2020 will likely see the rise of micro influencers. These are individuals who are highly knowledgeable in their field as opposed to random big name celebs. At Contentworks Agency we like to keep an eye on the top influencers in our sector. These are the guys and girls who provide original information, engage on social media and present difficult topics in original, relatable ways. Here are 20 finance influencers you need to watch.

#1 Farnoosh Torabi

Farnoosh is a leading influencer in the personal finance space where she’s best-known for financial education and wellness. Living in New York at the age of 22 and $30,000 in debt she realised that “young adults had no access to effective, fun, or even digestible financial advice.” Farnoosh collaborates with brands on financial initiatives and educational campaigns and is currently a Chase Slate Ambassador.

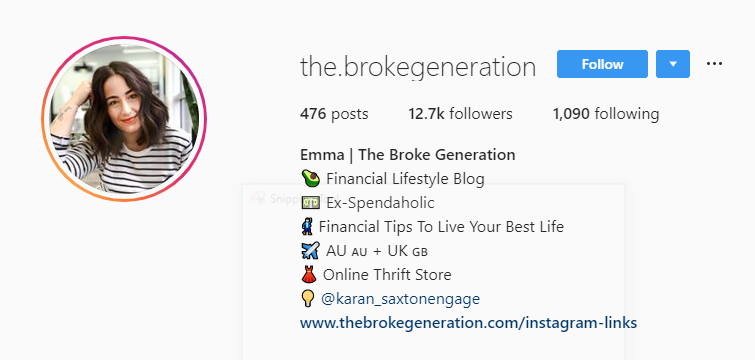

#2 Emma Edwards

Like Farnoosh, Emma started ‘The Broke Generation’ after identifying the lack of financial information for young people and how well she resonated with fellow millennials. Emma is English but currently lives in Australia. Her collaborations combine money tips, travelling, and living far from home. The campaigns are a hit with millennials who are the most travelled generation but also need money tips due to 62% living paycheck to paycheck.

#3 Chris Gledhill

Chris is a top-ranking Fintech authority who questions traditional banking principles and aims to reinvent the finance industry with disruptive technologies. He delivers globally recognised speeches, regular blogs and maintains a Twitter account that’s very popular among finance professionals and people looking for the latest Fintech news. Yep, we’re Chris fans!

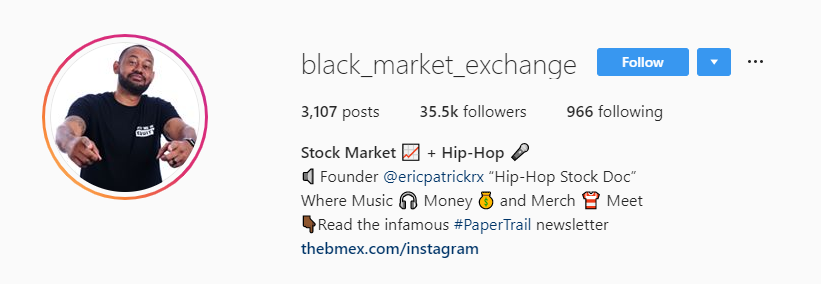

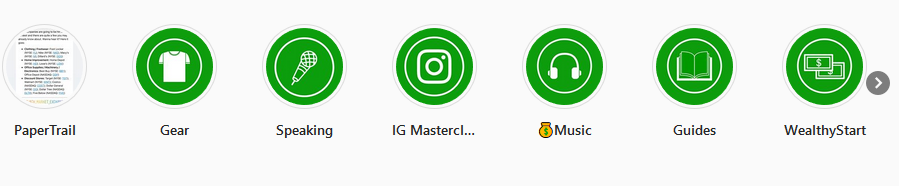

#4 Eric Patrick

Known as the Hip-Hop Stock Doc, investment educator Eric makes investing memorable by fusing it with urban media and hip-hop. Posting regularly, Eric divides his content into easily searchable categories using the Instagram Stories feature. He links to products and services as well as offering investment guides to his 35.5k followers.

#5 Emma Johnson

Emma began WealthySingleMommy.com after determining that single mums needed financial advice. In the US, about 17% of single mums didn’t complete high school, 40% are employed in low-wage jobs, 15% have no health insurance and nearly 67% receive free or reduced-price meals. As a single mum herself, she resonates with her audience and can represent this demographic with authenticity while making waves as a female finance influencer.

#6 Sebastien Meunier

Sebastien shares his passion for innovation and new technologies including machine learning and blockchain. With a passion for social responsibility, his focus is on bridging the finance and tech gap and using the innovations to improve lives. Humanitarian blockchain is a subject Contentworks Agency has been following closely so we are keen to hear Sebastien’s insights.

#7 Jeff Rose

Jeff, a certified financial planner and blogger at GoodFinancialCents.com is on a mission to help people dominate their finances through simplified financial concepts. In his words, “Big words make him nauseous because they lose the interest of 99.9% of the population.” 44% of consumers find finance challenging and so Jeff’s simplistic approach has earned him an extensive Twitter following.

He’s also straight talking and isn’t afraid to cause a stir as you can see from the below post entitled: ‘Financial advisers I would like to punch in the face.’

Marketing tip: Collaborate to simplify. For example, 56% of consumers have expenses that exceed their income so consider campaigns that give out tips and strategies like ‘5 tips and tricks to clear your debt’ or ‘20 hacks to get your income in shape.’

#8 & #9 Tanja Hester and Kara Perez

Tanja and Kara are punchy nano-influencers and the hosts of ‘The Fairer Cents’, a podcast that helps women address financial inequality. Kara is also founder of Bravely, a women’s financial education resource site and Tanja is the blogger behind ‘Our Next Life’. Just like Emma Johnson, Tanja and Kara have built a loyal audience through their focus on specific issues.

The duo’s appeal

Kara and Tanja are the epitome of women standing up for fellow women; helping close the wage gap and dealing with workplace discrimination. The gender pay gap is commonly quoted at 10-20% and the pension gap at 30-40% but the duo puts this into questions. In their words, they are about “Talking money and taking down the patriarchy.”

#10 J Money

Going by the pseudonym J. Money, this influencer uses anonymity to discuss finance freely. J. Money uses a people-first approach to get engagement and commenting on the approach he says “People are everything to me – the business, stats, money is secondary.” He also engages with catchy anecdotes and according to him “Finance is generally a boring subject, so when you have a mohawk and talk like a normal, everyday person, it seems to help connect better with people versus suits and ties.”

Besides his wit, J. Money spends lots of time with his audience responding to comments, answering questions, joining discussions and connecting with people, building trust and loyalty.

Marketing tip: Take time to respond to audience queries. Users expect responses within 30 minutes on social media and 82% expect immediate responses on sales and marketing questions.

#11 Tonya Rapley

‘My Fab Finance’, Tonya’s site, is unique. It’s about finance but with a focus on breaking money stigmas and the cycle of living paycheck to paycheck. Tonya says “I know how it feels to be depressed and ashamed about money, and that’s why I created My Fab Finance.”

Why Tonya?

- Two-thirds of millennials are still dealing with the 2008 financial crisis effects

- The rate of depression among millennials has increased by 47% in five years.

As a millennial who has suffered physical, emotional, and economic abuse, Tonya is a relatable and powerful millennial money expert.

#12 Tiffany Aliche

Known as The Budgetnista with the ‘live richer’ motto, Tiffany inspires her followers to achieve financial freedom through education. She founded a movement that provides financial education through free online courses and a community of people trying to improve their financial lives. Tiffany’s appeal is her genuine interest in education and helping people succeed spurred on by her own successful transformation.

#13 Spiros Margaris

Spiros publishes innovation proposals and is a sought-after speaker on Insurtech and Fintech. Although he regularly interacts with executives and regulators, Spiros works exclusively with start-ups making him a great influencer in the start-up arena. The Contentworks Agency team had the pleasure of meeting Spiros at last year’s Decentralized conference where he had a permanent queue of eager networkers!

Marketing Tip: Focus on niche areas. Budgeting, saving, and investing are common but as it stands, 63% of people don’t buy insurance because it’s expensive and 37% are unsure of which insurance to get and why. Providing solutions on big, yet less-explored topics, will give you an edge.

#14 Amanda Clayman

Amanda uses a therapy-based approach to help people address their financial issues. Although she grew up in a financially stable environment, Amanda ended up with personal financial problems and so she understands that poor money values are as bad as financial illiteracy when it comes to making poor financial decisions.

#15 Dominique Brown

Dominique not only rocks Instagram with his ‘Your Finances Simplified’ posts but with his focus on identifying underlying financial problems his followers have. Just like Amanda, Dominique crafts educational content based on the problem drivers. Dominique says “Getting the information about how to change and improve is easy. The execution, though? That’s the hard part. They have to put the work in, but I get them ready.”

#16 Winnie Sun

Winnie is an entrepreneur and the founding partner and managing director of Sun Group Wealth Partners. Having been through financial hardship, she now targets millennials as well as Gen Z audiences who are on track to become the most financially powerful generation.

Marketing tip: Tap into your audience by providing content suitable to your demographic. Audio listening in the US, for instance, is at an all-time high, driven by millennials and Gen Z music fans. So, to connect with your followers, it’s a good idea to incorporate these mediums into your strategy.

#17 Anthony Copeman

Anthony, a certified financial education instructor and founder of Financial Lituation, is helping millennials make their money work for them through money tips and informative yet highly-entertaining lessons. He brings a new angle to tackling finances stating: “I believe that our mindset is the primary currency for building wealth and money is second.”

Besides the distinctive focus on mindset, Anthony’s appeal lies in how he brings finance to life with animation. Our attention spans have decreased by 31% to just 8.25 seconds but animation keeps attention and makes for unique financial education.

#18 Ash Exantus

Also known as Ash Cash ‘The Financial Motivator,’ Ash Exantus is best known for his contagious energy and financial expertise that covers credit strategies and personal finance. He stands out for using motivation to improve finances and says, “I blend psychology and personal finance with music, pop culture and relevant news to help people manage their money better in order to live the life they want.”

Why Ash?

Just like Eric Patrick and music, Ash brings a refreshing angle to finance with his motivational quotes that come with a healthy dose of psychology.

#19 Lauren Bowling

What better way to take control of finances than with the help of someone who struggled but went on to make it? Lauren went from being a shopping addict with credit card debt to become a six-figure online entrepreneur and even an affiliate for leading online investment firm for women, Ellevest. She says, “Whatever you want to do: quit your job, start a family, travel the country in a van…I’m here to encourage it.”

#20 Ruth Soukup

Ruth, an author and finance blogger, created Living Well Spending Less in 2010 to write about her money challenges with her overspending which jeopardised her marriage. Just like Lauren, Ruth is all about empowering others to eliminate the habits that hold them back from financial freedom through tailored solutions and tools.

Marketing Tip: Tackle real-life issues. Both Ruth and Lauren tackle real-life issues with relatable and thoughtful advice on life and money morals. Social media is well-known for painting ‘the perfect life’ picture but things don’t always fall into a well-planned lifestyle and people prefer to see reality. In fact, 86% of people prioritise authenticity in marketing.

Did you enjoy reading 20 Finance Influencers You Need To Watch? If you did then hit share! For smart financial services content marketing, speak to the team at Contentworks Agency.