Don’t look now, but MiFID II is coming.

At Contentworks we know that many of you are still recovering (or trying to understand) the original MiFID. Well, there’s no time for that because the second version promises even more bloodbath for non-compliant financial companies. It literally pays to be prepared for the next round of heavy-duty financial regulation.

If you haven’t been living under a rock, you know that the Markets in Financial Instruments Directive (MiFID) is the legislative framework governing investment intermediaries and the trading of financial instruments in the European Union (EU). MiFID II goes after non-compliance more aggressively than the first turn of the documents during the financial crisis.

Where MiFID I generated compliance costs, MiFID II puts significant revenue at risk. The first iteration of MiFID was merely a compliance issue for the financial industry, but the new version poses challenges on revenue and its underlying business.

Make no mistake – MiFID isn’t just some annoying compliance exercise. It has major strategic implications that could impact your firm’s revenue. But for companies that are planning in advance, MiFID can actually boost market opportunities and competitive advantage. After all, the legislation is also intended to open access to the financial markets and increase competition outside vertical siloes. The Contentworks Agency team is going to help you break down MiFID II and discover the content marketing changes you need to know.

MiFID II: What’s Changed

Depending on your business model, MiFID II could impact a wide range of your broker’s functions, including trading, transaction reporting, IT and client services. The original MiFID dealt with things like internal controls, market transparency, market structure and investor protection. These same four categories also make up MiFID II, but extend far beyond the equities and non-equities buckets covered in the original legislation.

MiFID II makes very specific mention of equities, fixed income, commodities, structured products and derivatives. Content marketing largely falls under the investor protection category, so regulators will be scrutinising your content to make sure you’re not overselling your services or making guarantees you cannot keep.

MiFID II and Content Marketing

The forex market isn’t what it used to be back in 2007 when the original MiFID was hatched. The growth and widespread adoption of online trading has created significant competition among brokers in Cyprus and across the EU. There are literally millions of retail forex traders around the world, but it’s going to take a lot more than a fancy banner ad to get their attention.

That’s why brokers are launching SEO bombs all over the internet. Copy and content marketing are being used in tandem to generate business and convert leads into live accounts. Brokers are competing heavily for traffic through financial news, educational resources and other informative content being pumped out daily.

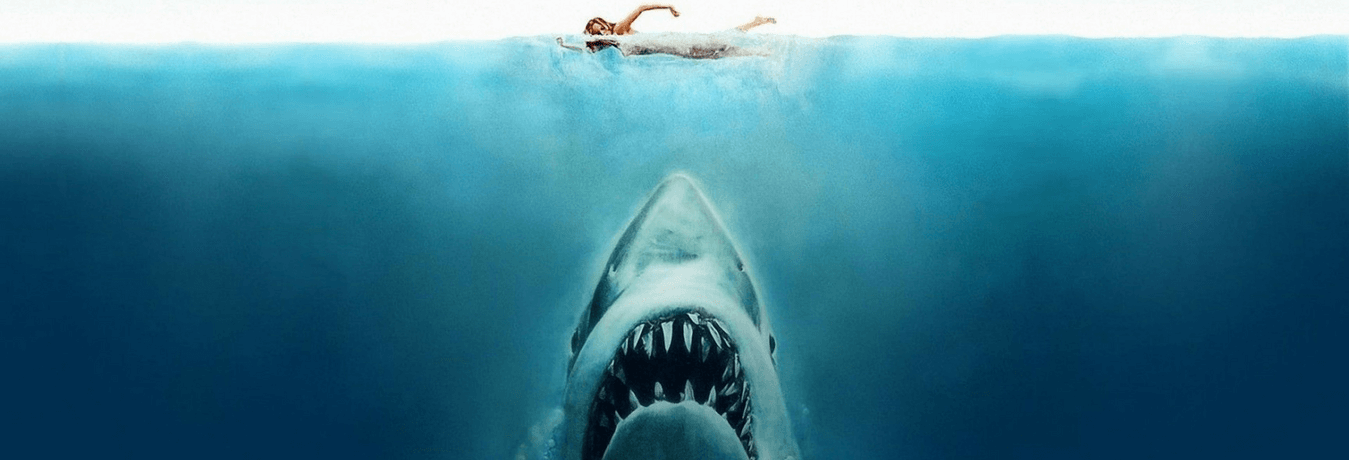

But lurking beneath the surface of these outreach campaigns are stringent regulatory codes that are going to get tougher to avoid under MiFID II. If your business is regulated under the new legislation, there are very specific content guidelines you need to follow to avoid a slap on the wrist or something far worse. In particular, your content marketing must:

- Disclose all facts

- Avoid publishing any testimonials

- Offer no recommendations

- Never make guarantees

- Avoid talking about specific investment products without including onerous disclosure statements

For firms generating large swathes of content marketing each day, staying on top of these guidelines is going to get tricky. It’s also going to put considerable strain on internal resources. This means your ROI cycle is going to get dragged out even further.

Preparation is Key

As you’ve probably noticed by now, MiFID II is going to add an extra layer of complexity to your content marketing strategy. For many brokers, this means expanding the size of their already bloated compliance departments and implementing other internal controls to ensure non-complaint content doesn’t slip through the cracks. These bottlenecks will add more time and cost to your marketing efforts, which means even more delays to launch your campaign.

It pays to have content marketers who have been through the process and who can generate compliance-ready resources quickly and with minimal direction. Under the new regulatory reality, financial experts with amazing penmanship and a strong understanding of EU compliance guidelines can be your ticket to marketing success. That’s why you should consider outsourcing your content marketing. This not only streamlines your content generating process, but can also free up internal resources to focus on other revenue-generating functions.

MiFID II launches everywhere on 3 January 2018. This gives forex brokers and other financial companies just enough time to straighten out their content guidelines before the regulatory sharks start circling.

MiFID II – you’re gonna need a bigger boat – is your content marketing ready? Reach out to Contentworks Agency for compliance-savvy financial content.

At Contentworks we always credit our sources. Thanks to the following sites for providing awesome information.

- Deloitte. From MiFID I to MiFID II, what are the main changes?

- Ernst & Young. Capital markets reform: MiFID II.

- Financial Authority Conduct (30 May 2017). MiFID II.