Financial media buying isn’t just about placing ads. Financial services brands must leverage media buying with precision to drive conversions. It’s about building a strategy that aligns messaging, channels, budget allocation, and measurement to produce maximum return on ad spend (ROAS). In this playbook, we’ll unpack key statistics, best‑practice tips, and content marketing takeaways, with an emphasis on strategy.

The Financial Media Buying Landscape

Digital Ad Spend Growth

- Global digital ad spend in financial services was projected to reach $78.5 billion in 2024, up from $68.2 billion in 2022—a compound annual growth rate (CAGR) of 7.8%.

- Programmatic channels now account for 53% of all digital financial media buys, reflecting a shift toward automated, data‑driven bidding .

Channel Performance

- Search advertising remains the strongest driver of qualified leads, with an average conversion rate of 4.05% for finance verticals, Nearly double the cross‑industry average of 2.35% .

- Social media ad spend in finance jumped by 18% year‑over‑year in 2023. It was driven by platforms like LinkedIn (B2B wealth management) and YouTube (educational video content) .

Audience Insights

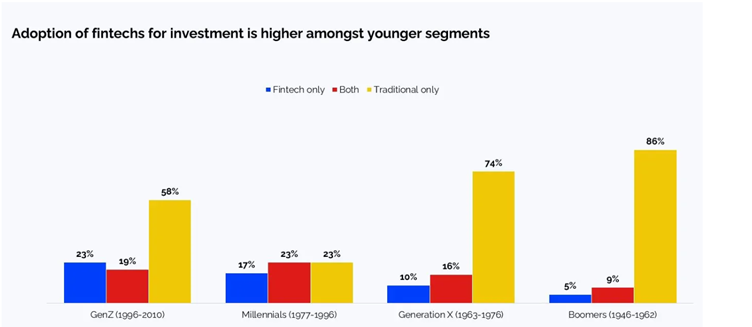

- Millennials and Gen Z now represent over 45% of new retail brokerage accounts opened in 2023. They are 27% more likely than older adults to discover financial products via social channels. Plus, much faster to adopt fintechs for investment.

- High‑net‑worth individuals (HNWIs) consume 2.5× more financial news content daily than the average adult, making premium digital news sites and newsletters prime inventory for media buys.

Core Principles of Financial Media Buying

#1 Audience Segmentation & Targeting

- Utilise first and third‑party data to build detailed audience segments. These include net worth, income brackets, life stages (e.g., new parents, retirees. Plus behavioural markers (active investors, mortgage shoppers).

- Leverage look‑alike modelling through programmatic platforms to scale profitable audiences. For example, a 1% look‑alike seed based on your top 10% of customers can increase conversion rates by 15–20%.

#2 Channel Mix Optimisation

- Balance “bottom‑funnel” channels (search, retargeting) with “mid‑funnel” (social video, native) and “top‑funnel” (display, CTV) to ensure both immediate leads and long‑term brand equity.

- Test emerging channels like audio streaming ads on Spotify. Or podcasts focused on personal finance, to tap into high‑intent audiences in a less crowded space.

#3 Creative & Messaging

- Financial marketing requires clarity and trust. That’s why we like to work with or create Tone of Voice and Brand Style Guides for our clients. These keep you sounding consistent, on brand and reputable throughout your communications. They also make it easier to expand globally and work with external agencies.

- A/B test headlines (e.g., “Grow Your Portfolio by 20%+” vs. “How to Invest Wisely in 2024”) and CTAs (“Start Your Free Trial” vs. “Talk to an Advisor”) to optimise click‑through and conversion rates.

- When it comes to financial media buying, brands need to be careful on compliance. Work with an agency that specialises in financial marketing and understands the strict regulations you are operating under. We follow regulatory news and updates from ASIC, CySEC, MFSA, FCA, FSA, FRB, SEC, MiFID II and more.

- Establish a rigorous ad approval workflow that includes compliance and legal reviews, especially when promoting regulated products like forex, credit, loans, or investment advice.

#4 Measurement & Attribution: Proving Value

- Move beyond last‑click models. Employ data‑driven attribution (DDA) or algorithmic multi‑touch models to accurately assign credit across impressions, clicks, and downstream conversions.

- Use Customer Data Platforms (CDPs) to stitch together cross‑device user journeys. This is particularly important for investors who research on mobile and convert on desktop.

- Aim for a tiered CPA that reflects the lifetime value (LTV) of different customer segments. For instance, acquiring a retiree with $500K in investable assets may justify a higher CPA than a new millennial investor.

- Track video completion rates (VCRs) and form‑fill progression to identify creative or UX drop‑off points.

- Integrate with platforms like Google Analytics 4 (GA4), Adobe Analytics, or Braze Engage for unified reporting dashboards.

Content Marketing Takeaways for Media Buyers

Educational Thought Leadership

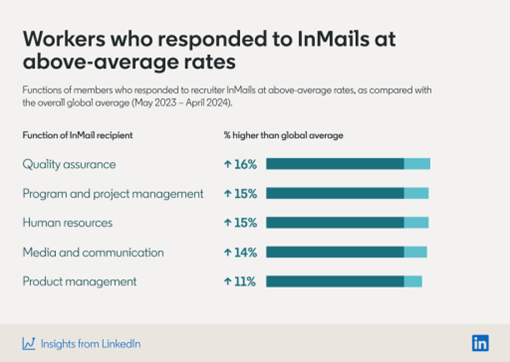

- Develop long‑form content like whitepapers, eBooks, and webinars. These address complex financial topics like retirement planning in a more serious way. Promote these through gated lead‑gen campaigns on LinkedIn and programmatic native channels. Example: A LinkedIn InMail campaign offering a free “2025 Investment Outlook” webinar can see engagement rates of 15–20% among C‑suite and senior‑level financial professionals.

Video & Interactive Experiences

- Video ad engagement in financial media buying across Facebook and YouTube outperform other verticals by 30%. This is especially true when ads offer actionable tips or integrate customer testimonials. Video content is core to the outcome you can expect so work with an agency that can create high performance videos.

Retargeting with Value‑Add Content

- Design sequential retargeting funnels. Example: initial display ads drive to a blog post; next carousel ads promote a case study; final retargeted search ads highlight free consultations. This layered approach can boost overall conversion lift by 25%.

Leverage User‑Generated Content (UGC)

- Client success stories, case studies or brief video testimonials do work. Run them as native ads on high‑traffic financial news sites and social feeds. UGC ads can increase trust signals and improve ad recall by 35%.

Getting Started With Financial Media Buying

Financial media buying is a disciplined blend of data, creativity, and optimisation. At Contentworks we combine deep industry knowledge with agile methodologies and creative content to deliver the results you need. Talk to our team about content, PPC, media buying, PR and social media management for your finance brand.