A smart financial marketing narrative builds investor confidence, strengthens brand value, and creates long-term shareholder trust. In this article, we’ll explore how to build investor confidence with smart financial marketing narratives. We’ll be looking at real-world case studies from forex brokers, neobanks, PSPs and of course, what not to do.

See how strategic marketing by Contentworks Agency helped this neobank define and execute it’s narrative.

How Financial Marketing Narrative Builds Trust

Marketing narrative is the cohesive story your financial brand tells about who it is, what it stands for, and why its future matters. It blends data with storytelling, showing not only how a company performs but why it exists and where it’s headed.

This narrative needs to connect two audiences:

- Customers and traders, who care about reliability, execution and compliance.

- Investors and shareholders, who care about growth trajectory, governance, and long-term stability.

A brand that can align both sides through a single, coherent story will always have a credibility advantage.

How Narratives Influence Investor Trust

- Consistency builds belief. When messaging is aligned across your website, reports and PR, it’s perceived as credible. Inconsistent messages trigger doubt.

- Transparency signals maturity. Acknowledging risk areas, rather than glossing over them, creates authenticity.

- Evidence validates narrative. Facts, metrics, and third-party recognition anchor your story in reality.

- Emotion creates recall. A purpose-driven or transformation narrative makes your message memorable.

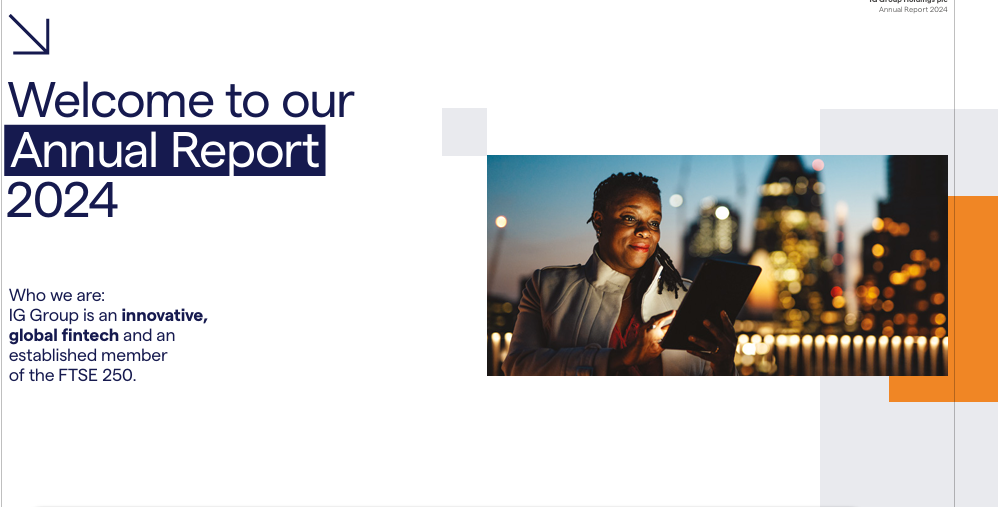

Case study: IG Group – The Compliance-First Narrative

At IG Group, the narrative is anchored in transparency and regulation. Their annual report includes their mission to “empower informed trading within a trusted regulatory framework.” Operating under FCA and ASIC oversight, IG makes governance a marketing advantage. The message: “We’re not chasing trends – we’re safeguarding traders and investors.”

Why Investor Confidence Matters in Financial Markets

Investor confidence drives market stability. When investors believe in a company’s story, they provide capital on better terms, value it higher, and stay committed through volatility. Lose that trust, and capital costs rise, valuations fall, and reputations can take years to repair.

The data behind confidence

According to UK Investors Speak Out 2025, investor confidence in the UK sits at 103, just below 2024’s high of 105, indicating cautious optimism. During the pandemic, confidence plunged to 62, a reminder of how quickly trust evaporates in uncertain times.

Meanwhile, PwC’s Global Investor Survey 2024 reports that over 70% of investors now assess companies based on their innovation story and transparency, not just their financial results.

These figures illustrate that narrative is data with context. It connects your financials to your purpose.

Connecting Financial Marketing Strategy with Shareholder Value

Marketing can and should serve as a long-term value driver, especially in finance. A coherent narrative underpins stability, strengthens reputation, and improves capital access.

- It supports capital raising. Companies with trustworthy narratives secure funding faster and on better terms.

- It reduces valuation volatility. Consistency means fewer “surprises” in investor perception.

- It builds reputational capital. Purpose-driven storytelling supports ESG and goodwill.

Case study: Wise – A Narrative of Long-Term Vision

Wise has anchored its messaging in one consistent story: “money without borders.” Every update, investor briefing and customer campaign links to that mission. Even when undergoing a name rebrand, Wise maintained trust through transparency and long-term clarity. Its investors knew what the company stood for.

So how does content shape narratives? Let’s look at some examples.

#1 Explain complex financial products with clarity

Finance is full of jargon. Confusing content creates uncertainty. Well-crafted editorial simplifies without dumbing down. It shows command of the subject and respect for the reader.

Case study: Blackwell Global – The Educator Narrative

Blackwell Global turns product complexity into clarity through its “Experts Corner” where articles and explainers break down advanced instruments and risk concepts. This educational transparency strengthens investor trust. They have worked closely with Contentworks Agency for 7+ years building a comprehensive education hub that ticks SEO, trader education at all levels and trending market news.

#2 Framing a company’s vision, growth path, and ethical stance

Narratives that clearly communicate a company’s why and where-to-next help investors visualise the journey ahead. Vision, milestones and ethics matter.

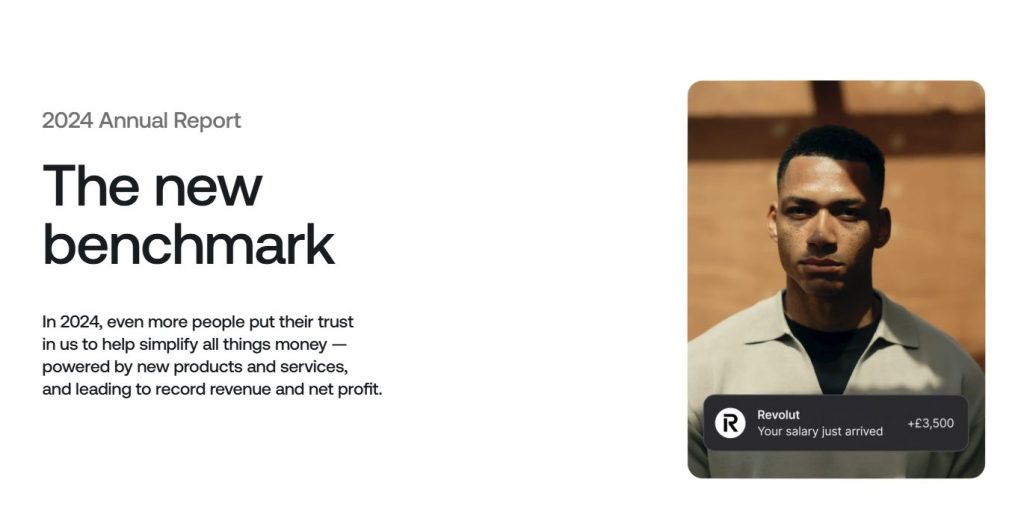

Case study: Revolut – The Innovation Narrative

Revolut’s investor communications consistently emphasise technology as a vehicle for democratising finance. The story isn’t just “we’re growing fast”, it’s “we’re building the world’s financial super-app.” This balance of innovation and compliance drives investor optimism.

#3 Building trust through transparent, compliance-driven messaging

Regulated narratives build credibility. Highlighting compliance and risk controls reassures both traders and shareholders.

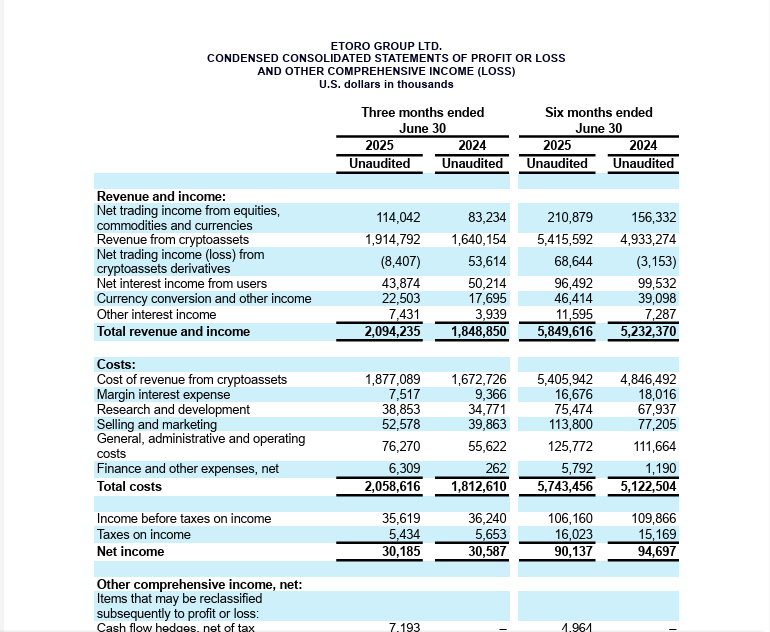

Case study: eToro – Compliance as Confidence

eToro’s investor messaging consistently reinforces its FCA, CySEC and ASIC regulation while spotlighting its 35+ million users worldwide. The brand balances innovation with accountability, a narrative that attracts institutional confidence.

#4 Building trust through purpose and ESG

Purpose-driven storytelling creates long-term investor alignment.

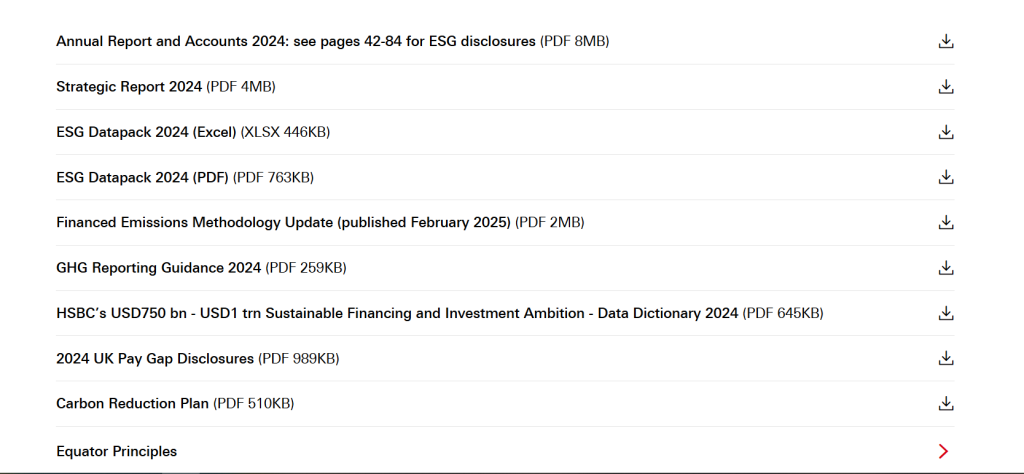

Case study: HSBC – The Sustainable Growth Narrative

HSBC embeds ESG directly into its investor communications, stating that over $210 billion in sustainable projects were financed in 2024. This narrative links profit with planet and shows that ESG isn’t just reputation management but a core growth strategy.

#5 Delivering well-written, digestible takeaways

Investors don’t have time for clutter. Executive summaries, key insights, visuals, and “What this means” sections make information accessible. Clear content shows respect and professionalism, two qualities that underpin confidence.

Tactics That Boost (or Erode) Investor Confidence

Tactics that boost confidence

- Consistent investor-focused content : Regular blogs, reports and updates sustain reliability.

- Case studies and thought leadership : Real examples demonstrate results and maturity.

- Educational hubs :They position your brand as a trusted resource, and are great for SEO.

- Storytelling that links performance with purpose : ESG, innovation and inclusion build meaning.

- Alignment between customer and investor narratives : Prevents cognitive dissonance.

Case study: Woodseer Dividend Forecasting – Exit Strategy

With the help of Contentworks Agency, Woodseer built a thought leadership content strategy to establish their expertise and succeeded in their eventual buyout.

Tactics that Erode Investor Confidence

- Overly promotional, “braggy” content undermines credibility.

- Vague or evasive communication raises red flags.

- Short-term hype narratives (e.g. “AI will fix everything”) appear speculative.

- Inconsistent messaging between customer and investor channels damages trust.

- Neglecting compliance is the fastest way to destroy investor goodwill.

Case Study: When Hype Backfires – The FTX Lesson

The collapse of FTX in 2022 exemplified how over-hyped narratives can implode. The exchange marketed “revolutionary trustless trading” but ignored governance and disclosure. When reality diverged from narrative, investor confidence, and billions in value, evaporated.

Key Content Pieces to Produce for Investors

Investor Pack / Pitch Deck

Investor packs are essential during fundraising, looking for partnerships, or M&A discussions. It’s the distilled form of your narrative and should include vision, performance, risks, KPIs and roadmaps. It’s the first impression investors will scrutinise, so tone and consistency matter.

Whitepaper

Whitepapers or eBooks are a great way to explain a new financial product, technology, or innovation. A whitepaper is the technical proof behind your story. It demonstrates strategic thinking, due diligence, and thought leadership. They reassure investors you understand both product and market. The key here is to simplify complex or technical matter to suit your target reader – be that a C-suite exec or retail client.

From complex enterprise blockchain projects to company brochures, Contentworks has helped global brands create narrative-driven white papers an eBooks. Check out some of our case studies here.

Founder / Thought Leadership Articles

Thought leadership humanises the brand. A CEO or founder’s voice can frame strategy with authenticity and confidence, turning leadership into narrative currency. As well as developing a regular content calendar, these pieces are great around milestones, funding rounds, or industry shifts.

Working With Financial Marketing Experts Like Contentworks

At Contentworks Agency, we understand that in finance, narrative is everything. Our team specialises in creating marketing for finance that aligns regulatory accuracy with investor psychology. We craft compliant content for investors that tells a credible, emotionally resonant story.

We work with forex brokers, fintechs and financial institutions to:

- Shape investor-ready narratives that reinforce credibility

- Align brand, compliance, and communication strategies

- Build content ecosystems that boost confidence for both B2C and B2B clients.

Narrative isn’t spin, it’s substance. It shapes how investors interpret your numbers, your vision, and your long-term potential. In financial markets where perception is value, building investor confidence through a smart, transparent marketing narrative is one of the best investments you can make. At Contentworks, we transform complex financial stories into confident, compliant narratives that drive real trust.