A neobank is a fully digital financial institution with no physical branches, built around sleek mobile apps or web platforms. Neobanks partner with licensed institutions to offer core services like deposits and lending, underpinned by modern tech stacks rather than legacy systems. The goal? Seamless user experiences featuring low or no fees, real-time insights, and APIs for embedded services. Let’s take a look at how to launch a neobank in 2025.

The State of the Market Now

- Over the past two years neobank launches have surged. Over a hundred new neobanks have emerged globally in regions like Latin America, Southeast Asia, Africa, and Europe.

- User adoption has skyrocketed from 39 million users in 2018 to nearly 400 million by 2023. Global transaction volumes forecast to reach almost $9 trillion by 2027.

- Valuation trends are equally dramatic: the global neobank market hit ~$210 billion in 2025 and is projected to eclipse $3 trillion by 2032.

- These figures signal both opportunity and intense competition in the neobanking space. In this article we’ll be examining 3 diverse neobanks, Monzo, Chime and Tonik as case studies on how to effectively launch a neobank.

Why Launching a Neobank in 2025 Is Tough

Today’s landscape is brutal.

- First you have to contend with regulatory complexity. Acquiring a full banking license takes years and requires heavy commitments on capital, compliance (like KYC/AML), and cybersecurity. For example, Bunq shelved its US licensing attempt in 2024 partly due to regulatory headwinds.

- Second, it is a hyper-competitive field. Hundreds of neobanks and thousands of incumbents compete fiercely. Leaders like Nubank, Revolut, Chime, Monzo, and Starling hold less than 5% of global banking customers.

- The golden goose of turning a profit is not easy. Chime, for instance, generated $1.7 billion in revenue in 2024 but still posted losses nearing $25 million. UK-based Monzo turned its first profit after years, but only £15 million, five years post-launch.

- Finally, one of the most crucial challenges is getting the tech and security talent in place. Building secure real-time systems demands a sophisticated tech team, a priority given that many neobanks allocate over 10% of their IT budgets to cybersecurity.

Who’s Winning and How

With all these challenges above, several neobanks are standing out. It’s not just about sleek tech, but strategic marketing that scales effectively.

Monzo (UK)

Monzo’s community-driven narrative allows them to lead with human stories, transparency, and even humour. Their flagship “Year in Monzo” social recap campaign turns dry spending data into a cultural moment, engaging users year after year. Each December, Monzo transforms user transaction data into personalised, culturally resonant recap reels. The results: consistently high engagement, user sharing, and earned media buzz.

On TikTok and Instagram, Monzo garners nearly 1 million followers by using a relatable, jargon-free tone and often pushing creative, meme‑inspired content while staying fully compliant. Their iconic hot‑coral debit card became a viral symbol, encouraging organic word-of-mouth at cafes and meetups over design alone This brand-first approach allowed Monzo to build trust early, then slowly monetise through subscriptions and lending.

Chime (US)

Chime exemplifies scaled, results-driven marketing. Their “Unlocking America’s Pay” campaign around MyPay, with over 2 million users enrolled, targets the frustrations of American workers trapped in two-week pay cycles.

They launched with grassroots influencer marketing and referrals that drove explosive growth. They then scaled into national ad campaigns when funds and product-market fit aligned. Their data-led content efforts across social platforms cemented brand consistency and drove down customer acquisition cost (CAC) while increasing LTV (life time value) through educational finance content.

However, recent commentary suggests CAC may be too high relative to profitability, a common scaling trap.

Tonik (Philippines)

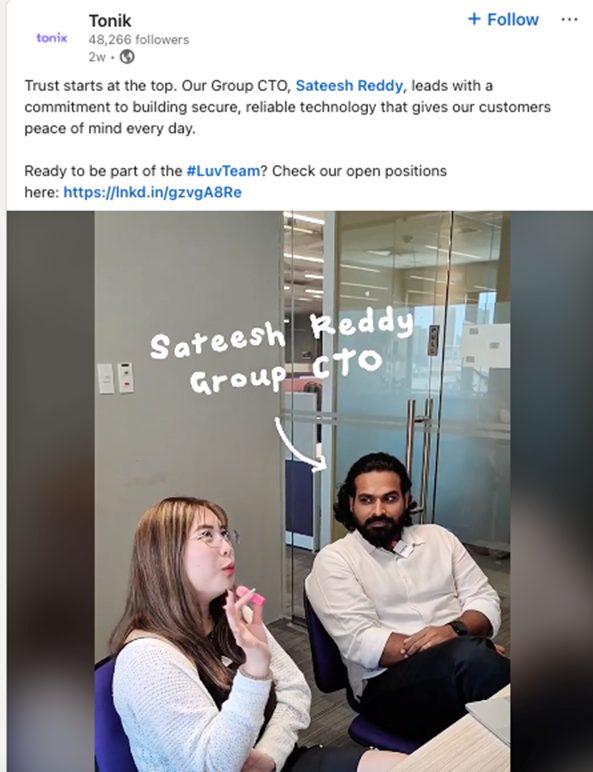

As well as the fun and creative side of marketing, there are operational and logistic considerations that can show compelling results. Tonik, Southeast Asia’s first full‑licence neobank (launched March 2021), used API‑first architecture on Google Cloud’s Apigee to rapidly scale digital onboarding, even in rural areas where banking access was limited.

Tonik’s partnership with Google Cloud allowed rapid scaling of onboarding, layered with telecom and agent partnerships. They hit 230,000 customers and a $500 million valuation in their first year, demonstrating that a product-led, inclusive strategy can yield strong traction.

While early promotional success leaned on leveraging telecom partnerships for app distribution, their down to earth, transparent approach in their marketing keeps it real for their users.

Marketing Strategy Essentials

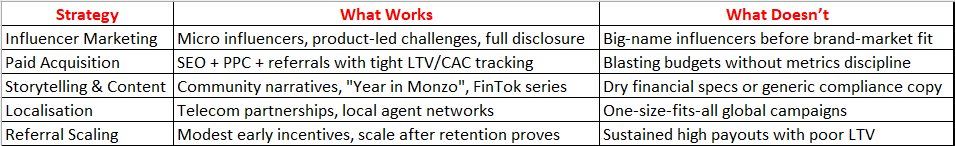

When launching a neobank, your campaign strategy must be sharp, structured, and data-centred. Here are the core pillars to an effective marketing strategy and how these neobanks are winning with them – or not!

Product Positioning & Narrative

Start by defining what makes your bank unique. Are you eco-conscious, business-first, youth-friendly? Then carefully craft your messaging around that USP to get emotional resonance from your audience. From our neobanks above, we can see that Monzo sells transparency and community; Chime offers financial control; Tonik emphasises inclusion and savings discipline.

Performance Marketing & Channel Strategy

An early investment in SEO pays off big time further down your marketing strategy. PPC/search ads and app-store optimisation along with referral programmes are all built upon your existing organic content marketing efforts like your website, blog, social media. Chime is known to track CAC vs LTV and scaling campaigns only when payback periods are justified.

Pro tip: Defer expensive awareness campaigns until after product-market fit; Chime introduced national TV ads only after robust digital traction.

Content, Education & Community

Building trust with relatable financial content is crucial. Monzo’s ‘Year in Monzo’ utilises financial memes, AMAs and Q&As to do this. Meanwhile, Chime provides #FinTok content, educational finance videos that 68% of users say improved their financial habits.

Strategic Influencer Marketing

Micro‑influencers led to better ROI in Tonik’s savings-challenge campaigns than broad macro targeting. Chime’s influencer partnerships focus on finance creators and are subject to FTC-style disclosure best practices

But beware: Throwing money at celebrity influencers pre-brand has led many neobanks into high CAC without customer stickiness.

Referral & Loyalty Programmes

Chime’s early $50–200 referral payouts drove explosive growth, though recent scrutiny questions their sustainability .

Best practice: Start small, repeat what works based on client behaviour, and only scale once retention is proven.

Hybrid & Localised Outreach

In emerging markets, offline agents plus digital marketing (like Tonik’s partnerships with telecoms and agents) are a winning combination. A one-size-fits-all approach to marketing, or the cookie-cutter approach as we say in marketing, rarely performs well.

What Works vs. Common Pitfalls

Strategy & Budget Essentials

As a quick recap, here is how these three neobanks strategised their launch and a quick look at the budgets required for sustainable success.

- Narrative-first launch: Monzo spent heavily on community campaigns before monetising products, paying dividends in brand loyalty.

- Performance foundation: Chime balanced guerrilla influencer marketing with structured referral programs—then intensified with national ad campaigns once ROI benchmarks were met .

- Education-led content: Chime’s #FinTok series saw 68% of viewers reporting financial improvements

- Local engagement: Tonik’s rural Philippines focus, combining API tech and on-the-ground agents, enacted inclusion and scale in unbanked regions

- Influencer discipline: Micro-influencer savings content in regional markets gave Tonik stronger ROI versus broad celebrity campaigns.

Budgeting To Launch A Neobank?

A realistic annual marketing budget for a mid-sized neobank could range from $3 million to $5 million across:

- Brand & content: $500K–1M

- Performance ads: $1–2M

- Influencers: $200K–500K

- Events & webinars: $100K+

- PR & media: $200K+

- Agency fees: 15–20% of total spend

Final Insights

Launching a neobank in 2025 offers huge upside, but only when coupled with a plan that’s as bold as it is disciplined. The market is massive, but standing out is harder than ever. Tough regulations mean you’ll need compliance baked into your strategy. It’s imperative to begin by building brand trust and not just throwing money at reach. Ensure you combine data-led acquisition with storytelling to drive retention and loyalty. Be like Tonik and localise strategies to suit market nuances. Develop budgeting discipline through tight CAC/LTV monitoring, and scale from there.

Final tip: Choose partners who understand fintech, regulation, UX, and growth.

Contentworks Agency is at the forefront of neobank marketing. Read about our recent case study with Greece’s newest neobank Snappi here. Contact our team and let us help you with your fintech marketing.