brand growth. Already, Pannovate has garnered a bigger collaboration with successful banking disruptor Bankingblocks to provide complete banking solutions for neo and challenger banks.

In explaining why Bankingblocks decided to partner with Pannovate, providing a seamless user experience stands out. Bankingblocks chose Pannovate because it wanted a full end-to-end solution that gives clients unified and tailored experiences.

Tip: Combine and optimise online, offline, and physical channels to give your customers flexibility. The major benefit of providing an omnichannel experience is that it empowers users to personalise their own experience.

Lesson 2: Purpose-driven marketing is successful marketing

88% of consumers want you to make a difference and using your marketing to highlight that your brand is driven by a worthy purpose can boost growth and customer loyalty. £560 million of charity money goes unclaimed annually because of issues in the way Gift Aid is processed. PayTech company Streeva’s marketing revolves around helping charities save this money and the brand makes this very clear.

Streeva’s marketing strategy aims to drive home the point that its Swiftaid product was created with the purpose to significantly boost Gift Aid income by automatically processing future donations.

The result:

This marketing has helped Streeva build brand awareness. The company is only three years old but it’s gaining recognition not only in the PayTech sector but also in the broader business sphere.

The brand recently won the PayTech Awards’ PayTech for Good award which honours a company that “puts the wider community first beyond the usual confines of business goals.” Streeva is also one of the nominees for Surrey Business Awards’ Innovation in Business Award.

Key takeaway: Having a clear brand message drives brand awareness and customer loyalty – two key elements for customer retention.

2020 Marketing Lessons From RegTech

Regulatory technology, in short RegTech, is a new technology that uses IT to enhance regulatory processes and transparency. Its main application is in the financial sector where regulation is critical and the cost of complying (and not complying) with complex and ever-changing regulations is relatively high. To date, RegTech has been focused on digitising manual reporting and compliance processes for financial services brands. But it’s now expanding into other regulated businesses. Many RegTech companies are embracing consumer needs and AI to help them engage with their customers.

Lesson 1: Address consumer pain points

RegTech firm Ascent built its marketing around using AI to help customers rise above the costs and complexities of regulatory compliance. The brand shows how its proprietary RegulationAI™ can process and analyse its clients’ regulatory text in a fraction of the time it would take individual consultants, compliance officers and lawyers to complete the work manually.

The result

By showing how AI is saving firms time and money, increasing their efficiencies and helping them avoid penalties and fines, Ascent is driving its growth. Recently, the brand managed to raise $19.3 million in funding to expand its compliance automation solution.

This marketing strategy is also increasing brand awareness as evidenced by the four-year-old firm’s impressive and growing client portfolio.

Tip: Remove focus on your brand and shift it towards how much the consumer stands to benefit from working with you.

Lesson 2: AI is the present and future. Embrace it.

Underneath Ascent’s focus on the customer lies the power of AI. Research shows that AI has the potential to boost profitability rates by 38%. It can actually lead to an economic boost of $14 trillion in additional gross value added by 2035.

Tip: Consumers want great experiences, so use AI to help you deliver this. Great AI applications that can boost your marketing include:

- Using AI to collect and analyse big data to provide more segmented campaigns and personalisation which 63% of consumers now expect. 40% of brands are worried about customer loyalty but consumers want brands to provide relevant and personalised offers that boost loyalty.

- Automating your marketing process. AI can help you streamline your marketing process by improving workflows and productivity while also cutting costs.

- Using AI chatbots to augment customer support as 96% of global consumers now expect brands to respond to issues within 24-hours.

Key Takeaway: Focusing on your customers and adopting AI doesn’t have to be complex, you can do it gradually. Great starting points include using simple automation and AI analytics tools to improve the efficiency and effectiveness of your marketing strategy. Companies like Pega also offer a digital transformation suite.

2020 Marketing Lessons From WealthTech

WealthTech is a fintech sector that unites wealth and technology to provide solutions that enhance both professional and personal wealth management and investing. Robo-advisors and digital brokerages are some of the most popular WealthTech solutions.

The sector is growing dramatically and 5x as much was invested in the sector in 2018 than in 2014. WealthTech startups are on the rise especially in Europe, Asia, and the US where there are already over 200 registered robo-advisor companies. It’s becoming increasingly important for businesses to have a robust marketing strategy that helps them stand apart from the competition.

Who’s doing well?

Robinhood, a no-fee, mobile-first stock brokerage, has successfully managed to tap into the large millennial consumer base – its customers are on average 32-years old. These customers are drawn by Robinhood’s low fees, but also by the marketing methods the brand is using.

Lesson 1: Podcasts are on the rise and the largest group of consumers is interested

The number of podcasts has increased by 27% in a year. It turns out the younger generations are driving a podcast revolution. 7 out of 10 millennials and Gen Z are listening to podcasts and Robinhood is capitalising on this to increase brand awareness.

Robinhood’s Snacks podcast, which gives a daily 15-minute breakdown of the top three business stories, is highly rated.

The average engagement rate on Instagram is 4.7% but the podcast posts on both the Robinhood and RobinhoodSnacks Instagram accounts get an average engagement of 10.4%. Followers also actively participate in the conversations surrounding the podcast.

Tip: Share what podcast listeners are interested in. Popular content includes news and current affairs, chat shows and educational episodes that answer consumer questions.

Lesson 2: Video content is king

Consumers want more video content. 72% would rather learn about a product via video and Cisco predicts that by 2021 video will account for 82% of all internet traffic. Video has become a vital form of content and Robinhood is leveraging its power to boost engagement. On average, the brand’s videos garner 13x more engagement than images.

Tip: Social media posts with video get 48% more views and social video generates 12x more shares than images and text combined. Partner with experts for professional video content that converts leads into customers and increases your ROI.

Key Takeaway: Be proactive in keeping up with marketing channels that consumers resonate with. The digital marketing landscape is fast-paced and you need to stay on top of any changes to create a competitive edge for your brand.

Going forward, many innovative solutions can be expected from these three fintech sectors. With these innovations will come more marketing lessons as companies put their services in front of ever-evolving consumers. Regardless of what the future holds, it’s clear that a consumer-centric marketing approach is the way to grow a brand and increase profitability. Did you enjoy reading 2020 Marketing Lessons from PayTech, RegTech & WealthTech? If you did then hit the share button now. Contentworks Agency works with leading brands to create unique marketing campaigns. Talk to our team now about marketing your PayTech, RegTech or WealthTech brand.