Getting your financial services firm to the top of search engine rankings can be difficult. You need to create high quality content while facing intense competition and adhering to strict regulations. YMYL (your money your life) topics come under tighter scrutiny by both regulators and social networks. And on top of all that, the content needs to demonstrate expertise, authority and trust to rank in a crowded space. In this article, we’ll be covering the key elements that go into financial SEO. What works, what doesn’t and how we deliver effective top of funnel (ToFu) content marketing strategies for forex brokers, fintechs, neobanks and our financial services clients. Here are the latest trends and best practices for financial services SEO.

Why Financial Services SEO Matters

For financial-services companies, organic search drives a large share of high-intent traffic. In 2025, organic search accounted for 53% of all traffic to websites. SEO leads in finance convert at about 14.6%, compared with just 1.7% for outbound leads with the first organic result in Google getting a massive 28.5% click-through rate (CTR). Finance remains one of the most competitive verticals. High CPCs for paid ads means SEO is a more cost-effective, long-term channel.

Contentworks Director, Niki says

Once SEO is working, results compound: good content, strong backlinks and authority lead to evergreen visibility and lower cost per lead over time.

Long-form vs Short-form: What Works in Financial SEO?

Why long-form content outperforms short-form in finance:

- Detailed, comprehensive articles (e.g. long-form content, pillar pages, guides) tend to engage users longer. For finance, where trust and information depth matter, that translates into credibility and higher likelihood of conversion.

- According to a recent industry benchmark, sites publishing around 10 or more blog posts per month, especially long-form educational posts, often see traffic grow as much as 3.5× compared to less-frequent publishing.

- In finance, users often look for full explanations, comparisons, FAQs, risk disclosures – something short-form content can’t deliver as well. A strong content hub (education centre or resources section) greatly supports this need.

When short-form makes sense:

- For urgent news updates (regulatory changes, interest-rate moves, market reactions) where timeliness matters.

- For quick FAQs, definitions, or landing-page content, but only if supported by deeper long-form pages.

- For micro-content, like quick social posts or summaries canonical to larger articles.

Contentworks Director, Charlotte says

For financial services SEO, long-form should be the backbone of your content strategy, while short-form is used to engage and attract users. Each one has its place and its platform so it’s just about understanding the landscape.

Do You Need an Education Centre?

Yes, you do need a financial education centre and here is why it matters.

- An education centre (content hub, knowledge base, FAQ section, guides) signals to both users and search engines that you’re serious about providing valuable, deep, trust-worthy information. In finance, that matters more than almost anywhere.

- It helps you build topical authority. Aim to cover a wide variety of related topics (trading, investments, insurance, bnpl, regulation, financial planning, fintech features) in a structured way. Over time, search engines recognise your site as an authoritative source.

- It supports lead generation and conversion. Visitors who arrive with general questions (e.g. “How does trading work?”, “What are investment risks?”) may not immediately convert but by offering thorough, helpful content, you nurture trust.

- It helps with compliance and risk-management. Because finance content often requires legal/regulatory oversight, having a central hub makes updates easier (e.g. when regulations change). Also helps by centralising disclaimers so you don’t have to repeat them constantly.

Smart Keyword Strategies for Banks, Brokers, and Fintechs

With financial services SEO, generic keywords like “bank account” or “forex trading” are saturated. Here’s how we approach keywords smartly:

- Segment by intent & audience: differentiate between informational (research, education), navigational (brand, comparison), transactional (apply, sign up) queries. Target each with appropriate landing or content pages.

- Include long-tail & question-style queries: with conversational or voice-search friendly language, especially as voice search and generative-AI search grow. SEO is moving from keywords to context and natural-language queries.

- Use niche and micro-segments: for example: “low-fee forex broker beginners”, “mortgage advice for first time buyers in Greece”. These long-tail queries have lower competition and high intent.

- Align with regulatory / compliance terms: for audiences comparing regulated services (e.g. “FCA regulated broker”, “MiFID II compliant investment platform”) this builds trust and filters for quality-conscious users.

- Local & hyper-local keywords where applicable: especially for financial advisors or fintechs serving specific geographies. Include region, city, or local qualifier (e.g. “financial advisor London”, “tax consultant France”, “forex broker Athens”).

This layered approach helps reach both broad and narrow audiences, securing traffic from multiple angles while avoiding overly competitive high-level terms. Get more tips from our forex SEO expert here.

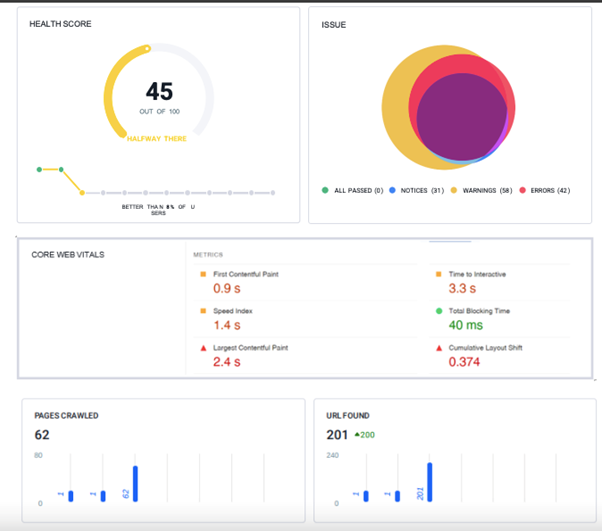

While content is still king, ensuring that your website is performing optimally is equally important. Contentworks conducts comprehensive SEO audits highlighting critical errors through to good to have items. Ask for a 15-minute zoom to check your site performance.

Balancing E-E-A-T and Brand Voice in Financial SEO

Because finance is in the YMYL sector, search engines apply strict standards. And that can be a difficult balancing act when you want to establish E-E-A-T (Expertise, Experience, Authoritativeness, Trust). Here are the key elements to keep in mind when creating content:

- Transparent authorship & credentials: whenever content provides advice or analysis, clearly show author name, role, credentials, and possibly professional qualifications. This signals expertise and authority.

- Accuracy, compliance and disclosures: include disclaimers, risk warnings, regulatory compliance statements, data-privacy assurances (e.g. SSL, secure forms). This builds credibility and helps meet compliance regulations.

- Consistent, user-friendly language: avoid overly technical jargon unless the audience expects it. Use clear, accessible language for broader audience reach, especially for general educational articles.

- Balanced brand voice: while adhering to trust and compliance, maintain a brand’s tone and positioning (e.g. approachable, professional, authoritative). Keep this formula in mind: good brand voice + trust signals = better engagement and loyalty.

- Regular updates and maintenance: keep content current (e.g. regulatory changes, market conditions). For finance, outdated info can harm credibility and rankings.

Niki says

Content plays many roles today. By combining compliance with a coherent brand voice, financial firms can meet search-engine standards, provide real value to traders and build long-term trust and authority.

How Can You Show Up on ChatGPT & AI-Driven Search?

AI, or large language models (LLMs) are reshaping how people discover financial content. Some key trends we leverage:

- Search engines and AI assistants increasingly interpret context, user intent, and natural language, not just individual keywords. That means content needs to be comprehensive and contextually rich.

- Questions and conversational queries are rising e.g. “What’s the safest investment for retirement?”, “How to open a forex account as a UK resident?”, “Is XYZ broker regulated in Cyprus?”. You need to build content that answers real questions with clarity.

- As AI-generated summaries and rich snippets (featured answers) become more common, formatting content for easy consumption (headings, bullet points, Q&A, schema/structured data) improves the chance of being surfaced directly by search or AI tools.

- Mobile-first and voice-search optimisation is vital. Many users (especially younger or mobile-first clients) use voice assistants or mobile devices to interact.

It is no longer enough to rank in Google, you need to be visible to the new search paradigms. Read more about the differences between SEO, AEO and GEO here.

Link-Building for Finance & Fintech

Backlinks remain a critical signal for authority. In finance, quality matters even more than quantity. Sites ranking at the top tend to have 3–4 times more backlinks than lower-ranked ones. But many link-building tactics that work for general niches are unsuitable for finance. Spammy links, irrelevant directories, or low-trust sources can harm rather than help, especially with YMYL scrutiny.

Here are some effective strategies that work for our clients:

- Guest articles and thought-leadership posts on reputable finance/industry publications. Unique insight, data-driven content or opinions give better chances for acceptance and valuable links. Do keep in mind, that for finance, these are mostly paid for placements.

- Original research, reports or surveys – producing original data or proprietary analysis helps attract natural citations and backlinks.

- Digital PR and collaborations with financial news portals, industry associations by publishing press releases, commentaries, market insights.

- Thoughtful directory listings to only trustworthy, niche-relevant directories or regulatory-body registries; avoid low-quality link farms.

- Internal linking & content structuring: create hubs, pillar pages, FAQs; interlink related content to improve crawlability and internal authority flow.

Read more about backlinking strategies here. Need help strategising and executing your educational hub? At Contentworks we understand the technical side of SEO as well as creating value-driven content that converts.

Optimising for Long-Term Organic Growth

Financial SEO is not a short sprint, it’s a marathon. Here’s how we build for sustainable success:

- Consistent content publishing: Frequent, high-quality content (insights, educational guides, updates) helps establish topical authority and keeps the site fresh. High frequency content publishers see much larger traffic gains.

- Content maintenance & updates: Finance changes fast (regulations, market conditions, interest rates). Regular audits and updates ensure accuracy — preserving trust and rankings.

- Technical SEO & UX fundamentals: Fast load times, mobile optimisation, secure (HTTPS) architecture, clean site structure, schema markup. All essential, especially with 2025’s AI-driven search algorithms

- User-centric content & clarity: Provide clear disclaimers, transparent risk info, easy-to-read language. Help the user, not just the robots! This builds trust and retention, especially vital for high-stakes finance content.

- Metrics, tracking & continuous optimisation: Track organic traffic, bounce rates, conversions, user engagement. Use data to refine content strategy, keyword targeting, link efforts.

Over time, this approach builds a sustainable organic foundation which means less reliance on ads, lower acquisition costs, steady lead flow and strong brand authority.

Rounding Off

Financial services SEO delivers high ROI, quality leads and long-term growth potential. Each brand needs a unique strategy built around their specific objectives and aims. The key pillars to keep in mind include comprehensive long-form content, a structured education hub, smart keyword and link strategy, strict E-E-A-T compliance, and technical excellence. With rising competition, search engines’ evolving algorithms and the shift towards AI-powered context-driven search, the companies that invest in strategic, data-driven SEO will win.

Ready to start implementing professional SEO? Book a Zoom call with our team.