The financial services marketing space is rewarding but tough. It’s a minefield of regulations, legalities and tough competition. If you’re a forex broker or financial services firm, you need to position your brand in this dynamic space and remain within the tight boundaries of the communication guidelines of the regulator. And you must achieve all this while keeping your audience engaged. As a leading content marketing agency in Cyprus, we stay on top of the latest updates from the financial watchdogs. If you’re registered with CySEC, we’ve put together a handy guide for CySEC brokers and updated it for 2024.

Here’s what you’ll read in this article to better understand content marketing compliance under the regulator:

- Who is CySEC, their remit and vision

- How they ensure compliance

- Penalties paid by firms in the last year for lack of compliance

- Key updates in 2024 including MICA

- Marketing transparency and avoiding green washing in line with the Unfair Commercial Practices

- The latest in AI regulation

CySEC Regulatory Sandbox Launch 12 June, 2024 with Chairman, George Theocharides, PhD.

CySEC: The Architect of the Cyprus Financial Landscape

The Cyprus Securities and Exchange Commission (CySEC) regulates the financial landscape of the country. Established in 2001, CySEC became a part of the MiFID regulation in 2004, when Cyprus joined the EU. As a member state of the union, the regulator aligns all its policies and guidelines with EU laws, including MiFID II, MiFIR, GDPR, KYC/AML guidelines, etc. It also intends to integrate the latest AI Act into its framework as soon as the guidelines are out.

In the last four years, up to February 2024, the number of supervised entities under the authority had grown by 12%. With 830 entities under its wing, the regulator already had 78 applications to process in February. With just 12.5% corporate tax, and compared to the UK’s 25%, it’s easy to see why Cyprus is an attractive investment destination. But the growth of the financial markets means that the CySEC is increasing efforts to maintain stringent vigilance and oversight.

Ex-Vice Chairman, George Karatzias covers important updates to MICA, DORA, AML and MiFID Review at Vision Forex in March, 2024.

With CBDCs on the horizon and the greater use of artificial intelligence (AI) across industries, the regulator is rapidly updating its guidelines to align with the evolution of the financial landscape. Our content marketing agency in Cyprus closely follows these developments through regulatory releases, finance industry seminars, and marketing events. We work closely with financial institutions, financial services providers, fintechs, and brokers to ensure consistent compliance across all communication and marketing content.

How Does CySEC Ensure Compliance?

CySEC is extremely active in ensuring the smooth functioning of investor safety in the financial markets. This is evident from the 700 onsite and remote audits conducted in 2023 alone. The regulator imposed about €2.2 million worth of sanctions in the year, including €1 million on a single Cypriot Investment Firm (CIF). This was the second year in a row when CySEC’s penalties surpassed €2 million. The regulator monitors promotional announcements of all CIFs and regularly advises them on eliminating misleading communications.

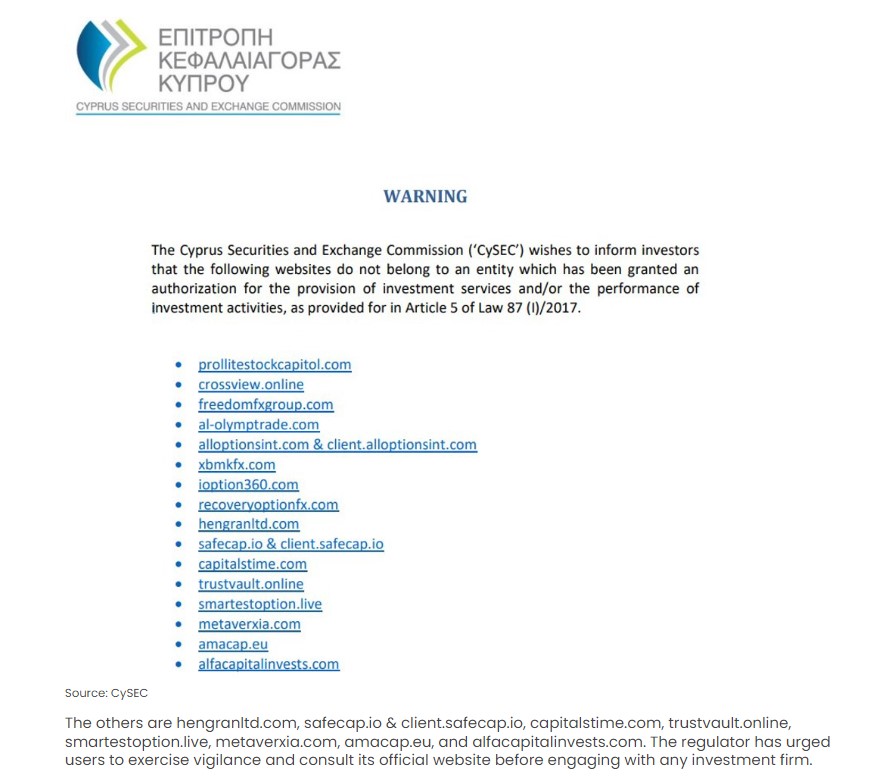

CySEC also issues advisories for investors to practise caution and make informed decisions. It flagged 16 unregistered investment firms in March 2024, highlighting its commitment to maintaining the integrity of the financial markets in Cyprus.

Source – Finance Magnates

2024 CySEC Updates Brokers Shouldn’t Miss

For 2024, the CySEC has 3 broad goals – enhancing supervision, promoting compliance culture, and proactively managing emerging market threats. The primary aim is to build business resilience. The regulator’s plans for 2024 include:

MiCA Compliant Communications and Wording

Since the European Banking Authority and ESMA have allowed third-country crypto companies to serve European customers directly, the CySEC plans to ensure that the Markets in Crypto-Assess (MiCA) regulation is implemented in Cyprus. The regulator will replace the existing Local CASP regime and simplify the process for CIFs to offer crypto-asset services. Brokers licensed under MiFID II can notify the CySEC according to MiCA guidelines without having to get separate licenses.

This means introducing crypto assets will become more straightforward for licensed CIFs with MiFID II certifications. Since cryptos are widely considered high-return investments, brokers must be careful while promoting these offerings. Keep the marketing content neutral, without including catchphrases like “winning,” “profits,” “foolproof success formula,” etc. Even saying that cryptocurrencies are high-return investments without underscoring the risk involved is considered misleading.

Ensuring Transparency in Marketing Communications

With the increased emphasis on sustainability, the European Parliament has adopted a new green transition directive. The directive aims to curb greenwashing, false sustainability claims, and obsolescence practices.

Under the Unfair Commercial Practices (UCP) Directive, making generic green claims, such as being “low impact,” “environment friendly,” “energy efficient,” or “carbon neutral” drives consumers to associate positive biases with an organisation. Even projecting a business as “responsible” or “conscious” is considered a strategic attempt to influence innocent customers. Using these terms without proper context and supporting credentials amounts to misleading and unclear communications.

Policymakers intend to develop frameworks under the UCP Directive in the form of environmental credits to quantify a business’s performance in offsetting the environmental impact. This is an attempt to offer measurable data that instils transparency in promotional content. While you transition your technology and operations to more sustainable solutions, make sure your marketing communications do not overstate your stance.

AI Disclosure

As AI use penetrates deeper into the financial services space, disclosure is increasingly critical. The CySEC and EU aim to foster a trustworthy AI environment. The key to navigating the competitive market is to balance innovation while protecting citizen’s rights. The use of AI for gathering customer insights requires user permission and opt-in/opt-out facilities. Leveraging the insights for discriminatory or influential purposes can result in penalties. Responsible AI use also prohibits activities, such as biometric categorisation.

The CySEC prohibits leveraging AI to offer educational or promotional content to exploit the vulnerabilities of customers. While AI regulation is still evolving, the regulatory body is set to follow the EU’s AI Act. Brokerages must avoid the use of AI-based deepfakes for media content. While using “high-risk” AI models is prohibited, the AI Act emphasises scrutiny of all Generative AI content. Therefore, all AI interventions must be clearly labelled to inform customers of machine-generated content.

The Expert Financial Content Marketing Agency In Cyprus

Leveraging AI may be a great way to minimise manual effort when creating marketing content. However, navigating compliance across promotional, informational and educational communications needs particular attention. There are a lot of demands on your content these days – to be current and on trend, to be engaging and actionable, and most importantly it needs to be compliant.

Contentworks Agency has years of experience in creating high performance content that is compliant in Cyprus, the broader EU markets and other world regions. Book a free Zoom call and learn how we can help you create exciting and compliant communications.