At Contentworks we’ve been supporting brokers for over 10 years with market and technical analysis. Custom curated analysis focuses on brokers tradable assets, business goals, trending economic events and tone of voice to deliver a more branded experience. But can forex market analysis really help brokers to retain their traders? Let’s look at the link between forex market analysis and trader retention.

The Forex Market In 2025

The global forex market is vast and continuously evolving. As of April 2025, the average daily foreign exchange turnover globally rose from $7.5 trillion in 2022 to $9.6 trillion, marking a significant 28% increase. This growth underscores the expanding opportunities within the market, but it also intensifies competition among brokers to retain their clientele. In such a dynamic environment, retaining traders becomes a significant challenge. Brokers must find ways to keep traders engaged and satisfied to maintain a stable client base. But the cost of retaining a client far outweighs the cost of acquiring a new one. Here are some stats to chew over as compiled by Business Dasher:

- The cost of acquisition is 5-25 times more than retaining an existing customer.

- The ability to sell to an existing client is 60-70% higher than to a new client.

- Your current clients are 50% more likely to try a new product and than a new one.

- 65% of your company’s revenue is from your existing clients vs 35% from new clients.

- If you can increase retention by just 5%, you will see 25-95% increase in profits.

Understanding Trader Retention

Trader retention means keeping traders active and engaged over time. High retention rates indicate that traders find value in the services provided and are satisfied with their trading experience. Conversely, low retention rates often signal dissatisfaction, which can lead to increased churn. Retaining clients is not only more cost-effective than acquiring new ones but also contributes to a broker’s reputation and long-term success. While there are many strategies to retain traders, market analysis, with tradable insights, is proven to be one of the most effective.

The Role of Market Analysis in Retention

Providing comprehensive market analysis plays a pivotal role in enhancing trader retention. Here’s how:

Building Trust and Credibility

Regular, high-quality market analysis helps establish a broker as a trusted source of information. Traders are more likely to stay with brokers who provide valuable insights that aid in their trading decisions. Access to quality analysis leads to greater client satisfaction and loyalty.

Enhancing Trading Confidence

Well-researched analysis can boost traders’ confidence in their strategies. When traders feel informed and supported, they are more likely to remain active and loyal. Brokers that offer technical analysis allow traders to visualise market trends and make data-driven decisions.

Differentiating from Competitors

In a saturated market, offering superior market analysis can set a broker apart from competitors. Traders often seek brokers who provide added value beyond basic trading platforms. By integrating advanced analysis tools, brokers can offer unique services that attract and retain clients.

Contentworks example: Branded, customised analysis.

Increased Trading Volumes

Brokers who provide regular and insightful market analysis report higher retention rates compared to those who do not. They also see higher trading volumes. Traders who feel informed are more likely to engage in higher trading volumes, benefiting brokers through increased activity.

Consequences of Inadequate Market Analysis

Before we dive into how effective market analysis looks like, here’s a quick look at what failing to offer quality market analysis can lead to:

- Decreased Trader Engagement: Without insightful analysis, traders may feel unsupported and disengage from trading activities.

- Increased Churn Rates: Traders dissatisfied with the lack of information may switch to brokers offering better analytical support.

- Damaged Reputation: Word-of-mouth and online reviews can tarnish a broker’s reputation if traders feel inadequately informed.

Tools and Resources for Enhancing Market Analysis

There are many existing analytical tools and platforms forex brokers now have access to, including:

- Acuity Trading: Offers AI-powered tools that analyse market sentiment and provide actionable insights, helping traders make informed decisions.

- TradingView: Provides advanced charting tools and social networking features, allowing traders to share ideas and strategies.

- Autochartist: Offers automated technical analysis tools that can be integrated into trading platforms, providing traders with real-time insights.

- MetaTrader 4 (MT4): A widely used trading platform that offers a range of technical analysis tools and supports automated trading.

- Trading Central: Provides technical analysis and research tools that can help traders make informed decisions.

Brokers integrate these tools in their platforms and think they have done enough. However, if you are not investing energy into getting this information directly into your traders hands, then you are not maximising the effectiveness of your spend. Contentworks creates branded analysis that integrates these tools into client communication to ensure a meaningful, branded experience.

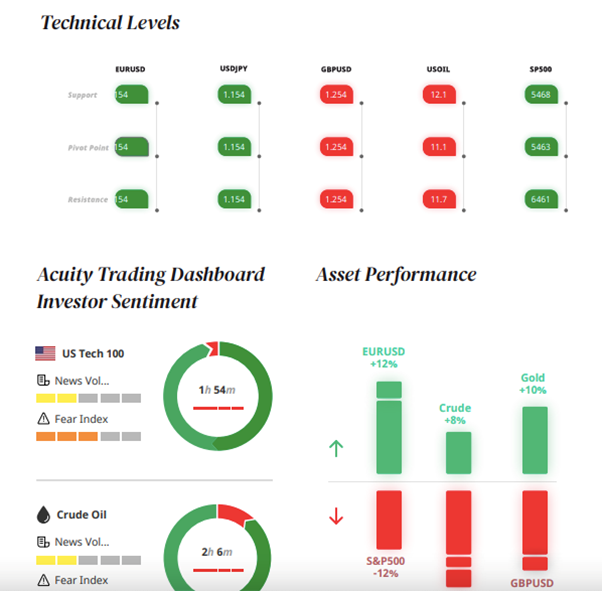

Here’s an example of Contentworks daily market analysis integrating Acuity’s sentiment tool into this brokers morning report – in English and Arabic.

Contentworks Example: Integrating analytical tools into daily emails

How Your Market Analysis Can Increase Trader Retention

To genuinely impact retention, market analysis has to be both valuable and accessible. Traders don’t just want commentary, they want actionable intelligence that supports their decisions in real time. The most effective approach combines technical, fundamental and sentiment insights. Technical analysis should highlight chart patterns, support and resistance levels and indicator signals that traders can immediately apply. Fundamental should cover economic data releases, central bank updates and geopolitical shifts to help provide context and direction. Sentiment analysis gives traders a clearer view of broader market positioning and confidence levels.

Implementing Effective Market Analysis Strategies

To leverage market analysis for improved retention, brokers should consider the following strategies:

- Regular Market Updates: Provide daily or weekly market summaries to keep traders informed of key developments.

- Educational Content: Offer webinars, tutorials, and articles that help traders understand market trends and analysis techniques.

- Personalised Insights: Use data analytics to offer tailored market insights based on individual trader behaviours and preferences.

However, format and timing are just as crucial as the content itself. Market analysis needs to be delivered when traders are paying attention, not buried in a platform or shared sporadically. Many brokers successfully provide:

- Daily email briefs timed to key market sessions such as pre-market updates before the EU open, or midday summaries ahead of the US session.

- Short-form video or reels (60–120 seconds) recapping major moves or previewing the trading day across major currency pairs.

- In-platform pop-ups or notifications highlighting breaking news or technical setups in real time.

- Weekly outlook reports or weekend recaps that help traders plan ahead.

- Live or recorded webinars around CPI releases, FOMC meetings or NFP weeks.

- Sentiment dashboards that traders can access directly through the trading platform.

When analysis is not only insightful but also delivered in the right format, at the right moment and through the right channel, it strengthens trader confidence, builds reliance on the broker and significantly improves retention.

Example of Contentworks Market Videos for Infinox

Continuous Improvement and Feedback

To ensure the effectiveness of market analysis in retaining traders, brokers should:

- Solicit Feedback: Regularly ask traders for feedback on the usefulness of the provided analysis.

- Monitor Engagement Metrics: Track how often traders engage with the analysis and adjust strategies accordingly.

- Adapt to Market Changes: Stay updated with market trends and adjust analysis to reflect current conditions.

While a templated approach to your emails is efficient, you need to change up your approach and look to keep it fresh for traders.

Fostering Loyalty with Forex Market Analysis

By providing insightful, timely, and relevant market analysis, brokers can build trust, enhance trader confidence, and differentiate themselves in a competitive market. Implementing effective analysis strategies not only retains clients but also fosters long-term loyalty and business growth.

Contentworks retains experienced market analysts who understand how to engage traders and stay on the right side of compliance. We cover forex pairs, commodities, metals, stocks and cryptos with a morning outlook, afternoon review or both. Our clients include forex brokers, banks, hedge funds and prop trading brands.

Ask our team about market analysis.