A novel breed of platforms is redefining how people engage with markets, risk and real-world events. These aren’t your typical stock exchanges or sportsbooks, they’re prediction markets, where users buy and sell contracts tied to the outcome of future events. As prediction markets gather traction and broker interest, our team is sharing some insights on the market.

What Are Prediction Markets?

Unlike traditional investing (where you own a slice of a company) or spread betting (where you bet on the direction of a market with potential unlimited losses), prediction markets let users trade binary outcomes. Britannica Money explains it as essentially yes/no bets that settle at $1 if the event happens and $0 if it doesn’t. The contract price moves between $0 and $1 based on demand, meaning users can express belief intensity and trade that belief as it shifts.

In regulatory terms, platforms like Kalshi have framed these trades as financial event contracts rather than pure gambling, gaining oversight in places like the US via the Commodity Futures Trading Commission (CFTC) giving a major differentiator from many sports betting and gambling platforms.

Growing Popularity of Prediction Markets

Prediction markets primarily tap into two basic human needs: the desire for financial gain and the fundamental need for information and making sense of the future. According to a report from Eilers & Krejcik, a research firm that specialises in sports and gaming, prediction markets could reach a trillion dollars in annual trading volume by 2030.

We’re diving into eight high-profile platforms that are blurring the line between gaming, investing, forecasting and betting.

#1 Kalshi

What It Is: One of the first federally regulated prediction marketplaces in the US, Kalshi lets users trade event contracts on everything from sports wins to political outcomes and weather shifts.

Why They’re Hot: Kalshi won a landmark regulatory battle allowing legal trading on election outcomes, then rode that wave into billions in traded volume, with a massive pivot toward sports markets.

Founders: Tarek Mansour and Luana Lopes Lara are both financial analysts who built Kalshi as a licensed alternative to offshore prediction platforms.

Known For: A regulated approach to prediction markets, high-profile partnerships (including media integrations), and innovative products like VIP programs for heavy traders.

#2 Polymarket

What It Is: A crypto-native prediction market built on blockchain (initially Ethereum then Polygon), gained traction during the 2020 US election by incentivising accurate forecasting and addressing misinformation, though it faced early regulatory challenges with the CFTC it evolved into a major source for crowd-implied probabilities.

Why They’re Hot: Polymarket’s decentralised architecture and community liquidity helped it soar in popularity and now has significant investment from figures like Vitalik Buterin and Peter Thiel.

Founder: Shayne Coplan is an American entrepreneur, technologist, and the founder and chief executive officer (CEO).

Known For: Massive trading volumes on major events, blockchain transparency, and attracting sophisticated retail and crypto-oriented traders.

#3 Robinhood Prediction Markets

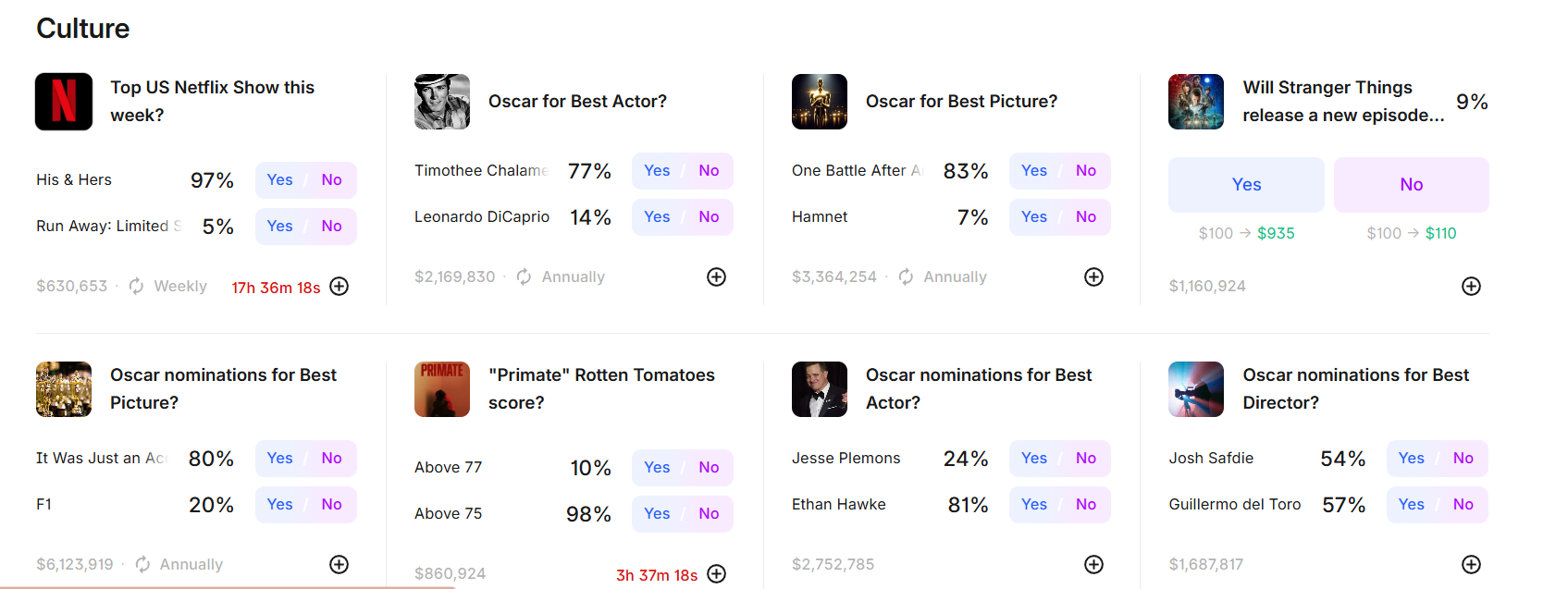

What It Is: A prediction market experience integrated inside the mainstream Robinhood trading app, bringing event contracts alongside stocks and crypto. It allows trading on sports events (like college football, pro basketball, hockey, tennis, soccer, golf), climate (daily weather conditions of US cities), future prices of crypto like bitcoin, entertainment (e.g. Oscar winners), economic events (Fed rates, jobs numbers), politics (e.g. who will be the next Fed chair, election results), financial (company earnings), and technology (see examples below).

Why They’re Hot: It taps Robinhood’s huge retail audience, lowering barriers for users who already invest in equities and crypto to experiment with event trading.

Who’s Behind It: Robinhood Markets, the popular commission-free trading platform.

Known For: Seamless user experience, no commissions on prediction trades, and placing event contracts beside core investment products.

#4 FanDuel Predicts

What It Is: A sports-focused prediction market recently launched by online gaming company FanDuel, a part of NYSE-listed Flutter Entertainment and Nasdaq-listed CME Group (a leading derivates marketplace).

Why They’re Hot: Combines deep sports betting heritage with derivatives expertise, making it a natural bridge between gaming and event trading.

Owned By: FanDuel Group, a leader in online sports wagering.

Known For: Easy access to localised sports markets with a familiar UI for sports bettors transitioning to prediction markets.

#5 Fanatics Markets

What It Is: A new entrant into prediction markets from Fanatics, the global sports retail brand, with a focus sports event contracts they also offer politics to pop culture.

Why They’re Hot: Leverages Fanatics’ massive customer base and brand love among fans to onboard non-professional traders into prediction gaming.

Known For: Accessible design and strong branding that lowers the barrier for casual users.

#6 PredictIt

What It Is: A long-running nonprofit prediction market focused primarily on political and policy events. After winning a legal battle in June 2025 against the CFTC, in September, PredictIt received full regulatory approval to operate as a designated contract market (DCM) and derivatives clearing organization (DCO). As of 2025, there were 400,000 active users on the site.

Why They’re Hot: It’s one of the most established places for political event markets, with deep academic and forecasting pedigree.

Founded By: Victoria University of Wellington and since 2014 under the purview of Aristotle, a data and technology company that has a central role in the operation and regulation of the PredictIt political prediction market.

Known For: As well as offering double auction trades to users, Predictit is also a highly engaged political forecasting community. It’s data sharing programme for members of the academic community has over 160 data partners, including researchers affiliated with Yale, Harvard, MIT and more.

#7 Augur

What It Is: A decentralised, Ethereum-based prediction platform where anyone can create and trade markets on virtually any topic. Currently it is undergoing a ‘reboot’ but worth a mention due to it’s unique enabling of users to create and trade on markets without a central authority.

Why They’re Hot: True decentralisation and open market creation made it a favourite among web3 purists and power users.

Known For: Flexibility, blockchain trustless settlement, and DIY market creation.

#8 Interactive Brokers (IBKR)

What It Is: Founded in 1978, IBKR is one of the largest online trading platforms world-wide. It’s prediction market offering simplifies binary yes/no contracts that pay out

if a specific real-world event happens (e.g., election results, economic indicators, climate outcomes. They’re offered via ForecastEx LLC, a CFTC-regulated subsidiary of IBKR.

Why They’re Hot: With professional-grade backing as part of IBKR’s regulated offerings, they appeal to both sophisticated traders and institutional users seeking structured exposure to event-driven outcomes. Their launch saw more than 1 million election forecast contracts traded in late 2024.

What They Are Known For: Transparent binary structure where each contract is a simple yes/no bet with visible pricing that reflects real-time sentiment. Integration through IBKR’s ecosystem, including desktop, mobile, and IBKR ForecastTrader, makes it easy for existing IBKR clients to participate.

The Future of Prediction Markets

These platforms sit at the crossroads of finance, gaming, and iGaming. They have turned predictions into tradable, game-like experiences that crowd in real money, sentiment and strategy. As regulation becomes clearer, these markets are evolving from novelty products into serious tools for price discovery, risk hedging and sentiment analysis. With real-time probabilities often outperforming polls and forecasts, prediction markets may reshape how we engage with investing, information and decision-making.

Speak to our team about expert financial services marketing for your forex, fintech, prop trading or banking brand.