A watershed moment for cryptocurrencies slipped in quietly at the end of 2024 with the MiCA regulations coming into force. The European Union’s Market in Crypto-Assets (MiCA/MiCAR) regulation was approved in April 2024 and came into full effect on December 30, 2024. Taking place during a bullish crypto-market, the historic moment means the EU is the world’s first major region to set out a comprehensive framework for regulating crypto-assets.

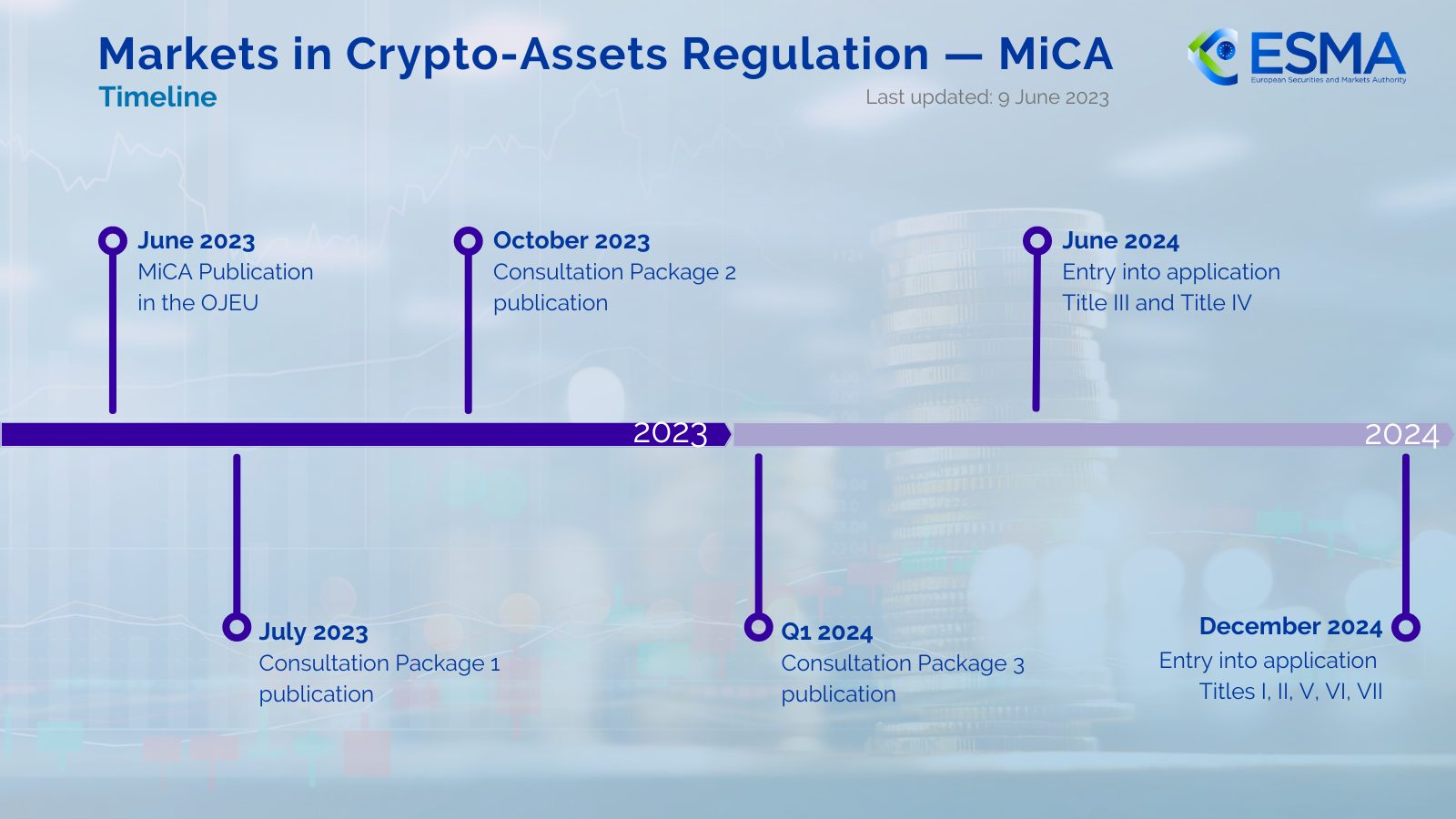

The MiCA regulation was adopted by the EC on May 16, 2023 and the framework was published in the Official Journal of the European Union on June 9, 2023. The first set of regulations came into effect on June 30, 2024, and the second package came into effect on December 30, 2024.

With DORA coming into full effect on 17 January, 2025, MiCA puts the EU a step ahead the rest of the world in putting order into the ‘Wild West’ of crypto. It comes just before Trump takes over the oval office once again on 20 January. His pledge is to make the US the ‘crypto capital’ of the world and ‘Bitcoin the superpower’.

The Markets in Crypto Assets Regulation

According to the European Parliament:

The Union’s financial services legislation is fit for the digital age, and contributes to a future-ready economy that works for the people.

MiCA aims to protect investors by enhancing transparency and putting in place a comprehensive framework for crypto issuers and service providers. With the new regulatory framework, consumers will be protected against fraud, while market abuse, money laundering, terrorist financing and other illegal activities will be discouraged, if not prevented. The new framework will make the EU an attractive destination for crypto asset service providers (CASPs). It will also spur innovation and preserve financial stability in the crypto market.

Entities impacted by the new regulations include crypto exchanges, ICO issuers, wallet providers, and those holding crypto assets on behalf of their clients, such as security token issuers and custodial wallets. The regulation classifies virtual assets into three broad categories:

- Electronic Money Tokens (EMTs): These are crypto assets linked to fiat currencies and are also known as stablecoins. They are backed by a financial institution or a central bank.

- Asset Referenced Tokens (ARTs): ARTs are tokens backed by physical assets, such as fiat currency, gold, real estate or oil. This provides stability to their valuation.

- Utility Tokens: These are tokens used solely to pay for specific services or products and don’t hold any value on their own.

For now, MiCA excludes non-fungible tokens (NFTs) and Decentralised Finance (DeFi).

New Obligations Under MiCA

The first requirement is to get a permit and be listed on the ESMA register. This permit will allow CASPs and issuers to offer products and services across all EU member states. However, local policies of member states will also need to be adhered to. In addition, policies and procedures associated with KYC, AML and anti-terrorist financing controls will need to be put in place to protect investors and consumers.

CASPs will also need to understand and comply with regulations related to:

- Operating trading platforms for crypto assets.

- Administration and custody of crypto assets on the client’s behalf.

- Exchanging crypto assets for other crypto assets or funds.

Crypto asset issuers will also need to publish whitepapers that detail the economic and technological aspects of each asset.

How MiCA Regulations Impact Banks and Brokers

While MiCA puts in place stringent compliance requirements to protect financial market participants and maintain stability, it also brings new opportunities for banks, brokers and other financial institutions offering crypto products and services.

Opportunities for Innovation

The new framework is likely to bring about innovation in RegTech to help TPPs and CASPs easily navigate complex regulations, such as streamlining compliance and automating reporting. Also, MiCA, in combination with the Payment Services Directive (PSD2), could foster innovation in open banking to unlock new avenues of growth through secure and customer-focused financial services. Payment services are also likely to see innovations to integrate crypto-based payment capabilities. This would lead to the development of new payment solutions that enhance customer experience.

Cross-Border Expansion

With a single, unifying framework, regulatory barriers to entry into new EU markets will be lowered. This is especially true for CASPs, who will be able to easily passport their products and services to new EU member states. This means new growth opportunities for the industry across Europe.

Adoption of Crypto by Traditional Banking

MiCA brings the opportunity for traditional banks to embrace crypto and provide comprehensive banking services. This will allow banks to expand their offerings and better cater to evolving customer demands.

Better Market Integration

A unified framework across the EU will reduce compliance costs and administrative obligations, easing the navigation of the entire EU market and increasing operational efficiency. It will drive cross-border collaborations, helping crypto products and services providers to leverage resources and expertise across markets. Knowledge sharing will drive greater innovation and lead to the development of disruptive solutions.

For Investors and Traders

When the consumer is assured of protection against fraud and market manipulation, they will gain greater confidence in the crypto markets. This will attract more investors and traders, both institutional and retail, which in turn would strengthen market stability and liquidity. Some of the other advantages include:

Safeguarding of Rights

The main objective of MiCA is to protect consumer interests and ensure the safety of investor funds and data. With stringent KYC/AML, consent requirements and rules for protecting customer data, including enhanced transparency regarding data usage, consumers can gain peace of mind regarding their security.

Enhanced Multi-Asset Access

Portfolio diversification will be eased with access to a broader variety of financial assets and investment opportunities. Since liquidity is expected to be reinforced through increased participation in the crypto markets, investors/traders will be motivated to explore new crypto assets and other innovative instruments. Enhanced liquidity and accessibility will also drive the democratisation of investment.

Access to Newer, More Innovative Offerings

With financial services and product providers looking at innovation through a streamlined regulatory framework, customers will benefit. They will have access to more convenient, relevant and effective solutions for their needs and demands, as well as improved customer experiences.

Marketing in Compliance with MiCA Regulations

MiCA regulations list compliance requirements related to marketing communications, such as ensuring that all communications are clear and not misleading. The information contained in all forms of communications should comply with the business’ official crypto-asset document. All token issuers are required to disclose on their website the number of tokens in circulation. The value of these tokens and the composition of reserve assets. This needs to be done at least once each month.

The guidelines for marketing communications are aimed at ensuring reliability and transparency. All while protecting the interests of all participants, including token holders.

Contentworks is committed to staying updated on the latest regulatory requirements associated with all financial markets, including cryptocurrencies. We have extensive expertise in providing compliant marketing solutions for the financial services space. Talk to us about your financial services brand.