Already eaten your bodyweight in Trick or Treat candy which you bought “for the kids”? Halloween is rapidly approaching and it’s the scariest night of the year. But did you know that it can be scary for the financial markets too? Legend has it that something weird happens to the stock markets during October. As content marketers for the finance realm, we’re giving ghost hunting a miss this year to unravel the Halloween Effect. Real or Lore? Let’s find out.

What is the Halloween Effect?

Stir your brew, prop up your broom and get comfy. This, you’ve got to hear. According to century-old hearsay, stock returns are at their highest from late October to April, only to flatten from May. Just like vampires awaken from a summer slumber in search of dark nights and fresh blood, equities come screaming back to life before decaying again in the spring. As this appears to be an annual pattern, the aptly named ‘Halloween Strategy’ suggests that investors should be fully invested in stocks from Halloween through to spring and out of stocks from May through October.

All a Bunch of Hocus Pocus – Or Is It?

The idea that Halloween brings higher returns is all a bunch of hocus pocus for many. After all, the summer months are notoriously quiet in the financial world as investors are on holiday. Indeed, the well-known phrase, “Sell in May and go away, come back on St. Leger’s Day” encourages traders to take a summer break and return to the markets again for St. Leger, the day of a famous British horse race which takes place in September. So, if the summer markets are spookily quiet, it makes sense for them to pick up again in Autumn, right? Well sure. But there’s more…

The summer slump and the autumn pickup assumes that increased participation means increased gains. However, market crashes and other disasters are often caused by high trading volumes and participation levels. So while increased participation might have some correlation with gains, it’s not likely to cause more profitable trading outcomes and this is where the Halloween Effect gets really interesting as the hike in returns still needs to be answered.

Did you know

The infamous 1929 stock market crash and the financial market crash of 2008 both started in October? These catastrophic market events add to the weight of this argument. They are also known as The October Effect.

Analysing the Evidence

Financial manager, Sven Bouman, and Tilburg University Professor of Finance, Ben Jacobsen, completed one of the first academic inquiries into the Halloween Effect in their 2002 paper, “The Halloween Indicator. ‘Sell in May and Go Away’: Another Puzzle,” published in the American Economic Review. By analysing data from 1970 to 1998 from major stock indices and indices on the MSCI Emerging Markets Index in 37 countries in Europe, North America, Asia, Africa and Australia, they found that:

- Returns were largest across years from November to April.

- Returns from May – October were at about zero and sometimes negative, whereas gains were similar across years in October and September.

- The “Sell in May” effect was present in 36 of the 37 countries in the sample. The Sell in May effect dates back to 1694 for the UK stock market.

While a clear-cut Halloween start date for improved trading returns was not found, it’s undoubtedly spooky that stocks continuously seem to rise at a similar time of year which just happens to be around Halloween. According to the paper, an investor who used the ‘Halloween Strategy’ would have to be fully invested for one six-month period and out of the market for the other six months of the year to reap the best annual return, with just half the exposure of someone who invests in stocks all year round. This summary alone makes it easy to see why this trading pattern has been steeped in mystery and speculation for years.

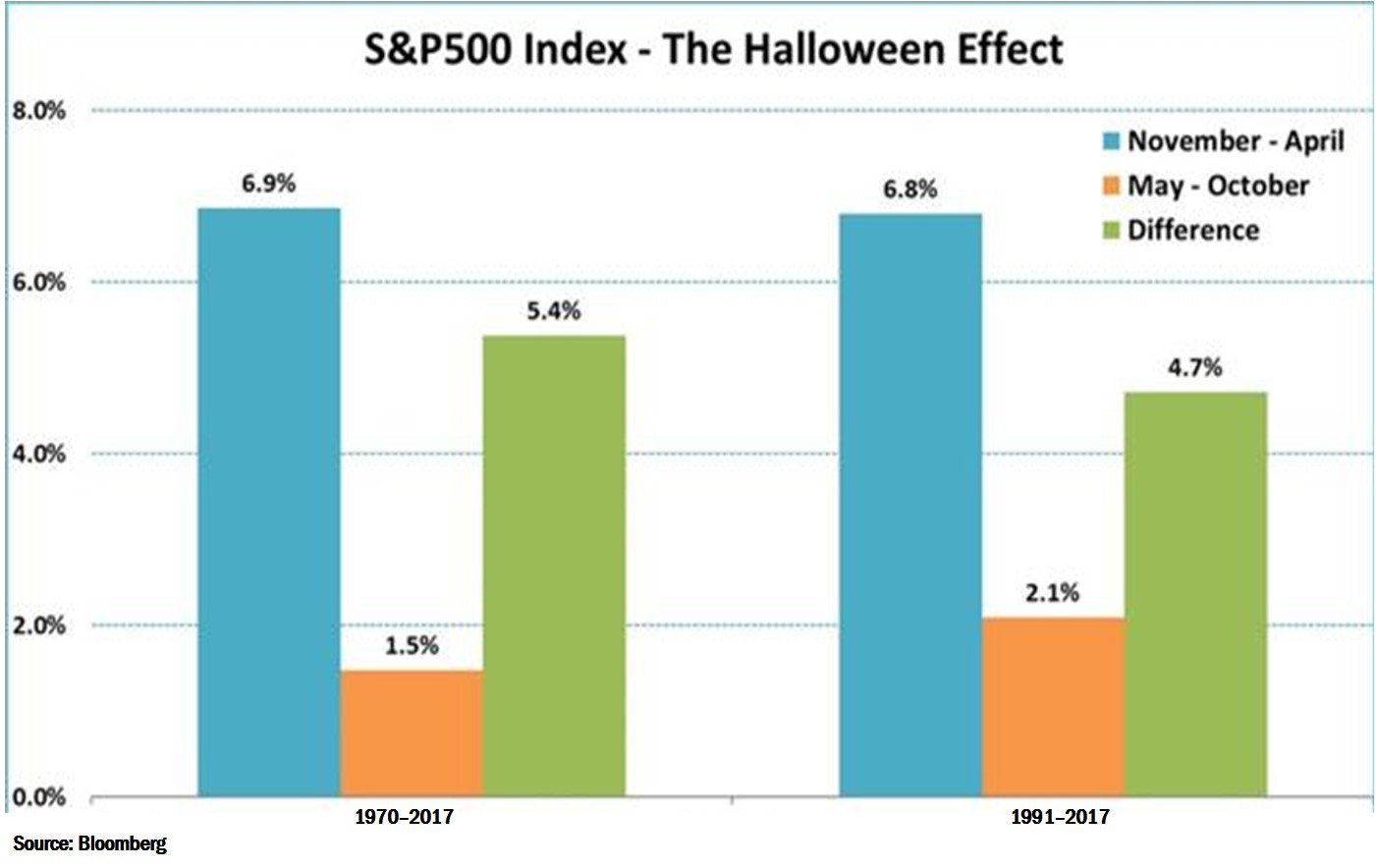

Take a look at the graph below which brings the Halloween Effect to life in visual form. The results show the Halloween Effect in action from 1970-2017 and 1991-2017.

The Dash for an Explanation

Just as ghost hunters and witches have been around for centuries, so have sceptics. And the Halloween Effect has been explained away numerous times by multiple sources. While many people note how the stock market rise links to Halloween, others point-blank refuse to believe there’s any connection at all.

According to the 2008 paper ‘Halloween or January? Yet Another Puzzle’ by economists Brian Lucey and Shelly Zhao, average stock returns were indeed better during the winter months but these gains were attributed to the ‘January effect.’ The January effect is a hypothesis that says investors sell their holdings in December for end-of-year tax purposes and then rebuy stock in the early days of January bumping up stock market values. This, they said, was proof that the Halloween Strategy was “weak at best.” The data correlated by Bouman and Jacobsen data has also been questioned due to various market crashes that could have swayed the results.

But what do you think? Are the Halloween links too much or a coincidence or can they be explained away by the January buy back? Tweet us @_contentworks and let us know.

Glossary of Spooky Financial Terms

With Halloween in the air, we’re ending this eerie article with a glossary of spooky financial terms, many of which are used throughout the entire year.

Want to watch more on our video? Check it out!

#1 Dead Cat Bounce

Black cats and Halloween go hand-in-hand, but if you come across a Dead Cat Bounce in trading, it’s not some sort of warped version of basketball that bored traders play in their lunch break. Instead, it means a temporary rise in share prices. A Dead Cat Bounce specifically refers to a jump in stock prices after a major decline.

#2 Death Play

The somewhat ominous term Death Play refers to the strategy of buying or short-selling a stock with the expectation that the move will prove lucrative should a company executive die. No coffins are opened and no skeletons are removed from their graves during this trading move.

#3 Ghosting

No we don’t mean disappearing after a date, never to be heard from again. Instead, ghosting in finance terms describes the action of firms who try to manipulate stock prices for their own benefit. Yes this is bad. But we still think ghosting a potential love interest is potentially worse. Just saying.

#4 Graveyard Market

If you’re imagining people in suits trading in a graveyard after dark, you couldn’t be more wrong. This term refers to bear markets in which investors can’t sell their holdings without suffering large losses. Many investors decide not to invest at all during these circumstances.

#5 Phantom Stock

According to the National Centre for Employee Ownership, Phantom Stock is the ‘promise to pay a bonus in the form of the equivalent of either the value of company shares or the increase in that value over a period of time.”

#6 Witching

If you’ve seen the new Hocus Pocus movie starring Bette Midler, Sarah Jessica Parker and Kathy Najimi, you would have been treated to some nostalgic witching around. But sadly this financial term doesn’t involve a one-eyed spellbook, face cream eating hags or a black flame candle. This term refers to the expiration of future and options contracts. The expirations tend to result in high volumes of trading and these periods are known as “double witching,” “triple witching” and “quadruple witching” depending on how many types of contracts are set to expire.

#7 Zombie Banks or Zombie Companies

Zombie banks and zombie companies won’t munch your brains, although they may still give you a headache or two. These terms are used to describe companies that are insolvent and yet continue to operate. Sometimes, companies that should have been liquidated are too complex and costly for lenders to shut down and so they remain half-alive, complicating the corporate world.

So there you have it. Even the financial markets can be creepy sometimes! Happy Halloween everyone! Enjoyed reading about The Halloween Effect – Real or Lore? Go ahead and hit share.