As digital natives who have never known a world without the internet, Gen Z is rapidly reshaping the financial landscape. Born between 1997 and 2012, this generation is coming of age in a complex world defined by economic volatility, advanced technology, and shifting values. As they begin to wield more financial power, their expectations are fundamentally different from those of Millennials or Gen X. In this article, we are exploring the key trends, needs, and challenges facing Gen Z and how financial brands can connect meaningfully with them. How Is Gen Z and finance shaping the future of banking, payments, fintech and forex? Let’s look.

#1 Digital Expectations from Day One

Our team includes Gen X, millennials and Gen Zs. Gen Xers can easily remember not having smartphones until their early 20s. Millennials had them earlier but weren’t born using them. Gen Z has grown up with smartphones, digital wallets, and one-click shopping. According to a 2024 report by Deloitte, over 90% of Gen Z use mobile banking apps, and 67% prefer digital channels for all financial services. And here’s one that stands out to us. 34% of Gen Z will ask TikTok before their bank. For them, physical branches are often irrelevant, unless they offer a compelling hybrid experience.

For Gen Z, financial services must be as fast, seamless, and intuitive as ordering from a food delivery app.

says Charlotte Day, Creative Director at Contentworks Agency.

If it doesn’t load in 3 seconds or it requires a phone call, it’s dead-on arrival.

They expect personalisation, round-the-clock customer support and smooth UX. Any lag, friction, or outdated interface leads to immediate churn.

#2 The Rise of Fintech: Trust and Innovation

Gen Z doesn’t just tolerate fintech, they prefer it. In fact, 71% of Gen Z respondents in a Cornerstone Advisors survey said they have at least one fintech account, compared to just 53% of Millennials. This includes platforms like Revolut, N26, Monzo, Venmo, and Cash App, which align with Gen Z’s desire for:

- Transparent pricing and real-time notifications

- Instant payments and account insights

- Easy integration with other digital tools (e.g., budgeting apps, crypto wallets)

- Strong ESG credentials

Yet while they embrace fintech, trust remains a hurdle. According to EY’s Gen Z financial behaviour report, only 42% of Gen Zers trust financial institutions compared to 59% of Millennials. For fintech brands, this means authenticity, data security, and social responsibility are not optional, they’re baseline requirements. Are Gen Z wrong for being distrustful? No, they are right. The finance space has seen numerous scams, crashes, hacks and impersonators. We can all learn a little scepticism from Gen Z.

#3 Conscious Capitalism and Value-Based Finance

Unlike previous generations, Gen Z isn’t motivated by money alone. They value ethical finance, climate responsibility, and inclusivity. A survey by First Insight found that 73% of Gen Z are willing to pay more for sustainable products, and that sentiment extends to financial services.

They want their banks and fintech providers to:

- Invest in ethical funds

- Support DEI (Diversity, Equity, Inclusion) initiatives

- Offset their carbon footprint

- Be transparent about how their money is used

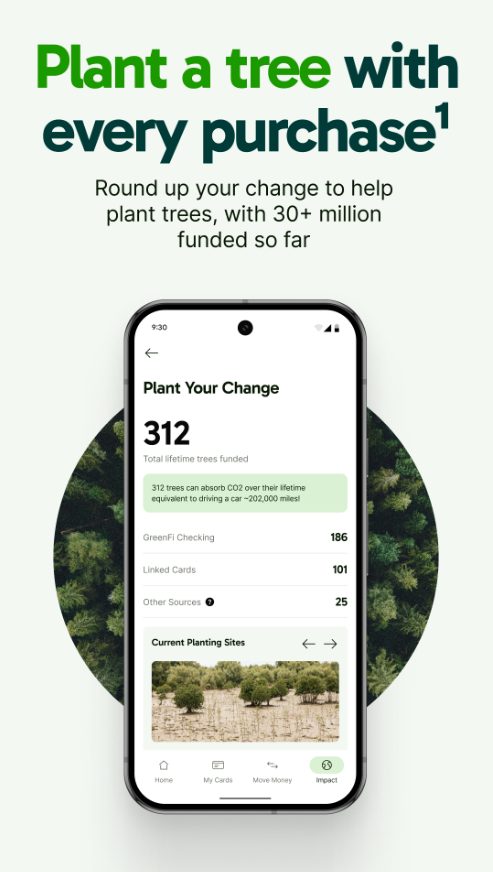

This mindset has birthed a wave of purpose-driven finance apps like GreenFI, which plants trees for every transaction.

Or Goodmoney, the brash and unapologetic app that promises no funding of fossil fuels. Financial marketers must understand that for Gen Z, money is a tool for activism.

But Gen Z is also aware of greenwashing. So, slapping a green label on your finance products does not mean they won’t be scrutinised. It also won’t make up for poor service, bad tech or unfavourable rates.

#4 Challenges in Financial Literacy

Despite their tech fluency, Gen Z faces critical gaps in financial literacy. The 2023 TIAA Institute-GFLEC Personal Finance Index found that Gen Z answered only 43% of financial literacy questions correctly, the lowest of any generation surveyed.

Many young people struggle with:

- Understanding interest rates, inflation, and taxes

- Managing credit and debt

- Making investment decisions

- Navigating insurance or mortgages

Paradoxically, they are more interested in money than their predecessors. According to Morning Consult, 54% of Gen Z regularly discuss financial topics online, especially on TikTok and Reddit.

This has given rise to “Finfluencers”—social media personalities doling out financial advice. But this democratization of finance also opens the door to misinformation and risky strategies says Charlotte.

Financial brands have a duty to provide real, accessible education to this generation. Gamified tools, explainer videos, or TikTok partnerships can bridge the gap between jargon and understanding. But don’t forget that regulators are always watching. You can’t say what you like just because it’s on TikTok.

#5 Payment Preferences

In the payments arena, Gen Z is pushing a cashless, contactless future.

- 85% of Gen Z prefer using digital wallets like Apple Pay, Google Pay, or PayPal (Forrester, 2024).

- Buy Now Pay Later (BNPL) usage among Gen Z surged 180% from 2020 to 2023, driven by players like Klarna, Afterpay, and Affirm.

- Cross-border payments are gaining traction, as Gen Z consumes global content and shops across borders.

- Shopping APIs are now the expected norm with consumers expecting in-app services like PayLater on checkout.

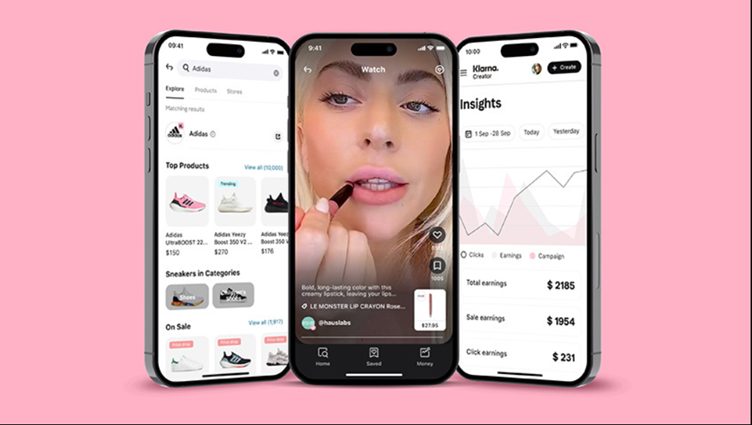

Klarna’s intelligent search tool Spotlight finds the best price for their product, so consumers can spend less time searching and more time saving. On top of that, a new endless stream of thumb-stopping, shoppable video content in the Klarna App lets consumers watch and shop the latest trending items directly from the video. Combined with the new Creator Platform, a portal that seamlessly connects creators and retailers to scale and optimize campaigns, Klarna continues to open up new channels and revenue streams that drive measurable growth for its 450,000+ retail partners worldwide.

#6 Forex Trading: Risk, Reward, and FOMO

Gen Z is more interested in forex and trading than any previous youth cohort. The rise of gamified platforms like eToro, Robinhood, and TradingView has made investing feel accessible and even fun. But with accessibility comes risk.

According to the UK’s FCA (Financial Conduct Authority), Gen Z investors are more likely to invest based on social media hype, often without understanding the risks. Their trading motivations often include:

- Fear of missing out (FOMO)

- Fast money expectations

- Peer influence from online forums

Yet, Gen Z’s interest in global markets, decentralization, and self-education is undeniable. Forex platforms need to balance innovation with responsibility by offering demo accounts, transparent fees, and educational content tailored to Gen Z’s learning styles. Contentworks founder Niki says:

Forex providers should remember Gen Z learns in memes, reels, and 15-second bursts,” says “Forget 50-page PDFs. Think TikTok explainers, explainer videos and Reddit communities.

#7 Mental Health and Money

The psychology of Gen Z finance cannot be ignored. This generation is financially anxious.

- 68% report money stress as a top mental health issue (Bank of America, 2024)

- 60% of Gen Z said they feel “behind” in their financial journey

- Many feel overwhelmed by student debt, inflation, and job insecurity

What they need are financial tools that prioritise mental wellness. Apps that don’t just show balances but coach behaviour, reward saving, and de-stigmatize budgeting. Apps like Cleo use humour, personalisation, and AI-driven nudges to support healthy habits. It will analyse user data (spending habits, income, etc.) to provide tailored insights and recommendations. Plus offer personalised advice on where you can cut back on expenses.

#8 Marketing to Gen Z: Authenticity or Bust

Marketing to Gen Z is not about slick ads or celebrity endorsements—it’s about authenticity, transparency, and relatability. Charlotte adds:

Gen Z has built-in BS detectors. They can smell pandering, fake CSR campaigns, or greenwashing a mile away.

To win their loyalty, financial marketers should:

- Collaborate with real creators, not just influencers

- Speak in their language. Even if that’s raw, funny, sometimes sarcastic

- Show real customers and real stories

- Engage on platforms they actually use like TikTok, and Discord

Financial brands who failed older generations were often forgiven. There was a “better the devil you know” approach taken by consumers. That doesn’t exist in younger generations who don’t foster the same brand loyalty. Especially to financial companies that fail to live up to expectations.

Designing Finance for Gen Z

Gen Z isn’t just a target audience. They’re architects of the financial future. They are curious, sceptical, value-driven, and digitally fluent. But they also face financial stress, educational gaps, and trust deficits.

To succeed with Gen Z, financial brands must:

- Offer digitally native solutions

- Prioritise education and financial wellness

- Embed purpose into every product

- Speak in authentic, platform-specific voices

At Contentworks Agency, understanding the psychology and digital behaviours of consumers isn’t just a marketing tactic, it’s a necessity. We are a leading financial marketing agency providing strategic content, social media, and compliance-savvy campaigns for global banks, fintechs, and forex brands. Book a free call with our team to discuss your finance brand.